US CPI data fails to change the odds of a Fed rate cut

A combination of softer headline and hotter core inflation has failed to change the odds of a rate cut from the Federal Reserve in September

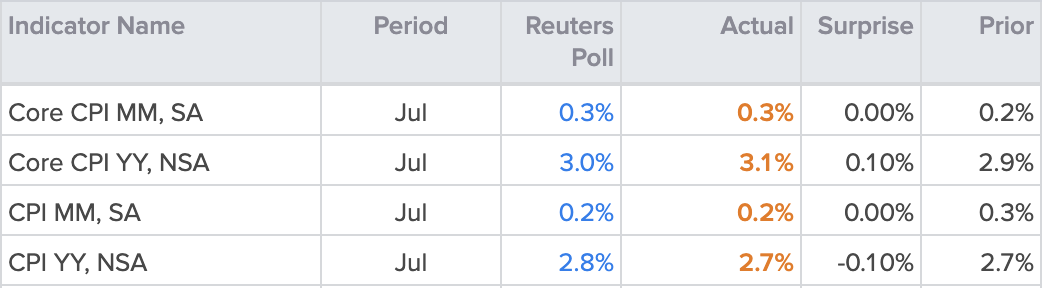

The U.S. Consumer Price Index (CPI) report for July 2025 showed that headline inflation held steady at 2.7% year-over-year, matching June’s pace and coming in slightly below expectations of 2.8%. On a month-over-month basis, headline CPI rose by 0.2%, down from 0.3% the previous month. However, core inflation, which excludes food and energy, rose by 0.3%, marking its largest monthly gain since January—suggesting that underlying price pressures remain sticky. As a result, the year-over-year reading came in higher than anticipated at 3.1% versus the smaller rise from 2.9% to 3.0% expected. Much of the inflationary pressure is being driven by tariff-sensitive categories, including furniture, apparel, and food.

US Consumer Price Index Readings for July 2025

Source: refinitiv

In the background, concerns over the integrity of the data have resurfaced, given recent budget cuts and staffing issues at the Bureau of Labor Statistics. Despite the uptick in core inflation, markets appear to be holding onto expectations of a Federal Reserve rate cut in September, with odds close to 90%, as overall disinflationary trends and a softer growth backdrop continue to shape policy outlooks.

As for markets, the combination of stronger core and softer headline readings has left some traders struggling for direction. There is a reason to be both bullish and bearish depending on which CPI reading you wish to focus on. For equities, the momentum seems to be back on the upside with the S&P 500 pushing to another daily higher high and closing in on the all-time high around 6,435 seen last month. The fact that the headline CPI reading failed to rise from last month has likely given buyers a boost, especially as this has enabled markets to continue pricing in a Fed rate cut next month.

S&P 500 daily chart

(Past performance is not a reliable indicator of future results)

On the flip side, dollar buyers have retreated after the data release, likely as a result of the failure to change the expectations about the Fed’s likelihood to cut.

US Dollar Index (DXY) 5-minute chart

(Past performance is not a reliable indicator of future results)