RBA Preview: Rates to remain unchanged with inflation-fighting still the focus

RBA Governor Michelle Bullock emphasizes inflation challenges for Australia's economy, citing supply shocks and demand-supply imbalances. Discover insights on CPI trends, interest rates, and the central bank's strategy for managing price pressures in 2024.

RBA remains focused on inflation risks

RBA Governor Michelle Bullock has made it clear that inflation remains a stubborn issue for Australia’s economy. Amidst barely positive GDP growth and weak household activity, the Governor has placed a particular emphasis on how ongoing supply shocks are complicating the task of getting inflation back under control. According to Bullock, while some of the early pandemic-driven supply disruptions have eased, aggregate demand continues to exceed aggregate supply, keeping price pressures elevated, especially in the services sector. This dynamic has made inflation "sticky," particularly in sectors like dining and personal services. For now, the RBA is betting on a gradual cooling of demand as higher interest rates filter through the economy, or alternatively, a highly unlikely increase in productivity to boost supply.

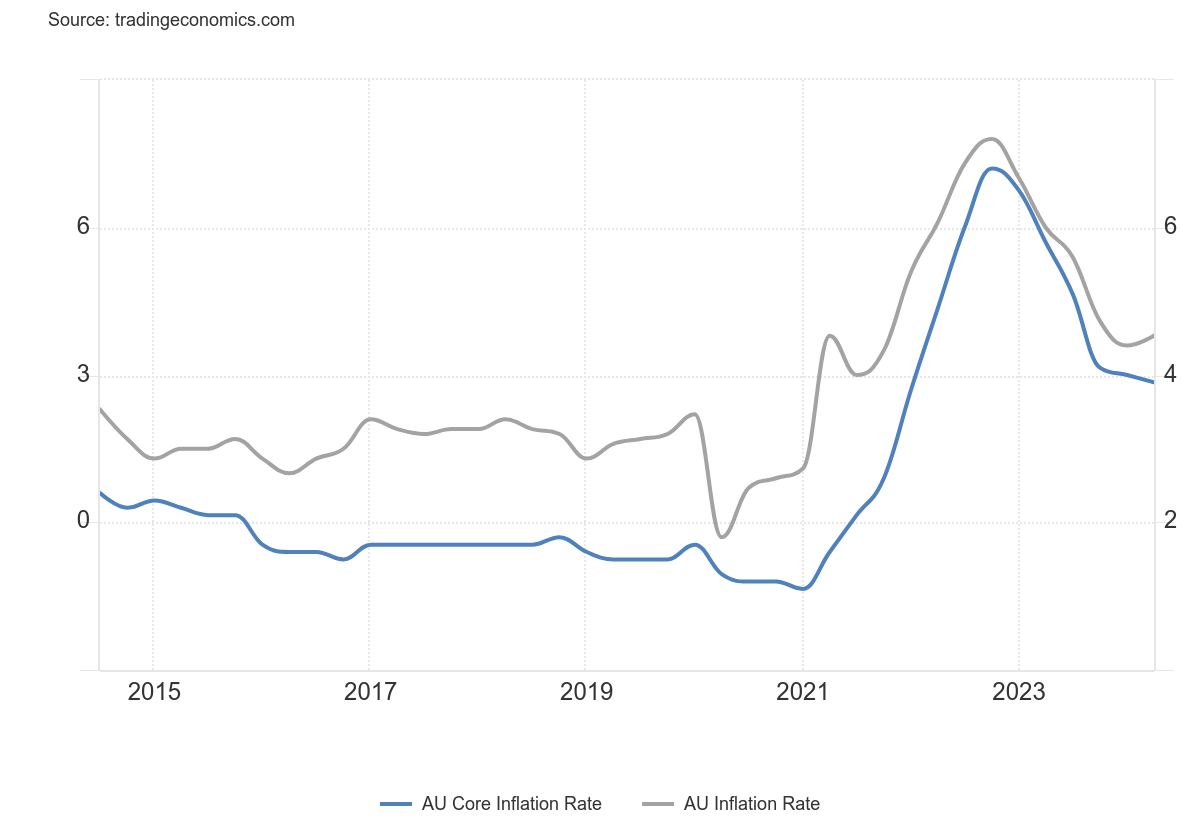

Progress on getting inflation back to the RBA’s 2-3% target band has slowed in 2024, with the most recent official CPI data revealing headline price growth of 3.8% and 3.9%. While this was lower than expected, it was higher than the previous quarter. The latest CPI indicator will be released a day after the RBA’s meeting, with forecasters tipping a significant drop in inflation to 3.1%. The markets will be more attuned to the trimmed-mean component, however, with consensus forecasts unavailable for that figure. That’s because the trimmed mean figure is a better representation of the underlying inflation pulse, especially given the distortions caused by the Australian government’s energy subsidies.

(Past performance is not a reliable indicator of future results)

(Source: Trading Economics)

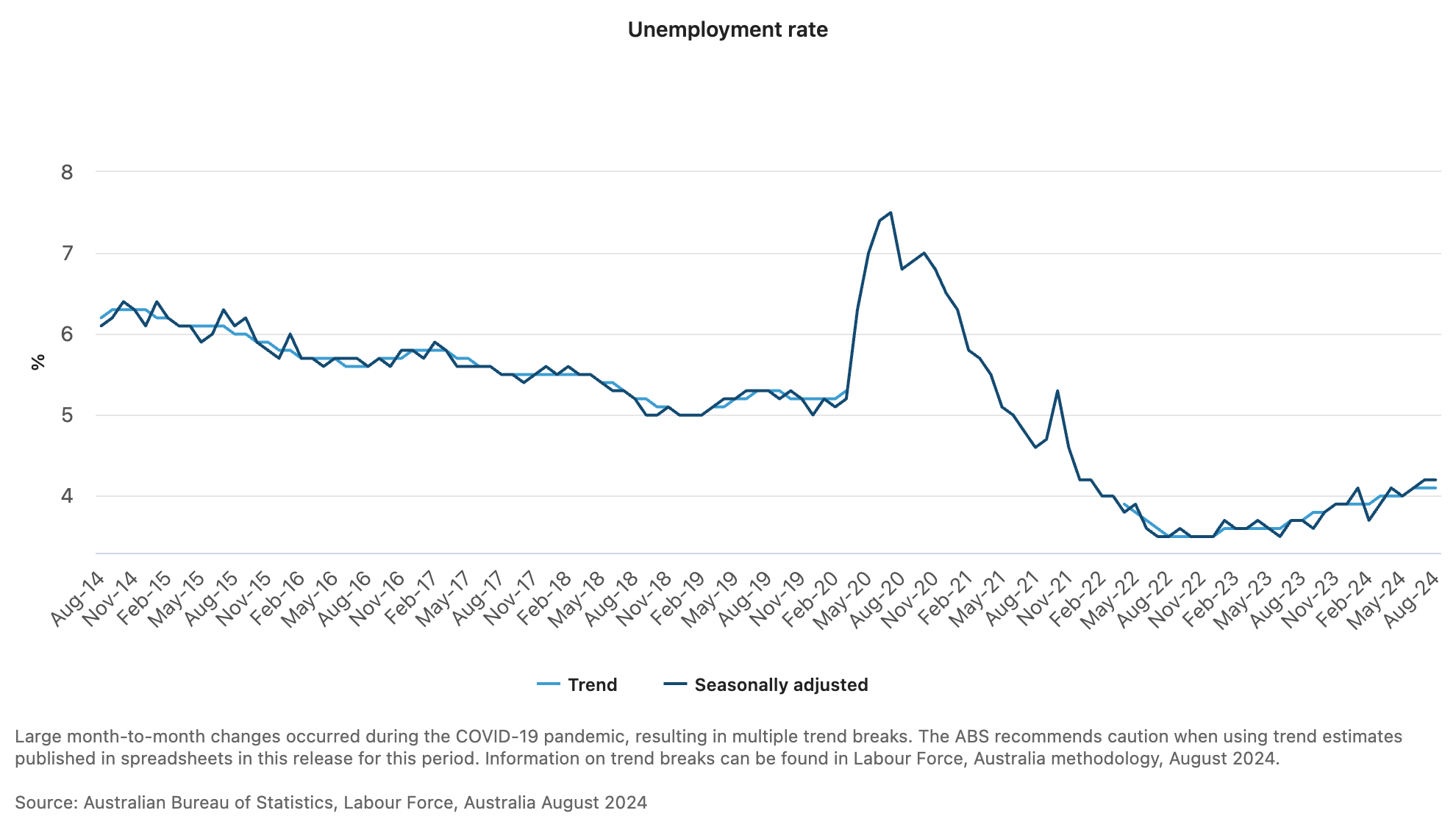

The most recent labour force data revealed ongoing resilience in the Australian jobs market. The figures showed that the unemployment rate remained unchanged at 4.2% courtesy of a larger than expected 47,500 increase in employment in August. The participation rate also held at a record 67.1%. However, the majority of the jobs were part-time, countering any concerns of marginally tighter labour market conditions. Nevertheless, the figures showed ongoing strength in hiring in the Australian economy, with the unemployment rate lingering below the 4.3% level that the RBA predicts the jobless rate should end 2024.

(Past performance is not a reliable indicator of future results)

(Source: ABS)

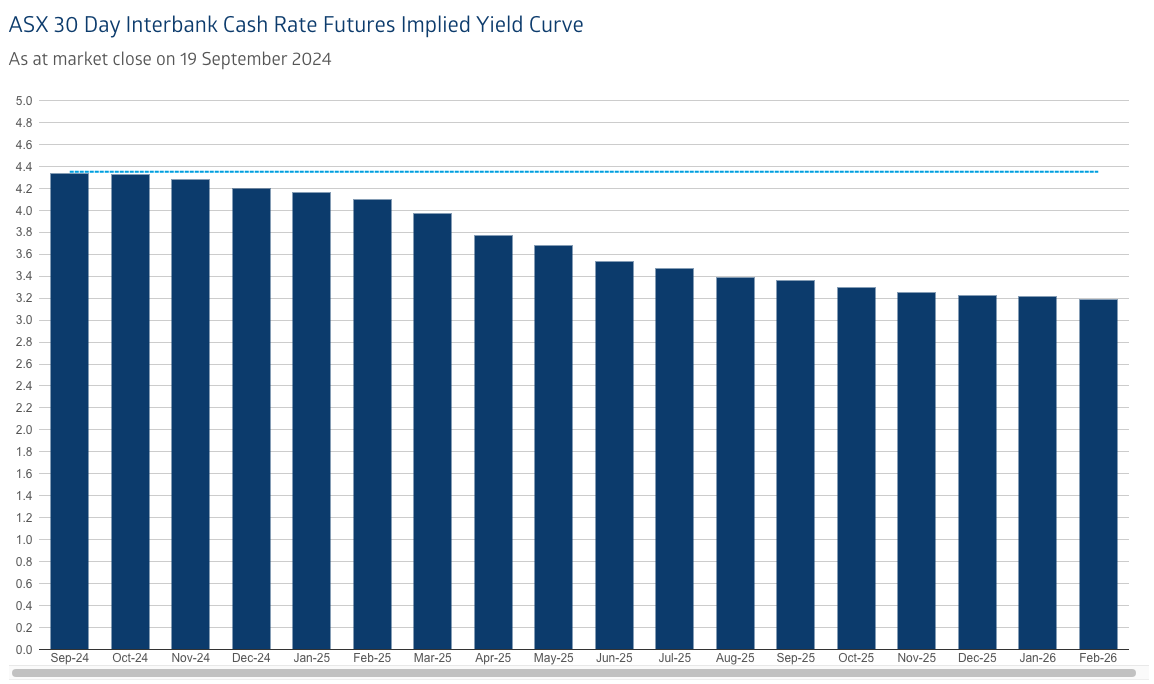

Markets imply next move for rates will be downwards

Despite relatively sticky inflation, cash rate futures continue to imply that the next move in interest rates will be downwards. The dynamic is being supported by interest cuts across the globe. A drop in yields is dragging down Australian rates, while the expectations of softer economic growth that are leading to rate cuts globally is expected to flow through to weaker growth conditions in Australia. Currently, the markets are fully pricing-in an RBA cut by the first quarter of 2025, with more than one more cut discounted by the end of the following. Owing to above target inflation and the increased hawkishness in the RBA’s rhetoric regarding future policy, the curve may be overestimating the number of cuts likely to come from the central bank in the short-and-medium.

(Source: ASX)

AUD/USD and ASX200 supported by US rate cuts

The AUD/USD and ASX200 are trading as a function of US monetary policy. Both are trending higher as falling global rates ease financial conditions and weaken the US Dollar.

The ASX200 remains in a primary uptrend, with market sentiment clearly bullish as the index scales fresh record highs. The index could be challenging an upward sloping trendline. However, having broken support at previous record highs, the bulls are in control of the market. In the longer-run, dip buyers have emerged below the 20-week moving average.

(Past performance is not a reliable indicator of future results)

Meanwhile, the AUD/USD appears on the cusp of breaking above 0.6800 resistance and potential reversing its long-term trend channel. A weekly close above that level could open a challenge of resistance just shy of 0.6900. An upward sloping trendline is a potential support level, which if broken, may hint at a continuation of the primary downtrend.

(Past performance is not a reliable indicator of future results)