Natural gas prices retreat as milder weather cools demand

Forecasts of milder weather keep natural gas prices under pressure as inventories build

Natural gas prices have undergone another sharp decline over the past week, with Monday seeing a 5.6% drop. By Tuesday morning, buyers were attempting to regain control, with intraday support emerging around $3.38 per million British thermal units (MMBtu). However, the technical outlook remains cautious. A sustained breakdown below the $3.00 level could accelerate the bearish trend, whereas a hold above this threshold may lead to consolidation or even a rebound.

Natural Gas daily chart

(Past performance is not a reliable indicator of future results)

In late April and early May, natural gas prices rallied from approximately $3 to nearly $4—one of the most significant short-term moves this year. The surge was unexpected given the seasonal context but was driven by unseasonably cool weather across northern U.S. states. The resulting increase in heating demand, particularly from residential and commercial consumers, sparked bullish momentum in the futures market.

This price spike was further supported by record U.S. liquefied natural gas (LNG) exports. With overseas demand from Europe and Asia remaining elevated, gas deliveries to export terminals surged, tightening domestic supply and amplifying upward price pressure. At the time, markets anticipated that inventories could remain tight heading into the summer.

Shifting Fundamentals Pressuring Prices

However, the rally proved short-lived. Forecasts have since turned, with milder weather now expected to persist through late May. This reduces the need for both heating and cooling, lowering overall demand and dragging on prices. The current environment also reflects the effort to replenish storage levels following the spring surge.

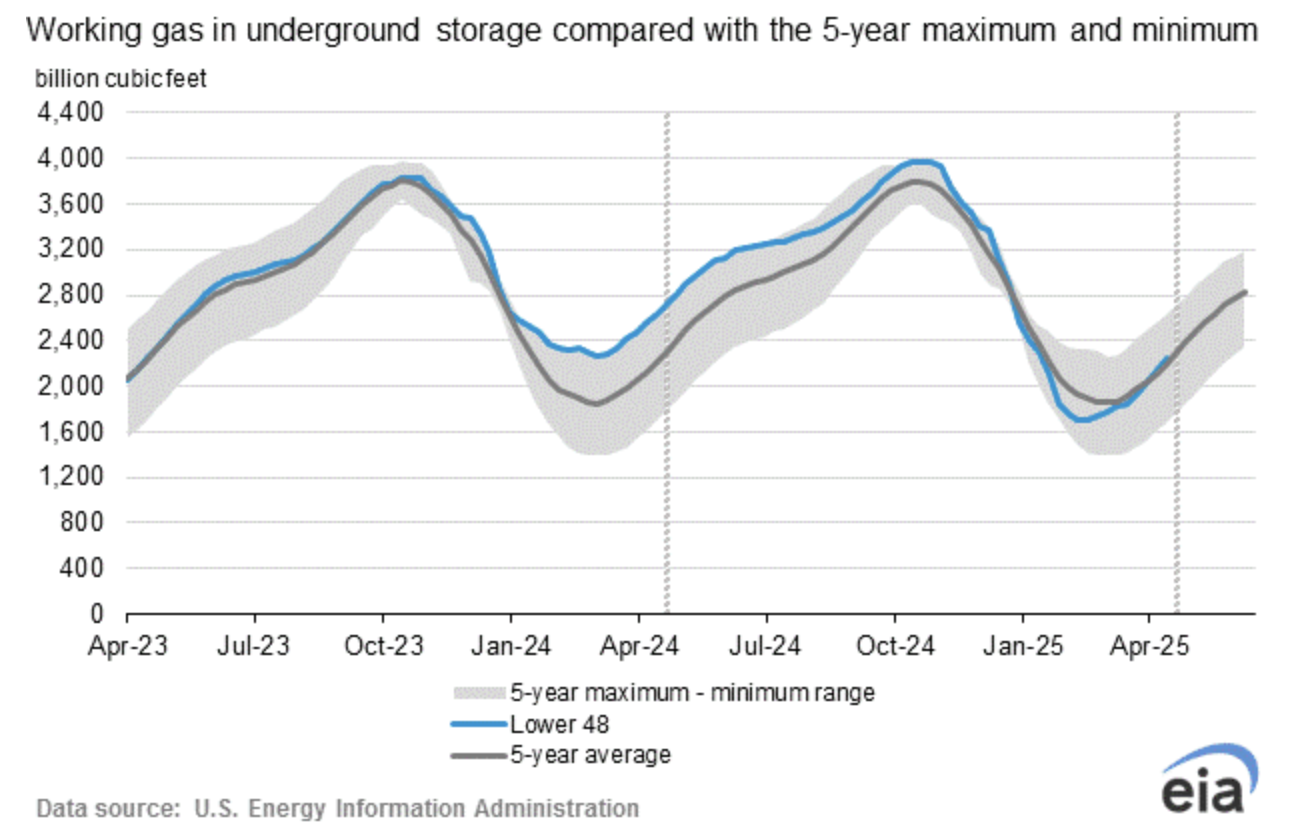

Data from the U.S. Energy Information Administration (EIA) shows that gas storage injections have significantly outpaced the five-year seasonal average. With production remaining robust and demand subdued, the market is again facing oversupply—placing additional downward pressure on prices.

Looking Ahead

Weather will remain the primary near-term driver for natural gas. Should cooler conditions persist, further price weakness may follow, especially if inventories continue to build. However, if temperatures begin to rise in June, an uptick in cooling demand could tighten the market and support a price rebound.

Traders should keep a close eye on updated forecasts and storage data, as these factors will be pivotal in shaping price action in the coming weeks.