XDC network price prediction: What is XDC network?

It aims to enable business-friendly blockchain services, but what is next for XDC? For an xdc network price prediction round-up, read on...

It aims to create blockchain services for business, but what is XDC Network (XDC)? Let’s see what we can find out, and also cast our eyes over some of the xdc network coin price predictions that were being made as of 15 December 2022, too.

The XDC network explained

The XDC Network is a blockchain that forked from Ethereum (ETH) and is designed to give businesses the chance to create their own networks. The blockchain has joined the many “Ethereum killers” that aim to escape the problems, such as slowness and cost, that had an impact on the original chain.

It uses a delegated proof-of-stake (POS) consensus mechanism that produces blocks more efficiently. XDC Network boasts on its website that this has allowed it to process more than 2,000 transactions per second and keep a minuscule gas fee.

Explaining the blockchains features, its documentation said:

Ritesh Kakkad and Atul Khekade are the Singaporean co-founders behind the network, which was originally known as XinFin. Kakkad previously co-founded the cloud-hosting company IndSoft Systems in 1998. Khekade graduated with a degree in IT at the Sardar Patel College of Engineering in India and founded a range of startups, such as the private jet service company Airnetz.

What is an XDC coin?

Powering the network’s transactions and smart contracts, computer programs which automatically execute once certain conditions are met, is the XDC cryptocurrency. In order to become a validator on the network, nodes must hold 10 million XDC. After completing know-your-customer (KYC) checks, they are able to participate in block generation and earn gas fees.

Investors and businesses are the ones paying these fees in XDC. The organisation has created its own XDCPay application, a web extension with support for Google Chrome and Mozilla Firefox, to make this process easier.

Decentralised applications (dApps) being built on the platform have also been using XDC as a utility token. These dApps include the finance distribution platform TradeFinex and the oracle MyContract.

XDC price history

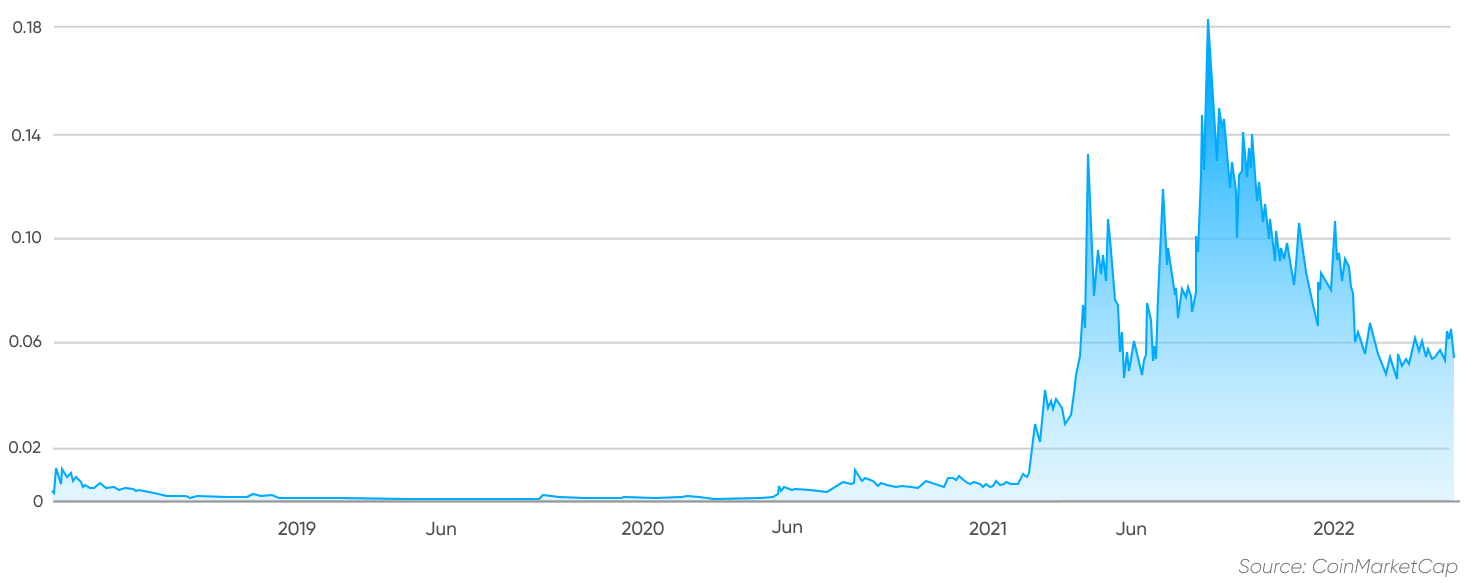

Let’s now cast our eyes over the XDC price history. While past performance should never be taken as an indicator of future results, knowing what the coin has done in the past can give us some very useful context when it comes to either making or interpreting an xdc network price prediction.

The XDC token had a tough start to its price history. It launched at $0.002 on 13 April 2018 and fluctuated around this launch price for the next three years.

Not until February 2021 did the cryptocurrency see its first breakout. It rallied to a peak of $0.14, which came after the XDC coin announced a bridge to the cryptocurrency Corda Network. XDC subsequently became the leading token of value on Corda.

XDC came close to that high again on 4 July when it hit $0.12. This happened during the lead up to the token’s listing on the BitMart exchange with a tether (USDT) pairing.

The following month it surged to its all-time high of $0.19 on 21 August. XDC had recently become the first blockchain company to join the global TFD initiative. This was an organisation created to improve automation and transparency in the trade asset industry by the ITFA.

After this price record, XDC crashed along with the wider bearish crypto market. Aside from a slight rally on 1 January 2022 past $0.10, it continued falling throughout the new year as a series of market crashes saw it fall to a low of $0.02236 on 30 June. There was then a small recovery, and the coin enjoyed prices above $0.03 in July and August, but things fell down again in the autumn.

XDC suffered in the wake of the collapse of the FTX (FTT) exchange, falling to a low of $0.02032 on 7 December, but it made something of a recovery to $0.02463 on 15 December. At that time, there were around 12.3 billion XDC in circulation out of a total supply of just over 37.7 billion. This gave it a market cap of about $303m, making it the 94th largest crypto by that metric.

XDC network price prediction

With that all said and done, let's take a look at some of the xdc network price predictions that were being made as of 15 December 2022.

It is important to remember that price forecasts, especially when they concern a commodity as potentially volatile as crypto, end up being wrong more often than not. Also, it is worth pointing out that many long-term crypto price predictions are made using an algorithm, which means that they can change at a moment’s notice.

First, CoinCodex had a somewhat mixed short-term xdc network coin price prediction. The site said that the crypto could climb to $0.024672 by 20 December before falling back to $0.023222 by 14 January 2023. The site’s technical analysis was, perhaps appropriately, neutral, with 15 indicators sending bullish signals and 14 making bearish ones.

Next, the XDC price prediction from AMB Crypto was incredibly bullish, claiming that it could reach $0.15 next year, $0.27 in 2025 and making an xdc network price prediction for 2030 that saw it break through the dollar barrier to potentially stand at $1.11.

Meanwhile, CaptainAltcoin, was more cautious in terms of its xdc network crypto price prediction, arguing that the coin could drop to $0.014 by the end of 2023. The site then made an xdc network price prediction for 2025 that suggested the coin might reach $0.0358 that year, before dropping to $0.0215 in December 2027. After that, though, there was some optimism, with it arguing that XDC could reach $0.0895 in 2030 and $0.179 in 2040.

Finally, WalletInvestor was also pessimistic when it came to making an xdc network price prediction for 2023. The site thought XDC could have a tough 12 months ahead of it, falling to $0.00183 by December next year.

When considering a XDC coin price prediction, it is important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin or token’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. Never trade with money that you cannot afford to lose.

FAQs

Is xdc network a good investment?

It is hard to say. A lot will depend on how the market performs as a whole.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether the XDC token is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors. Keep in mind that past performance is no guarantee of future returns. Never invest money that you cannot afford to lose.

Will xdc network go up or down?

No one can really tell right now. While the likes of AMBCrypto are bullish in their assesment of a future XDC price, the likes of WalletInvestor are far more downbeat. Keep in mind that price predictions very often end up being wrong, and that prices can, and do, go down as well as up.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether XDC is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors. Keep in mind that past performance is no guarantee of future returns. Never invest money that you cannot afford to lose.

Should I invest in XDC network?

Before you decide whether or not to invest in xdc network, you should do your own research, not only on XDC, but on other post-Ethereum crypto coins.

Ultimately, though, this is a question that you will have to answer for yourself. Before you do so, however, you will need to conduct your own research and never invest more money than you can afford to lose, because prices can go down as well as up.