Meta stock forecast: Third-party price targets

Meta Platforms (NASDAQ: META) last traded at $748.76 as of 10:03 a.m. UTC on 27 October 2025, moving within an intraday range of $732.09–$750.10.

Meta is tracking broader gains in U.S. equities, with the Nasdaq Composite up 0.8% amid optimism over progress in the U.S.–China trade negotiations (Bloomberg, 26 October 2025). Investor focus now shifts to Meta’s Q3 2025 earnings release on 29 October, with consensus estimates at $49.5 billion in revenue and $6.71 EPS (MarketBeat, 26 October 2025). The results will be closely watched as AI monetisation and data-centre spending remain key themes for investors (Reuters, 15 October 2025).

Meta stock forecast: Analyst price target view

MarketBeat (consensus survey)

According to MarketBeat’s analyst consensus, 48 analysts set a 12-month average target of $829.66 for Meta Platforms, with estimates ranging from $600 to $1,086. The platform notes a “Buy' consensus, as analysts highlight continued revenue growth from advertising and AI integration linked to the company’s expanding infrastructure (MarketBeat, 25 October 2025).

Stock Analysis (broker composite)

Stock Analysis reports a mean target of $825.75 from 44 analysts, indicating an implied 11.8% upside from the prior close. The report cites expectations of steady advertising spend and progress in AI monetisation amid broader technology sector optimism (Stock Analysis, 27 October 2025).

Benzinga (analyst update tracker)

Benzinga’s compilation shows an aggregate target of $826.95, based on 40 analyst ratings. Oppenheimer, Cantor Fitzgerald, and UBS each reiterated positive outlooks earlier in October, referring to operational leverage and near-term earnings momentum ahead of the company’s Q3 results (Benzinga, 27 October 2025).

TipRanks (Wall Street consensus)

TipRanks reported an average price target of $878.09, suggesting around 19% upside from current levels. The service attributes the higher average to upgraded revenue forecasts driven by AI-enhanced advertising efficiency ahead of the upcoming results (TipRanks, 27 October 2025).

24/7 Wall St. (research summary)

24/7 Wall St. indicated a median one-year price target of $876.91, consistent with a “Strong Buy' consensus among 47 analysts. The outlook reflects expectations of sustained advertising revenue and efficiency gains associated with AI-related capital investment (24/7 Wall St., 22 October 2025).

Analyst forecasts are often inaccurate, and they can’t account for unforeseen market events. Past performance is not a reliable indicator of future results.

META stock price: Technical overview

META last traded at $748.76 at 10:03 a.m. UTC on 27 October 2025, trading above its key moving averages – the 20-, 50-, 100-, and 200-day SMAs at approximately $723, $743, $732, and $676 respectively. A firm 20-over-50 crossover is absent, with the 20-SMA still below the 50-SMA around the $723–$743 range. The 10-day SMA sits just below the latest price at $724, while the 10-day EMA is $729, both showing a short-term trend holding above recent lows.

Momentum indicators place the 14-day RSI in neutral territory at around 53, while the ADX (14) indicates a weak trend near 20. The first resistance level is the R1 pivot at $776, followed by $819 on a confirmed daily close above that zone. On the downside, initial support is near the $749 pivot, with a broader base at the 100-SMA around $732. A move below $732 could expose S1 support near $707 (TradingView, 27 October 2025).

This technical analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Meta share price history

Meta Platforms’ share price has almost doubled over two years, rising from about $302 in October 2023 to $748.76 as of 27 October 2025 – an increase of roughly 148%. The stock gained around 31% year on year, extending its recovery through 2025 following a strong rebound during the previous year’s technology sector rotation and recovery in digital advertising spend.

Price movements in 2024–25 reflected renewed market confidence in Meta’s AI-driven revenue model and tighter capital management. After consolidating around the mid-$500 range in late 2024, the stock advanced through 2025, repeatedly testing the $700 level before reaching intraday highs near $750 by October.

Past performance is not a reliable indicator of future results.

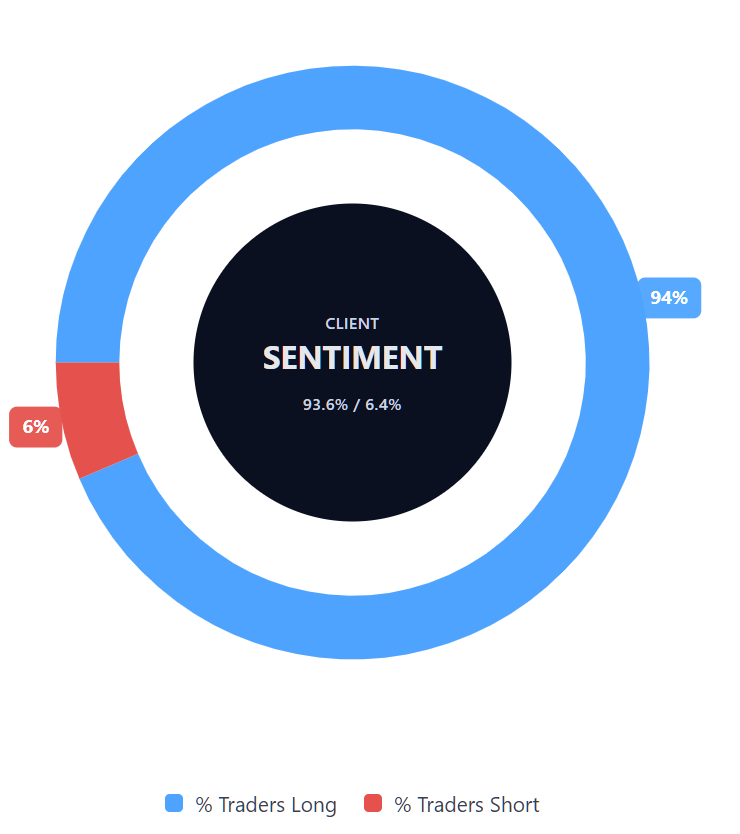

Capital.com’s client sentiment for Meta CFDs

As of 27 October 2025, Capital.com’s client sentiment for Meta CFDs is strongly weighted towards long positions, with 93.6% buyers and 6.4% sellers – a difference of around 87 percentage points. This indicates a clear bias towards buying, with long positions currently dominant among open trades on the platform. This data reflects live positions on Capital.com and is subject to change.

FAQ

Is Meta a good stock to buy?

Meta Platforms has shown solid share price performance in recent years, supported by steady advertising revenue and growth in AI-driven products. However, whether it is a good time to buy depends on individual risk tolerance, objectives, and market conditions. CFD traders can track Meta’s price trends and analyst forecasts to form their own view. Contracts for difference (CFDs) are traded on margin – leverage amplifies both profits and gains.

Could Meta stock go up or down?

Meta’s share price can rise or fall depending on factors such as quarterly results, advertising demand, and developments in artificial intelligence. Market sentiment, sector trends, and regulatory updates may also influence its movement. Past performance is not a reliable indicator of future results.

Should I invest in Meta stock?

Whether to invest in Meta depends on personal circumstances and understanding of market risk. Trading or investment decisions should be based on independent research and, where appropriate, professional advice. Past performance is not a reliable indicator of future results.

What factors influence Meta’s share price?

Meta’s share price is driven by advertising revenue, AI-related investment, user growth, and broader technology-sector trends. Earnings announcements, competition, and macroeconomic factors such as interest rates or global growth can also have an impact.