What is a forex swap and how do you trade it?

What is a forex swap?

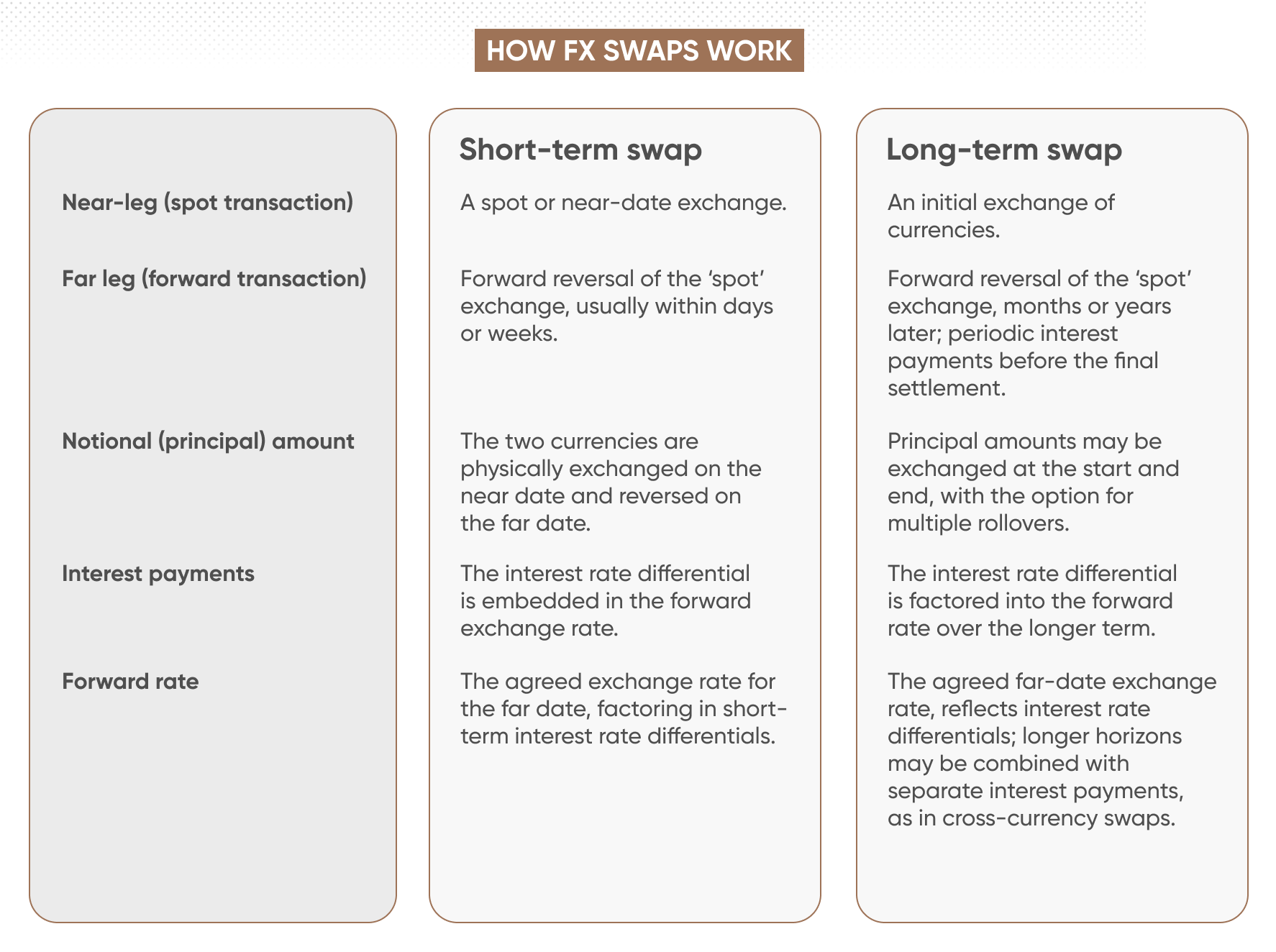

A forex swap – also known simply as an ‘FX swap’ – is a financial agreement involving two linked currency transactions. First, one currency is exchanged for another (known as the near-leg, often at the spot or a near-term date). Later, the exchange is reversed through a forward contract at a pre-agreed future date.

Short-term FX swaps usually last days or weeks, with the forward rate reflecting interest rate differences between the two currencies. Long-term FX swaps can extend for months or years.

Traders and institutions use FX swaps for various reasons:

-

Short-term swaps: to manage currency risk, secure temporary financing, or take advantage of differences in interest rates between currencies.

-

Long-term swaps: to hedge against currency exposure or implement long-term financing strategies.

How does a forex swap work?

A forex swap works as an agreement between two parties, with two linked transactions which occur in sequence: the near-leg (spot) and the far-leg (forward).

Both parties agree upon the type of FX swap, whether it’s short-term or long-term, as well as the ‘forward rate’, ‘principal amount’, and the interest implications.

Here’s how spot and forward transactions work in a forex market swap:

Step 1: spot transaction

An agreement to exchange two currencies at the current market rate (the spot rate) on a specified near date.

Traders might use the near-leg as the initial stage of a trading strategy, potentially suitable for short-term approaches, such as day trading, or longer-term arrangements, such as position trading, because the principal is locked in at the outset.

Step 2: forward transaction

Within the same agreement, both parties agree to reverse the initial exchange at a predetermined future date (the far date). The far date’s forward rate typically factors in the interest rate differential between the two currencies.

What are the different types of forex swaps?

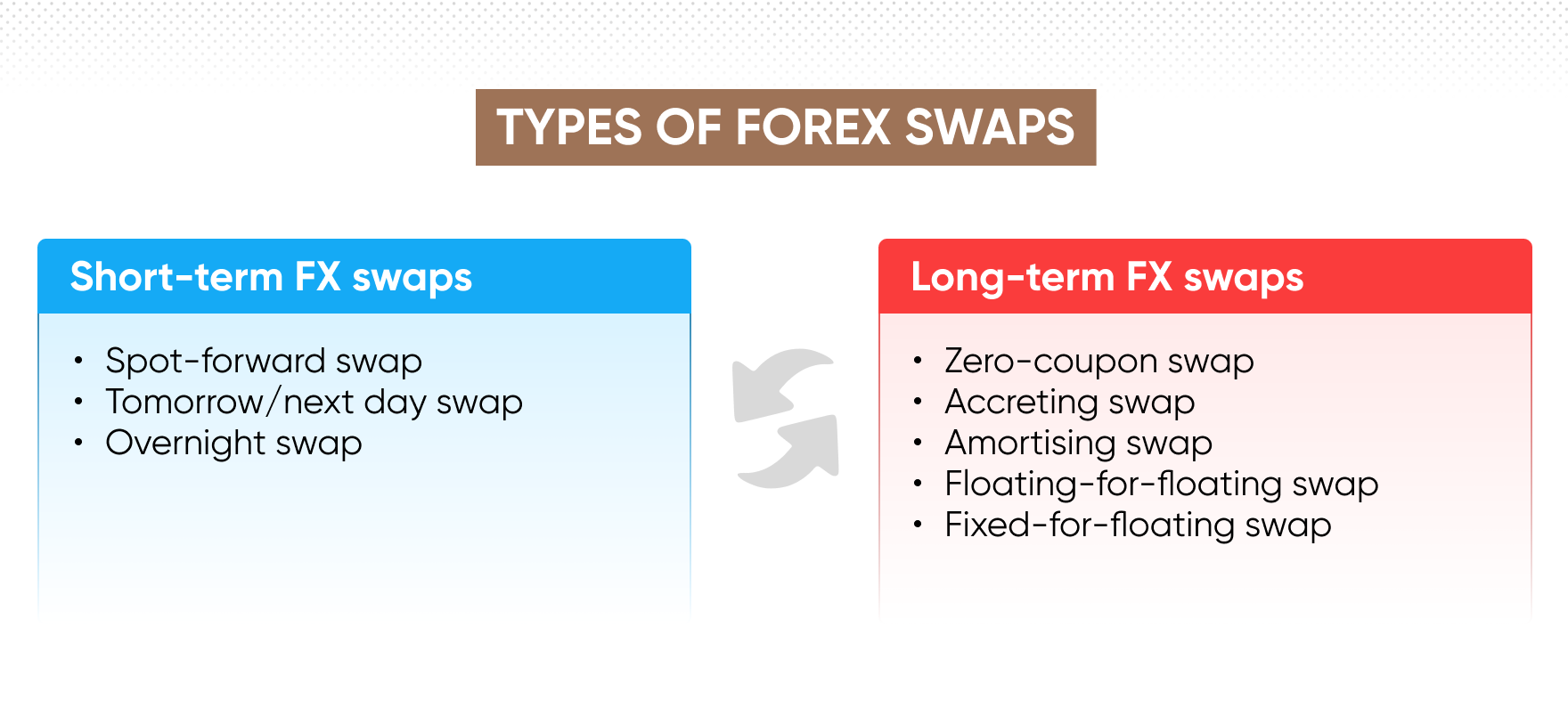

Short-dated FX swaps mainly revolve around a single near-leg and a single far-leg, while longer-term swaps can feature different structures. If those structures involve both principal and interest payments in separate currencies, they may be described as cross-currency swaps.

Here are some common types of swaps:

Types of short-term swaps

- Overnight swap: Rolls a currency position from one business day to the next, typically settling the near-leg on the current day and reversing it the following day.

- Tomorrow/next day swap: the near leg settles ‘tomorrow’ and the far leg reverses it the ‘next’ business day.

- Spot-forward swap: the first leg settles at spot value (usually two business days) and the second leg settles on a specified forward date (e.g., in a week or a month).

Types of longer-term swaps

- Fixed-for-fixed swap: Both parties pay fixed interest rates in their respective currencies. If structured as a cross-currency arrangement, each party pays interest in a different currency.

- Fixed-for-floating swap: One party pays a fixed interest rate, while the other pays a floating rate (e.g., SONIA or EURIBOR).

- Floating-for-floating swap (basis swap): Both parties pay floating interest rates tied to different benchmarks, such as SOFR, SONIA, or TONA.

- Amortising swap: The principal amount reduces over time, often matching a loan repayment schedule.

- Accreting swap: The opposite of an amortising swap. The principal amount increases over time.

- Zero-coupon swap: One party makes regular payments while the other defers all payments until a lump sum at the end.

Consider your trading preferences, financial objectives, and risk tolerance before choosing a forex swap type.

Forex swap example

Let’s say you spot an opportunity in the GBP/USD currency pair after the Bank of England hints at raising interest rates, potentially strengthening the pound against the US dollar. You decide to open a CFD position to try and capitalise on this anticipated move while managing overnight exposure through a forex swap.

-

Near-leg: You open the first leg of the swap at the spot rate of 1.2650, effectively going long on GBP/USD.

-

Far-leg: At the same time, you agree to a forward rate for the far leg of the swap, set to close one week later. This rate incorporates the interest rate difference between the UK and the US.

Over the week, GBP/USD rises to 1.2720, as you anticipated. On the far date, your initial exchange is automatically reversed at the agreed forward rate. When you close the position, your net result includes:

-

The profit from the upward price movement.

-

The swap charge (or credit) embedded in the forward rate, reflecting the interest rate gap.

This strategy lets you participate in potential price movements while managing overnight financing costs or benefits – a flexible approach for active CFD traders navigating the forex market.

Forex swap vs. forex trade: What are the differences?

Traders interested in the forex market have several options to choose from, including swaps and trades.

-

A ‘forex trade’ is a single transaction to buy or sell one currency against another, with the position opened and closed independently.

-

A ‘forex swap’ involves two connected transactions: a near-date exchange and a far-date reversal.

Here’s how they compare:

|

Forex swap |

Forex trade |

|

|

Structure |

Involves two legs: a near-leg exchange and a far-leg reversal. |

A single buy-or-sell transaction, often opened and closed at will. |

|

Interest rate |

|

Important in forex trading strategies, such as covered interest arbitrage. |

|

Settlement |

Near and far legs agreed upon simultaneously; interest differentials are factored into the forward. |

Closed at the trader’s discretion; overnight fees may apply. |

|

Potential use |

Hedging, short-term funding, or leveraging interest differentials. |

Speculating on price movements or hedging. |

Learn more about the FX market – read our comprehensive trader’s guide to the forex market.

FAQ

What is a forex swap in trading?

A forex swap is an agreement between two parties to exchange one currency for another and reverse that exchange at a specific future date.

In short-term FX swaps, the interest rate differential is reflected in the forward rate.

In long-term (or long-dated) FX swaps, that differential may apply over a much longer horizon. If arranged as a cross-currency swap, parties typically exchange periodic interest payments in each currency. Both structures can help traders manage currency risk or potentially benefit from interest rate differentials.

Is there a forex swap fee?

Any ‘swap fee’ may include interest rate differentials between the two currencies plus any broker-specific fees. One side may effectively pay more or receive less interest, based on whether their currency’s central bank rate is higher or lower.

Can forex swaps reduce my currency exposure?

Yes. By locking in near and far rates, traders can mitigate the impact of spot market volatility and interest rate surprises. Short-dated FX swaps embed this in the forward points, while long-dated FX swaps can apply over months or years.