What is gold trading and how does it work?

What is gold trading?

Gold trading involves speculating on the price of gold – either directly or via derivatives like contracts for difference (CFDs) – which allow exposure without owning the physical metal.

As one of the most actively traded precious metals, gold has historically been seen as a potential safe haven during periods of market stress or geopolitical uncertainty. Its price is influenced by factors such as inflation, interest rates, central bank policy, and movements in the US dollar, which often shows an inverse correlation.

Traders may look to gold to diversify portfolios, manage risk, or seek short-term opportunities through online trading platforms.

How does gold trading work?

Gold trading involves speculating on the price movements of spot markets and futures-based contracts. If you use derivatives like contracts for difference (CFDs), you can trade gold without owning the physical metal. CFDs are traded on margin, and leverage amplifies both profits and losses. Here’s how it works:

Buy and sell positions

As a gold trader, you might take a long position when you expect prices to rise, or go short if you think prices will fall. This flexibility means you can respond to a range of gold trading price conditions – from central bank policy shifts to geopolitical events – without taking delivery of the metal.

Spreads and trading costs

Gold CFD trading costs are typically reflected in the spread – the difference between the buy and sell price – though commissions or overnight charges may also apply. If you keep a position open beyond the trading day, overnight funding charges may apply. Before trading, learn the costs on our charges and fees page.

Trading on margin

Gold CFDs are traded on margin, so you only need to deposit a percentage of the full trade value to open a position. This allows for greater exposure than your initial outlay, which can magnify both profits and losses. It’s important to manage risk appropriately and understand your margin requirements before placing a trade.

Gold price volatility

Gold prices can be volatile, often reacting to macroeconomic data, central bank interest rate decisions, shifts in the US dollar, and gold trading news. Events such as non-farm payrolls or inflation reports can cause sharp price swings, creating opportunities for day traders and those using short-term strategies.

Market access

You can trade gold online with our CFD trading platform – available on desktop and mobile. High liquidity in gold markets can support efficient execution and competitive spreads, although slippage may still occur during periods of heightened volatility.

Which gold markets can I trade?

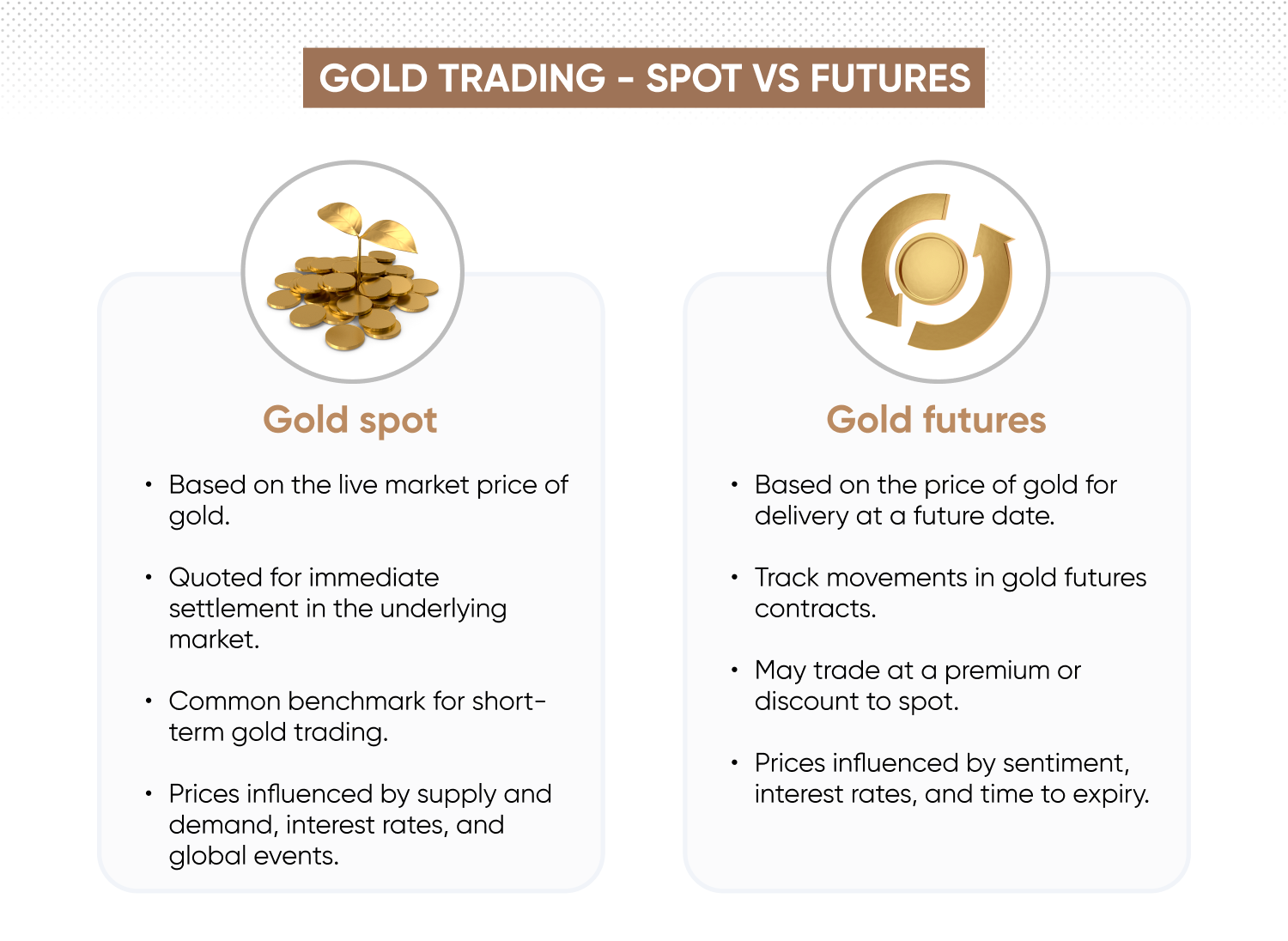

When you trade gold CFDs with us, you have two key markets to choose from: gold spot and gold futures:

-

Gold spot CFDs reflect the live market price of gold, typically quoted for immediate settlement in the underlying market. It’s the most common benchmark for gold CFDs, giving you exposure to short-term price moves without owning the metal. Gold spot prices are influenced by global supply and demand, interest rates, and major economic events.

-

Gold futures CFDs track the price movements of gold futures contracts, which lock in a price for gold at a future date. Gold future prices often trade at a premium or discount to spot, depending on factors like market sentiment, interest rates, and time to expiry. With CFDs, you can trade on these price changes without the need to access a futures exchange or hold a futures account.

Learn more in our contracts for difference (CFD) trading guide.

Learn more in our contracts for difference (CFD) trading guide.

What is an example of gold trading?

Trade Gold spot CFD – long position

Suppose gold is trading at $2,300 an ounce. After a lower-than-expected US inflation report, you think the price will rise.

You open a long gold CFD at £10 per point. This means you’ll make or lose £10 for every $1 movement in the gold price. With a 5% margin requirement, you need to deposit £11,500 to open the position.

Later that day, gold rises to $2,320. That’s a 20-point move in your favour. You close the position and make a gross profit of £200 (20 × £10), before any spread or overnight funding costs.

However, if gold had dropped to $2,280 instead, you’d be looking at a 20-point decline — resulting in a loss of £200 (20 × £10), and any charges and fees, if applicable.

Trade Gold futures CFD – short position

Now imagine you expect gold prices to fall, based on upcoming commentary from the US Federal Reserve.

In this scenario, gold futures trade at $2,320. You go short at £10 per point, meaning each $1 move equates to £10 profit or loss. With 5% margin, you deposit £11,600 to open the trade.

Gold falls to $2,300, and you close out for a 20-point gain — a profit of £200 (20 × £10), before costs.

If the market moved the other way — say to $2,340 — that same 20-point move would result in a loss of £200, excluding the spread.

Where can you trade gold?

Gold trading is available through derivatives markets, accessed via regulated online brokers. Retail traders can speculate on gold price movements using CFDs, without owning physical bullion or accessing gold commodity trading exchanges directly.

Here are some common venues that underpin gold CFD prices:

-

COMEX (part of CME Group): a major exchange for gold futures, widely used as a reference point for gold derivatives pricing.

-

The London OTC gold market: the primary global venue for physical gold trading. The London Bullion Market Association (LBMA) administers the LBMA Gold Price, a benchmark for physical gold often referenced in gold spot CFD pricing.

-

Shanghai Gold Exchange (SGE): a leading physical gold trading hub in Asia that contributes to regional and increasingly global price discovery, particularly through the Shanghai Gold Price benchmark.

You can trade gold CFDs with us through our easy-to-navigate web platform and mobile apps, with price alerts, gold trading charts, risk management tools, market analysis, and more.

Learn more about commodities markets in our commodities trading guide.

What are the gold market trading hours?

As a globally traded commodity, gold trading hours run nearly around the clock. On our trading platform, you can access extended hours for gold CFDs during the week.

Here are the gold market trading hours (in UTC):

|

Market |

Summer hours* |

Winter hours** |

Our hours (via CFDs) |

|

Gold spot |

Sunday 10pm - Friday 9pm |

Sunday 11pm - Friday 10pm |

|

|

Gold futures |

Sunday 10pm - Friday 9pm |

Sunday 11pm - Friday 10pm |

Gold future CFD trading hours |

*Daily break 9pm-10pm

**Daily break 10pm-11pm

If you choose to trade CFDs, you can follow gold’s performance live in US dollars with our comprehensive gold futures and gold spot price charts.

Gold trading: What are the risks and benefits?

Gold trading carries both potential opportunities and risks, influenced by market volatility, leverage, and global events.

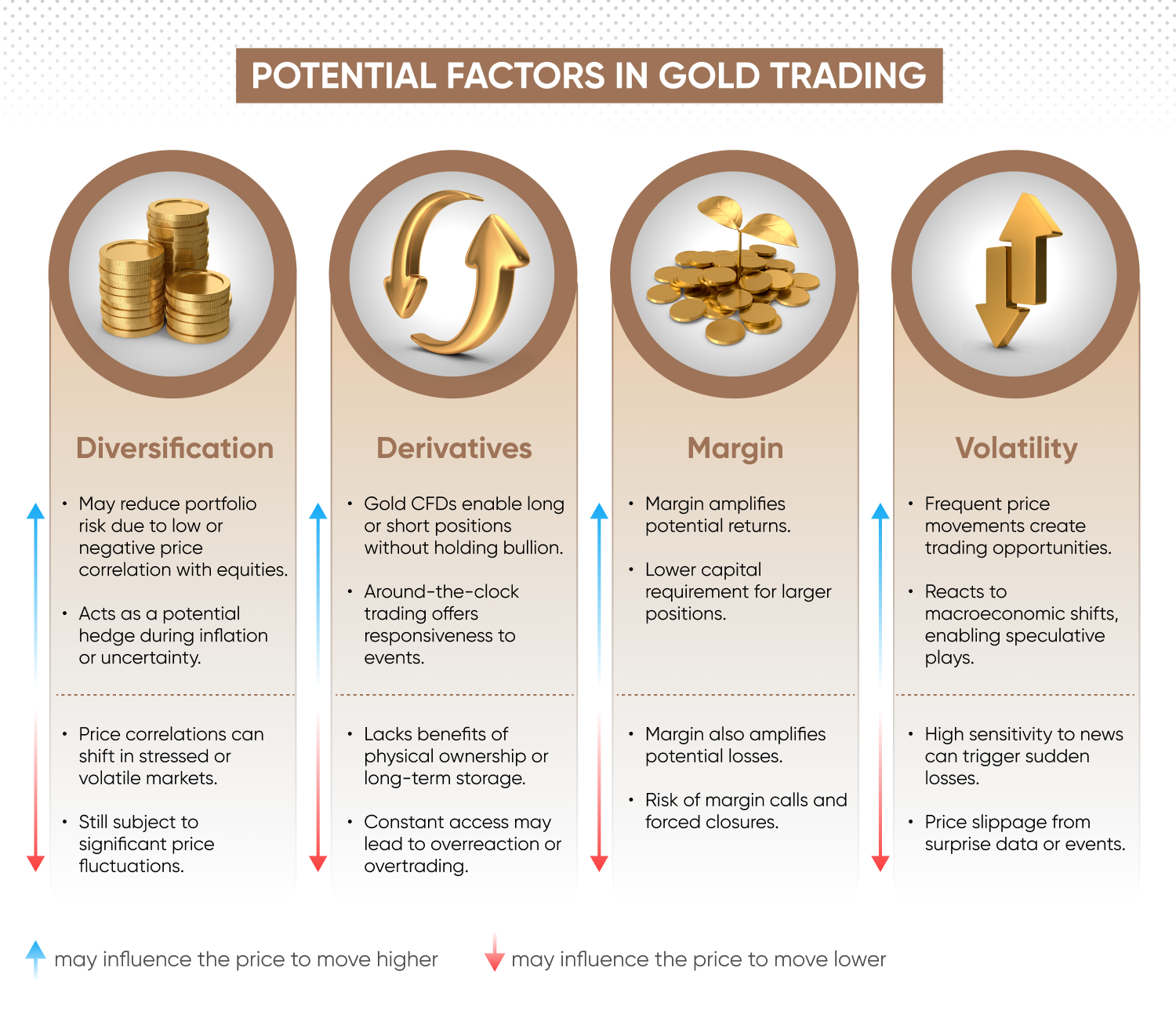

Diversification and safe-haven appeal

Gold is considered a diversification tool thanks to its historically low correlation with equity markets. During periods of economic stress or inflationary pressure, gold can behave differently to shares or indices, potentially making it attractive for hedging strategies. However, correlations can shift in times of extreme volatility, and gold itself can still experience sharp price swings.

Flexibility and access

CFD trading gives you the ability to go long or short on gold prices, without needing to own or store the physical metal. This allows for greater flexibility in different market conditions when trading gold online. Gold trading is available nearly 24 hours a day on weekdays – with short breaks – and gold CFDs are widely accessible on most trading platforms. However, round-the-clock gold trading hours can increase the risk of reacting to short-term noise or overtrading.

Leverage and margin

Trading gold on margin means you can control larger CFD positions with a smaller deposit. Margin amplifies potential gains as well as potential risk, and margin calls or automatic position closures may occur when equity falls below required thresholds.

Volatility and news sensitivity

The gold trading price can be influenced by a wide range of macroeconomic factors, including interest rate expectations, US dollar strength, inflation forecasts, geopolitical conditions, and central bank policy decisions. While this can create potential trading opportunities, it also means prices can react sharply to unexpected news or data releases — which might increase risk of price slippage or sudden losses.

No ownership of the underlying asset

When gold trading online via CFDs, you’re speculating on price movement rather than owning bullion. This means you don’t benefit from physical ownership (such as long-term holding or storage value), and exposure is limited to the terms of the CFD instrument, including charges and fees.

Past performance isn’t a reliable indicator of future results.

Trading gold vs silver: What are the differences?

Gold and silver are two of the most actively traded precious metals. While often grouped together, they differ in terms of demand and trading characteristics. Here’s how they compare:

|

Gold |

Silver |

|

|

Market size |

Larger, more liquid |

Smaller, less liquid |

|

Volatility |

Lower, steadier price movements |

Higher – more prone to price swings |

|

Demand |

Investment, central banks, jewellery |

Industrial use (electronics, solar), jewellery, investment |

|

Trading uses |

Hedging, diversification, short-term strategies |

Speculation, hedging, volatility-based strategies |

Gold trading

Gold is one of the most liquid precious metals in the commodities market. For CFD traders, it typically offers tighter spreads, steady pricing, and high responsiveness to macroeconomic events — especially central bank decisions, inflation data, and moves in the US dollar. It’s often viewed as a hedge or diversification tool, but also features in day trading strategies during volatile periods like major economic releases or geopolitical events.

Silver trading

Silver shares some characteristics with gold, but it’s distinguished by its broader industrial demand. Silver can experience greater intraday volatility, making it popular among traders seeking frequent price movements. Like gold, silver CFDs are available for extended trading hours on weekdays, with short daily breaks.

Learn about trading silver in our comprehensive silver trading guide.

What are some gold trading strategies?

Gold traders have a range of strategies to choose from. Which gold trading strategy is best for you may depend on timeframe, risk tolerance, and access to a reliable gold trading platform. Here are some common trading strategies:

Day trading strategy

As a day trader, you might open and close multiple gold CFDs within the same day, aiming to capitalise on intraday volatility. Short-term gold price movements may be influenced by key economic data releases like US inflation or non-farm payrolls. Day traders monitor support and resistance levels, moving averages, and RSI to help identify potential entry and exit points.

Swing trading strategy

Swing trading involves holding gold positions for several days to a few weeks. Swing traders look to capture medium-term price moves, often around technical levels or changes in momentum. Swing traders use tools like RSI, Fibonacci retracements, and candlestick patterns to inform trade timings.

Trend trading strategy

Trend traders aim to follow sustained moves in the gold price – either upward or downward. Trend trading strategies can involve technical indicators such as moving averages, trendlines, or the ADX to assess the strength of a prevailing trend. For example, a weakening US dollar or dovish central bank stance may support a longer-term bullish trend in gold.

Position trading strategy

Position trading is a longer-term approach. These traders hold gold CFDs for weeks or months, basing their decisions on macroeconomic factors such as central bank policy, inflation expectations, and geopolitical risk. As a position trader, you might use wider stop-losses, while monitoring margin requirements.

Discover more trading strategies on our comprehensive trading strategies page.

What this means for EU traders

For traders in Europe who operate internationally, gold offers access to one of the world’s most liquid and widely recognised commodities. Beyond its role as a traditional safe-haven asset, gold is influenced by global policy shifts, dollar movements and cross-border flows, all of which are relevant to traders working across regions.

Seeing gold within a broader global framework, rather than solely through local market conditions, provides a more rounded view of the factors that may affect price movements. This approach can help align trade timing, currency exposure and risk management more effectively with wider market trends.

Create an account Open a demo account

FAQs

What is gold trading?

Gold trading means speculating on the price of gold. Retail traders might use contracts for difference (CFDs), which could reference the spot price of gold or futures contracts – without buying or selling physical bars or coins. You can trade long if you think the price will rise, or short if you think it will fall — with profit or loss depending on the size and direction of the move. CFDs are traded on margin, which amplifies both losses and gains.

Can you make money trading gold?

Yes, it’s possible to make money trading gold if your market predictions are correct. However, keep in mind that past performance is not a reliable indicator of future results. CFD trading offers profit potential in both rising and falling markets, but it also carries the risk of losses — especially when trading on margin, which amplifies these effects. Sound risk management and a disciplined strategy remain key.

How do you trade gold?

To trade gold, you’ll need to open an account with a regulated broker offering gold CFDs, such as Capital.com. Once set up, you can take a position on gold spot or futures prices using a trading platform. Traders use technical analysis, economic news, and chart patterns to inform their decisions. You can use charts, technical indicators and economic news (such as inflation data or interest rate decisions) to guide your entries. Trades can be opened and closed online, and you can set risk management controls like stop-loss, take profit, and price alerts. Stop-loss orders are not guaranteed. For more information about guaranteed stop-losses, visit our charges and fees page.

How does gold trading work?

Gold CFDs reference prices in the underlying gold market — such as spot or futures prices. Traders can go long if they expect prices to rise, or short if they anticipate a fall. Margin trading allows for greater exposure with a smaller deposit, but this also increases the risk. Prices can react to macroeconomic factors like inflation data, US dollar moves, and central bank policy.

Curious about trading other assets?

We offer access to the most popular financial markets in the world.Indices trading

Find out more about index trading, a popular way for traders to gain broad exposure to listed companies.

Shares trading

Trade price movements of the biggest companies without needing to own the stock itself.

Forex trading

Learn about the world’s most-liquid market and why so many people trade it.