Swing trading strategy: An educational guide

Swing trading is a style of trading that attempts to capture medium-term gains on an asset by holding it for a period of time. Learn more about it in our educational guide.

Swing trading explained

Swing trading refers to the medium-term trading strategy that involves taking a position on a security for a period of a few days to a few weeks, aiming to profit from price swings. Swing trading strategies employ fundamental or technical analysis to determine whether a particular security could go up or down in price in the near future.

Highlights

- Swing trading is a trading strategy that involves taking a position on a security over a period of days or weeks, in an attempt to profit from expected price swings in the market.

- Swing traders use fundamental and technical analysis to identify potential trading opportunities. One of the key differences between swing trading and day trading is time.

- Swing trading tends to be more medium-term with positions kept open for days or weeks, while day trading positions are opened and closed on the same day.

Fundamental analysis for swing trading

Fundamental analysis is a method of analysing securities by examining the underlying economic, financial and other qualitative and quantitative factors that could influence their value.

This may involve keeping aware of the state of the economy, news releases regarding a particular security, analysing a company’s financial statements such as its quarterly earnings reports, and studying market conditions to determine a company’s intrinsic value and potential for future growth.

Technical analysis for swing trading

Technical analysis is a method of analysing price and volume data over specific time frames, to identify trends and forecast future price movements. It is a form of chart analysis that uses historical price data and various chart patterns to identify trends and make predictions about the future direction of markets.

Technical indicators are mathematical calculations that use historical price data and volume data to provide insight into the potential direction of a security. These indicators can be used to identify trends, gauge market sentiment, identify support and resistance levels and more.

Examples of technical indicators include moving averages (MAs), the Relative Strength Index (RSI), Bollinger Bands® and stochastic oscillators.

Building a swing trading strategy

There are a number of steps a trader could take if they hope to build an effective swing trading strategy.

-

Identifying their market. As a first step traders could identify which market they wish to trade in. This could be shares, indices, forex, commodities, or cryptocurrencies.

-

Utilising fundamental and technical analyses. These analyses could be helpful in letting traders determine when to enter and exit trades.

-

Setting risk parameters. This could include setting stop-losses – or guaranteed stop-losses, which have no risk of slippage but incur a fee if triggered – profit targets and position sizing.

-

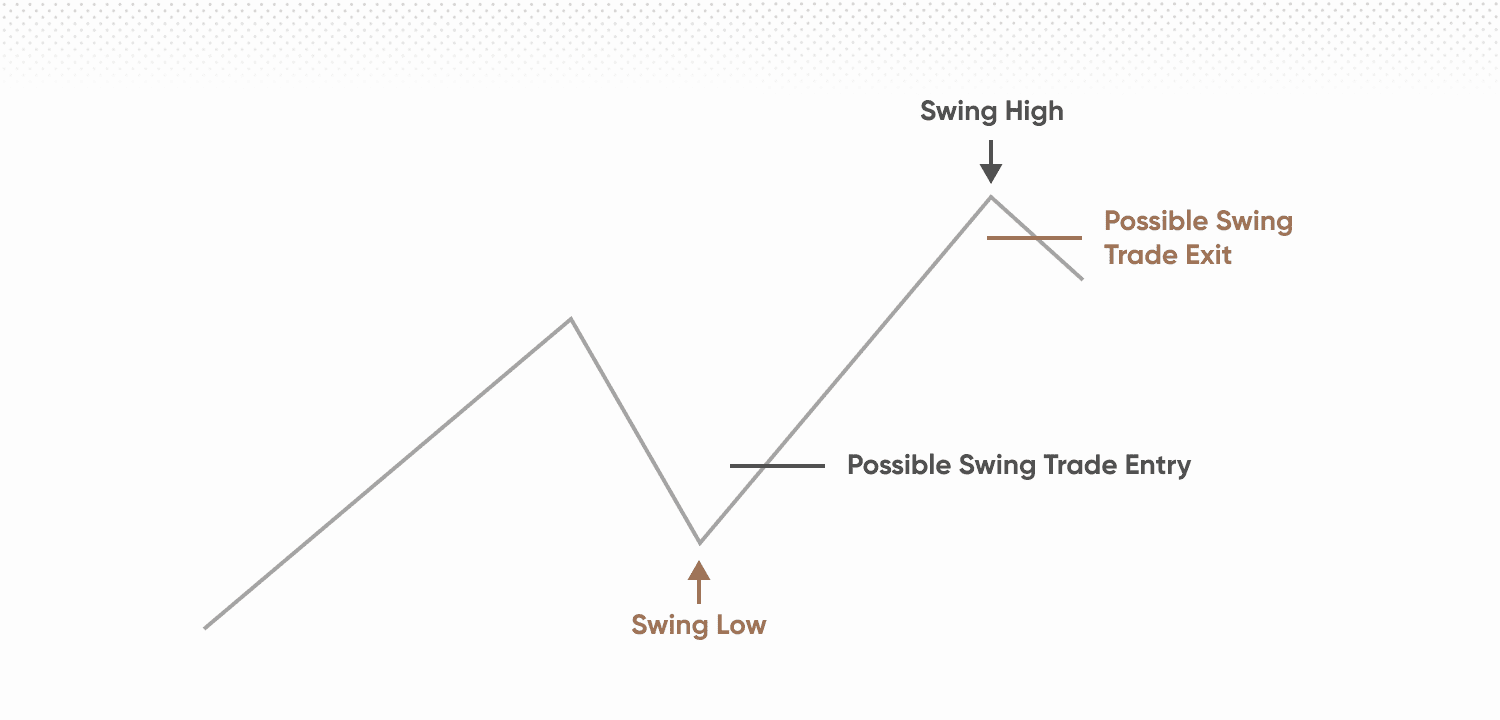

Developing an entry and exit strategy. An entry and exit strategy could include criteria for entering and exiting trades, as well as any trailing stops or profit targets traders may choose to utilise.

-

Backtesting the strategy. Traders may find it useful to test their strategy before risking any funds, to help identify potential weaknesses and improve their strategy over time.

-

Executing the trades. Once traders have developed and tested their strategy, they may decide to begin executing trades. However, it’s important to remember that even with a carefully thought-out strategy there is always the risk of making a loss. Before making any decision, traders should consider how comfortable they are losing money, their expertise in the market and the diversity of their portfolio among other factors. They should also never trade money they can’t afford to lose.

Swing trading strategies and techniques

How do you swing trade? There are several different swing trading strategies often implemented by traders. Below are some of the most popular.

Breakout

A breakout technique is an approach where a trader takes a position on the early side of the uptrend, looking for a market or stock that is most likely to ‘break out’. The trader gets into the trade as soon as they see the desired level of volatility and movement of a stock that breaks a key point of stock’s support or resistance.

Breakdown

A breakdown strategy is the opposite of a breakout. The market price goes lower than a defined support level and the chart points toward lower prices. Then, traders monitor the same fundamentals as with breakouts.

Reversal

This swing trading technique uses price-changing momentum when its growth or fall slows down before having a complete reversal.

Retracement

A concept that is quite similar to reversal. Retracement is applied when the price reverses within a larger trend, but not to its high or for any length of time. A stock temporarily retraces to an earlier price point and then continues to move in the same direction later.

What instruments do swing traders typically trade?

There are many types of financial instruments that can be used for swing trading. As usual, each type has its own advantages and disadvantages. The choice of an instrument depends on the trader's risk profile, level of experience and present market conditions.

We will list the most popular of the instruments for this type of trading:

Currencies. When working with currencies, the swing trading trader is looking for a particular currency to move in an expected direction (both down and up) in comparison to another currency.

Individual stocks. Another choice for swing trading is with individual company stocks. The idea behind it is exactly the same: swing traders buy a stock for a specific period of time, then sell it for a profit.

Swing trading helps the traders to diversify their investments. Yet, it is important to remember that every trading method has its pros and cons, and it is up to the trader which one of them he or she will choose.

FAQs

What does swing trading mean?

Swing trading can be explained as a trading strategy that focuses on taking advantage of medium-term price movements in a stock or other security.

How can traders find stocks for swing trading?

Traders could utilise fundamental and technical analysis in order to determine which stocks are most suitable for their swing trading strategy.

Is swing trading profitable?

There is the possibility of turning a profit with swing trading, however, there is also always the risk of making a loss if the market moves against a trader’s position. Traders should be sure to always do their own thorough research before making any trading decisions and never trade with more money than they can afford to lose.