What is commodity trading and how does it work?

Learn how to trade commodities, including where to trade them, trading hours, types of commodities for traders, strategies, and how to trade commodities via CFDs.

What is commodity trading?

Commodity trading is the buying and selling of raw materials – like oil, gold, wheat or coffee – via financial instruments such as futures and contracts for difference (CFDs), without taking ownership of the physical goods.

These markets are driven by supply and demand, with prices influenced by factors like weather, geopolitics, and global economic trends. Traders use commodity markets to speculate on price movements, hedge risk, or help stabilise supply chains for essential resources.

Which commodities can I trade?

When you trade commodities you have a wide variety of assets at your disposal – from raw materials and agricultural products to energy resources and metals. Generally, commodities can be divided into four main categories:

-

Agricultural commodities: these include food crops, such as cocoa, cotton, corn and coffee, livestock, like pigs and cattle, and industrial crops, such as palm oil and lumber.

-

Energy commodities: these include natural gas, crude oil and gasoline, coal, uranium, ethanol and electricity.

-

Metal commodities: cover base metals (copper, iron, zinc, aluminium, nickel, etc.) and precious metals (gold, silver, palladium and platinum).

-

Environmental commodities: these include renewable energy certificates, carbon emissions allowances.

How does commodity trading work?

Commodity trading involves speculating or hedging on the price movements of raw materials such as oil, gold, or wheat. Traders do this using financial derivatives like options or contracts for difference (CFDs).

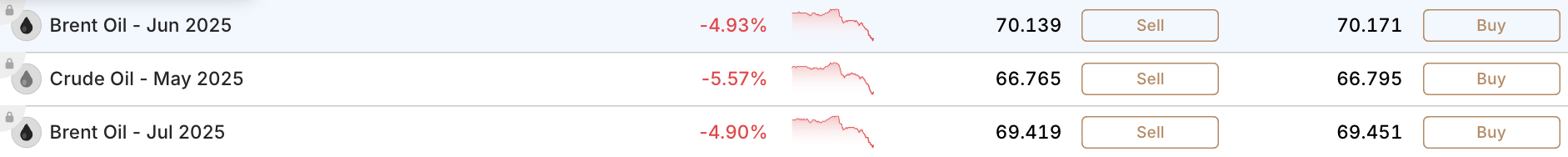

Spot price vs futures

When trading commodities via derivatives, you can take positions based on either the spot price (the current market price for immediate settlement) or a futures price (the current market price for settlement at a future date).

Spot pricing is often used for short-term trading, with tighter spreads and no expiry. Futures-based pricing is popular for hedging or trading around key contract dates, as it reflects broader market expectations over time.

When you trade futures with us, you’ll see the commodity listed with its expiry date, meaning you’re locking in today’s price for settlement on that future date. Meanwhile, for spot markets we don’t show this date, meaning you’re trading for immediate settlement.

Find out more about futures trading.

Long and short positions

Traders might open a buy position when anticipating the price of a commodity to rise, or a sell position if they expect it to fall. For example, a trader could short natural gas ahead of a mild winter, anticipating lower demand and falling prices.

Price drivers

Commodity prices are influenced by supply and demand, weather events, geopolitical factors such as conflict or trade policy, production output, and macroeconomic data. These factors can lead to sharp price movements and high volatility.

Speculation and hedging

Traders may speculate on short-term price movements or hedge existing exposure. For example, a coffee producer might hedge against falling prices, while a retail trader might speculate on gold as a safe-haven asset.

Trading access

With an online brokerage account, retail traders can access global markets – such as CME Group or ICE – and trade a range of assets electronically, often with flexible position sizes.

What is an example of commodity trading?

Gold CFD trade

Let's say you decide to trade gold CFDs. The current market price for gold is $2,000 per ounce.

After conducting some fundamental analysis, you believe the price of gold will rise. You open a long CFD position equivalent to 20 ounces of gold. With a margin requirement of just 5%, you'd only need to put down $2,000 (5% of the total exposure: 20 ounces × $2,000 = $40,000).

Over the next day, gold's price increases by $20 per ounce to $2,020, and you close your position.

You've made a profit of $400 ($20 increase × 20 ounces), minus any overnight funding charges if applicable.

However, if the price of gold decreases by $20 per ounce to $1,980, you would incur a loss of $400 ($20 decrease × 20 ounces), plus any applicable overnight funding charges.

Where can you trade commodities?

Commodities trading primarily takes place on global exchanges and in over-the-counter (OTC) markets. Retail traders can access these markets through trading platforms provided by regulated online brokerages, where they can speculate on commodity prices via derivatives, such as CFDs or futures, without owning the underlying assets.

The largest and most influential commodity exchanges globally include:

-

CME Group: trades agricultural commodities (wheat, corn), energy (US crude oil, US natural gas) and precious metals (gold, silver) – electronic trading via CME Globex.

-

Intercontinental Exchange: specialises in energy commodities like Brent crude oil, natural gas, and agricultural products such as coffee and cocoa – electronic trading via ICE Futures.

-

London Metal Exchange: focuses on industrial metals such as copper, aluminium, zinc, and nickel – electronic trading via LMEselect.

Retail traders typically access these exchanges through regulated brokers who offer platforms featuring live price charts, flexible position sizes, and leverage options.

Learn more about CFDs in our contracts for difference (CFD) trading guide.

What are the commodity market trading hours?

Commodity trading operates nearly 24 hours a day, five days a week, across various global exchanges. Unlike stock markets with fixed schedules, commodity markets offer extended trading periods to accommodate participants worldwide.

Here are the trading hours for key commodities markets in coordinated universal time (UTC)*:

|

Exchange |

Summer hours |

Winter hours |

|

CME Globex |

Sunday 10pm - Friday 9pm (break 9-10pm) |

Sunday 11pm - Friday 10pm (break 10-11pm) |

|

ICE Futures |

Monday 12am - Friday 10pm (break 9:05 pm - 10:25pm) |

Monday 1am - Friday 11pm (break 10:05 pm - 11:25pm) |

|

LMEselect |

Monday 12am - Friday 6pm |

Monday 1am - Friday 7pm |

Commodities trading hours vary for each commodity. Visit the specific commodities market page to find the latest trading hours for each asset.

For weekend trading hours, visit our comprehensive weekend trading hours page.

*These schedules are subject to change due to factors such as public holidays and exchange-specific maintenance periods.

Commodity trading: What are the risks and benefits?

Commodity trading carries both potential benefits and inherent risks, due to various factors, including price volatility and commodity-specific conditions.

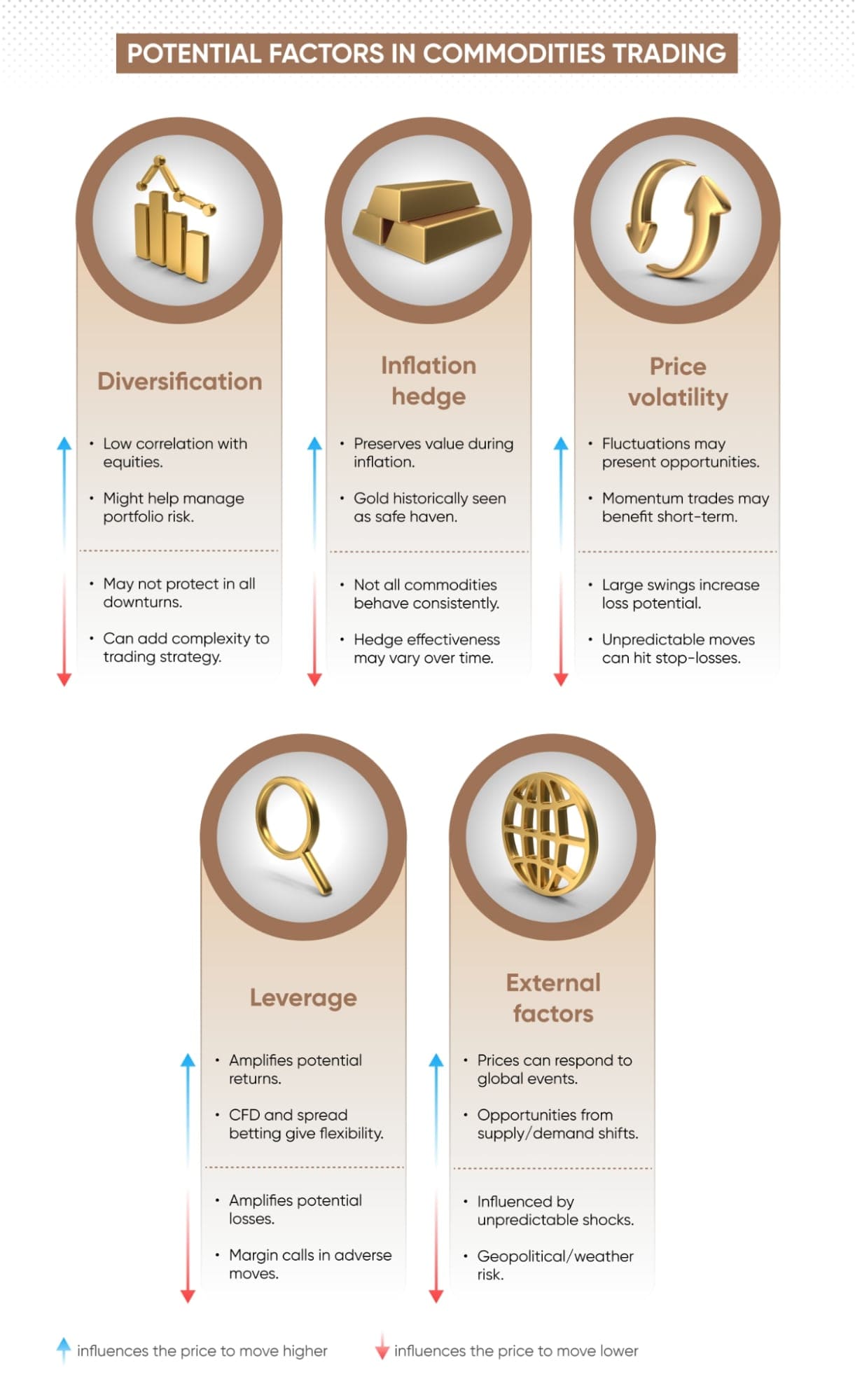

Diversification

Commodities may offer portfolio diversification, as they have historically shown a low correlation with traditional assets like stocks and bonds. However, in broad market sell-offs or during systemic shocks, correlations can increase, reducing diversification benefits.

Inflation hedge

Commodities such as gold have historically acted as a hedge against inflation, potentially preserving purchasing power. However, not all commodities behave consistently during inflationary periods, and their effectiveness as a hedge can vary.

Price volatility

Frequent price swings can create short-term trading opportunities, particularly for active traders using technical strategies. At the same time, sharp and unpredictable price movements can lead to significant losses, especially in leveraged positions.

Leverage and access

Trading commodities via CFDs allows exposure with relatively small upfront capital, increasing potential returns. However, leverage can also amplify potential losses, trigger margin calls or force position closures.

External factors

Commodity prices are influenced by global events such as supply disruptions, weather, and geopolitical developments, often leading to substantial price moves and increased uncertainty. While these factors can present trading opportunities, they also make markets more difficult to predict.

What are some commodities trading strategies?

Commodities traders can use a range of strategies, using a combination of technical and fundamental analysis, to help identify and confirm potential trends with effective risk management.

Scalp trading strategy

Scalping is a short-term trading strategy where traders execute multiple trades daily, aiming for small profits from minor price fluctuations. Scalpers typically hold positions for minutes or even seconds, relying heavily on technical indicators, price action, and real-time market data.

Trend trading strategy

Trend trading involves identifying and trading in the direction of an established market trend. Trend traders typically use technical indicators such as moving averages and other tools to confirm the strength and direction of the trend before opening a long (buy) or short (sell) position.

Swing trading strategy

Swing trading targets short to medium-term price movements. Swing traders might hold positions from a few days up to several weeks – using both fundamental and technical analysis to calculate potential entry and exit points based on broader market trends.

Day trading strategy

Day traders open and close positions within the same trading day, contrasting with swing traders who may hold trades for days or weeks. They might aim to capture gains from short-term price volatility, frequently using technical analysis tools such as volume indicators to inform trading decisions.

Discover more trading strategies on our comprehensive trading strategies page.

Need more support? Try our step-by-step commodities course to guide you through the basics to the advanced concepts.

FAQ

What is meant by commodity trading?

Commodity trading refers to the buying and selling of physical assets like oil, gold, or wheat, which are traded in large volumes on global markets. Traders speculate on price movements – often without owning the underlying asset – using derivatives like futures, options, or CFDs. Markets are influenced by factors such as supply and demand, geopolitical risk, and economic data.

How does commodity trading work?

Commodity trading works by buying (going long) or selling (going short) based on the expected future price of a commodity. Retail traders typically access the market via online commodity trading platforms using leveraged products, which amplify exposure to price movements without requiring physical delivery.

What does a commodity trader do?

A commodity trader analyses markets, identifies trading opportunities, and executes trades on raw materials or related financial instruments. This can involve short-term speculation or longer-term hedging. Institutional traders often manage large portfolios, while individual traders operate through commodity trading accounts provided by online brokers.

What is an example of a commodity trade?

An example of a commodity trade is speculating on the price of crude oil using a contract for difference (CFD). A trader might open a short position if they expect prices to fall due to reduced demand or higher supply. If the market moves as anticipated, they can close the position for a profit – minus any trading costs.

Can I make money trading commodities?

Yes, it’s possible to make money trading commodities by correctly anticipating price movements. However, commodities are volatile, and trading involves significant risk. Using leverage can amplify both gains and losses. Develop your market knowledge, build a trading strategy, and implement risk management tools to limit potential risks while trading.

Curious about trading other assets?

We offer access to the most popular financial markets in the world.Indices trading

Find out more about index trading, a popular way for traders to gain broad exposure to listed companies.

Share trading

Trade price movements of the biggest companies without needing to own the stock itself.