Velas (VLX) price prediction: World’s fastest EVM blockchain

Cross-chain functionalities. An ecosystem of decentralised products. Is there more upside to come for VLX? Read on for the latest Velas price prediction…

Built on the Solana network, Velas is a open-source AI-powered blockchain that hosts a wide range of decentralised applications (DApps), including VelasPad and BitOrbit.

The project, headquartered in Switzerland, claims to be the world’s fastest Ethereum Virtual Machine (EVM) blockchain and open-source platform for decentralised projects and applications. It is led by a diverse team of engineers, cryptographers, researchers, mathematicians and business leaders.

Velas combines both centralised and decentralised solutions, with a particular focus on advancing blockchain technology using Web 3.0 tools. According to Velas’s whitepaper, the Web 3.0 phenomenon, which is saturated with DApps that are distributed across domain-specific clusters, is decentralising the internet.

With the explosive growth in the use of customer data in emerging technologies such as artificial intelligence (AI), it is becoming increasingly important to develop consensus protocols and design seamless user interfaces that provide developers and enterprises with community-governed ecosystems for Web 3.0 – a venture that Velas has undertaken.

As such, the project has been created with innovative technologies in mind, namely a decentralised ecosystem of products and services that accelerate blockchain adoption across the wider industry.

What is the Velas coin?

VLX is the native token of the Velas network and the primary unit of account for transactions, payments and fees. The network is based on a delegated proof-of-stake (DPoS) mechanism and its token can also act as a means of exchange across the DApps that the Velas platform hosts.

Users can earn staking rewards for creating blocks. There are two options for staking tokens on Velas:

-

Users can create their own pool and become a validator

-

Users can join an existing pool as a delegator

To become a validator, users must hold at least one million VLX tokens, or have at least one VLX to become a delegator. Pool rewards are proportionally distributed between validators and staking delegators. Velas is divided into staking epochs, and at the beginning of each epoch, an algorithm selects validators and creates a snapshot of their pools. The DPoS mechanism also enables delegators to stake tokens for voting purposes.

VLX price analysis: A technical view

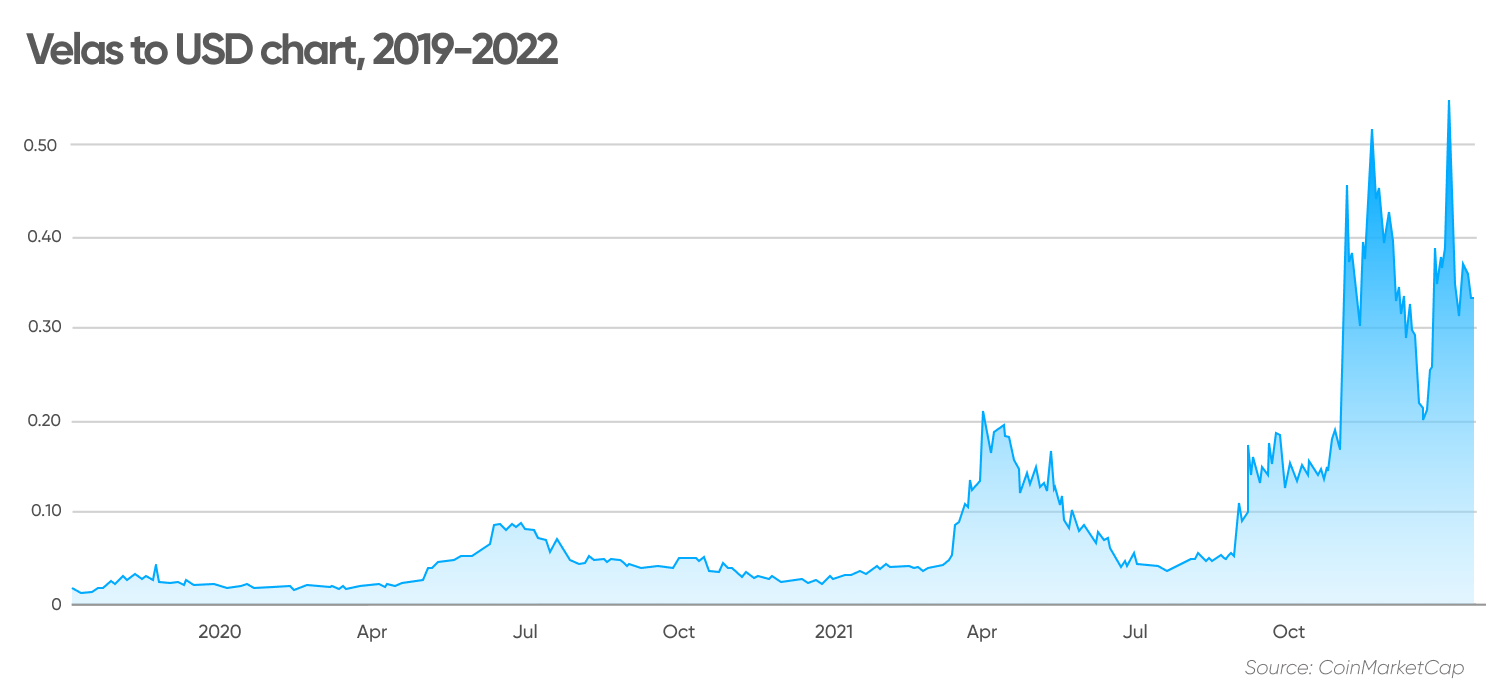

The Velas price trend was higher throughout the months of September to December 2021, hitting the key $0.10 level, and on 23 September 2021 it reached $0.1857 as bullish momentum took hold. Prior to this, it had been trading as low as $0.05354 on 28 August 2021.

VLX started the summer at $0.04612 on 21 June 2021 but soared to $0.1724 on 6 September 2021, an increase of 273.2% in 76 days. The uptick in momentum continued when the price rallied to $0.4542 on 4 November 2021. After a dip to $0.3113 on 11 November 2021, the Velas cryptocurrency rallied again, reaching $0.5158 on 19 November 2021.  After yet another dip to $0.2003 on 20 December 2021, the coin regained momentum and surged to an all-time-high of $0.5473 on 4 January 2022. This jump could be at least in part attributed to Velas announcing just a day earlier that it will be partnering with the decentralised space agency, SpaceChain.

After yet another dip to $0.2003 on 20 December 2021, the coin regained momentum and surged to an all-time-high of $0.5473 on 4 January 2022. This jump could be at least in part attributed to Velas announcing just a day earlier that it will be partnering with the decentralised space agency, SpaceChain.

Another positive catalyst may have been Velas’s partnership with the Italian luxury sports car manufacturer, Ferrari, announced at the end of 2021, which led the coin to break out above its resistance level of $0.311 and reach $0.3769 on 30 December 2021. On 6 January 2022, VLX showed a falling wedge pattern and the price has since consolidated, mostly trading within the $0.31 to $0.35 range.

To date, the Velas coin value has risen 2,732% from its lowest level of $0.01162 on 16 October 2019. VLX is currently (18 January) trading at around $0.329159 and ranks 102nd in the list of cryptocurrencies by market capitalisation, at $728m, according to CoinMarketCap.

Technical analysis provided by CoinCodex shows that short-term sentiment on VLX is bearish, with 14 indicators displaying bullish signals compared to 16 bearish signals at the time of writing (18 January).

The daily simple and exponential moving averages are giving mostly sell signals, according to data from TradingView, while the relative strength index (RSI) stands at 47 – a neutral position – as of 18 January. An RSI reading of 30 or below indicates an oversold or undervalued condition, while a reading above 70 would suggest the asset is becoming overvalued or overbought.

A whopping 75,000TPS with $0.00001 fees

A standout feature of Velas is that it offers a passwordless authentication system that allows users to securely access a variety of services through their Velas account. This is made possible through unique authorisation quotas.

The passwordless process stands to benefit users who may be in possession of several passwords across multiple accounts. Thus users can enjoy a seamless application login process through the network’s biometric security measures.

In other Velas coin news, the project appointed a new CEO, Farhad Shagulyamov, in December 2021, and secured a partnership with the decentralised multi-chain digital wallet BitKeep this month. In another boost to the project, VLX was listed on the cryptocurrency exchange ZBG on 18 February 2020 and then on KuCoin on 19 November 2021.

Velas also boasts a network throughput of up to 75,000 transactions per second (TPS), along with a transaction finality speed of 1.2 seconds. In comparison, the Visa payment system is capable of processing 1,700 TPS. There are minimal fees on the Velas network, too, at a rate of $0.00001 per transaction.

A risk for the project lies in the fact that decentralised blockchain technology is only about nine years old, making it a relatively new frontier. Also, transaction fees on decentralised finance (DeFi) protocols can be particularly high during periods of network congestion.

For example, a cryptocurrency such as Ethereum (ETH), which was processed 1.1 million times a day during the month of July 2021, currently has an average fee of $33.56, according to data from BitInfoCharts.

Velas (VLX) price prediction: Buy, sell or hold?

In terms of a Velas crypto price prediction, algorithm-based forecasting service Wallet Investor gives a positive VLX/USD outlook. Based on historical data, Wallet Investor estimates the price rising to $0.343 by February 2022, reaching $1.228 in January 2024 and hitting $1.681 by January 2025.

Digital Coin Price supports the bullish VLX forecast, expecting the Velas token price to grow to $0.43164098515 in February 2022, $0.47734355406 in 2023, $0.68726640248 in January 2025 and $1.17 in January 2028.

While the Velas coin price prediction for 2030 is not yet available, Digital Coin Price suggests it could be $1.42 in December 2029.

Note that predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

FAQs

Is the Velas coin a good investment?

Whether VLX is a good investment for you depends on your personal circumstances and risk appetite. Cryptocurrencies are high-risk assets. You should do your own research and evaluate the level of risk you are prepared to accept before investing. Never invest money you cannot afford to lose.

How high can the Velas coin go?

While the VLX coin achieved its all-time high of $0.5473 on 4 January 2022, the prospect of VLX trending higher in the future largely depends on the token achieving broader adoption.

Will the Velas crypto reach $1?

Based on the Velas price prediction from Digital Coin Price, the VLX price could reach $1 within the decade. Digital Coin Price predicts the price to hit $1.17 in January 2028. Note that predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.