What are the biggest stock exchanges worldwide?

There are 60 major stock exchanges around the world, varying in size and trading volume, from the New York Stock Exchange to small local markets. This overview focuses on the largest stock exchanges in the world by market capitalisation.

What are the biggest stock exchanges in the world?

Stock exchanges play a pivotal role in global finance, acting as marketplaces where investors and traders can buy and sell the shares of publicly-held companies.

There are over 60 major stock exchanges around the world, each contributing to the economic fabric of their respective regions. They enable companies to raise capital by issuing shares, thereby also providing investors with opportunities to own parts of those companies – and potentially earn returns on their investments.

For traders, understanding the dynamics and the scale of these exchanges is crucial for making informed decisions. So let’s take a look at the 10 biggest stock exchanges in the world.

The 10 biggest stock exchanges in the world

Here are the world's largest stock exchanges as of November 2023, ranked by market capitalisation:

-

NYSE: $25,240,862.83 million

-

The Nasdaq Stock Market (US)*: $20,576,639.34 million

-

Shanghai Stock Exchange: $6,597,371.63 million

-

Euronext: $6,262,679.57 million

-

Japan Exchange Group: $5,751,761.21 million

-

Shenzhen Stock Exchange: $4,382,224.24 million

-

Hong Kong Exchanges and Clearing: $4,103,862.10 million

-

National Stock Exchange of India: $3,585,644.76 million

-

LSE Group London Stock Exchange: $3,423,238.55 million

-

Saudi Exchange (Tadawul): $3,055,417.03 million

Source: the World Federation of Exchanges.

These huge figures reflect the significant influence these exchanges have on global finance. Let’s look at each in more detail.

NYSE

Market cap: $25,240,862.83 million

The New York Stock Exchange is one of the bedrocks of the global economy. Established in 1792 on Wall Street (under a buttonwood tree, as legend has it), the NYSE has grown to list companies from across the globe – making it a barometer of both the US and global economic health.

The NYSE has strict listing requirements, which uphold its reputation for reliability and trustworthiness. This makes it a prestigious platform for companies to access capital markets. Representing a diverse range of sectors from finance to technology, the exchange is a vital hub for investors seeking to diversify and grow their portfolios. Notable listings include JPMorgan Chase & Co in finance, Exxon Mobil in energy and IBM in technology.

The Nasdaq Stock Market (US)

Market cap: $20,576,639.34 million

The Nasdaq Stock Market is renowned for the technological prowess of its constituents. It houses many global companies renowned for their innovative products – including tech giants like Apple, Amazon, and Google's parent company, Alphabet.

Founded in 1971, Nasdaq was the world's first electronic stock market – a revolutionary departure from traditional floor trading. Its focus on technology has positioned the exchange as a benchmark for the performance of technology and dot-com stocks. It's also known for its comprehensive indexes, particularly the Nasdaq Composite, a valuable indicator for the performance of stocks in the tech sector.

Nasdaq's influence extends beyond the tech industry, with the exchange playing a pivotal role in the global financial system by facilitating liquidity and innovation in trading technology.

*Nasdaq® is a trademark of Nasdaq Inc. The information provided herein is served for informative purposes only.

Shanghai Stock Exchange

Market cap: $6,597,371.63 million

Established in 1990, the Shanghai Stock Exchange (SSE) facilitates the trading of stocks, bonds, and funds, among other securities, serving as a critical gateway for domestic and international investors to access China's rapidly growing economy.

The SSE is characterised by its 'A' and 'B' share markets. 'A' shares are traded in yuan by mainland Chinese and certain foreign investors, while 'B' shares are traded in US dollars. This structure reflects China's controlled yet progressively opening financial market.

The exchange's importance is underscored by listings from key state-owned enterprises such as PetroChina and Bank of China, alongside an increasing number of private sector success stories like Alibaba and Tencent, reflecting the broader shifts in China's economy.

Euronext

Market cap: $6,262,679.57 million

Euronext is a pan-European stock exchange with venues in Amsterdam, Brussels, Lisbon, Dublin, Oslo, and Paris. Formed in 2000 from the merger of several European exchanges, it has since grown through further acquisitions – most recently the Oslo Stock Exchange in 2019.

Euronext operates regulated markets in equities, fixed income, derivatives, and commodities. Its diverse market infrastructure supports local economies while offering access to a wide European and international investor base.

Euronext plays a crucial role in financing, particularly for small and medium enterprises (SMEs) through Euronext Growth and Euronext Access exchanges, designed for smaller, high-growth companies seeking capital.

On its main exchange, Euronext boasts big cross-sector names – like LVMH Moët Hennessy Louis Vuitton in luxury goods, Sanofi in pharmaceuticals and Royal Dutch Shell in energies.

Japan Exchange Group

Market cap: $5,751,761.21 million

Born from the merger of the Tokyo Stock Exchange and the Osaka Securities Exchange in 2013, the Japan Exchange Group (JPX) is a cornerstone of Asian finance.

JPX operates multiple securities and derivatives markets, offering a comprehensive range of trading, clearing, and settlement services. It's pivotal in facilitating global investment into Japan and supports the nation's economic growth by providing a platform for Japanese companies – like Toyota, SoftBank and Sony – to raise funds.

The exchange is at the forefront of advocating for corporate governance reforms in Japan, aimed at enhancing transparency and attracting more foreign investors. JPX's strategic focus on innovation and international collaboration aims to cement its position as a global financial hub, particularly for Asian markets.

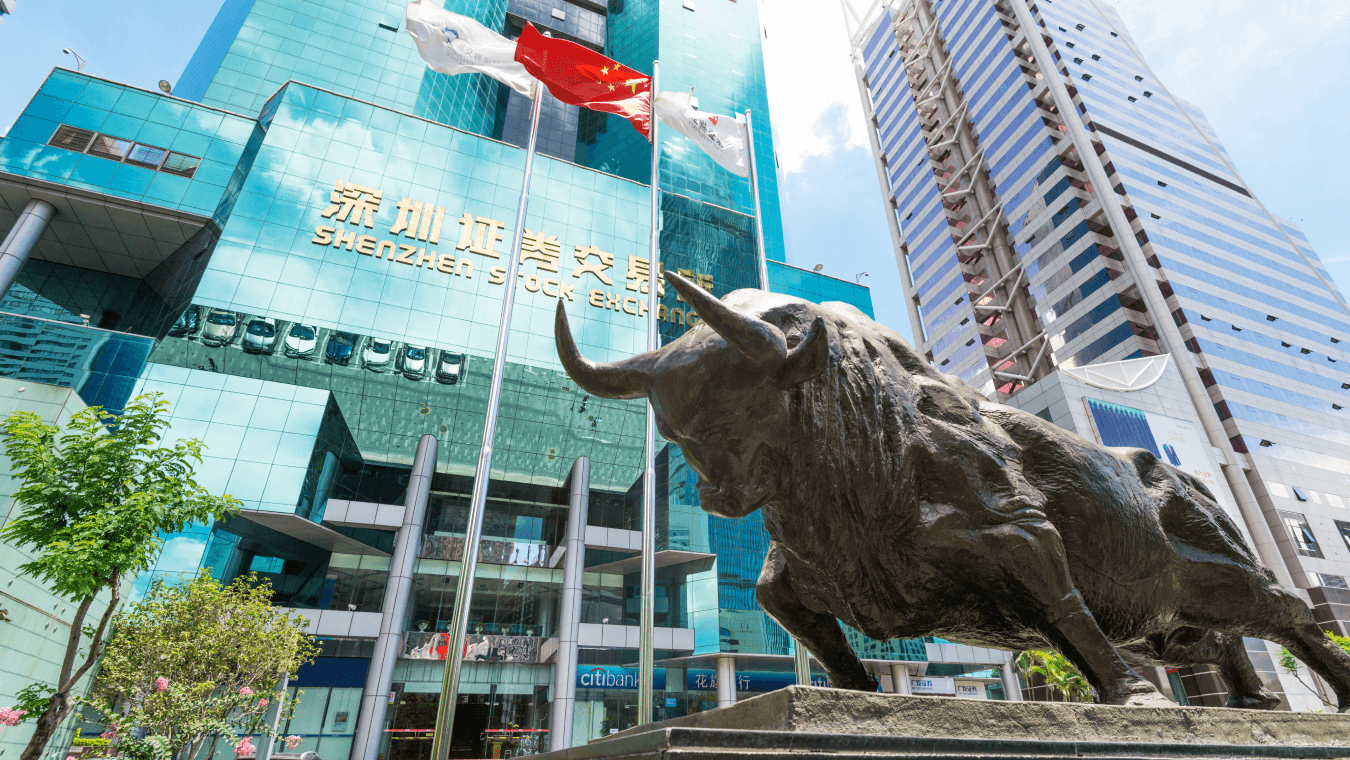

Shenzhen Stock Exchange

Market cap: $4,382,224.24 million

The Shenzhen Stock Exchange (SZSE) complements the Shanghai Stock Exchange as another key player in China's financial markets.

Established in 1990, SZSE is known for its emphasis on serving innovative and high-growth enterprises, particularly small and medium-sized companies. It operates a Main Board, an SME Board, and the ChiNext market – China's answer to Nasdaq, providing a platform for technology and growth companies.

SZSE's forward-looking approach includes pioneering market reforms and embracing financial technology to enhance market accessibility and efficiency. It plays a significant role in China's economic strategy, supporting the growth of emerging sectors and facilitating the global ambitions of Chinese companies.

Hong Kong Exchanges and Clearing

Market cap: $4,103,862.10 million

Established in 2000, Hong Kong Exchanges and Clearing (HKEX) stands as a global financial hub that bridges the East and West.

HKEX operates a range of equity, derivative, commodity, and fixed income markets. It's renowned for its role in facilitating international access to Chinese capital markets, particularly through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs. These exemplify HKEX's strategic position as a gateway for international investors into China, and for Chinese investors seeking global exposure.

National Stock Exchange of India

Market cap: $3,585,644.76 million

Established in 1992, the National Stock Exchange of India (NSE) has rapidly emerged as a dynamic force in global finance. Many of the companies listed on the exchange are renowned around the world – like HDFC Bank, and IT consultancy Infosys.

The NSE was the first exchange in India to provide a fully automated screen-based electronic trading system, offering more efficient and transparent trading. It hosts the Nifty 50, a leading index that serves as a key benchmark for the Indian stock market and economy.

As the largest derivatives exchange globally by volume, the NSE plays a crucial role in the Indian financial market's growth, significantly contributing to the country's economic liberalisation and integration into the global economy.

LSE Group London Stock Exchange

Market cap: $3,423,238.55 million

The London Stock Exchange (LSE) Group is one of the world’s premier exchange groups, with a rich heritage dating back to 1698. The institution is a pivotal hub for global business and finance, extending beyond its trading floors to financial indices, data and analytics, and clearing houses.

This wide-ranging portfolio allows LSE Group to offer comprehensive services across the financial ecosystem, supporting companies of all sizes in accessing global capital markets. Particularly noteworthy is its AIM market, dedicated to helping high-growth potential SMEs (like ASOS and Boohoo) flourish.

Saudi Exchange (Tadawul)

Market cap: $3,055,417.03 million

The Saudi Exchange, formerly known as Tadawul, is the primary stock market of Saudi Arabia.

As part of Saudi Arabia's Vision 2030, the exchange has undergone significant reforms to diversify the Saudi economy and reduce its dependence on oil. These reforms include the introduction of new market segments, improved regulatory frameworks, and the inclusion of the Saudi market in major global indices.

The Saudi Exchange is pivotal in the Gulf Cooperation Council (GCC) region, hosting some of the largest public listings – including the record-breaking IPO of Saudi Aramco. Its ongoing modernization and integration into the global financial system underscore its role in the economic transformation of the region.

FAQs

What are the biggest stock markets in the world?

The largest stock markets globally are the Nasdaq and the NYSE in the United States, followed by Euronext, the Shanghai Stock Exchange, and the Japan Exchange Group, based on market capitalisation.

What are the oldest stock markets in the world?

The Amsterdam Stock Exchange, established in 1602, is considered the world's oldest stock exchange – it’s now part of Euronext. The NYSE, founded in 1792, is the oldest stock exchange in the United States.

How do I trade in the biggest markets in the world?

You can trade in the world’s markets – whether large or small – in a range of ways. You can invest in companies by buying and selling shares outright. Or you can use derivative products like exchange-traded funds (ETFs), options or contracts for difference (CFDs) to open positions on a share’s price, rather than buying it outright.

Derivatives often give you access to leverage. This means that you may be able to open a position for a much smaller deposit (known as the margin) than your trade’s true value. This can lead to large, fast gains and losses that you might not expect, so it’s important to understand the market and your chosen product before you start trading.

With us, you can take a position on thousands of global markets – including shares – using CFDs. Take a look at our guide to trading CFDs to get started. When you’re ready, find out more about how to trade shares, and check live share prices.