BrewDog IPO – How to trade BrewDog shares

Learn about BrewDog and its upcoming initial public offering (IPO), with potential price drivers, and how to trade stocks via CFDs.

When is the BrewDog IPO?

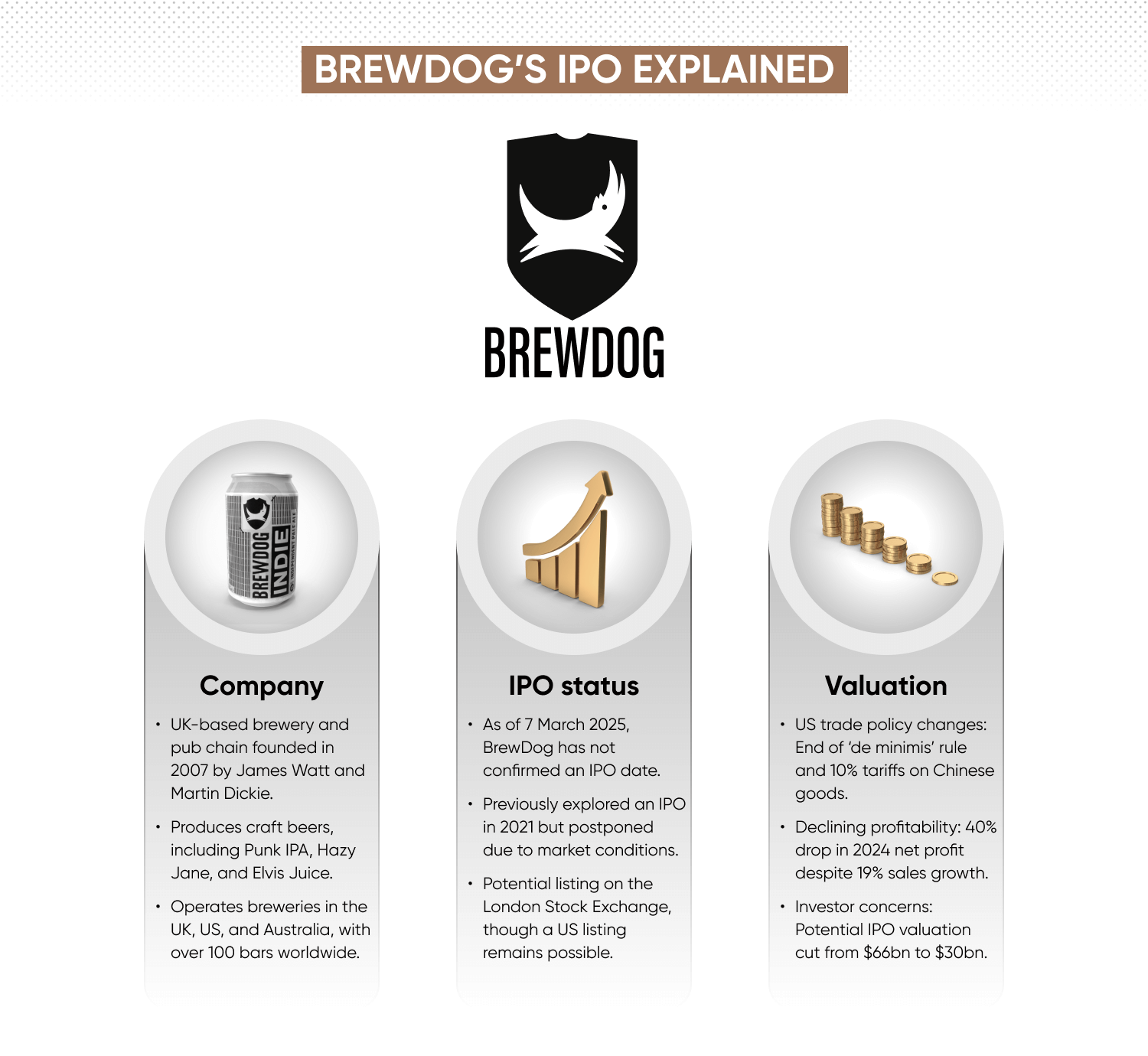

As of 7 March 2025, BrewDog has not confirmed a date for its IPO, and no formal filing has been made. BrewDog previously explored an IPO in 2021 but delayed plans due to market conditions. Reports suggest the company could list on the London Stock Exchange, though a US listing remains possible.

BrewDog’s most recent valuation was around £1.8bn, based on its last funding round. However, it was reported that the company’s pre-tax losses had doubled to £59 million in the final year under co-founder James Watt, prior to his resignation in May 2024. Watt was replaced as CEO by then Chief Operating Officer James Arrow.

The IPO timing may be influenced by market sentiment, financial performance, and regulatory factors. Traders may also consider alternative beverage stocks such as Diageo or AB InBev for sector exposure.

It’s important to note that BrewDog’s IPO plans may change depending on market conditions and company strategy.

What is BrewDog?

BrewDog is a UK-based brewery and pub chain known for its craft beers and direct-to-consumer sales. Founded in 2007 by James Watt and Martin Dickie in Fraserburgh, Scotland, the company produces a range of beers, including Punk IPA, Hazy Jane, and Elvis Juice. BrewDog operates breweries in the UK, US, and Australia, alongside over 100 bars worldwide.

BrewDog’s business model includes retail sales, wholesale distribution, and hospitality. It launched its Equity for Punks crowdfunding scheme in 2009, raising capital from retail investors. The company also runs online beer sales, beer subscription services, and branded hotels.

Key milestones in BrewDog’s history

- 2007founded in Fraserburgh, Scotland, focusing on craft beer innovation.

- 2009launched Equity for Punks, a crowdfunding initiative for beer industry financing.

- 2015announced plans for international expansion with a U.S. brewery in Ohio.

- 2017TSG Consumer Partners acquired a 22% stake, valuing the company at approximately £1bn.

- 2020saw record online sales as demand surged during lockdowns.

- 2021postponed IPO plans amid market uncertainty and workplace culture scrutiny.

- 2022BrewDog claimed that Goldman Sachs valued the company at £1.8bn.

- 2023revenue grew from £321m to £355m; losses doubled to £59m.

- 2024CEO James Watt stepped down in May, transitioning to 'captain and co-founder'.

As of 7 March 2025, BrewDog operates globally, with over 100 bars and hotels worldwide. By 2030, the company projects an increase to approximately 300 venues, including plans to expand in India, China and South Korea.

How does BrewDog make money?

BrewDog makes money as a brewery, retailer, and hospitality business, selling craft beer through direct-to-consumer channels, wholesale partnerships, and branded venues. The company also raises capital through crowdfunding initiatives.

Here’s more on BrewDog’s revenue streams.

|

Revenue stream |

Description |

|

Retail & e-commerce |

BrewDog sells its beers directly through its website and subscription services. Its online store offers cases, mixed packs, and limited-edition releases, while the BrewDog & Friends subscription provides regular deliveries for a monthly fee. |

|

Wholesale & distribution |

The company supplies major supermarket chains, independent bottle shops, and hospitality venues. Retail partners include Tesco, Sainsbury’s, and Waitrose in the UK, alongside distributors in Europe, the U.S., and Australia. |

|

Bars & hotels |

BrewDog operates over 100 venues worldwide – including both company-owned and franchised locations, generating revenue from beer sales, food menus, and events. The company also runs BrewDog-branded hotels, such as the DogHouse in Manchester and Columbus, offering beer-themed stays. |

|

Equity for Punks |

BrewDog raises capital through its Equity for Punks crowdfunding scheme, selling shares directly to retail investors. This initiative fosters community ownership and engagement, with participants receiving perks, including discounts, early access to new products, and invitations to shareholder events. |

|

Collaborations |

BrewDog partners with brands and retailers to produce exclusive beers. Examples include co-branded releases with various supermarket chains, as well as limited-edition collaborations with global brands. |

BrewDog’s diversified business model combines beer production with direct sales, hospitality, and crowdfunding, positioning the company as a multi-channel beverage brand.

What might influence BrewDog’s live stock price?

BrewDog’s IPO valuation will depend on investor appetite for beverage stocks, consumer spending, market trends, and its financial performance. While previous funding rounds suggest a valuation of around £1.8bn, analysts will assess whether BrewDog’s business model can support long-term growth.

BrewDog’s stock price – if the company lists – could be influenced by several factors, including earnings performance, consumer demand, regulatory developments, and macroeconomic conditions.

Earnings, growth, and profitability

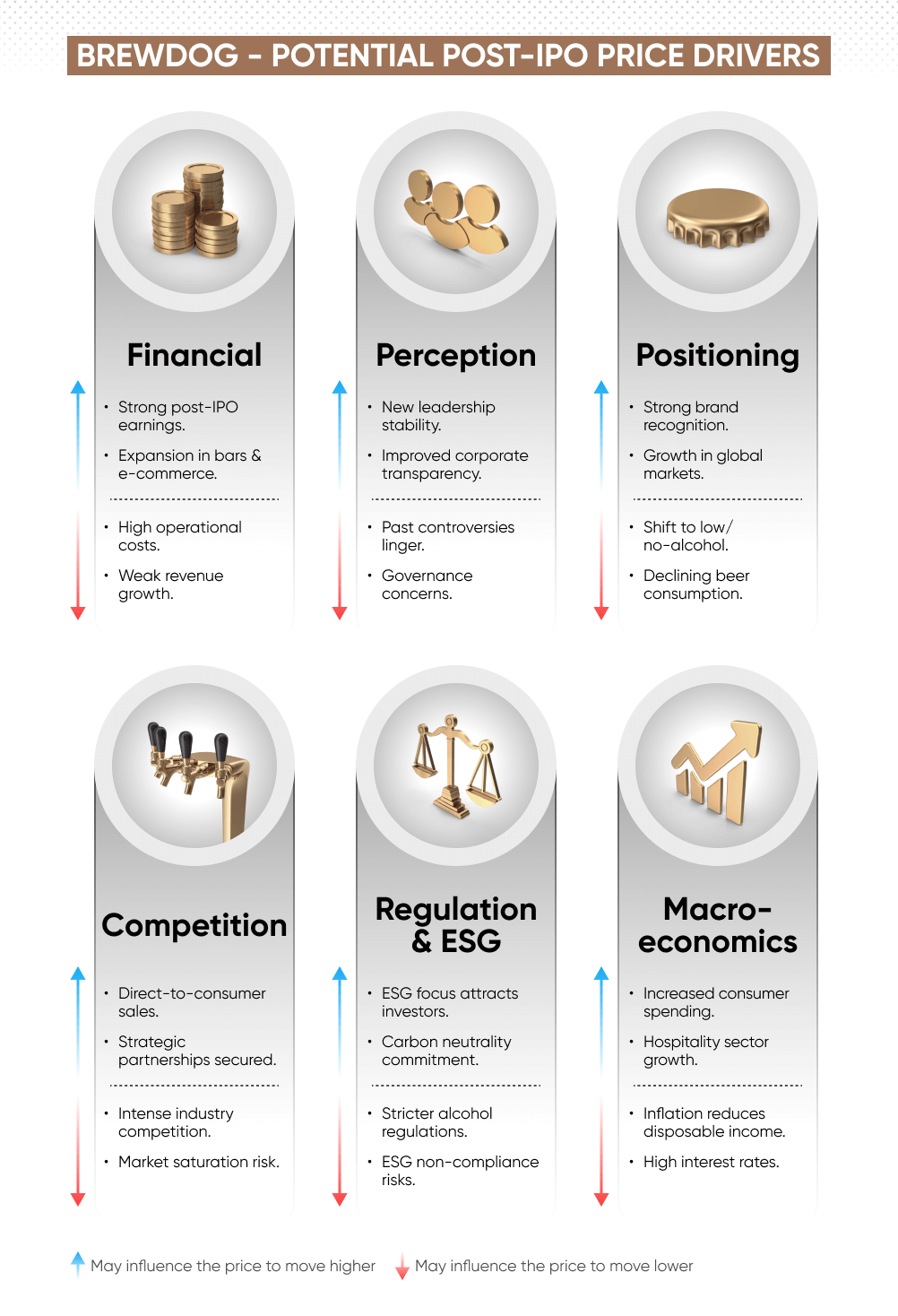

As a private company, BrewDog does not publish regular earnings reports. Post-IPO, quarterly results will be a key driver of its stock price. Analysts will monitor revenue from beer sales, bar operations, and e-commerce, alongside profitability metrics such as gross margins and debt levels. If BrewDog demonstrates sustained revenue growth and operational efficiency, investor confidence may increase. Conversely, weaker results or high operational costs could put downward pressure on its valuation.

Reputation, leadership, and governance

Co-founder James Watt, known for his outspoken public persona, stepped down as CEO in May 2024. BrewDog’s leadership and governance practices could impact sentiment. Allegations of a 'toxic workplace' in 2021 and claims of inappropriate behaviour have raised concerns among investors. If BrewDog successfully addresses governance issues and improves corporate transparency, it may bolster confidence. However, further controversies could lead to reputational risks which may impact BrewDog’s stock performance.

Consumer demand and market expansion

BrewDog operates in a competitive and evolving industry, where shifting consumer preferences could impact demand. While its brand remains strong, trends towards low-alcohol and alcohol-free beverages present both challenges and opportunities. BrewDog’s expansion into non-alcoholic products and new markets, such as the US and Asia, may support growth. However, declining beer consumption in key regions or stronger competition from craft and multinational brewers could affect revenue projections.

Competitive landscape

BrewDog competes with both multinational brewers, such as AB InBev and Heineken, and independent craft beer brands. Its ability to secure major retail and distribution partnerships could influence stock performance. BrewDog’s direct-to-consumer model and branded bars provide differentiation, but increasing price competition or market saturation may pose risks. Success in securing exclusive deals or launching innovative product lines could support its valuation, while market share losses could influence the price to drop.

Regulatory environment and ESG considerations

Alcohol regulations vary by region, and changes in advertising restrictions, alcohol duty, or sustainability requirements could impact BrewDog’s operations. The company’s commitment to carbon negativity and its Lost Forest reforestation project align with ESG (environmental, social, and governance) investment criteria. However, failure to meet sustainability targets or comply with regulatory shifts could deter institutional investors. Traders may monitor regulatory developments in the UK, US, and EU as potential stock price catalysts.

Macroeconomic factors and discretionary spending

BrewDog’s revenue is tied to consumer discretionary spending. Throughout 2024, high inflation and cost-of-living pressures affected hospitality and alcohol sales. If economic conditions stabilise, increased consumer spending on premium beer and experiences could drive revenue growth. Conversely, prolonged inflationary pressures, higher interest rates, or shifts in consumer behaviour towards lower-cost alternatives could impact BrewDog’s financial performance. Traders may track inflation, retail sales, and hospitality sector trends to assess BrewDog’s stock potential.

How to trade BrewDog stocks via CFDs

If BrewDog completes its IPO, traders will be able to speculate on its share price movements. Here’s how to trade BrewDog stocks when they become available.

- Choose a brokerage platform:select a regulated broker offering BrewDog shares or CFDs. Learn more about contracts for difference in our CFDs trading guide.

- Set up a trading account:register and verify your identity.

- Deposit funds:add money to your account using your preferred method.

- Monitor stock performance:stay updated on financial reports and industry news.

- Place a trade:buy or sell shares using market or limit orders. Consider stop-loss orders for risk management.

Stay ahead of market movements with expert insights in our news and analysis section.

Which other beverage shares can I trade?

As of 7 March 2025, BrewDog remains privately held, with no confirmed IPO date. But you can gain exposure to the beverage industry through these publicly listed companies:

Diageo (DGE) – A global leader in alcoholic beverages, owning brands such as Guinness, Johnnie Walker, and Smirnoff. Diageo operates in over 180 countries, generating revenue from spirits, beer, and ready-to-drink products.

Anheuser-Busch InBev (BUD) – The world’s largest brewer, with brands including Budweiser, Stella Artois, and Corona. AB InBev generates revenue from its extensive global distribution network, and its expanding into non-alcoholic and premium beverage segments.

Heineken (HEIA) – A major multinational brewer with operations in over 70 countries. Heineken owns brands like Heineken, Amstel, and Birra Moretti, and continues to expand in emerging markets, such as Brazil, India, and Vietnam.

Molson Coors (TAP) – A major North American and European brewer, known for Coors Light, Miller Lite, and Blue Moon. Molson Coors has diversified into non-alcoholic beverages and RTDs (ready-to-drink).

Constellation Brands (STZ) – A US-based beverage company focusing on premium beer, wine, and spirits. Constellation Brands holds the rights to distribute Corona and Modelo within the US, and has expanded into premium spirits and cannabis-infused drinks.

Davide Campari Milano (CPR) – An Italian drinks company with a strong presence in spirits, including Aperol, Campari, and Wild Turkey. Campari Group continues to grow through acquisitions and premium brand positioning.

Learn more about shares and stock markets in our comprehensive shares trading guide.

FAQ

What are the risks and rewards of trading BrewDog?

As of 7 March 2025, BrewDog has not confirmed an IPO date. Therefore, discussing potential investor interest is speculative. However, potential rewards could stem from its strong brand, global expansion, and diversified revenue streams. The company's focus on sustainability and direct-to-consumer sales may support growth. However, risks include competition from multinational brewers, changing consumer preferences, and regulatory challenges in the alcohol industry. BrewDog's financial performance post-IPO will be key to determining its valuation.

Could the BrewDog IPO happen in 2025?

As of 7 March 2025, BrewDog has not confirmed an IPO date. BrewDog has considered an IPO in the past but has not confirmed specific plans or dates. Reports suggest BrewDog may consider a London Stock Exchange listing, though no official filing has been made. The timing of its IPO will depend on evolving market conditions, demand, and BrewDog's strategy.

How do I trade or invest in BrewDog before its IPO?

Until BrewDog goes public, its shares are not available for trading on stock exchanges or through CFD platforms. Some institutional investors may access BrewDog shares via private placements, but these opportunities are typically restricted. Traders seeking exposure to the beverage sector before BrewDog’s IPO may consider listed alternatives such as Diageo, AB InBev, or Heineken – all available for CFD trading.

Will BrewDog shares be available for CFD trading?

If BrewDog completes its IPO, its shares may be available for CFD trading, depending on broker offerings. Traders should check with their provider to see if BrewDog stock will be listed as a tradable instrument. CFD trading would allow speculation on BrewDog’s price movements without owning the underlying shares.

Who owns BrewDog?

As of 2025, BrewDog remains privately owned. Major shareholders include co-founder James Watt, private equity firm TSG Consumer Partners, and retail investors from the company's Equity for Punks crowdfunding scheme. Ownership structure may change if BrewDog proceeds with an IPO.

Explore our IPO guides

Stay informed on upcoming or recent IPOs, market trends, and the newest trading opportunities

Arm IPO