AUD/VND forecast: Vietnamese dong quietly gaining on its Aussie peer. Will the trend continue?

What lies in store for the Australian dollar and Vietnamese dong in 2022 and beyond?

The Vietnamese dong (VND) has softened against the Australian dollar (AUD) in the past week after climbing to its highest level since May 2020. With Asia-Pacific currencies coming under pressure from a strong US dollar (USD) on rising interest rates, the dong has found relative strength as it has maintained its trade surplus.

Weak economic growth in China is weighing the Australian dollar, while Vietnam is benefitting from its potential as an alternative investment decision – particularly as the US-China trade war ramps up.

What is the outlook for the AUD/VND exchange rate? Will the dong continue to gain on the Aussie dollar? In this article we look at the latest performance and AUD/VND forecast analysis.

What drives the AUD/VND exchange rate?

The AUD/VND pair in foreign exchange (forex) trading represents how many Vietnamese dong – the quote currency – are needed to buy one Australian dollar – the base currency.

Australia is the world’s 12th largest economy, the Australian dollar – also known as the Aussie – is the fifth most traded currency.

The Aussie is considered a commodity currency, along with currencies such as the Canadian dollar (CAD), New Zealand dollar (NZD) and the Singapore dollar (SGD). Australia is one of the world’s major commodity producers, with mining accounting for 11.5% of the economy and natural resources accounting for 68.7% of its exports.

The value of the Australian dollar is also strongly influenced by the Chinese economy, as China accounts for 36.5% of its exports.

The Vietnamese dong is one the world’s lowest valued currencies. Vietnam’s central bank, the State Bank of Vietnam (SBV), sets the reference rate for the value of the currency against the US dollar. The SBV has devalued the dong five times since 2014, in line with its policy to boost exports and control high inflation through the currency.

The dong’s value is influenced by Vietnam’s trade flows, economic growth, interest rates and inflation, foreign currency reserves, as well as US monetary policy.

VND holds up against pressured AUD

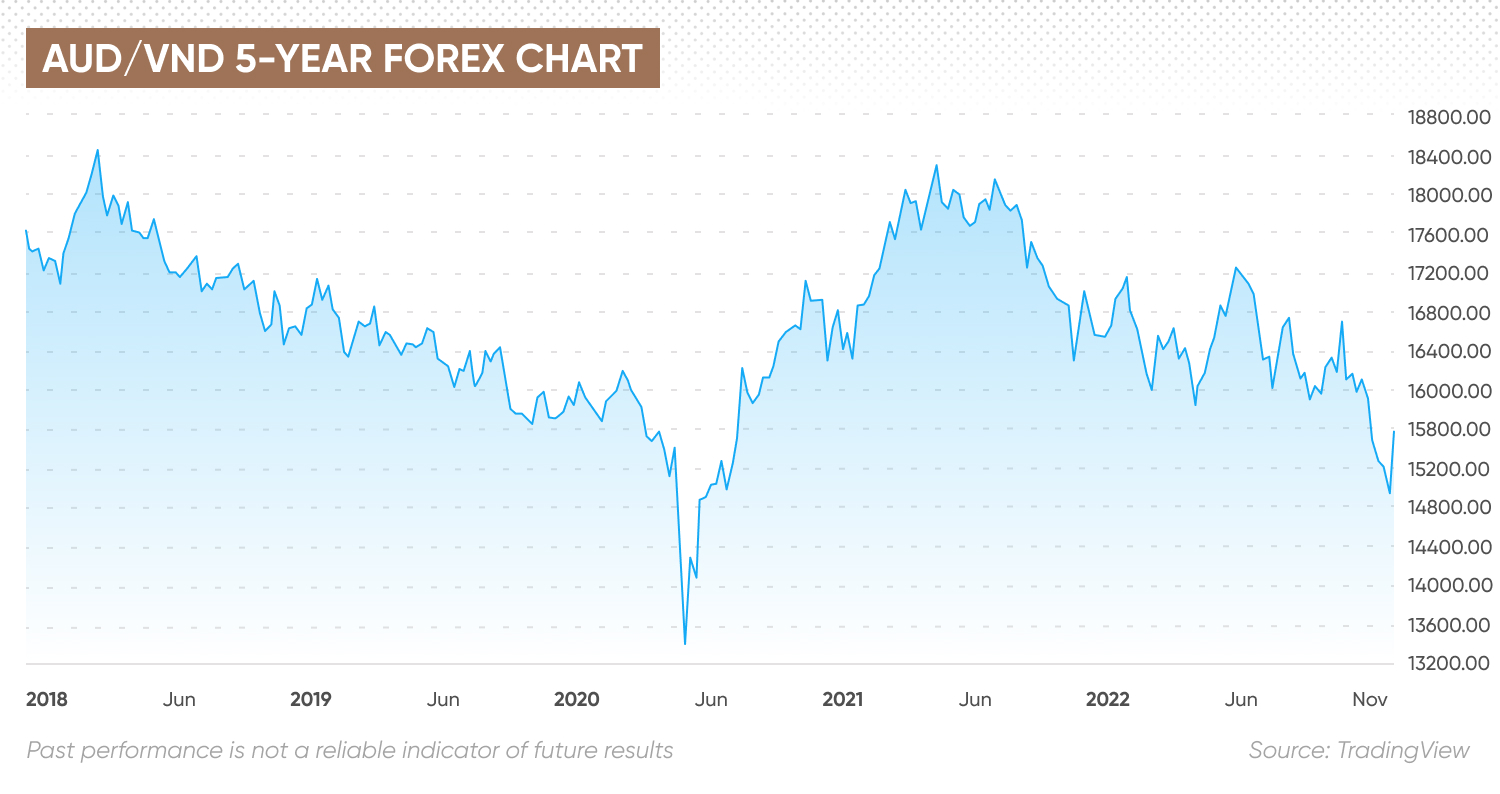

The AUD/VND pair started 2022 at 16,437 and rose to 17,335 in April. It began moving lower in May, falling back to around 15,800 as the Aussie dollar came under more pressure than the dong.

The pair rebounded to 16,851 in June before retreating to 15,730 in July.

The AUD/VND rate traded up to 16,670 on 12 August and has since been in a downward trend as concerns about a slowdown in the Chinese economy and the knock-on effect on the Australian economy have increased.

The Australian central bank, the Reserve Bank of Australia (RBA), raised its interest rates by 25 basis points (bps) to 2.6% on 4 October. That was less than the 50bps the market had been expecting and the Aussie dollar initially depreciated in response.

On 22 September, the SBV unexpectedly raised its benchmark rate by 100bps to 5% for the first time in two years in response to the rise in US rates.

AUD/VND reached 14,969 on 14 October, its lowest level since 10 May 2020. It then bounced to 15,400 on 18 October. On 17 October, the SBV widened the dong’s daily trading band to +/-5%, from +/-3%, which saw the currency depreciate along with other Asian currencies, falling to a record low against the US dollar.

Why has the dong held up its relative value against the Aussie even though China is also its largest trading partner? According to analysis by Singapore-based bank DBS:

“Vietnam benefits from China’s economic uncertainties, offering itself as an attractive alternative investment destination with robust growth (Q2 2022 [gross domestic product] GDP was 7.7% [year-over-year] YOY), relatively stable inflation, and the second-most resilient exchange rate in the region after the [Hong Kong dollar] HKD.

“Despite the challenging global environment, Vietnam has maintained macroeconomic stability. The country reported trade surpluses in the past five out of six months. Unlike many countries, Vietnam’s inflation will be modest at 3.6% this year and 3.4% in 2023. Our economist sees the central bank (SBV) hiking the refinancing rate from 4% to 5% this year and 6% next year. Finally, Fitch also ranked Vietnam fifth out of 35 Asian countries in terms of economic openness.”

What is the outlook for the Australian dollar to Vietnamese dong forecast in the future?

Will the dong extend gains against the Aussie? Analysts see the potential for some support to the Aussie dollar in the medium term after short-term weakness. According to French wealth management firm BNP Paribas:

“The weak growth in China, highlighted by the latest PMI figures, continue to weigh on the AUD. We believe that the Chinese Communist Party on October 20th will help boost Chinese growth. This should be beneficial for the AUD. The macroeconomic environment over the next year should be more risk-on. This will also benefit the AUD. The upside is however lower due to the lower terminal rate.”

Analysis by Singapore-based United Overseas Bank (UOB) noted the increase in the trading bandwidth for the dong “confers more space for the VND to fluctuate as it copes with ‘unpredictable developments’ due to a string of monetary policy tightening by global central banks. At the same time, it is worth mentioning that an expanded bandwidth does not imply that the VND will trade to the weaker side of the allowed trading band.”

As of 21 October, the AUD/VND forecast from TradingEconomics anticipated the dong strengthening against the Aussie, with the pair trading at 14,719.40 by the end of this quarter and 14,034.70 in one year, based on its global macro model projections and analysts’ expectations.

The AUD/VND forecast for 2022 from algorithm-based forecaster Wallet Investor projected that the pair could trade at 15,150.07 by the end of the year. But the long-term prediction was bearish for the dong, with the AUD/VND forecast for 2025 projecting that the pair could climb to 15,709.05 and then rise to 16,023.67 by October 2027.

The AUD/VND prediction from Gov Capital had the pair trading at 26,943.35 in a year’s time. Analysts and forecasters had yet to issue an AUD/VND forecast for 2030.

Are you looking for an AUD/VND forecast to help you decide how to trade the pair? Keep in mind that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Why has AUD/VND been dropping?

The AUD/VND exchange rate has declined in recent months as the Australian dollar has come under more pressure from the prospect for a global recession than Vietnam, which has maintained a trade surplus and is benefitting from its growing attractiveness as an alternative investment destination to China.

Will AUD/VND go up or down?

The direction of the AUD/VND exchange rate could depend on the health of the global economy, central bank policies in Australia and Vietnam on interest rates, and inflation and trade balances.

When is the best time to trade AUD/VND?

The best time to trade on forex markets is around the release of major economic announcements, such as trade data, inflation and interest rates.

Is AUD/VND a buy, sell or hold?

How you trade the AUD/VND pair is a personal decision depending on your risk tolerance and investing strategy. You should do your own research to take an informed view of the market. Remember to never invest money you cannot afford to lose.