What is the official short selling definition?

Short selling is a popular way of making a profit from securities going down in value. This strategy is also known as “going short”, “selling short” or “shorting” and is usually undertaken by experienced traders and investors.

Key takeaways

Short selling involves borrowing shares through a broker, selling them at current market value, then buying them back later at hopefully lower prices, with profit being the difference minus fees; it can be applied to stocks, ETFs, forex, commodity futures, and bonds.

This high-risk high-reward strategy has theoretically infinite loss potential since prices can rise indefinitely and is recommended only for experienced traders who use it to speculate on price declines or hedge against downside risk in their long positions.

The GameStop rally demonstrated short squeeze risk when shares surged 1,500 percent forcing Wall Street short sellers into billions in collective losses, while in 2020 short sellers profited over $50 billion during coronavirus sell-off with Tesla shorts alone making $1.1 billion weekly.

Dating to 1600s Dutch Republic inventor Isaac Le Maire, short selling remains controversial with critics blaming it for market failures leading to restrictions after the Great Depression and 2008 crash, though supporters argue it provides liquidity and prevents unjustified price inflation.

Regulations include UK's Financial Conduct Authority requiring notification at net short position thresholds and US Securities and Exchange Commission's uptick rule restricting short sales when stocks fall more than 10 percent from the previous day's closing price.

Traders usually use this strategy to speculate on the decline in the asset’s price, while investors may undertake it as a hedge against the downside risk of their long position in the same or a related asset.

To answer “what is short selling in trading”, let’s refer to the official financial regulators. The US Securities and Exchange Commission (SEC) defines short-selling as follows:

If the price of the stock drops, short sellers buy the stock at the lower price and make a profit. If the price of the stock rises, short sellers will incur a loss.

Latest short selling issues

Short selling stocks can be a controversial practice, with short sellers often depicted as ruthless operators who are bent on destroying companies. But there’s a good case to be made that short selling provides liquidity to markets, and stops stocks from inflating to unjustifiably high levels through over-optimism or hype. Abusive short-selling practices such as bear raids and rumour-mongering to drive a stock lower are illegal, but properly executed short selling can be a good strategy for portfolio risk management.

Being a high-risk high-reward trading strategy, short selling can lead not only to big profits, but cause big loss, especially in case of a short squeeze like that which happened during the recent GameStop rally.

In a matter of days, shares of struggling video game retailer GameStop turned into the stock market’s frenzy, climbing up 1,500 per cent. The hike wasn’t a typical stock market rally, as it was fuelled by retail investors who teamed up to short squeeze the company’s stock. As a result, big Wall Street players, who went short on the stock, faced billions of dollars in collective losses and had to buy the company’s shares to get out of their losing trades.

Short selling explained

Short selling is most often done with instruments traded in public securities, futures or currency markets. You can short sell stocks, exchange traded funds, forex, commodity futures of all types, and bonds.

Short selling is arranged through a broker, who loans you shares to sell at their current value, though you don't buy them until you “close” your position – by which time you hope the price will have come down. The difference between what you sold them for and what you ended up paying for them is your profit or loss – excluding commissions and interest. As the risk of loss on a short sale is theoretically infinite, short selling is only recommended for experienced traders who are familiar with its risks.

Investors might “go short” as part of a speculation strategy. They predict that the price of a security will go down, so they sell short to try and profit from this predicted price movement. More risk averse investors may use short selling as part of a hedging strategy – they short a security to offset some of the risks of a long position. They “go long” in the belief that the price of a security will rise, but if it goes down instead, the gains from their short position can mitigate their losses. This can be an expensive strategy, though, and it doesn't eliminate basic risk.

Short selling example

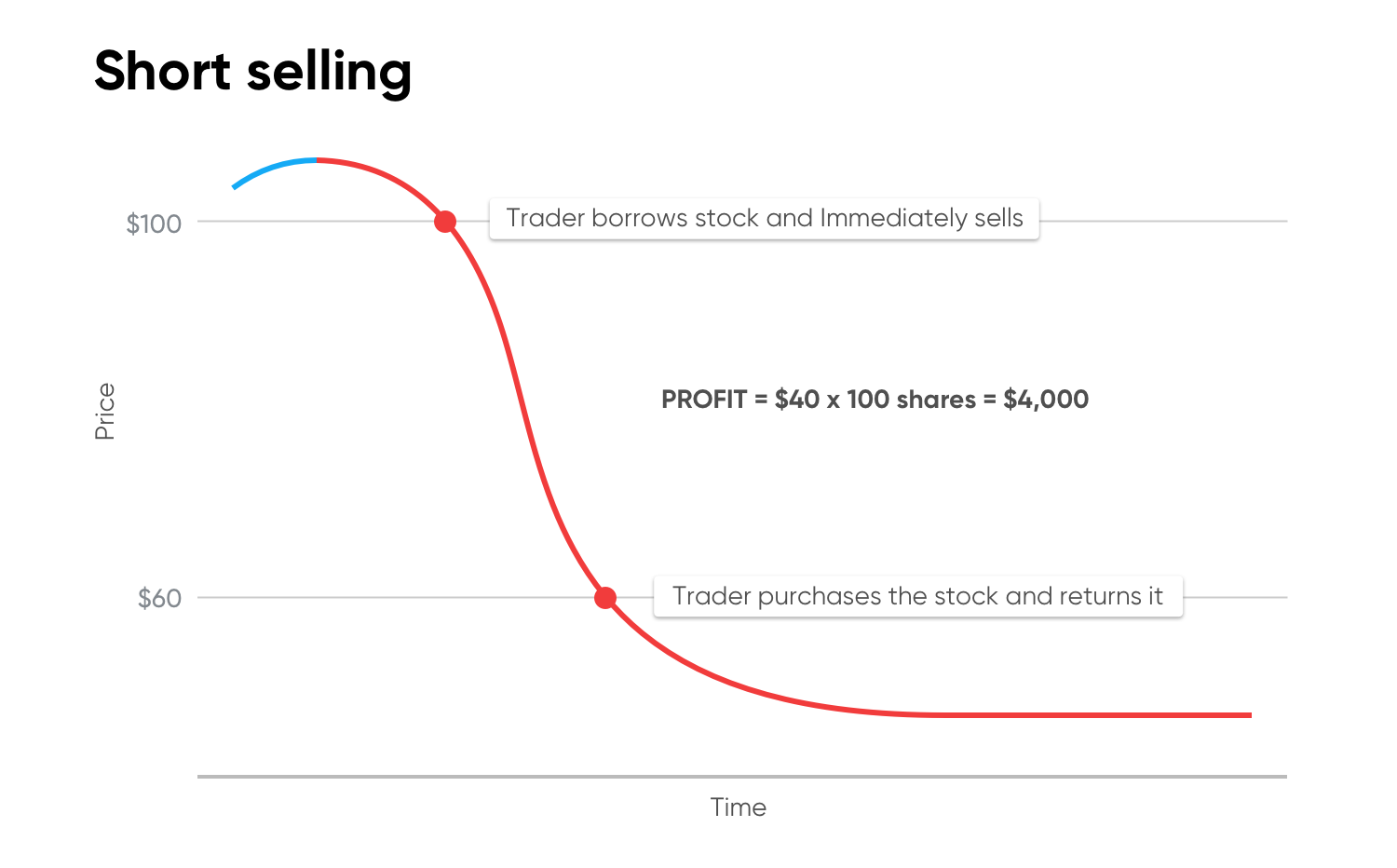

To better understand the short selling meaning, you can take a look at a simple example.

Let’s assume that shares of the N company are trading at $100, but you expect them to decrease in value and make the decision to short-sell the stock. You borrow 100 shares of N from your broker and sell them on the open market.

Over the next week, the stock moves downwards to $60. You close your position and buy 100 shares back at $60 each.

Calculating the difference between the price of shares when you borrowed them (100 x $100 = $10,000) and the price after you re-bought the stock (100 x $60 = $6,000), you get a profit of $4000 – excluding your broker’s commission.

However, if your stock price forecast was incorrect and the stock price continued to move higher, your potential risk could be very high, as you would have to close your position at a loss.

Short selling history

Understanding short-selling could start with tracing back its history. Short selling has been around since stock markets first emerged in the Dutch Republic in the 1600s. The practice of short selling was first invented by Dutch businessman Isaac Le Maire, an ex shareholder of the Dutch East India Company. He contracted to sell shares in the East India Company for future delivery, sending the share price plunging. A year later, the first ban on short selling was imposed.

Throughout history, short sellers have been blamed for failures in the world's financial markets, and some company executives have accused them of driving down their company's stock prices. The US restricted short selling as a result of the events leading up to the Great Depression. Short selling stocks got a bad name after the 2008 financial crash, as widespread short selling was thought to have influenced big falls in stock value. As a result, some countries introduced temporary short selling bans. But the practice is still popular with traders.

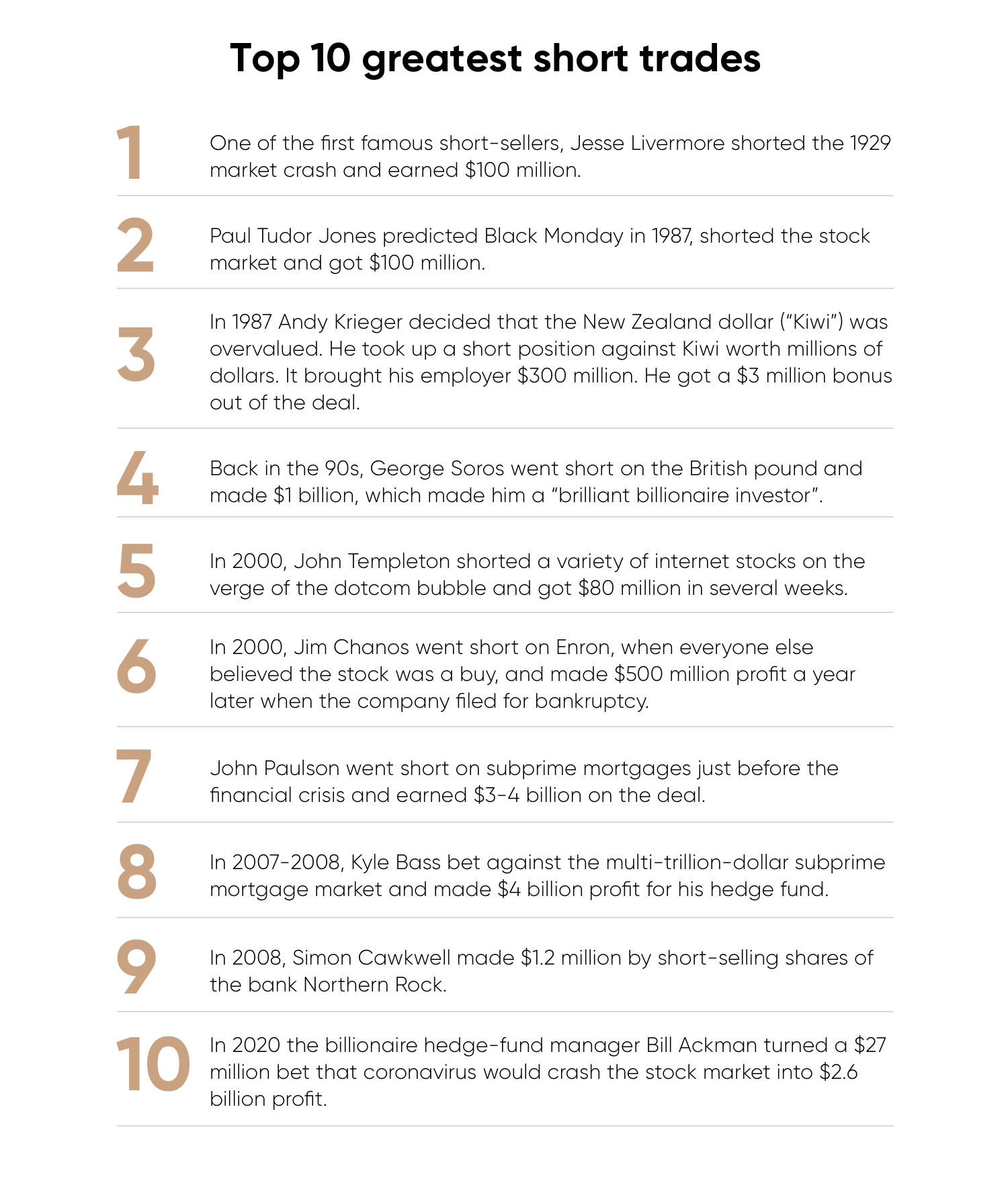

Top 10 biggest shorts of all the time

In 2020 short sellers made more than $50 billion during the coronavirus sell-off. The most profitable short was Tesla, as investors betting the stock would plunge made more than $1.1 billion in one week.

Short selling regulation

The UK’s Financial Conduct Authority has regulated short selling and certain aspects of credit default swaps since November 2012, under the EU’s Short Selling Regulation (SSR). The SSR applies to people undertaking short selling of shares, sovereign debt, sovereign CDS and related instruments that are admitted to trading or traded on a trading venue in the European Economic Area – unless they are primarily traded on a third country venue.

The SSR requires holders of net short positions in shares or sovereign debt to make notifications when certain thresholds have been breached. The regulation also sets out restrictions on investors entering into uncovered short positions in shares or sovereign debt.

The SSR gives powers to domestic regulatory authorities – which in the UK means the Financial Conduct Authority – to suspend short selling or limit transactions when the price of various instruments (including shares, sovereign and corporate bonds, and ETFs) fall by set percentage amounts from the previous day’s closing price.

In the US, an “uptick rule” was introduced in 1937, which allowed short selling to take place only on an uptick from the stock's most recent sale. In 2007, the Securities and Exchange Commission rescinded the uptick rule, and short sellers took advantage of their new freedoms in the next stock market crash in 2008.

Since then the SEC has revised the rule again, imposing the uptick rule on certain stocks when the price falls more than 10 per cent from the previous day's close. So short selling is often under the spotlight – and the regulatory stance can change according to the political fashions of the day.

The Financial Conduct Authority’s website gives full details of the regulator’s oversight of short selling. The same could be found on the US Securities Exchange Commission website, together will all the details about short-selling regulation in the US.