EUR/CHF forecast: Third-party price targets

EUR/CHF is trading around 0.93384 as of 11.28am UTC on 4 December 2025, within an intraday range of 0.93277–0.93430 on the Capital.com platform. The pair remains close to the levels seen in early December. Past performance is not a reliable indicator of future results.

As of 4 December 2025, the euro / Swiss franc pair trades against a backdrop of relatively stable euro–franc conditions. European Central Bank (ECB) data placed the euro reference rate for the franc near 0.9336 (European Central Bank, 3 December 2025), while recent communication from the ECB has signalled no immediate policy changes. On the Swiss side, expectations that the Swiss National Bank (SNB) will keep its policy rate at 0% well into 2026, together with inflation running near the lower end of its 0–2% target band, are helping to anchor funding conditions (Reuters, 3 December 2025).

Past performance is not a reliable indicator of future results.

EUR/CHF forecast 2026–2030: Analyst price target view

Third-party euro / Swiss franc forecasts from October and December 2025 suggest relatively modest expected moves in EUR/CHF, with many projections clustered close to prevailing spot levels. These views typically reference safe-haven flows, rate differentials and potential SNB policy responses.

UBS (house view FX grid)

UBS’s October 2025 House View FX table shows a near-term EUR/CHF point forecast of 0.93 and a 6–12-month forecast of 0.94. This implies limited expected appreciation from the levels prevailing at the time. UBS attributes this to subdued Swiss inflation, low domestic rates and the possibility of softer safe-haven demand if global risk conditions stabilise, while noting that the SNB may still act to counter excessive franc strength (Investing.com, 20 October 2025).

ExchangeRates.org.uk (multi-bank forecast aggregation)

ExchangeRates.org.uk reports a blended projection placing EUR/CHF near 0.93407 at end-2025, rising towards approximately 0.93807 by mid-2026 and 0.94422 by end-2026. The site notes that this profile is based on a gradual improvement in euro-area growth and a softer franc as safe-haven flows normalise, assuming relatively steady SNB policy settings (Exchange Rates UK, 4 December 2025).

UBS (Q4 2025–Q3 2026 scenario)

A UBS-focused scenario summary places EUR/CHF around 0.94 from Q4 2025 through Q3 2026, treating that level as a medium-term anchor. The rationale suggests that while safe-haven demand for the franc may persist, it is expected to be transitory. As global political and trade uncertainties ease, interest-rate differentials and SNB policy could provide room for the euro to stabilise or recover relative to the franc (FastBull, 20 October 2025).

Wallet Investor (algorithmic path estimates)

Wallet Investor’s algorithmic estimates from early-December 2025 project EUR/CHF to close 2025 around 0.898. These projections draw on recent price behaviour and statistical modelling, assuming broadly unchanged macro and policy conditions in both economies (Wallet Investor, 4 December 2025).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

Euro / Swiss franc price: Technical overview

EUR/CHF is trading near 0.93384 as of 11.28am UTC on 4 December 2025, sitting above a tight cluster of moving averages. The 20/50/100/200-day SMAs are currently near 0.9298, 0.9295, 0.9326 and 0.9363 respectively. The short-term tone remains constructive while price holds above the 20–100-day band. The 14-day RSI at around 59.7 lies in the upper-neutral zone, while ADX near 17.6 indicates a moderate trend.

On the upside, the nearest classic pivot above spot is R1 at 0.9389, with R2 at 0.9456 coming into view if price closes above that level. On pullbacks, initial support sits at the classic Pivot around 0.9284. The 100-day SMA at 0.9326 is the first moving-average layer, and a sustained move below it could open the way towards S1 near 0.9218 (TradingView, 4 December 2025).

This technical analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

EUR/CHF history

Over the past two years, EUR/CHF has traded within a relatively contained range, generally between the high-0.92s and mid-0.98s. From late 2023 into early 2024, the pair mostly held above 0.94, briefly approaching the 0.98–0.99 region in April–May 2024 before retracing as the franc strengthened.

From the second half of 2024 into 2025, the cross drifted lower from the 0.95–0.97 area, slipping under 0.94 by April 2025 and spending much of the year between roughly 0.93 and 0.94. As at 4 December 2025, EUR/CHF is trading near 0.9340, only slightly below its 2024 year-end close of around 0.9399. This highlights how range-bound the pair has remained during this period.

Past performance is not a reliable indicator of future results.

Capital.com analyst view

EUR/CHF’s comparatively narrow trading range over the past two years reflects its status as a lower-volatility cross, influenced by similar inflation profiles and conservative central bank policies in the eurozone and Switzerland. Periods of euro strength have tended to align with improving euro-area data or firmer risk appetite, while renewed demand for the Swiss franc has often coincided with episodes of market caution or speculation around possible SNB tolerance for a stronger currency.

Looking ahead, market participants may continue to monitor ECB and SNB communications and broader risk sentiment for signals on how rate differentials and safe-haven flows could influence the cross. Stronger European growth or improving risk appetite could lend support to the euro, while geopolitical tensions, weaker euro-area data or changes in SNB signalling could favour the franc.

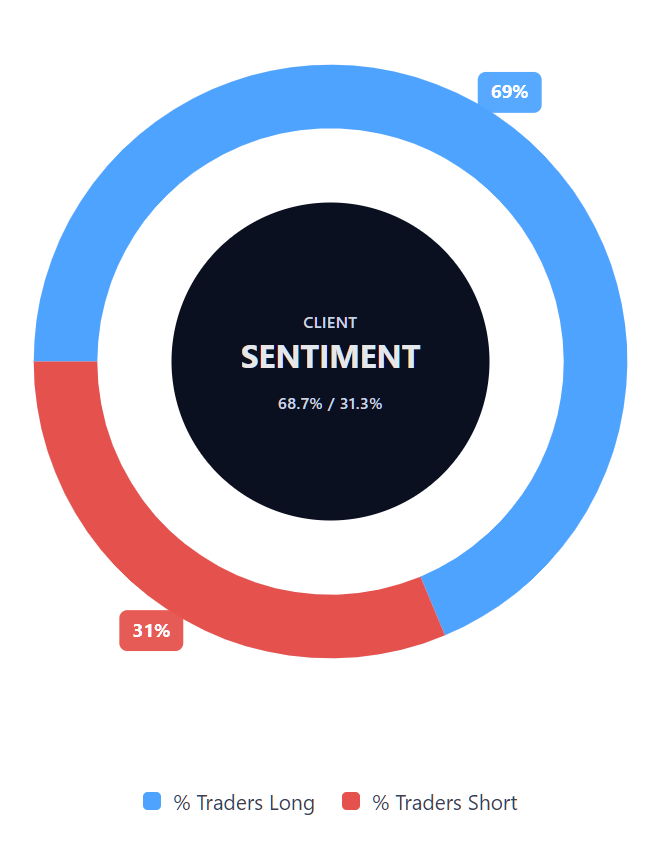

Capital.com’s client sentiment for EUR/CHF CFDs

As of 4 December 2025, client positioning on Capital.com currently shows 68.7% of open EUR/CHF CFD positions are held by buyers and 31.3% by sellers. This majority-buy stance is not extreme and may shift as traders adjust their exposure.

Summary – EUR/CHF 2025

- EUR/CHF has traded in a tight band through 2025, oscillating mainly between the low-0.93s and mid-0.94s.

- The pair has eased from levels above 0.95 seen earlier in the cycle, reflecting both softer euro phases and intermittent demand for the franc.

- Technical conditions show price moving around a cluster of short- and medium-term moving averages, with the 20–100-day SMAs just below current spot and the 200-day SMA slightly above.

- Momentum remains upper-neutral, with RSI(14) just under 60 and moderate trend readings, consistent with a range-bound environment.

- CFD sentiment shows 68.7% buyers versus 31.3% sellers on Capital.com, indicating a majority-buy skew without reaching a one-sided extreme.

- Past performance, including the relatively narrow volatility profile and repeated returns towards the mid-0.93s, is not a reliable indicator of future results.

Past performance is not a reliable indicator of future results.

FAQ

What is the euro / Swiss franc forecast?

Recent third-party forecasts for EUR/CHF generally point to modest projected moves, with many estimates clustering in the low-to-mid-0.90s. These outlooks typically consider factors such as euro–Swiss interest-rate differentials, safe-haven demand for the franc and the possibility of SNB intervention if the currency becomes significantly stronger. Forecasts differ by provider and methodology, and remain sensitive to changes in macroeconomic conditions, policy signals and wider market sentiment.

Why has EUR/CHF been dropping or rising?

EUR/CHF responds to shifts in economic data, central bank communication and broader market sentiment. The pair may rise when euro-area indicators improve or risk appetite strengthens, while it may fall when caution increases or geopolitical uncertainty prompts demand for the Swiss franc. Inflation trends and interest-rate expectations in both economies also play a role. Because these influences evolve over time, movements in EUR/CHF are rarely explained by a single driver.

Could EUR/CHF go up or down?

EUR/CHF can move in either direction depending on future economic developments, policy updates and market sentiment. Potential influences include changes in euro-area growth expectations, shifts in safe-haven demand, ECB or SNB communication and broader geopolitical conditions. As these factors are uncertain and subject to change, no future path for the pair can be predicted with certainty.

How can I trade EUR/CHF CFDs on Capital.com?

You can trade EUR/CHF CFDs on Capital.com through our user-friendly platform and app, which offers real-time pricing, fast execution and built-in tools such as price alerts, customisable charts and risk-management features like stop-loss orders. Contracts for difference (CFDs) are traded on margin – leverage amplifies both profits and losses.*

*Standard stop-loss orders aren’t guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee if activated.