GBP/PLN forecast: How low can the zloty go?

What’s next for the USD/PLN forex pair? Read on to learn more about the pair and its possible future fluctuations.

The British pound (GBP) has gained in value against the Polish zloty (PLN) in the past couple of months, as the central bank of Poland raised interest rates by 0.25 basis points less than expected in July.

The Bank of England (BoE), which hiked rates by 50 basis points on 22 September, is expected to continue raising rates, while providing relative support to the pound.

But currency analysts are cautious on the outlook for both the pound and the zloty in the coming months, based on a macroeconomic environment of decades-high inflation and looming recession.

What does that mean for the value of the GBP/PLN foreign exchange (forex or FX) pair?

In this article, we look at the key drivers for the exchange rate and the latest pound to zloty forecasts being made by analysts.

What drives the GBP/PLN pair?

The GBP/PLN forex pair refers to how many Polish zlotys (the quote currency) are required to buy one British pound (the base currency).

The pound is the world’s fourth most-traded currency and one of the strongest, reflecting its role as the former global reserve currency and the UK’s position as the world’s fifth-largest economy and a major financial centre.

The name of the Polish zloty is derived from the Polish word for gold – zloto – and was first used for the country’s currency in the 14th century. The current version of the zloty dates back to 1995, when the PLZ was redenominated as the PLN.

Poland joined the European Union (EU) in 2004, with plans to adopt the euro (EUR) as its national currency. But it has not set a target date and eurosceptics in the government are resisting pressure to join the single currency in the near term.

Foreign exchange rates are primarily driven by data indicating the health of their home economies, including gross domestic product (GDP), international trade data, interest rates and inflation.

The value of the pound sterling has largely been driven by the status of the Brexit process since the UK voted to leave the European Union in a 2016 referendum. The pound has weakened since the start of the Covid-19 pandemic on a combination of economic uncertainty, rapidly rising inflation and political instability, falling in July to its lowest level against the US dollar since 1985.

The Polish zloty, Czech koruna (CZK) and Hungarian forint (HUF) are considered to represent the performance of central and eastern European (CEE) currencies. CEE currencies have been affected in 2022 by geopolitical events such as the Russian-Ukraine war driving up energy prices and US-China tensions increasing over the status of Taiwan.

Erste Group analyst Katarina Gumanova noted in a recent report:

GBP/PLN rises as zloty weakness outweighs sterling under performance

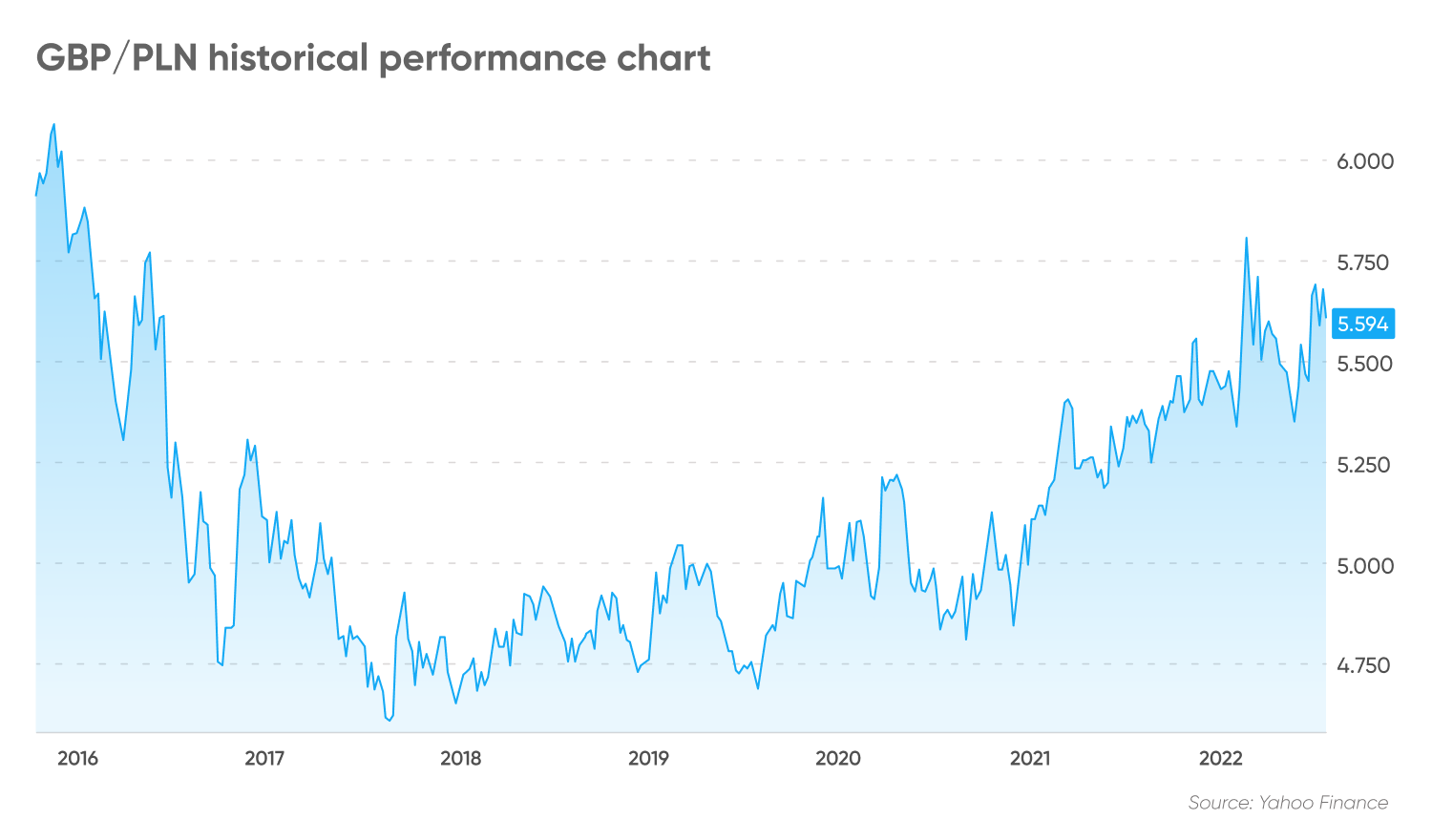

The GBP/PLN exchange rate reached a high above 6 in November 2015, subsequently retreating as the value of the pound fell in 2016 in response to the outcome of the Brexit referendum.

GBP/PLN dropped to a rate of 4.74 in September 2016, although it rebounded to 5.27 by the end of the year. The pair dropped again to 4.60 in August 2017, its lowest level since 2011.

The GBP/PLN rate moved back above 5.00 in February 2019, and reached 5.20 at the start of the Covid-19 pandemic in March 2020. While the rate pulled back to 4.80 in August 2020 as Covid-19 cases climbed in the UK, the roll-out of vaccines later in the year and the full reopening of the economy from lockdown restrictions lifted the value of the pound and it has since remained above 5.00 zlotys.

The Russian invasion of Ukraine and subsequent concerns about the impact of sanctions on commodities supply in Europe saw the GBP/PLN rate soar to 6.02 on 7 March 2022. But the pair then pulled back, dropping to 5.46 by the end of March and falling further to 5.35 in early June. The exchange rate turned higher in June and has since moved up to the 5.60-5.70 range.

The BoE began raising interest rates in December 2021 with a 15-basis point hike, followed by four 25-point hikes. On 22 September 2022, the central bank lifted the rate by 50 basis points for the second consecutive time, bringing the benchmark rate up to 2.25%.

Higher interest rates are typically bullish for a currency, as they offer higher returns for fixed-income investors and increase demand for the currency from overseas. But of concern for traders is the Monetary Policy Committee’s August report, which forecast the UK economy will enter recession in the fourth quarter of 2022 that will persist until the fourth quarter of 2023. It expected the economy to contract by more than 2% between the third quarter of this year and early 2024.

Meanwhile, in Poland, the zloty has weakened against the euro. Jarosław Kosaty, an analyst at Spanish bank Santander, maintained that “EUR/PLN will remain under increasing upward pressure in coming months. We forecast that the rate will move up to around the 4.90 level in October and will remain near there until the end of this year.”

But Russia has also announced further maintenance, raising concerns on the market that it could be part of a strategy to prevent European countries from accumulating gas reserves for the winter, increasing risk aversion and weighing on the value of the zloty, according to Kosaty.

Unlike other central banks around the world that have indicated they will continue raising interest rates as they look to get inflation under control, the Narodowy Bank Polski (NBP) indicated that it will end its interest rate increases.

Kosaty commented:

What do the challenging geopolitical and macroeconomic conditions mean for the value of the British pound against the Polish zloty?

GBP/PLN forecast: Will the zloty depreciate further, or will the pound weaken?

Analysts at Dutch bank ING were cautious on the outlook for sterling in the wake of the MPC’s August report.

“The fact that the bank is stepping up the pace of rate hikes while also forecasting a meaningful recession shows just how worried it is that worker shortages and supply issues could keep inflation elevated even as the economy weakens. In other words, it’s the supply side of the economy – much more so than what’s happening with demand – that will heavily determine when and after how many more hikes the BoE will stop tightening,” the analysts wrote in an FX market commentary on 4 August.

According to analysts at CIBC: “Even though the BoE looks set to increase the pace of tightening, the backdrop for sterling remains negative due to macro and political uncertainty”.

But Erste’s Gumanova also sees the potential for external factors to drive CEE currencies, including the zloty, lower in the short term:

“Geopolitical risks lurk around every corner and the China-Taiwan escalation is certainly not helping the region,” ING analysts noted.

“The approaching end of the rate-hiking cycle signalled by the NBP amid further increases in CPI inflation readings and accelerating rate hikes in core markets, particularly the US, put negative pressure on the zloty,” Santander’s Kosaty wrote. “We expect the downward pressure on the zloty to persist in the coming months, as:

-

“Although Polish gas reserves remain at relatively high levels relative to other EU countries, the risk of insufficient reserves in the European market reinforces already strong recessionary fears, which increases risk aversion.

-

“Signals of a slowing Polish economy are becoming more evident with the arrival of more domestic data. Under such circumstances, the likelihood of further NBP rate hikes is diminishing more and more.

“In the longer term, we expect limited appreciation of the zloty, due to the expected improvement in investment sentiment in Europe and the gradual weakening of the dollar in global markets.”

Where does that leave the British pound to Polish zloty forecast?

Analysts at Denmark-based Danske Bank were bearish in their GBP/PLN forecast for 2022, expecting the exchange rate to weaken from 5.71 in late July to 5.65 in a month and 5.56 in three months’ time. But the pair could then move up to 5.60 in six months and 5.64 in 12 months, the bank’s GBP/PLN prediction shows.

At the time of writing, analysis by Trading Economics gave a similar GBP/PLN forecast to Danske Bank, of 5.56536 for the end of the current quarter. Trading Economics expected the pair to rise to 5.68502 in a year, based on its global macro models projections and analysts’ expectations.

In the longer term, the GBP/PLN forecast for 2025 from algorithm-based forecasting service WalletInvestor showed the pair closing 2022 at 5.616 and 2023 at 5.847. In five years, the rate could climb to 6.662, the site’s GBP/PLN forecast suggested.

The GBP/PLN forecast from AllForecast showed the pair trading down to an average of 4.6912 by the end of 2024, from 4.6876 at the end of 2023 and 5.0548 at the end of 2022.

Analysts have yet to issue a GBP/PLN forecast for 2030.

When consulting forecasts for currencies or any other asset, remember that analysts can and do get their predictions wrong. We recommend you always research and consider the latest market trends and news, technical and fundamental analysis, and expert opinion before making any investment decisions. Keep in mind that past performance is no guarantee of future returns, and never invest money you cannot afford to lose.

FAQs

Why has GBP/PLN been rising?

The GBP/PLN exchange rate has been trending higher as the Polish central bank raised interest rates by less than expected in July, while the UK’s central bank continues to raise rates to tackle inflation. In the meantime, keep in mind that markets remain volatile and past performance is no guarantee of future returns.

Will GBP/PLN go up or down?

The direction of the GBP/PLN pair will likely depend on geopolitical events, economic activity in the UK and Poland and the countries’ central bank policies on interest rates and inflation, among other factors.

We recommend you do your own research to develop a view of where you expect the pair to move. Keep in mind that past performance is no guarantee of future returns, and never invest money you cannot afford to lose.

When is the best time to trade GBP/PLN?

The forex markets are open 24 hours a day on week days. However, there are certain time slots when forex trading is most busy. This is typically when major news events or policy announcements drive price volatility.

However, you should make trading decisions only after performing your own researc. Remember that high volatility increases risks of losses and that past performance is no guarantee of future returns, and never invest any money that you cannot afford to lose.

Is GBP/PLN a buy, sell or hold?

Whether you should take a long or short position on the GBP/PLN pair, or use it to hedge your portfolio, dependы on your personal circumstances and risk tolerance. You should do your own research into the economic data, government policies and other factors that drive the exchange rate to make an informed decision.

Keep in mind that past performance is no guarantee of future returns, and never invest money you cannot afford to lose.