How to trade wheat: a complete guide

Learn all about wheat and its price history, as well as how to trade it via CFDs on Capital.com.

What is wheat?

Wheat is a staple grain and one of the most widely grown crops in the world. It serves as a key ingredient in various food products, including bread, pasta, and flour. Wheat is traded as a commodity in global markets, with its price influenced by factors such as weather conditions, crop yields, global demand, and geopolitical events.

For traders, wheat is commonly traded through futures contracts, which are agreements to buy or sell a specific amount of wheat at a predetermined price on a future date. They can also be traded as a derivative through instruments like CFDs (contracts for difference), allowing speculation on both the futures and spot price movements without physically owning the commodity.

Why trade wheat?

Wheat trading offers opportunities to profit from wheat price fluctuations driven by factors like weather conditions, global demand, and geopolitical events. Additionally, wheat is a seasonal commodity, meaning its price tends to follow predictable patterns based on planting and harvest cycles, which traders can potentially capitalise on.

By trading wheat CFDs, you can take advantage of leverage, or margin trading, allowing you to control larger positions with a smaller capital investment, although leverage is risky as it magnifies both profits and losses. Wheat CFDs also enable you to profit from both rising and falling prices, offering flexibility in various market conditions without the need to handle physical delivery.

Whether you're looking to hedge against inflation, diversify your portfolio, or take advantage of seasonal price movements, wheat is an accessible market for traders.

Find out more about why people choose commodity trading in our guide, and learn essential concepts with our trading basics for beginners.

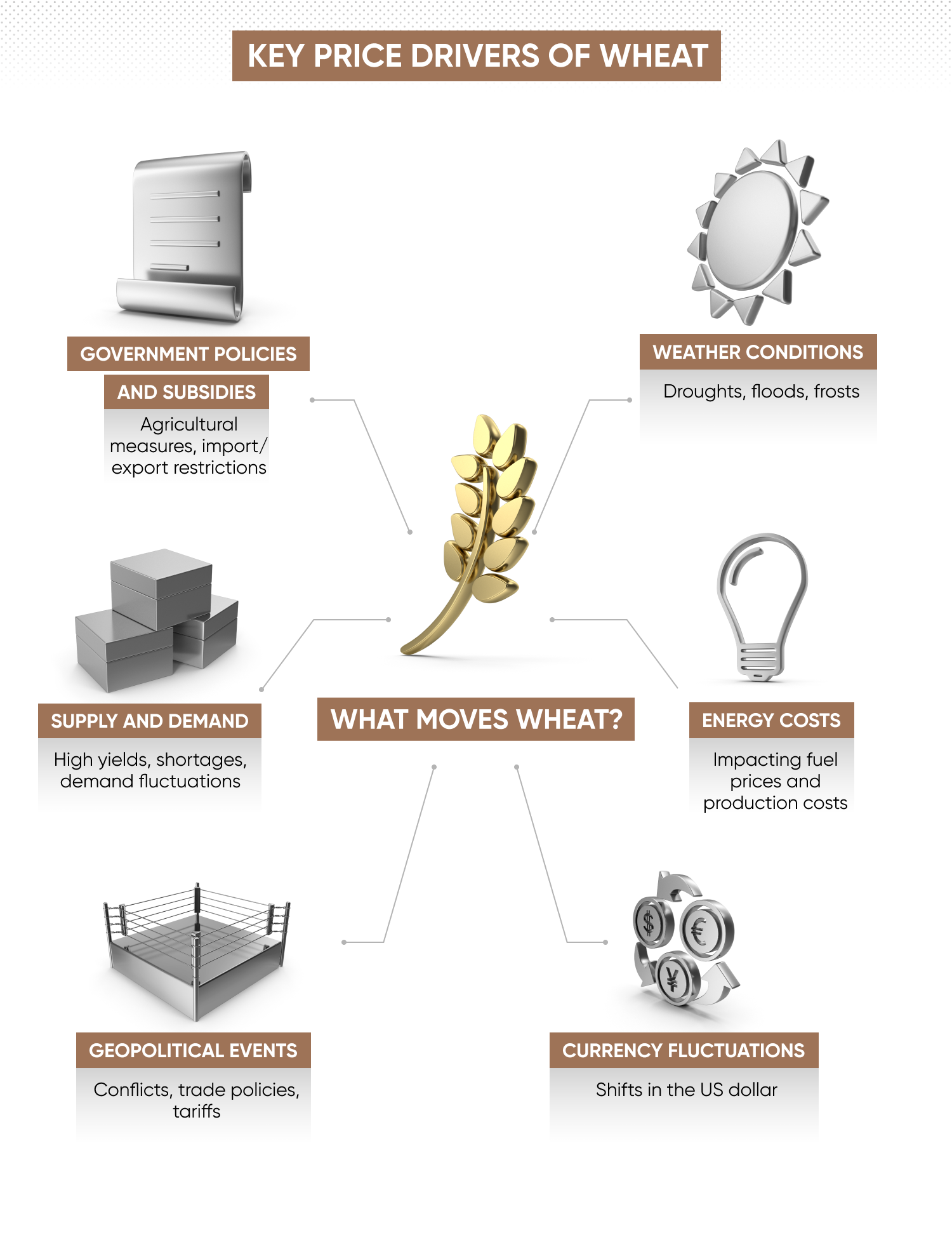

What affects the wheat price?

The price of wheat is influenced by several key factors, primarily global supply and demand. For wheat and other agricultural commodities, elements such as weather patterns, geopolitical events, and currency fluctuations are important drivers in turn. These events can influence your fundamental analysis of this and other markets, helping you understand how price might move.

Supply and demand

Global wheat prices fluctuate based on the balance between supply and demand. A high crop yield typically drives prices down, while shortages or increased demand push prices higher.

Weather conditions

Adverse weather events, such as droughts, floods, or frosts, can disrupt wheat production, reducing supply and causing prices to rise. Favourable weather conditions lead to higher yields and lower prices.

Geopolitical events

Political instability or conflicts in key wheat-producing regions (such as Russia, Ukraine, or the US) can disrupt exports, leading to global price spikes. Trade policies, tariffs, and sanctions also impact the global wheat market.

Currency fluctuations

Since wheat is traded globally in US dollars, fluctuations in currency exchange rates can affect the cost of wheat for importers and exporters, influencing global prices.

Energy costs

The production and transportation of wheat are energy-intensive, meaning rising fuel prices can increase production costs, which can lead to higher wheat prices.

Government policies and subsidies

Changes in agricultural policies, subsidies, or import/export restrictions from major wheat producers or consumers can also significantly affect wheat prices globally.

Wheat price history

Wheat prices have historically been volatile, shaped by a mix of supply shocks, export restrictions, and shifting demand. Seasonal cycles and weather play a regular role, but major geopolitical and macroeconomic events often cause the biggest moves. While wheat typically trades within a broad range, it can spike sharply when global supply is threatened, especially given its role as a staple food commodity.

2007-2008: Global food crisis sends prices soaring

Wheat futures surged past $13 per bushel in early 2008, more than doubling from the year before. A mix of droughts in Australia, rising oil prices, and export restrictions in key producers like Argentina and Ukraine tightened global supply. At the same time, biofuel demand pushed more crops toward energy production. The result: food inflation worldwide and growing market interest in agricultural commodities.

2012: US drought squeezes supply

Another major spike came in 2012, when the worst US drought in decades hit Midwestern crops. Wheat prices climbed to around $9.50 per bushel as the USDA slashed yield estimates. The rally was reinforced by dry conditions in Russia and Ukraine, sparking concerns about export capacity and tighter global stockpiles.

2022: Russia-Ukraine war disrupts global trade

In early 2022, wheat surged above $13 per bushel once again as Russia invaded Ukraine – two of the world’s largest wheat exporters. Black Sea shipping disruptions and sanctions on Russian exports created a sudden shock to global availability, pushing prices to 14-year highs. Panic buying and fears of food insecurity across emerging markets contributed to the rally.

2023–2024: Normalisation and volatility

Prices eased from 2022 highs but remained volatile. A grain corridor agreement helped restore some Ukrainian exports, while record crops in countries like Australia and Russia helped rebalance supply. Wheat traded mostly between $6-8 per bushel during this period, reacting to weather patterns, planting forecasts, and geopolitical headlines.

Past performance is not a reliable indicator of future results.

How is wheat traded?

Wheat is primarily traded on major exchanges such as the Chicago Board of Trade (CBOT), where physical contracts allow for the buying and selling of wheat in large quantities. This traditional method is popular among large-scale producers and commercial buyers who seek to manage price risks related to physical delivery.

However, as mentioned, retail traders can gain exposure to wheat through CFD trading, which allows you to speculate on wheat price movements without owning the physical asset. With CFDs, you can take a long position if you believe prices will rise or a short position if you expect them to fall, using leverage to control larger positions with smaller capital.

When trading wheat CFDs, it’s essential to combine fundamental analysis, like evaluating global supply and demand and weather conditions, with technical analysis to track market trends and price patterns. You might choose to engage in day trading, taking multiple positions within the same day, or prefer swing trading, holding trades for several days or weeks. To manage risk effectively, traders can set stop-loss and take-profit orders to lock in profits or limit losses as the market fluctuates, as part of a risk management strategy.

What are wheat futures?

Wheat futures are standardised contracts to buy or sell a specific quantity of wheat at a set price on a future date, again primarily traded on exchanges like the CBOT. These contracts allow traders to speculate on wheat prices or hedge against potential price movements.

For those looking to trade wheat futures without managing physical deliveries, they can also be traded via CFDs, allowing speculation on wheat futures prices without owning the underlying asset, along with the other draws of CFDs mentioned above.

Learn more about the difference between commodities and futures.

What are the wheat futures trading hours?

The wheat futures trading hours (via CME Globex) are Sunday to Friday: 12:00am to 6:45pm UTC*, with a 45-minute break from 6:45pm to 7:30pm UTC.

CFD trading hours for wheat often mirror or extend these hours, allowing CFD traders nearly 24/5 access to the wheat market. However, it’s important to confirm the specific trading hours with your CFD broker, as they may offer extended hours beyond the official exchange times.

*Trading hours may differ depending on national holidays and daylight savings time.

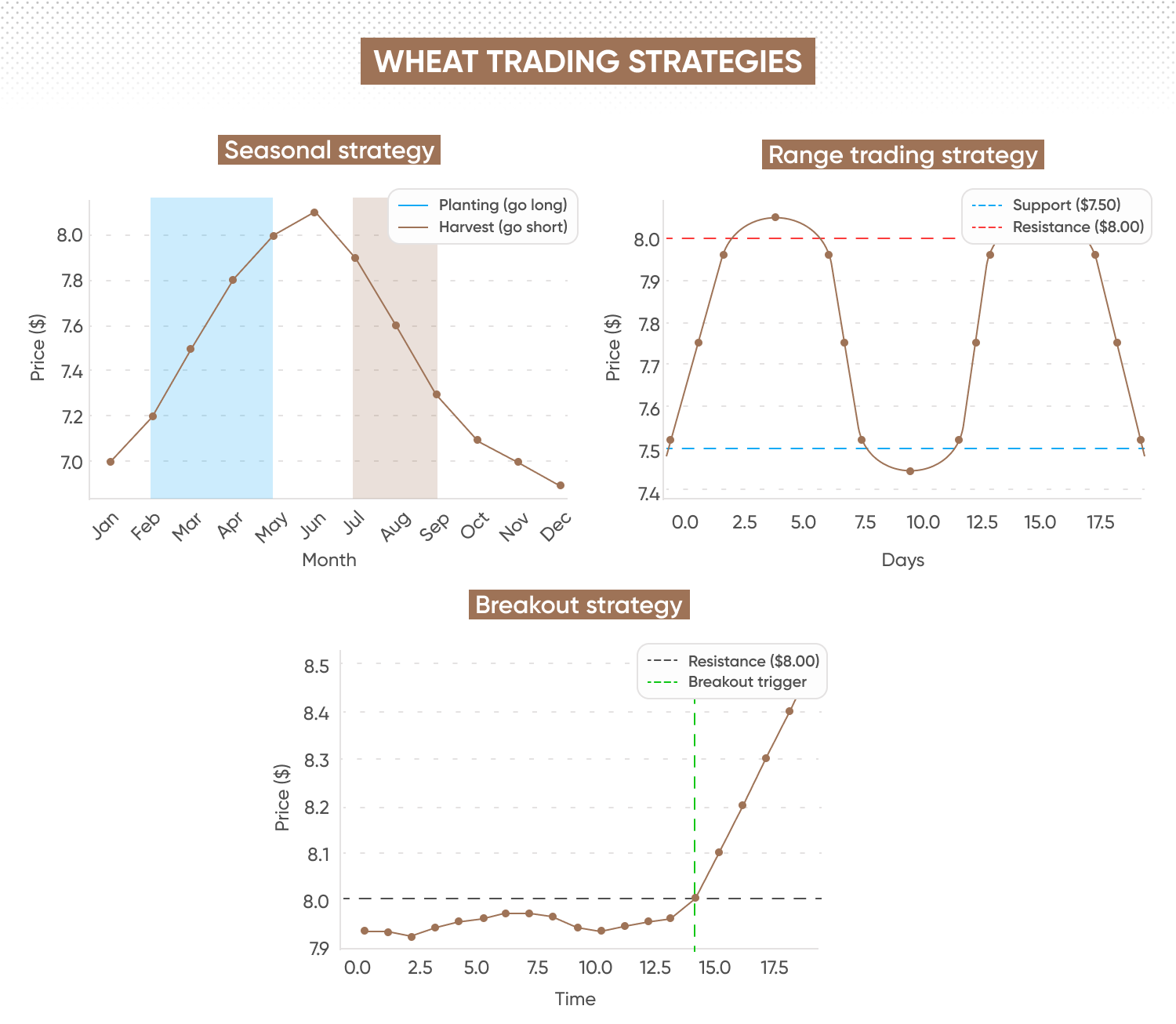

Top wheat trading strategies

Wheat trading strategies, along with other soft commodities, differ in some ways from those used in markets like metals or forex due to factors like seasonality, weather sensitivity, and storage costs. These elements create unique trading opportunities in wheat CFDs, requiring a different approach. Here are three potential strategies that take these factors into account.

Seasonal trading strategy

For this strategy, imagine you’re trading during wheat planting season. Prices tend to rise due to the uncertainty around how large the harvest will be. As a trader, you might go long on wheat CFDs during this period, expecting prices to increase as demand for future supplies grows. Conversely, during harvest season, when supply is plentiful, you could short wheat CFDs, anticipating a price drop. It’s important to remember, however, that past performance is not a reliable indicator of future results.

Range trading strategy

For range trading, you notice that wheat prices have been fluctuating between $7.50 and $8.00 per bushel over the past few weeks. This is a common scenario for soft commodities with seasonal cycles. You could buy near the support level at $7.50 and sell near resistance at $8.00, profiting from these repetitive price movements. Stop-loss orders below support and above resistance could help protect against sudden market shifts.

Breakout strategy

In this strategy, you’re monitoring wheat for a potential breakout. Prices have been trading in a tight range, and you’ve identified $8.00 as a key resistance level. If prices break above this level – perhaps due to an unexpected weather event or supply shortage – you could place a buy order above $8.00, anticipating a surge. Conversely, if prices break below support, you might consider a short trade.

Past performance is not a reliable indicator of future results.

FAQs

Why trade wheat?

Wheat is one of the most widely consumed and traded agricultural commodities, making it a vital part of the global economy. Traders may be drawn to wheat due to its price volatility, which is influenced by factors such as weather conditions, global demand, and geopolitical events. Additionally, wheat serves as a hedge against inflation and offers traders opportunities to profit from both rising and falling prices through instruments like futures, options, and CFDs.

What are the ways to trade wheat?

Wheat can be traded in several ways, depending on your trading goals. Futures contracts are standardised agreements to buy or sell wheat at a set price on a future date, commonly traded on the Chicago Board of Trade (CBOT). Meanwhile, derivatives like CFDs allow traders to speculate on wheat price movements without owning the physical commodity, using leverage to control larger positions, which can amplify profits but also losses.

How to trade wheat futures?

To trade wheat futures, you need to open an account with a broker that offers access to futures exchanges like the CBOT. You can then choose to go long (buy) or short (sell) based on your market outlook. Traders often use fundamental analysis (like supply-demand trends and weather reports) and technical analysis (such as chart patterns) to make informed decisions. You can also set stop-loss orders to manage risk and protect against unexpected market movements.

Visit our other complete guides

How to trade crude oil