What is DeFi and how does it work?

Learn all about DeFi, how it works, its role in crypto markets, and how to trade DeFi tokens.

What is DeFi?

Decentralised finance, or ‘DeFi,’ refers to a financial ecosystem built on blockchain technology. DeFi platforms use smart contracts – self-executing agreements coded on a blockchain – to automate financial transactions and enable decentralised services.

Designed as an alternative to traditional finance, DeFi platforms operate autonomously and grant users direct control over their funds, supporting a range of financial activities such as lending, borrowing, trading, and earning interest. These services are typically offered without the need for conventional financial intermediaries like banks, although some platforms may rely on governance oracles or external entities to operate effectively.

Examples of DeFi protocols include:

- Uniswap (UNI) – a decentralised exchange known for enabling token swaps through its automated market maker (AMM) model. It operates without relying on traditional centralised intermediaries but is primarily built on the Ethereum blockchain.

- Aave (AAVE) – a leading lending and borrowing platform that allows users to deposit cryptocurrencies to earn interest or borrow assets against collateral. Known for features like flash loans and stable-rate borrowing.

- SushiSwap (SUSHI) – a community-driven decentralised exchange offering token swaps and yield farming opportunities. Built on Ethereum, it rewards liquidity providers with SUSHI tokens, enabling governance participation.

- PancakeSwap (CAKE) – a Binance Smart Chain-based decentralised exchange specialising in low-cost transaction fees due to Binance Smart Chain’s efficiency, offering diverse DeFi services such as staking, liquidity pools, and lotteries.

What are the different types of DeFi?

DeFi encompasses a wide array of applications designed as a blockchain-based alternative to traditional financial services. Here are some common types of DeFi protocols:

|

Type |

Aim |

Examples |

Key features |

|

Decentralised exchanges (DEXs) |

Token swaps and trading |

Uniswap (UNI), PancakeSwap (CAKE) |

Facilitates peer-to-peer trading without intermediaries; automated market makers (AMMs) and liquidity pools enhance trading efficiency. |

|

Lending and borrowing platforms |

Access to loans and earning interest |

Aave (AAVE), Compound (COMP) |

Users can deposit assets to earn interest or borrow against their collateral, known for features like flash loans and algorithm-defined lending rates. |

|

Yield farming and staking |

Maximising returns via rewards |

Yield farming focuses on providing liquidity in exchange for rewards, while staking secures networks by locking tokens. |

|

|

Stablecoins |

Reducing volatility in transactions |

USD coin (USDC), DAI, Tether (USDT) |

Cryptocurrencies designed to maintain price stability through pegging to fiat currencies, algorithms, or diversified asset reserves. |

|

Insurance protocols |

Protecting against risks |

Nexus Mutual (NXM), InsurAce (INSUR) |

Provides coverage for smart contract failures, exchange hacks, or other risks in the DeFi ecosystem. |

|

Synthetic assets |

Tokenised versions of real-world assets |

Enables the creation and trading of blockchain-based tokens that mimic the value of real-world assets, such as shares, commodities, or forex currencies. |

As shown, intent and use cases can differ substantially from one token to the next, owing to the sheer variety of DeFi tokens available.

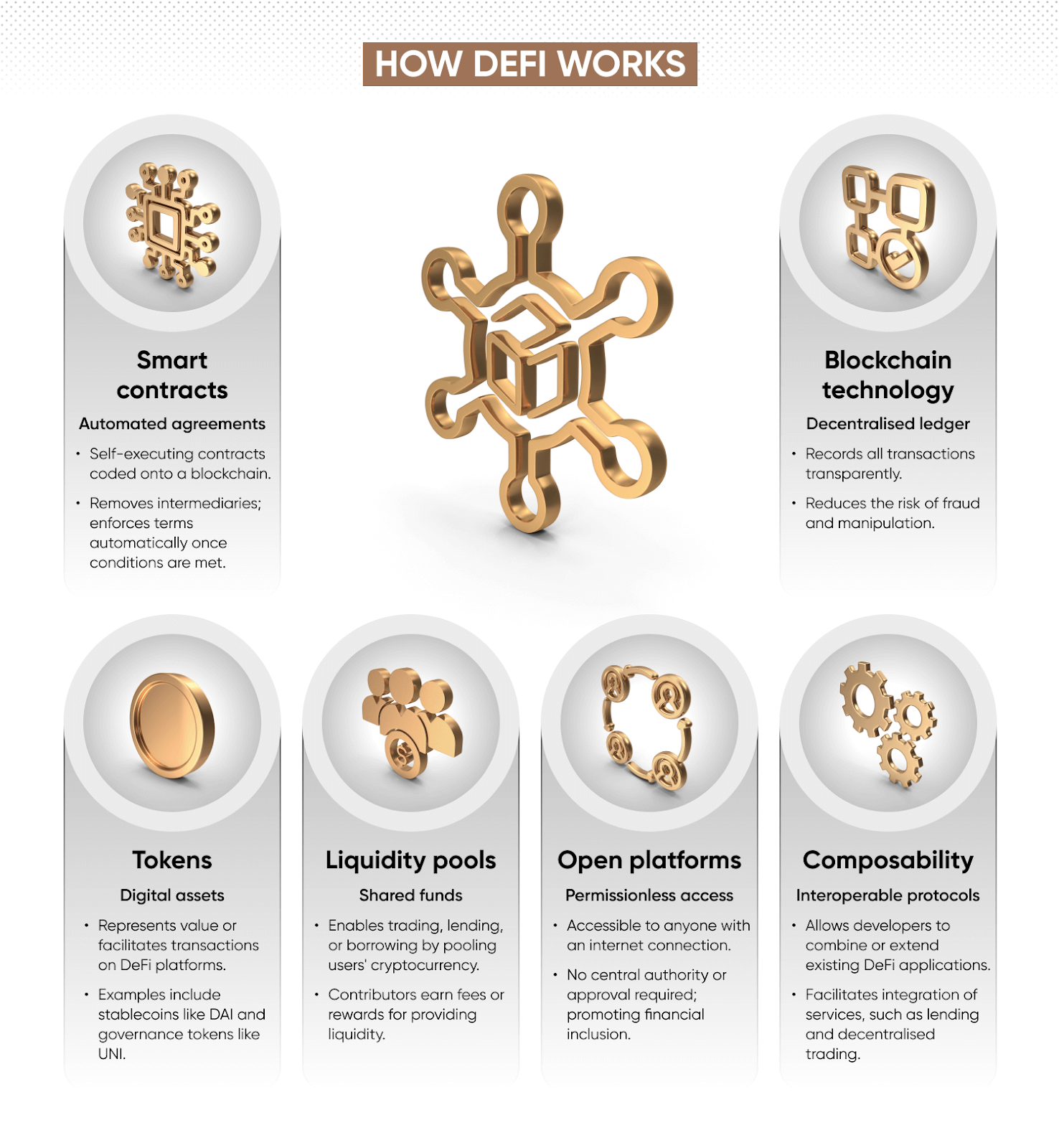

How does DeFi work?

DeFi operates on blockchain networks, utilising smart contracts to provide financial services without intermediaries. Unlike traditional finance, where banks or brokers act as gatekeepers, DeFi systems are decentralised, transparent, and accessible to anyone with an internet connection.

Here’s a breakdown of how DeFi works:

Smart contracts and decentralisation

Smart contracts – self-executing agreements coded onto a blockchain – remove the need for intermediaries in DeFi by automatically enforcing terms when predefined conditions are met. Note that vulnerabilities or bugs in smart contracts can sometimes expose users to security risks.

DeFi runs on blockchain technology, where all transactions are recorded on a decentralised ledger. This ensures transparency, which means users can independently verify activity while reducing some risks of manipulation or fraud, though vulnerabilities and exploits can still occur.

Tokenisation and liquidity pools

DeFi platforms often use tokens to represent assets or facilitate transactions. Stablecoins like USDC are pegged to fiat currencies, though the mechanism of maintaining the peg can vary, such as through algorithms or collateralisation. Meanwhile, governance tokens such as UNI give holders a say in protocol decisions.

Liquidity pools are another cornerstone of DeFi, enabling users to contribute cryptocurrency into shared pools that facilitate trading, lending, or borrowing. Contributors, often called liquidity providers, earn fees or rewards for their participation.

Permissionless access and composability

Many DeFi platforms are permissionless, meaning they are open to all users without requiring approval from central authorities. This global accessibility comes with risks, as malicious actors can exploit these open systems. Users should exercise caution and conduct due diligence before participating.

DeFi allows developers to build new applications by combining or extending existing protocols. For instance, a platform might integrate lending services with decentralised exchanges to provide seamless borrowing and trading.

DeFi vs bitcoin (BTC): what are the differences?

Decentralised finance (DeFi) and bitcoin (BTC) both exist within the blockchain ecosystem, but they have differences. Here's how they compare:

|

Bitcoin |

DeFi |

|

|

Primary aim |

A decentralised digital currency, store of value, and payment system. |

Aims to replicate traditional financial services in a decentralised manner. |

|

Examples |

||

|

Underlying technology |

Blockchain using proof-of-work (PoW) consensus mechanism. |

Blockchain platforms supporting smart contracts, such as Ethereum and Solana. |

|

Programmability |

Limited, focused on simple transactions. |

Highly programmable – supports complex financial applications. |

|

Scope of use |

Peer-to-peer transactions, trading, and as a store of value. |

Lending, borrowing, trading, liquidity provision, and yield farming. |

|

Decentralisation |

Fully decentralised with a single global network. |

Varies – levels of decentralisation depend on the governance model and protocol architecture. |

|

Accessibility |

Requires a crypto wallet. |

Requires understanding of DeFi protocols and wallet integration. |

Learn more about bitcoin and BTC and how they work – read our comprehensive trader’s bitcoin (BTC) guide.

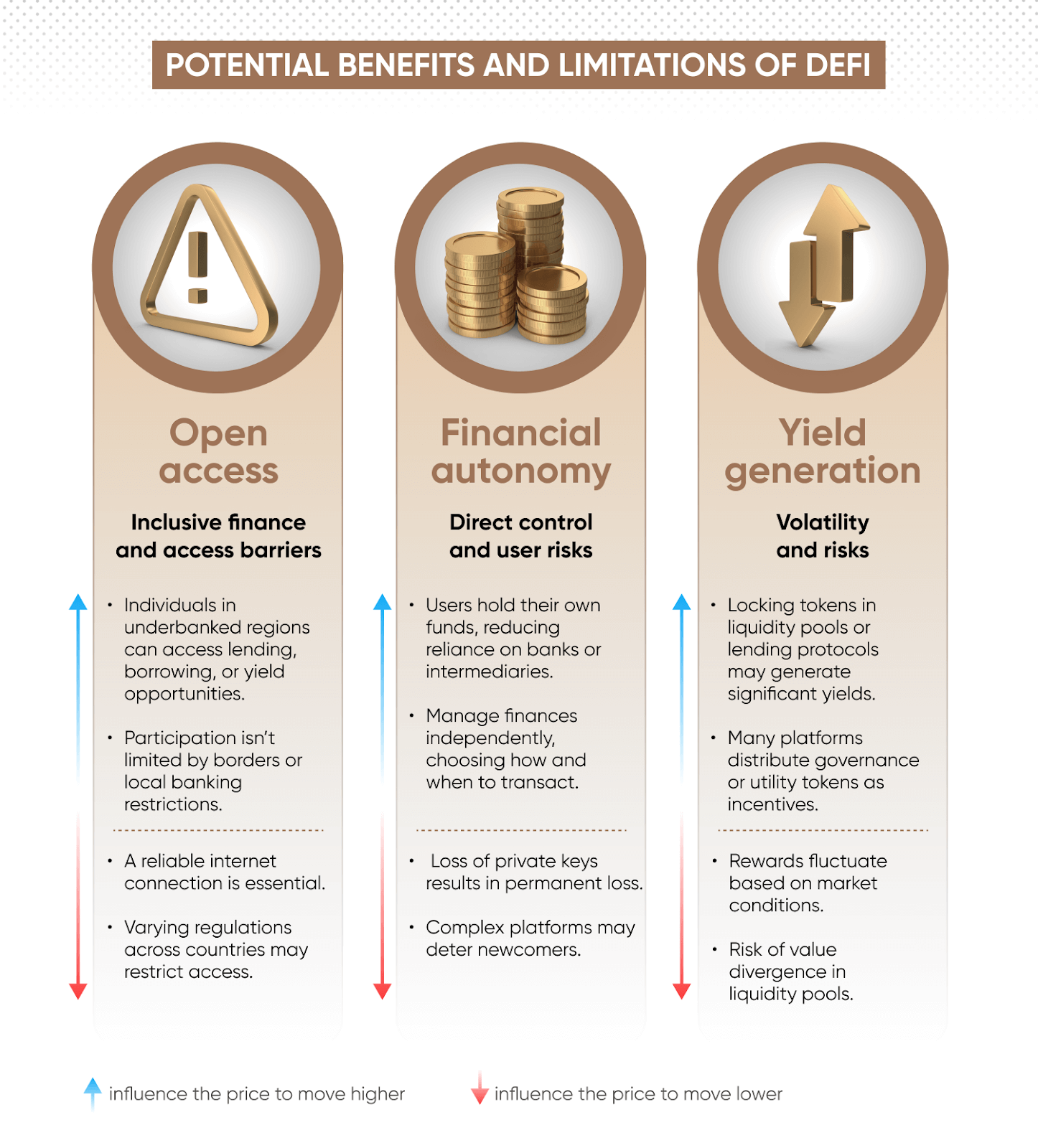

Potential benefits and limitations of DeFi

Consider the potential risks and opportunities when trading DeFi. Here are some of the key ones:

Open access

DeFi services can potentially remove many geographic barriers, although access may still be restricted in certain regions.

Potential benefits

-

Inclusive finance – individuals in underbanked regions can access lending, borrowing, or yield opportunities.

-

Global reach – participation isn’t limited by borders or local banking restrictions.

Potential limitations

-

Connectivity issues – a reliable internet connection is essential, but it may be difficult in certain areas.

-

Regulatory uncertainty – different regions have varying regulations that could affect access.

Financial autonomy

Many DeFi protocols aim to give users greater control over their assets, minimising reliance on traditional middlemen.

Potential benefits

-

Self-custody – you hold your own funds, reducing reliance on traditional banks or intermediaries.

-

Flexible control – you can manage your finances on your terms, choosing how and when to transact.

Limitations

-

User responsibility – misplacing private keys or making transaction errors can result in permanent loss.

-

Steep learning curve – navigating multiple platforms and wallets can be complex for newcomers.

Yield generation

Staking, yield farming, and liquidity provision may offer attractive returns compared to some traditional methods.

Potential benefits

-

High earning potential – locking up tokens in liquidity pools or lending protocols may offer attractive yields, though these depend on market conditions.

-

Token rewards – many DeFi platforms distribute governance or utility tokens, adding extra incentives.

Limitations

-

Volatile returns – rewards are not guaranteed and can fluctuate based on market conditions.

-

Impermanent loss – contributing to liquidity pools carries the risk of asset value divergence.

Security and regulation

From a legal perspective, smart contracts and decentralised infrastructures present both innovative opportunities and new challenges.

Potential benefits

-

Transparent transactions – public ledgers enhance fund traceability, though hidden costs like network fees may still apply.

-

Automation – smart contracts enforce rules without human intervention, lowering counterparty risk.

Limitations

-

Smart contract vulnerabilities – coding errors and exploits can lead to significant financial losses.

-

Regulatory action – governments may implement rules that restrict or reshape DeFi operations.

What are the DeFi trading hours?

DeFi tokens often run on decentralised blockchain networks that are active 24 hours a day, seven days a week, 365 days a year. This means you can trade DeFi tokens like UNI, CAKE, AAVE, and SNX at any time, including on weekends and holidays.

-

Cryptocurrency exchanges – many exchanges facilitate 24/7 trading, allowing for continuous market participation.

-

Online trading platforms – some reliable and trusted brokerages provide DeFi trading via CFDs.

If you choose to trade CFDs, you can follow the UNI, CAKE, AAVE, and SNX performance live in US dollars with our comprehensive UNI/USD, CAKE/USD, AAVE/USD, and SNX/USD price charts.

Monitoring the cryptocurrency’s activity can help you keep an eye out for any key fundamental or technical events that may affect short-term movements in its value.

How to get involved in DeFi

Decentralised finance (DeFi) revolves around blockchain-based tokens, protocols, decentralised exchanges, lending platforms, and stablecoins, among other components. Traders may choose to buy DeFi tokens such as UNI or AAVE on a cryptocurrency exchange or interact directly with DeFi applications by linking a compatible crypto wallet.

You could also use a contract for difference (CFD) to speculate on the price of DeFi token pairs – for example, UNI/USD. A CFD is a derivative agreement, typically between a broker and a trader, where one party agrees to pay the other the difference in the value of a security between the opening and closing of the trade. Unlike traditional investing, CFDs do not involve ownership of the underlying asset.

By using CFDs, you can take a position on whether you think UNI/USD will rise (called ‘going long’) or fall (‘going short’). CFDs give traders access to leverage, which can magnify potential profits but also magnify losses. As a result, leveraged trading involves substantial risk and may not be suitable for all traders.

You can learn more about trading DeFi tokens via CFDs in our guide to cryptocurrency trading.

FAQs

What is decentralised finance (DeFi)?

Decentralised finance (DeFi) refers to a broad financial ecosystem built on blockchain technology, where various traditional financial services – such as lending, borrowing, trading, and saving – are conducted using smart contracts.

Unlike centralised systems, DeFi operates without intermediaries like banks, enabling users to maintain full control over their assets.

Is decentralised finance safe?

DeFi is considered a high-risk space due to its reliance on emerging technologies. While smart contracts eliminate the need for trust in intermediaries, they are not immune to bugs or vulnerabilities that hackers may exploit – and the absence of regulation means there is limited recourse in cases of fraud or platform failure.

Conduct thorough research, use well-audited protocols, and exercise caution when engaging with DeFi.

Is Defi a good investment?

DeFi offers opportunities for potentially high returns, especially during periods of rapid adoption and innovation. However, the market is volatile and speculative, with significant risks of losing capital. DeFi trading requires careful consideration of the underlying protocol, market conditions, and personal risk tolerance.

Visit our other complete guides

How to trade Solana