Berkshire Hathaway top holdings: Warren Buffett’s 2025 portfolio

Discover Berkshire Hathaway top shareholdings in 2025, with recent movements, and how to trade Berkshire shares via CFDs

Warren Buffett – known as the 'Oracle of Omaha' – has confirmed he’ll step down from Berkshire Hathaway by the end of 2025, ending a legendary run in global markets.

As of 27 May 2025, Class A and B shares (BRK.A, BRK.B) are up 10.95% and 11.67% year-to-date. And with Berkshire’s Q1 13F filing revealing major moves – including a full Citigroup exit, a $2.1bn cut to Bank of America, and a $1.2bn boost to Constellation Brands – the portfolio is under intense scrutiny.

In this article, we break down the top 15 Berkshire Hathaway holdings and what they reveal about Buffett’s final investment calls.

What is Berkshire Hathaway?

Berkshire Hathaway (BRK.A and BRK.B) is one of the world’s largest investment conglomerates, chaired by Warren Buffett. Originally a struggling textile manufacturer, Buffett transformed Berkshire after taking control in 1965 following a gradual share acquisition that began in 1962.

Famous for its disciplined, value-oriented philosophy, Berkshire’s primary revenue and profit drivers are its insurance operations (eg, GEICO), alongside wholly owned subsidiaries such as BNSF Railway and Duracell, as well as strategic equity stakes. The companies that Berkshire Hathaway owns span railroads, energy, manufacturing, consumer goods, services, retail, and more.

According to May 2025 13F filing, Berkshire Hathaway managed equity investments worth approximately $258bn by the end of Q1, spanning industries from tech giants like Apple to financial institutions such as American Express and Bank of America. Recent moves include fully exiting Citigroup and significantly increasing its holding in Constellation Brands.

Warren Buffett is set to retire at the end of 2025, marking a significant leadership transition for Berkshire Hathaway. Its future will rest in the hands of his successor, Greg Abel.

Past performance is not a reliable indicator of future results.

Top 15 Berkshire Hathaway holdings

Below are Berkshire Hathaway’s 15 largest holdings as of Q1 2025, based on its latest SEC filing (13F). These stocks accounted for approximately 94% of the conglomerate’s equity portfolio, valued around $258bn.

1. Apple

Apple (AAPL) designs and manufactures consumer electronics, including the iPhone, Mac computers, and a growing ecosystem of digital services. Berkshire Hathaway’s 300m Apple shares were valued at approximately $66.6bn, making it the largest single holding on this list. Apple delivered revenue and earnings growth in Q2 2025, with continued strong performance across its services and hardware lines.

However, Apple shares had fallen 19.57% year-to-date as of 27 May 2025, influenced by escalating US tariff threats.

2. American Express

American Express (AXP) – also called ‘Amex’ – is a global payments and credit card provider known for its premium customer base and rewards programmes. Berkshire’s stake in American Express was valued at around $40.8bn, making Berkshire the largest institutional shareholder as of 28 May 2025.

Amex’s first-quarter results were driven by higher net interest income and luxury card fees, targeting revenue growth of 8%-10% for 2025.

3. Coca-Cola

Coca-Cola (KO) is the world’s largest beverage company by sales, with iconic brands including Coca-Cola, Diet Coke, and Sprite. Berkshire Hathaway’s shareholding was valued at approximately $28.6bn. Coca-Cola’s Q1 2025 earnings showed organic sales up 6%, supported by robust performance in emerging markets and successful launches of health-focused, low-sugar drinks.

4. Bank of America

Bank of America (BAC) is one of the largest financial institutions in the US, providing banking, investing, and asset management services. As of its most recent 13F filing, submitted 15 May 2025, Berkshire’s BAC shares were valued at roughly $26.4bn. Bank of America’s Q1 2025 profits were driven by growth in net interest income and robust trading revenue.

5. Chevron

Chevron (CVX), a global energy giant, explores, produces, and distributes oil and natural gas. Berkshire’s CVX shares were valued at approximately $19.8bn. Chevron exceeded its Q1 2025 earnings expectations, despite weaker oil prices and reduced share repurchases.

6. Occidental Petroleum

Occidental Petroleum (OXY) is an oil and gas exploration and production company with significant operations in the Permian Basin. Berkshire’s OXY shares were valued at approximately $13.1bn. Occidental Petroleum reported improved operational efficiency in Q1 2025 amid volatile commodity prices, with its integrated downstream and chemicals segments providing additional diversification.

7. Moody’s

Moody’s (MCO) provides financial analytics and credit rating services globally. Berkshire’s stake was worth roughly $11.5bn. Moody’s reported solid growth in Q1 2025 revenue and operating income, but lowered its full-year outlook owing to anticipated declines in credit-rating revenue.

8. Kraft Heinz

Kraft Heinz (KHC) is a major packaged foods producer, home to brands such as Heinz ketchup and Kraft cheese. Berkshire’s stake was valued at around $9.9bn. Kraft Heinz faced volume declines and inflationary pressures in Q1 2025, prompting lower earnings guidance.

9. Chubb

Chubb (CB) is a global insurance provider, offering property, casualty, and specialty coverage. Berkshire’s Chubb shares were valued at approximately $8.2bn. Despite California wildfires weighing on Q1 2025 profitability, Chubb reported underlying underwriting results and increased investment income driven by higher interest rates.

10. DaVita

DaVita (DVA) is a healthcare services company specialising in dialysis treatments. Berkshire’s DVA shares were worth about $5.4bn. Despite disruptions from a recent cyberattack, DaVita maintained its full-year earnings outlook in its Q1 2025 earnings, underscoring the resilience and stability of its core operations.

11. Kroger

Kroger (KR) is one of America's largest grocery retailers, operating a wide network of supermarkets and online grocery services. Berkshire’s investment in Kroger stood at around $3.4bn. Kroger reported improved identical-store sales and growing digital revenues in Q4 2024. Increased digital advertising income and effective cost management supported earnings growth.

12. VeriSign

VeriSign (VRSN) manages internet infrastructure services, primarily domain registrations (.com, .net). Berkshire’s VRSN shares were worth around $3.4bn. VeriSign’s Q1 2025 performance was driven by higher domain renewals and new registrations. Meanwhile, the company raised its full-year guidance and announced its first quarterly dividend.

13. Visa

Visa (V) is a global leader in electronic payments and financial technology. Berkshire’s Visa shares were valued at about $2.9bn. Visa delivered consistent revenue growth in its Q2 2025 release, supported by solid payment volumes despite moderating cross-border transaction growth. However, the company remained cautious about potential economic impacts due to tariffs and spending shifts.

14. Sirius XM

Sirius XM (SIRI) provides satellite and digital radio services, including premium subscriptions and advertising-supported streaming. Berkshire’s stake was worth approximately $2.7bn. Sirius XM continued to experience subscriber declines and lower advertising revenue in Q1 2025.

15. Constellation Brands

Constellation Brands (STZ) produces and distributes beer, wine, and spirits, including leading brands like Corona and Modelo. Berkshire increased its holdings to around $2.2bn. However, weak consumer sentiment impacted recent results, causing Constellation to cut its revenue outlook in its Q1 2025 earnings.

What other stocks does Berkshire Hathaway own?

Below are the remaining Berkshire Hathaway stocks, ranked by holding value. They accounted for only a small fraction of Berkshire's entire stock portfolio in Q1 2025, according to the May 2025 filing.

|

# |

Stock name |

Ticker |

Shares held |

Value in US dollars |

% of portfolio |

|

16 |

Mastercard |

MA |

4m |

$2.2bn |

0.84% |

|

17 |

Amazon.com |

AMZN |

10m |

$1.9bn |

0.74% |

|

18 |

AON |

AON |

4.1m |

$1.6bn |

0.63% |

|

19 |

Capital One |

COF |

7.2m |

$1.3bn |

0.50% |

|

20 |

Domino’s Pizza |

DPZ |

2.6m |

$1.2bn |

0.47% |

|

21 |

Ally Financial |

ALLY |

29m |

$1.1bn |

0.41% |

|

22 |

T-Mobile US |

TMUS |

3.9m |

$1bn |

0.40% |

|

23 |

Liberty Formula One (class C) |

LLYVK |

10.9m |

$743.9m |

0.29% |

|

24 |

Charter Communications |

CHTR |

2m |

$731.3m |

0.28% |

|

25 |

Louisiana-Pacific |

LPX |

5.7m |

$521m |

0.20% |

|

26 |

POOLCORP |

POOL |

1.5m |

$466.1m |

0.18% |

|

27 |

Liberty Live (class A) |

LLYVA |

5m |

$335.3m |

0.13% |

|

28 |

Liberty Live (class B) |

FWONK |

3.5m |

$316.1m |

0.12% |

|

29 |

Heico |

HEI.A |

1.2m |

$245.2m |

0.09% |

|

30 |

NVR |

NVR |

0.01m |

$80.5m |

0.03% |

|

31 |

Diageo (ADR) |

DEO |

0.2m |

$23.9m |

0.01% |

|

32 |

Jefferies Financial |

JEF |

0.4m |

$23.2m |

0.01% |

|

33 |

Lennar |

LEN.B |

0.2m |

$16.6m |

0.01% |

|

34 |

Liberty Latin America (class A) |

LILA |

2.6m |

$16.7m |

0.01% |

|

35 |

Atlanta Braves (series C) |

BATRK |

0.2m |

$8.9m |

0.00% |

|

36 |

Liberty Latin America (class C) |

LILAK |

1.3m |

$8m |

0.00% |

Risks and rewards to shares trading

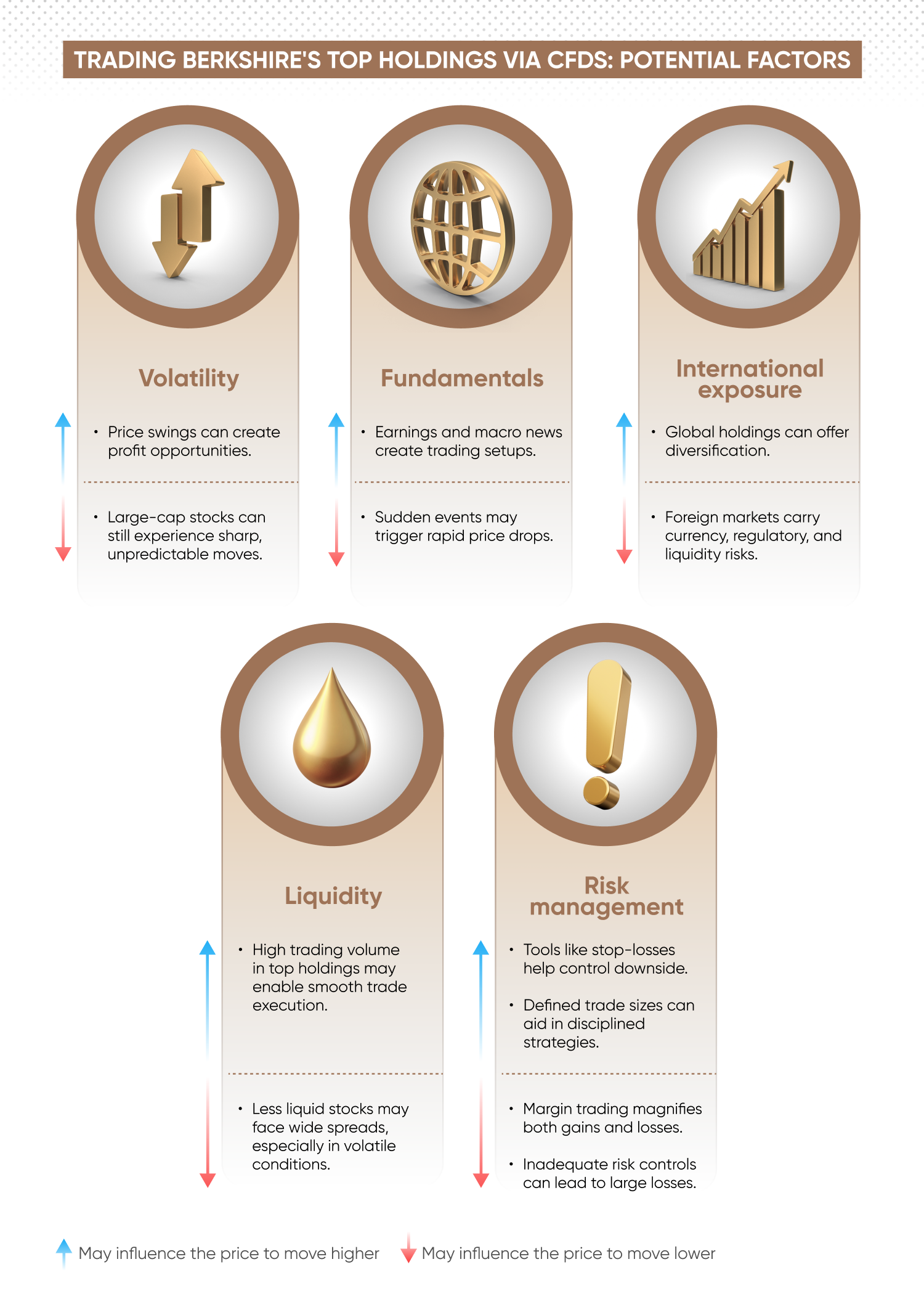

Trading share CFDs on Berkshire Hathaway’s holdings provides access to large, well-known companies, but it carries risks as well as potential rewards. Here are key factors to consider.

-

Volatility: while many top holdings like Apple and Chevron are large caps, they can still show significant price fluctuations.

-

Event-driven moves: earnings, regulatory changes, and macro data can cause price swings.

-

International exposure: Berkshire’s portfolio also includes international holdings, which may be subject to different risks and liquidity conditions.

-

Liquidity: most of Berkshire’s top holdings trade with high volume, supporting smooth execution. Lower-ranked holdings may exhibit wider bid–ask spreads during volatile periods.

-

Risk management: use tools like stop-loss orders and defined trade sizes. Trading on margin amplifies both profit and loss potential.

Shares trading strategies to consider

If you're trading share CFDs on Berkshire Hathaway or its holdings, a structured strategy can help guide decision-making and risk management. While no strategy guarantees success, maintaining consistency and employing tools – such as stop-loss and take-profit orders – can support disciplined trading.

Here are some common trading strategies:

Day trading

As a day trader, you open and close positions within a single trading day, aiming to profit from short-term price movements. In day trading, you might use indicators such as the MACD, VWAP or price action to spot potential entry points and avoid holding positions overnight.

Swing trading

As a swing trader, you hold positions for a few days to capture medium-term price movements. Common swing trading techniques include trading chart patterns, key support and resistance levels, or using momentum indicators.

Trend trading

Trend trading involves identifying a wider market direction and trading in line with it. You might go long during an uptrend or short during a downtrend. In trend trading, indicators like moving averages or the RSI can help confirm signals.

Position trading

Position trading takes a long-term view, with positions held for weeks to months. As a position trader, you might focus on fundamentals – such as earnings or macroeconomic indicators – and use technical analysis to refine entry and exit points.

Learn more on our trading strategies page.

Learn more about share CFD trading in our shares trading guide.

FAQs

What are Berkshire Hathaway’s top holdings in 2025?

Berkshire Hathaway’s largest positions in Q1 2025 included: Apple, American Express, Coca-Cola, Bank of America, and Chevron. These five stocks alone account for approximately 70.46% of the company’s listed equity portfolio, based on the latest 13F filing. Apple remained the top holding by value.

Who owns the most Berkshire Hathaway stock?

Warren Buffett is the largest individual shareholder. As of the latest data, he owns more than 227,000 Class A shares, giving him significant influence over the company. Institutions such as Vanguard and BlackRock also hold substantial positions in the publicly traded Class B shares.

How many holdings does Berkshire Hathaway have?

According to its Q1 2025 disclosure, Berkshire Hathaway holds 36 publicly listed US equities. While most of the portfolio is concentrated in a handful of large-cap companies, smaller positions include companies such as Domino’s Pizza, POOLCORP, and Liberty Media tracking stocks.