Fantom price prediction: What is fantom (FTM)?

What's next for the FTM cryptocurrency?

The Fantom blockchain heralds itself as a faster, cheaper alternative to other networks but, in terms of cryptocurrency, what is fantom (FTM)?

Let’s see what we can find out, and also take a look at some of the fantom price predictions that were being made as of 17 March 2023.

Fantom explained

Fantom is a secure and scalable smart contract platform aimed at the development of decentralised finance (DeFi) applications. It is designed to overcome the limitations in transaction speeds that are affecting older blockchain platforms running smart contracts.

Launched in 2018, the Fantom Foundation leads the open-source platform’s development. It was founded by Ahn Byung Ik, a South Korean computer scientist.

The foundation is currently led by CEO and chief information officer (CIO) Michael Kong, along with a team of engineers, scientists and designers with experience in full-stack blockchain development.

The Fantom mainnet, called Opera, launched in December 2019. Fantom uses Lachesis – a new consensus mechanism to facilitate smart contracts. It’s an Asynchronous Byzantine Fault Tolerance (aBFT) consensus protocol that the company claims is faster and cheaper than older technologies, while maintaining high security standards. It’s the consensus layer of the blockchain, and can be connected to any distributed ledger.

According to the Fantom website: “An aBFT consensus protocol allows for maximum decentralisation, high scalability, and bank-grade security.

“Unlike Classical consensus, such as pBFT, Lachesis doesn’t use new events in the current election; instead, new events are used to vote for the events in 2-3+ previous virtual elections simultaneously. This leads to a smaller number of created consensus messages, as the same event is reused in different elections.”

The Opera mainnet uses the Ethereum Virtual Machine (EVM), enabling developers to transfer their Ethereum (ETH)-based decentralised applications to Fantom. “Its modular architecture allows for full customisation of blockchains for digital assets, with different characteristics tailored to their use-case,” according to the website.

There are three forms of fantom. There is the Opera FTM token, which runs on the Fantom mainnet; an ERC-20 FTM token, which runs on the Ethereum blockchain; and a BEP-2 FTM token, which runs on the Binance Chain and facilitates transactions on the Binance decentralised exchange (DEX).

The FTM crypto is used for staking, and also allows holders to vote on decisions about the network’s future.

Fantom price history

Let’s now take a look at the FTM price history. While past performance should never be taken as an indicator of future results, knowing what the token has done in the past can give us some useful context when it comes to either interpreting a fantom price prediction or else making one of our own.

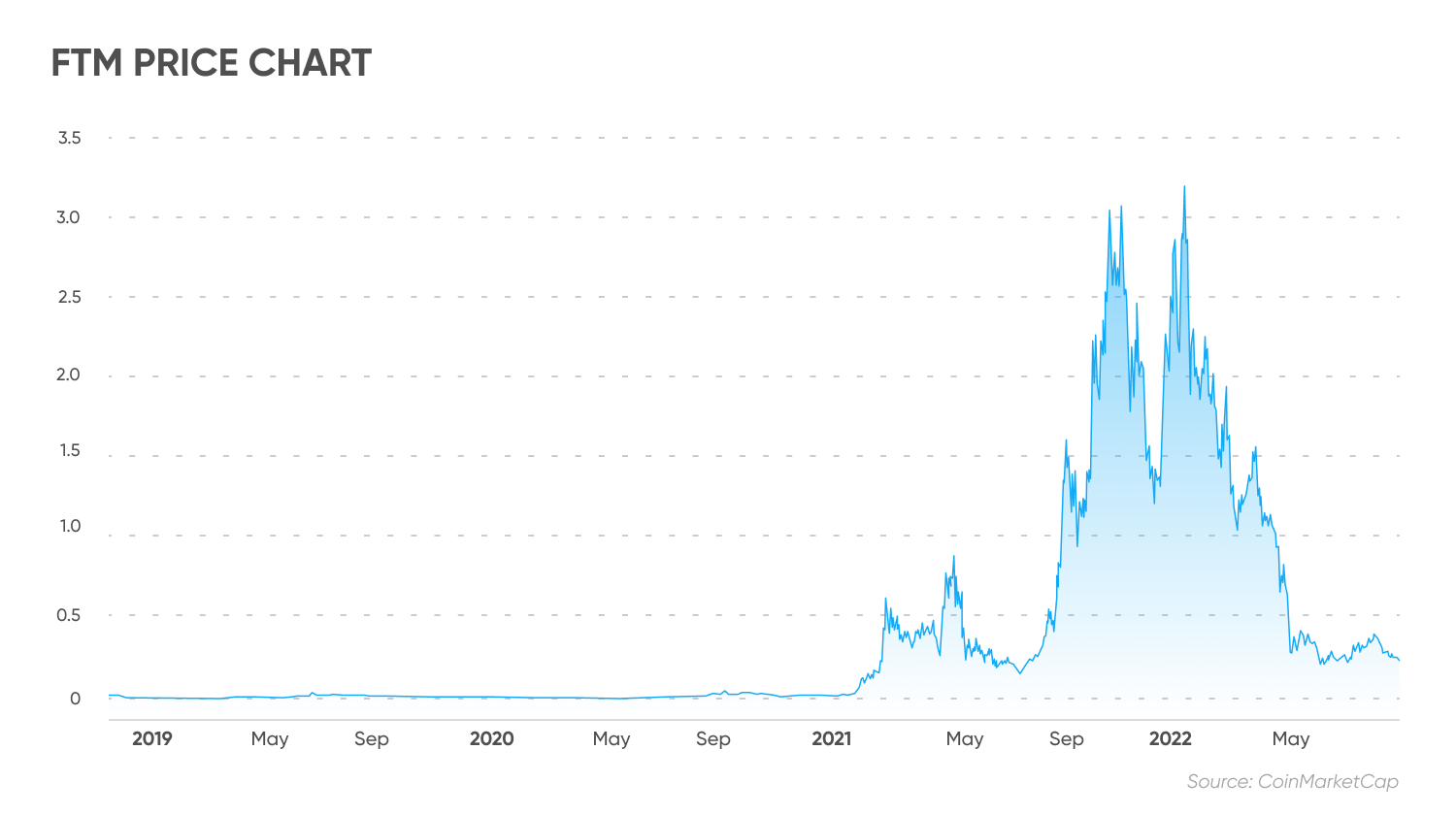

From the chart below, we can see that the FTM token price rallied strongly in 2021 as the Fantom Foundation announced several partnerships and integrations.

The FTM price started 2021 at $0.017 and spiked to $0.872 in February before falling back down. It then climbed to $0.957 in May before quickly dropping back to $0.263 as the cryptocurrency markets fell.

The FTM chart shows that the price bottomed out at $0.153 in July, before starting to rally strongly again in August 2021. The price climbed to $1.93 on 9 September, slipped back to $0.951 on 21 September and then rallied to an all-time high of $3.48 on 28 October, following the pattern of the broader cryptocurrency markets. After the markets sold off in November, FTM ended 2021 at $2.25, a gain of more than 13,000% for the year.

The FTM price traded up towards the October high in mid-January, reaching $3.36 on 17 January 2022. But the price trended lower, falling to a low of $1.31 on 24 February.

FTM first dropped below $1 on 25 April 2022, falling to a low of $0.9896. It then continued its downtrend, bottoming out at $0.1961 on 13 June as the market was rocked by the news that the Celsius (CEL) crypto lending platform had cancelled withdrawals.

There was then something of a fightback, and on 30 September it was worth about $0.2285. Things gradually went down overall after that, however, with it reaching a low of $0.1648 on 22 November before recovering to close the year at $0.1997, representing an annual loss of more than 90%.

The crypto was able to join the market in making something of a recovery in 2023, with it rallying to a high of $0.6533, its highest price since May 2022, on 3 February. After this, it went down in fits and starts, with the collapse of the Silvergate bank seeing it hit a low of $0.3063 on 10 March. After that, though, there was some recovery and it was worth about $0.4615 on 17 March 2023.

At the time, there were about 2.78 billion FTM in circulation, out of a total supply of 3.175 billion. This gave the token a market cap of $1.28bn, making it the 43rd-largest crypto by that metric.

Working with governments

Fantom has been working with several national governments to implement its blockchain-based technology, signing memorandum of understandings (MOUs) back in 2021 with the Pakistan Punjab Prisons Department and the Pakistan Private Educational Institutions Regulatory Authority (PEIRA), the Afghanistan Ministry of Industry and Commerce – which was the sixth government entity in the country to use Fantom technology – and the Ministry of Industry and New Technologies of the Republic of Tajikistan.

On 1 January 2022, the Fantom Foundation tweeted that the network had reached 1.5 million unique addresses, compared to just over 5,000 a year earlier. The blockchain has since grown further and, as of 13 December 2022, there were just over 26.6 million unique addresses after a massive increase in interest in the facility over the course of the previous month or so.

In early January 2022, crypto research group Delphi Digital said people were moving from rival blockchain Avalanche to Fantom.

“Fantom surpassed Avalanche in daily transactions at the start of 2022. Opportunistic capital moved over to yield farm on Fantom with high yields on stablecoins of around ~30-60% APR,” it stated.

On 18 January 2022, cryptocurrency exchange FTX said it had added support for the Fantom (FTM) mainnet and integrated cryptocurrency e-commerce platform Shopping.io, enabling users globally to purchase items online from retailers such as Amazon (AMZN), eBay (EBAY), Walmart (WMT) and Home Depot (HD) using FTM. Later that month, Fantom announced that cryptocurrency exchange Nexo added access to FTM for its three million users.

On 10 February, the Fantom Foundation said that staking infrastructure platform Stader Labs would integrate with Fantom to enable its users to “unlock the value of their staked FTM through liquid staking and delegate to multiple validators with a single click”.

Additionally, Blocknative, the Web3 infrastructure company, launched beta support for the Fantom Network, enabling the tracking of transactions moving from initiating wallets or smart contracts to the point of consensus validation. And, on 16 February, the exchange Okcoin said it had started trading FTM.

By the end of March 2022, influential developer Andre Cronje, who held a technical advisory role for three years, had left the project. Immediately following the announcement on Twitter, Fantom’s FTM token fell 17.5%. By late November 2022, though, Cronje appeared to be back with Fantom.

The crashes in the second and third quarters took a heavy toll on the pricing of FTM, but the protocol continued on extensive blockchain development programmes, releasing fUSD, an ‘over-collateralised’ stablecoin backed by staked FTM.

More recently, the implementation of DAG 2.0 has aimed to make participating in the Fantom network more affordable and accessible. This is because the DAG relies on transactions rather than mining or any of the expensive mining hardware associated with it.

According to the Fantom website, Gitcoin’s integration into the Fantom network should enable the platform to launch its new 335m FTM incentive programme in partnership with Gitcoin grants. Gitcoin uses quadratic voting to democratically allocate funding to projects, such as DeFi, games, NFT, education. infrastructure or something else.

According to data compiled by DeFiLlama, the total value locked (TVL) on the Fantom blockchain surged from $1.17bn on 6 October 2021 to $8.06bn on 3 March 2022 across 181 DeFi apps built on the network. Following a steep decline across March, the TVL surged to $5.12bn on 4 April. However, at the time of writing on 17 March 2023, it stands at only $458.63.

Fantom price predictions

Let’s now take a look at some of the fantom price predictions that were being made as of 17 March 2023. It is important to remember that price forecasts, especially for something as potentially volatile as cryptocurrency, often end up being wrong. Also, many long-term crypto price predictions are made using an algorithm, which means they can change at a moment’s notice.

First, CoinCodex had a rather mixed short-term fantom price prediction for 2023. The site said that the coin could trade at $0.464696 on 22 March before falling to $0.383297 on 16 April. The site’s overall technical analysis for the coin was, perhaps surprisingly, bullish, with 22 indicators making upbeat signals against just six making bearish ones.

Next, DigitalCoinPrice made a fantom crypto price prediction which said it could reach $0.94 this year and $1.61 in 2025, and made a fantom price prediction for 2030 of $4.74.

Meanwhile, the fantom coin price prediction from PricePrediction suggested the crypto could average $0.53 this year. The site then made a fantom price prediction for 2025 of $1.18. The site thought that FTM could jump to $8.02 by 2030.

Finally, Wallet Investor made an FTM price prediction that suggested the coin was in for a tough 12 months ahead, saying FTM could fall to a mere $0.0369 by 17 Marxh 2024.

When considering an FTM coin price prediction, it’s important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin or token’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns, and never trade with money that you cannot afford to lose.

FAQs

Is fantom a good investment?

It is hard to say. A lot will depend on how FTM responds to market events and how the market as a whole behaves.

Remember, you should always carry out your own thorough research before making an investment. Even high market cap cryptocurrencies can be affected by bear markets, so investors should be prepared to make losses and never purchase more than they can afford to lose.

Will fantom go up or down?

No one can tell for sure right now. While some forecasting sites such as PricePrediction were optimistic as of 17 March 2023, others including Wallet Investor were far more gloomy. It is important to remember that price predictions often end up being wrong, and that prices can go down as well as up.

In volatile cryptocurrency markets, it’s important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether FTM is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors.

Keep in mind that past performance is no guarantee of future returns, and never invest money that you cannot afford to lose.

How many fantom coins are there?

As of 14 December 2022, were about 2.78 billion FTM in circulation, out of a total supply of 3.175 billion.

What is the fantom coin used for?

FTM is the native cryptocurrency of the Fantom blockchain platform. It is used to secure the network via staking, to send and receive payments on the network, to pay network and smart contracts fees, and for on-chain governance.

Should I invest in fantom?

Before you invest in fantom, you will have to do your own research, not only on FTM but on other crypto coins.

This is a question that you will have to answer for yourself. Before you do so, however, you will need to conduct your own research. Never invest more money than you can afford to lose, because prices can go down as well as up.