Volkswagen stock forecast: Third-party price targets

Volkswagen AG is a Germany-based automotive manufacturer listed in Frankfurt, producing passenger cars and commercial vehicles, with performance shaped by global demand, regulation and the shift towards electric mobility. Explore third-party VOW price targets and technical analysis.

Volkswagen AG (VOW) is trading around €102.79 in early European dealings on Thursday, 12 February 2026, within an intraday range of €101.59-€104.79, as indicated by Capital.com’s quote feed at 4:03pm UTC. Past performance is not a reliable indicator of future results.

The move follows recent company updates on deliveries and cash flow. Volkswagen previously reported 2025 group deliveries of about 8.98 million vehicles, down 0.5% year on year (Volkswagen, 20 January 2026), while posting automotive net cash flow of approximately €6bn for 2025, above prior guidance and market expectations (Volkswagen, 21 January 2026). Trading also takes place against a backdrop of firmer German equities. Germany’s main stock index (DE40) has advanced in recent sessions and remains higher than a year ago, providing a comparatively supportive domestic equity backdrop for large-cap constituents such as Volkswagen, although broader market strength does not determine individual share performance (Trading Economics, 12 February 2026).

Volkswagen stock forecast 2026–2030: Third-party price targets

As of 12 February 2026, third-party Volkswagen stock predictions reflect differing views on execution risks, cash-flow resilience and the wider automotive cycle. These targets represent indicative 12-month objectives, not guaranteed outcomes, and analysts may revise them as new information on earnings, strategy or macroeconomic conditions becomes available.

J.P. Morgan (broker research)

J.P. Morgan maintains a Neutral rating on Volkswagen with a 12-month price target of €110. The bank notes that previously released free-cash-flow figures were a ‘pleasant surprise’ and frames its target against ongoing uncertainties around demand trends and competitive intensity in key markets (MarketScreener, 21 January 2026).

Deutsche Bank (broker research)

Deutsche Bank reiterates its positive stance on Volkswagen and lifts its target price from €110 to €120. The broker says stronger-than-expected automotive cash flow and cost-cutting measures underpin the higher target, while the group continues to face structural headwinds linked to electrification and competition (MarketScreener, 22 January 2026).

Jefferies (broker research)

Jefferies maintains a Buy rating on Volkswagen with a 12-month target price of €140. The firm highlights potential upside from the execution of efficiency programmes and portfolio actions, alongside ongoing investment requirements in electric vehicles and software (The Globe and Mail, 23 January 2026).

RBC Capital Markets (broker research)

RBC Capital Markets keeps Volkswagen at Outperform with a target price of €135. RBC refers to cost measures and capital-allocation discipline as factors supporting its target, while flagging macroeconomic and regulatory uncertainty in Europe and China (The Globe and Mail, 23 January 2026).

MarketScreener (consensus snapshot)

A consensus snapshot compiled by MarketScreener shows an average 12-month Volkswagen target of around €116.94, with individual sell-side estimates spanning from €92.60 to €151. The service aggregates multiple broker models and updates its consensus as new research is released, which means the average target can shift over time as assumptions on margins, cash flow and regional demand change (MarketScreener, 12 February 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

VOW stock price: Technical overview

On the daily chart, the VOW stock price trades near €102.79 as of 4:03pm UTC on 12 February 2026. The price holds close to the classic pivot around €102.4 and remains within the intraday range of €101.59-€104.79. The simple moving averages are relatively clustered, with the 20-, 50-, 100- and 200-day averages at approximately €103, €104, €99 and €98 respectively. The 14-day RSI stands near 49.9, in neutral territory, while the ADX around 10.7 suggests a weak trend environment.

On the upside, traders often monitor the classic R1 pivot near €108.2, with R2 around €113.5 coming into focus only if the price sustains a daily close above the first resistance level. On the downside, initial support aligns with the classic pivot at about €102.4, followed by the 100-day simple moving average near €99. A move below S1 around €97.1 could expose the lower pivot zone. Technical analysis reflects historical price data and does not predict future performance (TradingView, 12 February 2026).

It is provided for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Volkswagen share price history (2024–2026)

VOW’s stock price moved through a broad cycle over the past two years, trading from the mid €80s in late 2024 to peaks above €150 before easing back. The stock closed at about €89.39 on 2 January 2025 and rose during the first half of the year, reaching the €110-€115 area in March. It then traded largely within a €90-€105 range through the summer and early autumn.

After dipping towards the low €90s in October 2025, VOW moved higher into year-end, finishing December around €105-€110 before starting 2026 firmer. By 12 February 2026, the share price traded near €103.21, only modestly above levels seen a year earlier, illustrating a volatile but broadly range-bound pattern over the medium term.

Past performance is not a reliable indicator of future results.

Volkswagen (VOW): Capital.com analyst view

Volkswagen’s share price has traded in a broad sideways range over the past year. Rallies towards the low €100s have often met resistance, while pullbacks into the €90 area have seen renewed interest, leaving VOW close to where it traded in early 2025. At around €102-€103 in mid-February 2026, the stock reflects a balance between company-specific developments and sector-wide pressures.

Preliminary 2025 figures indicating around €6bn of automotive net cash flow and more than €34bn in net liquidity suggest that Volkswagen retains financial flexibility to fund electrification, software development and restructuring initiatives. At the same time, intense competition in electric vehicles, regulatory requirements and uneven demand conditions in Europe and China could influence margins and capital allocation. As a result, future price movements may depend on how effectively the company manages costs, investment needs and regional demand trends, alongside broader market conditions.

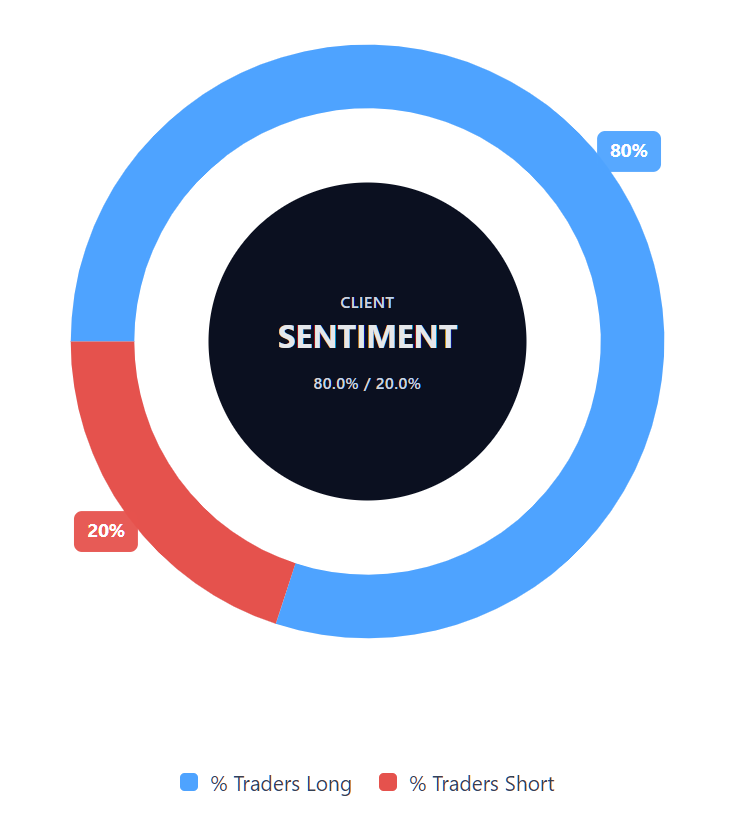

Capital.com’s client sentiment for Volkswagen CFDs

As of 12 February 2026, Capital.com client positioning in Volkswagen CFDs shows 80% buyers versus 20% sellers, a difference of 60 percentage points. This indicates that a majority of clients currently hold long positions, while a smaller proportion hold short exposure. Client sentiment data reflects open positions on the Capital.com platform at a specific point in time and can change quickly. It should not be viewed in isolation or as a signal of future price direction.

Summary – Volkswagen 2026

- Volkswagen (VOW) trades around €102.79 as of 4:03pm UTC on 12 February 2026, within an intraday range of €101.59-€104.79.

- Over the past two years, the share price has fluctuated between the mid €80s and above €150, with recent price action broadly range-bound within the €90-€110 area.

- Technical indicators show the price near the daily pivot at approximately €102.4, with clustered 20-, 50-, 100- and 200-day moving averages and a neutral RSI around 49.9, consistent with a weak trend environment.

- Recent company updates reference approximately €6bn in 2025 automotive net cash flow and solid liquidity, set against competitive, regulatory and demand-related pressures in the global automotive sector.

Past performance is not a reliable indicator of future results.

FAQ

Who owns the most Volkswagen stock?

Volkswagen AG has a concentrated ownership structure. Porsche Automobil Holding SE is the largest shareholder and controls a significant share of voting rights through its holding of ordinary shares. The State of Lower Saxony also holds a substantial stake, which gives it notable influence under Volkswagen’s governance framework. Institutional investors and asset managers own additional shares, while part of the free float trades on the open market.

What is the five-year Volkswagen share price forecast?

There is no fixed five-year VOW stock forecast. Most published analyst targets focus on a 12-month horizon, and analysts revise these targets as earnings results, strategic updates and macroeconomic conditions change. Longer-term projections depend on factors such as electric vehicle adoption, cost control, competitive positioning and global demand trends. Any multi-year estimate should be viewed as indicative rather than predictive, given the cyclical nature of the automotive sector.

Is Volkswagen a good stock to buy?

Whether Volkswagen is considered ‘good’ depends on your objectives, risk tolerance and time horizon. The company reports solid liquidity and cash-flow generation, but it operates in a highly competitive and capital-intensive industry. Share price performance can reflect both company-specific developments and broader economic conditions. Investors and traders typically assess financial statements, valuation metrics and technical indicators before making a decision, while recognising that outcomes are uncertain.

Could Volkswagen stock go up or down?

Volkswagen’s share price can move in either direction. Earnings releases, delivery data, regulatory developments, macroeconomic trends and shifts in investor sentiment can all influence price action. Technical levels, such as support and resistance zones, may also shape short-term trading behaviour. As with any listed equity, volatility can increase around corporate announcements or wider market events. Past performance does not guarantee future results.

Should I invest in Volkswagen stock?

Deciding whether to invest in Volkswagen stock requires careful consideration of your financial situation, goals and risk appetite. Shares can provide exposure to the automotive sector, but they carry market and company-specific risks. You should conduct your own research and, where appropriate, seek independent financial advice before making an investment decision. This information is for educational purposes only and does not constitute financial advice.

Can I trade Volkswagen CFDs on Capital.com?

Yes, you can trade Volkswagen CFDs on Capital.com. Trading share CFDs lets you speculate on price movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.