A trader’s guide to US natural gas

Learn all about natural gas and its price history, as well as how to trade it via CFDs on Capital.com.

What is natural gas?

Natural gas is a fossil fuel formed millions of years ago from the remains of dead animals and plants. Today, it’s a crucial energy commodity, playing a significant role in electricity generation and serving as an affordable and efficient fuel for industries, governments, and households. Its versatility also makes it a key player in heating, cooking, and powering industrial operations.

The US natural gas price is actively traded on futures markets, such as the NYMEX, and through CFDs. Traders speculate on price movements influenced by supply-demand dynamics, geopolitical events, weather patterns, and economic factors, making it a key asset in energy trading.

What affects the natural gas price?

There are a range of factors that impact the supply of and demand for natural gas in the global economy, which in turn can cause significant price movements that are closely watched by commodity traders. Here are the main ones.

Production levels

Fluctuations in natural gas production influence its availability, affecting prices.

Infrastructure development

The expansion of pipelines and LNG terminals enhances transportation, facilitating supply.

Exploration success

Discoveries of new reserves or improved extraction technologies can boost supply and therefore cause prices to fall when demand can’t keep pace.

Economic growth

Increased industrial and residential demand accompanies economic expansion and in turn potentially boosts natural gas demand, which can raise its price.

Weather patterns

Cold winters or hot summers elevate demand for heating or cooling, affecting short-term prices.

Global energy policies

Shifting towards cleaner energy sources can alter long-term demand patterns.

Natural gas price history

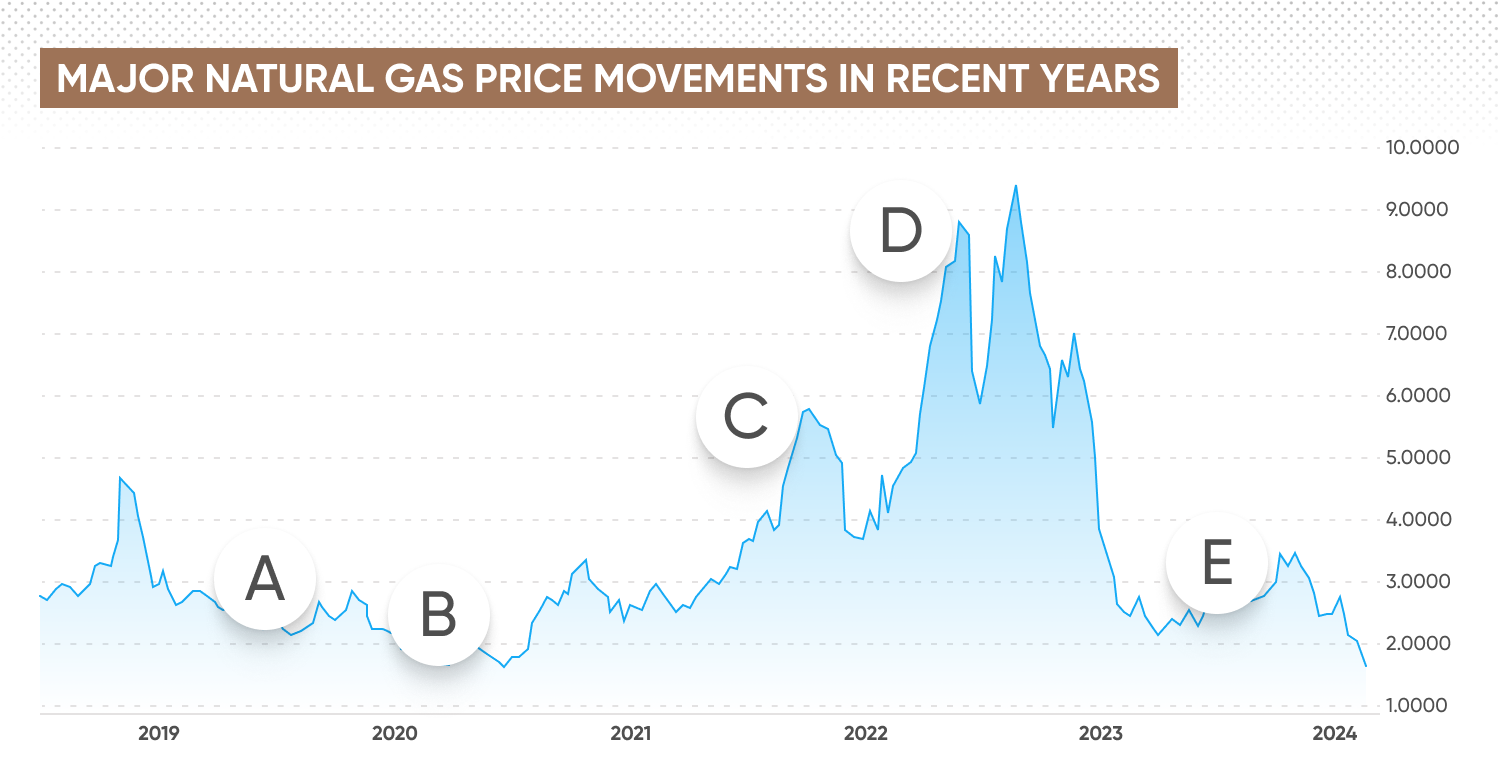

Here’s a chart of the natural gas price history over the past few years, showing the key events that contributed to its fluctuations.

Major natural gas price movements in recent years

There have been numerous natural gas movements caused by a combination of the above factors. Here’s a chart showing five key events, with an explanation of how the price was affected.

A: 2019: Natural gas prices move as low as $2 per British Thermal Units (MMBtu) in the midst of high US production levels, mild weather conditions and increased storage levels which put downward pressure on prices.

B: 2020: The COVID-19 pandemic leads to widespread lockdowns, travel restrictions, and economic slowdowns globally, resulting in a significant drop in industrial activity. In turn, this reduces energy consumption, and lowers overall demand for natural gas, with prices dropping below $1.6 per MMBtu.

C: 2021: Prices recover as major economies rebound from the worst effects of the pandemic, creating a rise in natural gas demand, influencing prices to rise above the $6 per MMBtu mark.

D: 2022: A volatile year for natural gas is marked by ongoing Russian military action against Ukraine, with supply restrictions and sanctions. Coupled with high demand amid especially cold weather, prices move above $9 per MMBtu. However, later in the year governments and businesses aggressively replenish their storage of LNG, leading to a glut that sends prices down again around the $5 per MMBtu mark.

E: 2023: After the moves of 2022, 2023 is more stable for natural gas prices, with an average price of $2.53 per MMBtu.

Sources: Capital.com, Yahoo Finance. Past performance is not a reliable indicator of future results.

What are the natural gas trading hours?

Natural gas trading hours vary depending on the exchange. For instance, on the NYMEX (New York Mercantile Exchange), natural gas futures trading runs from 10:00pm to 9:00am UTC, Sunday through Friday. Other platforms offering CFDs or spot trading on natural gas may follow different schedules, so it’s important to confirm the trading hours specific to your platform in UTC. Trading hours allow nearly 24-hour access to the market, enabling traders to react to global events as they unfold.

How to trade natural gas

You can trade natural gas by speculating on its spot price, or by using futures, terms we’ll explain below. Using CFDs (contracts for difference), you can take a position on the price movements of an asset without owning it outright. If you think the price will rise, you can take a long (buy) position, or if you think it will fall, a short (sell) position, based on your market outlook.

You may want to use fundamental analysis, technical analysis, or both, to make sense of price action and determine which direction you think the market will move. You might choose to day trade, opening and closing numerous positions within a day, or swing trade, using a timeframe of days to weeks. You can also set stop-loss and take-profit orders as part of a risk management strategy.

Trading natural gas on the spot market

When trading natural gas on the spot market, you are trading at the current market price (the spot price) for immediate settlement. This involves speculating on the present price of natural gas, which is influenced by supply and demand. You can trade CFDs based on the spot price, allowing you to take long or short positions with leverage without owning the physical asset.

Trading natural gas with futures

Futures contracts involve agreeing to buy or sell natural gas at a specified price on a future date. These are standardised contracts traded on exchanges like NYMEX. Futures allow you to hedge or speculate on future price movements, with an obligation to settle at the contract's expiration unless closed out earlier. Unlike spot trading, you’re speculating on where prices will be at a set date in the future.

Why trade natural gas with CFDs?

Trading natural gas with CFDs offers several advantages. CFDs allow traders to speculate on natural gas price movements without owning the physical asset, offering flexibility and lower upfront capital requirements. With leverage (also known as margin trading), you can control larger positions, potentially amplifying profits (though it also increases risk). CFDs also allow you to go long or short, enabling you to benefit from both rising and falling markets. Additionally, natural gas CFDs provide access to global markets without the logistical challenges of physical delivery.

Learn more about CFD trading.

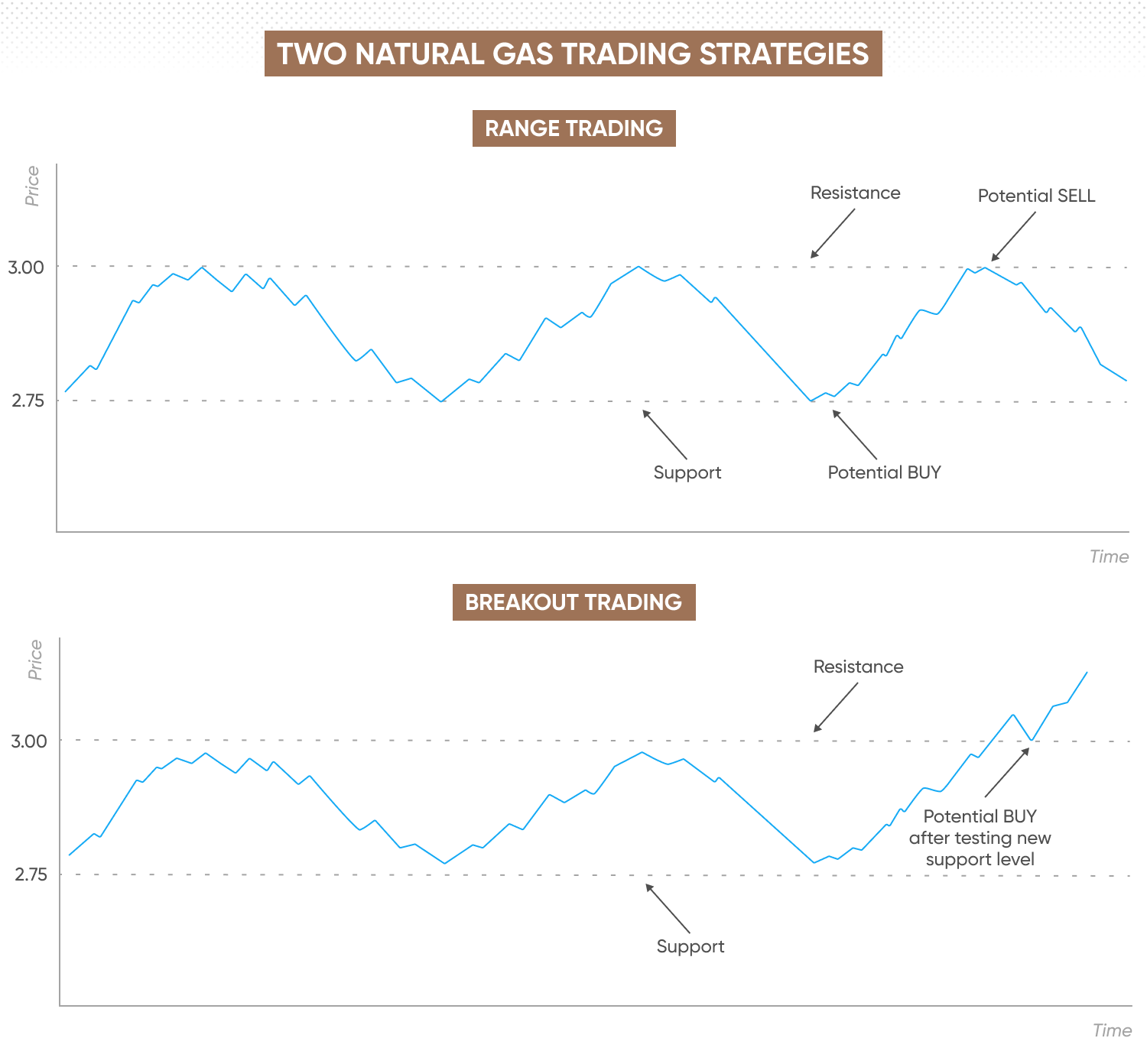

Natural gas trading strategies

Example of natural gas trading strategies may involve using fundamental or technical analysis, or a combination of both, to make sense of price action. Technical strategies may include methods like range trading or breakout trading, use tools such as RSI, MACD or Fibonacci retracements to assist in determining potential entry and exit points.

Breakout strategy example

Suppose natural gas is trading at $2.80 with support at $2.75 and resistance at $3.00. A breakout strategy would involve placing a buy order above $3.00, expecting prices to surge once resistance is broken. If the price breaks through, a potential target could be $3.20. On the flip side, if it breaks below support, a short trade could be placed below $2.75, aiming for a potential drop to $2.50.

Range trading example

If natural gas is fluctuating between $2.75 and $3.00, a range trading strategy would involve buying at support near $2.75 and selling near $3.00. Traders can profit from the repetitive price movements between these levels, placing stop-loss orders just below support and above resistance to manage risk.

FAQs

What factors influence natural gas prices?

Natural gas prices are primarily influenced by supply and demand dynamics, which can be impacted by weather conditions, production levels, and geopolitical events. For example, colder winters increase demand for heating, while geopolitical tensions can disrupt supply. Additionally, storage levels and shifts in energy policy also play a role in natural gas price fluctuations.

Can I trade natural gas CFDs with leverage?

Yes, trading natural gas CFDs allows you to use leverage, enabling you to control a larger position with a smaller initial investment. However, while leverage can amplify potential profits, losses are also magnified, making leveraged trading risky.

What is the difference between trading natural gas on the spot market vs. futures market?

When trading natural gas on the spot market, you're speculating on the current market price with immediate or near-immediate settlement. In contrast, futures contracts involve agreeing to buy or sell natural gas at a specific price on a future date, allowing traders to hedge or speculate on future price movements. CFDs allow you to speculate on both spot and futures prices without owning the physical asset.