Egyptian pound forecast: EGP sinks to record lows as IMF deal nears, further weakening likely

What lies ahead for the Egyptian pound after its historic low against the US dollar?

The Egyptian pound (EGP) has fallen over 19% year-to-date (YTD) against the US dollar (USD). In December, the Egyptian government reached a deal with the International Monetary Fund (IMF) for a $3bn loan and agreed to move to a more flexible exchange rate regime. On 10 January, the Egyptian government even committed to reducing the military's role in the economy as part of its IMF bailout package.

In January, the IMF said “critical” structural reforms to which Cairo had agreed included “levelling the playing field between the public and private sector” as part of a state-ownership policy endorsed by President Abdel Fattah al-Sisi.

As the Arab state grapples with a foreign currency crisis, a weakening pound and rising inflation, the government allowed the pound to fall 57.6% during 2022. It has shed more value in the opening days of 2023.

The Egyptian economy has come under pressure from budget cuts, the effects of the Covid-19 pandemic and the Russia-Ukraine conflict, and faces a shortage of foreign currency.

Will Egypt weaken its pound further? What has been driving the value of the currency lower? In this article we look at the currency’s recent performance and analysts’ latest EGP predictions.

What drives the Egyptian pound?

The Egyptian pound is the official currency of Egypt. The Central Bank of Egypt initially allowed the pound to float freely in November 2016, resulting in a devaluation and has since controlled the exchange rate.

The value of the Egyptian pound against other currencies’ value is driven by the country’s trade balance and net reserve.

Egypt relies heavily on grain imports, as the world’s largest importer of wheat. Around 82% of its wheat imports over the past five years came from Russia and Ukraine, exacerbating the impact of the conflict between the two countries on its trade deficit and driving up inflation.

Ukraine’s wheat exports were largely halted following Russia’s invasion, driving up prices on the international markets to record highs.

As with other emerging market currencies, the Egyptian pound has come under pressure this year as the value of the US dollar has climbed on the back of rapidly rising US interest rates. That has driven up the cost of importing other dollar-denominated currencies such as oil, as well as wheat.

EGP weakens in challenging economic environment

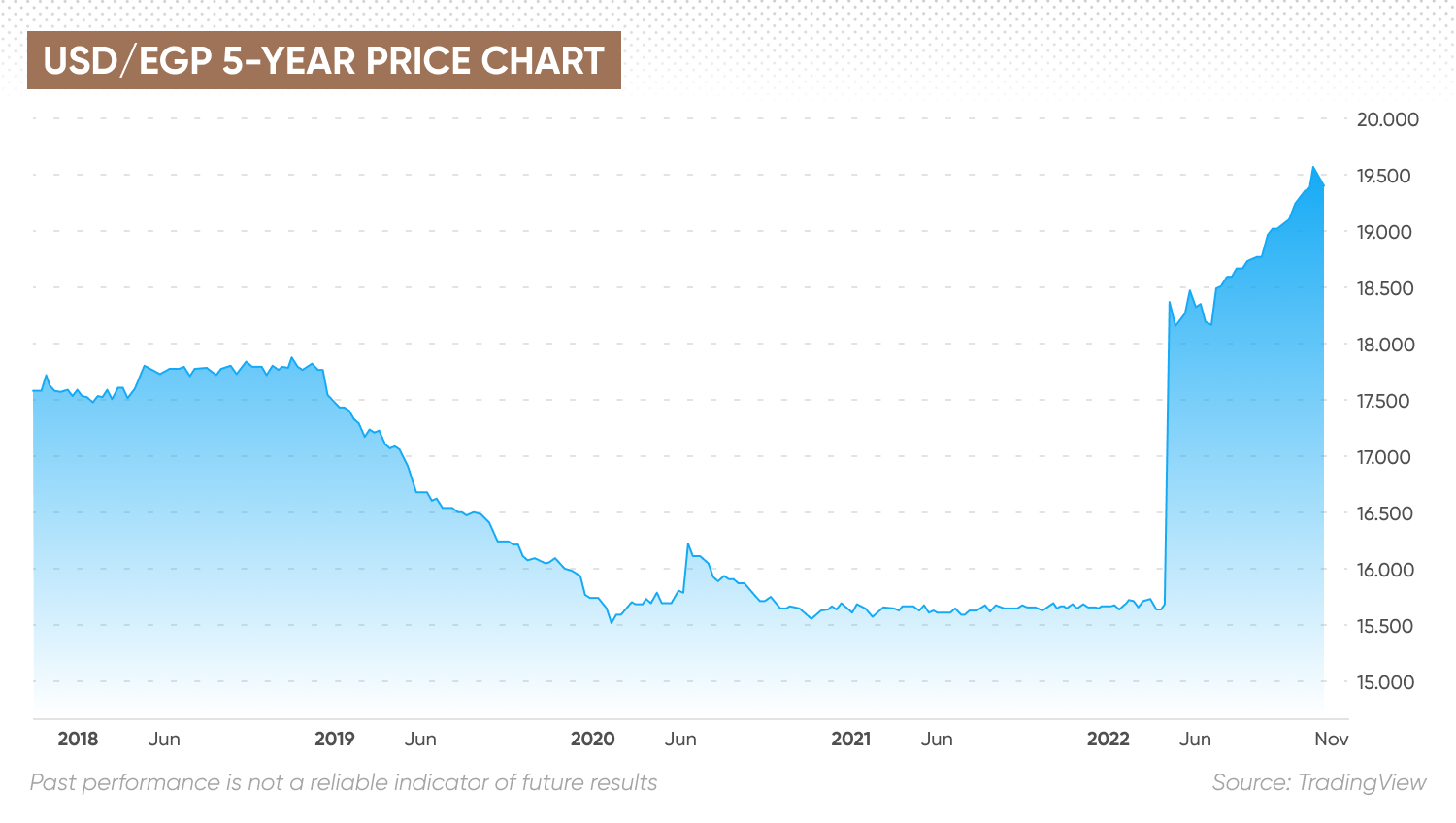

The value of the Egyptian pound strengthened slightly against the US dollar following the 2016 devaluation that took the USD/EGP exchange rate from 7.83 at the start of the year to 18.60 by its end.

The rate started 2022 at 15.71. It jumped to 18.54 on 22 March when the government devalued the currency in response to the war in Ukraine and rising inflation caused by higher commodity prices.

The value of the pound has continued to decline as the economic picture has deteriorated. The USD/EGP exchange rate breached the 19 mark at the beginning of August and climbed to 24.18 at the end of October. The rate continued to rise in smaller increments, ending the year at 24.75. It then rose, hitting 27.22 in the first few days of January.

The EGP has also weakened against the euro (EUR) in the past year. The March devaluation saw the EUR/EGP exchange rate climb from 17.37 to 20.45. The pair then retreated to 18.91 on 14 July before bouncing to 19.77 on 11 August. The euro declined again to 18.70 on 27 September, but moved up to 23.90 at the end of October. By the end of December, the EUR/EGP pair was trading around 26.49. So far in 2023, the pair has continued to move higher, reaching 28.84.

In 2023, USD/EGP exchange started at 27.55 on 9 January, by the start of February it had risen to 30.23 and has remained around that mark right up until the start of April. EUR/EGP exchange rate has climbed 27% YTD. It started January at 26.30 and since then has risen to 33.69 as of 4 April.

According to data from Egyptian statistics agency CAPMAS the annual urban inflation rate in Egypt further accelerated to 31.9% in February 2023, from 25.8% in the previous month, and well above market expectations of 26.9%. It was the sharpest inflation rate since August 2017, staying above the upper limit of the central bank’s 5-9% target range for one year, largely due to a weaker pound after a series of devaluations in recent months.

Main upward pressure came from prices of food & non-alcoholic beverages (61.8% vs 48% in January), by far the most relevant in the CPI basket. The annual core inflation rate, which strips out volatile items such as food, jumped to 40.26% in February 2023, the highest reading since at least January of 2005, up from 31.24% in the prior month. On a monthly basis, consumer prices rose 6.5% in February, the most since October 1989, from 4.7% in the previous month.

The Central Bank of Egypt (CBE) resumed rate hikes in October, raising it by another 200 basis points. The Monetary Policy Committee acted again on 22 December, hiking the overnight deposit rate, overnight lending rate, and the rate of the main operation by 300 basis points to 16.25%, 17.25% and 16.75%, respectively.

The bank raised again its overnight interest rates by 200 basis points (bps) in March 2023, following a meeting of its Monetary Policy Committee (MPC), saying it aimed to bring high inflation into check.

The MPC stated:

Egypt’s main sources of foreign are exports, tourism, remittances, foreign direct investment (FDI) and transit fees for vessels passing through the Suez Canal.

Egypt’s tourism revenues have been hit by the Russia-Ukraine war, as it is a popular holiday destination for Russian and Ukrainian tourists. Investors have liquidated their holdings in Egyptian bonds to reduce their exposure to emerging markets as risk aversion has increased amid the ongoing geopolitical turmoil.

On 16 December the IMF Executive Board announced that it had approved a 46-month arrangement under the Extended Fund Facility (EFF) for Egypt to receive a loan of $3bn.

The package includes “a permanent shift to a flexible exchange rate regime to increase resilience against external shocks and to rebuild external buffers”, as well as monetary policy aimed at gradually reducing inflation, transitioning away from subsidising lending schemes, debt management while increasing social spending, and structural reforms to reduce the state footprint and foster private-sector growth.

What is the outlook for the pound against other currencies for the rest of the year and beyond? Will it set new lows against the dollar or rebound?

EGP forecast 2023: What lies ahead 2023 and beyond?

Analysts expected the Egyptian pound to remain under pressure in the near term, potentially setting new lows.

“The sharp fall in the Egyptian pound today, coming in the wake of last week’s move to ease FX restrictions, suggests that the authorities are starting to make good on their pledge to shift to a more flexible exchange rate regime. There are already signs that improved competitiveness is supporting exporters. But in the very near term, high and rising inflation as well as tight fiscal and monetary policy caused by the pound’s fall will weigh on economic growth,” according to the latest Egyptian pound forecast analysis on 4 January by Jason Tuvey, Senior Emerging Markets Economist at Capital Economics.

USD/EGP forecast

Analysts at Fitch Solutions expect the Egyptian pound to remain vulnerable against the dollar in their EGP forecast. They see potential for some relief in 2023, stating in October that “we believe that Egypt’s agreement with the IMF will ease pressures in the short term and reduce uncertainties. While the floating of the currency will increase inflationary pressures and pressure consumption, it will help address imbalances in the currency market. That said, external vulnerabilities will persist until authorities' efforts will translate into fresh and sustainable inflows of foreign capital.”

The Fitch analysts added:

At the time of writing, an analysis by TradingEconomics indicated that USD/EGP could climb to a fresh high over the next year, rising from 27.00 at the end of this quarter to 29.59 in 12 months’ time, according to its global macro models and analysts’ expectations.

The EGP forecast for 2023 from algorithm-based forecaster WalletInvestor showed the pound trading at 27.073 against the US dollar by the end of the year, climbing to 29.732 in 2025 and 32.331 in five years’ time.

EUR/EGP forecast

Predictions indicate that the Egyptian pound could also continue to weaken against the euro.

Analysis by TradingEconomics showed the EUR/EGP rate rising from 28.1759 at the end of this quarter to 29.3940 in one year.

For the longer term, WalletInvestor’s EGP forecast for 2025 against the euro showed the EUR/EGP pair ending the year at 30.247, up from 28.263 at the end of 2023.

Analysts have yet to issue an EGP forecast for 2030.

The bottom line

If you are looking for an Egyptian pound forecast to inform your foreign exchange trading, keep in mind that analysts and algorithm-based predictions can be wrong. You should not use forecasts as a substitute for your own research. Always conduct your own due diligence, looking at the latest news, fundamental and technical analysis, and analyst commentary.

Remember that past performance does not guarantee future returns. And never trade money you cannot afford to lose.

FAQs

Is EGP a good investment?

While emerging market currencies, including the Egyptian pound, can offer growth potential, they have come under pressure from geopolitical and global economic instability in 2022. Whether EGP is a suitable investment for your portfolio will depend on your investing approach and time horizon. Remember that past performance does not guarantee future returns. And never trade money you cannot afford to lose.

Will EGP go up or down?

The direction of the Egyptian pound against other currencies could depend on the central bank’s monetary policy and whether there is another devaluation. It could also depend on US interest rates and the geopolitical environment.

Should I invest in EGP?

Whether you invest in the Egyptian pound will depend on your personal circumstances, risk tolerance and investing strategy. You should do your own research before making a decision. And never trade money you cannot afford to lose.