Telcoin (TEL) price prediction: the future of blockchain remittances on mobile

Is Telcoin the future of low-cost blockchain money transfers? Read our Telcoin forecast.

Telcoin, the global money transfer provider which uses its coin TEL as a means to move value over mobile phone networks turning the devices into bank accounts, has seen its coin lose 47% of its value in April including 2% today (29 April) to take the price down to $0.0047.

This followed a strong second half to March but most of those gains have now gone and the bearish trend is extending.

According to CoinMarketCap as of 29 April it had a market capitalisation of $284m which placed it 162nd in the league of cryptocurrencies by value.

Telcoin's goal is to use blockchain and mobile money infrastructure to disintermediate what it calls "high cost remittance agents."

It distributes TEL to telco operators in a quantity based on their transaction volume and "integration maturity". These are then used as the money exchange mechanism within the telco.

However despite the growing popularity of the service, the value of the coin has been declining since an all time high last May.

What is its target price for the rest of 2022 and the longer term future?

Here we look at the project’s fundamentals and explore the latest TEL price prediction and market sentiment and analysis.

What is Telcoin?

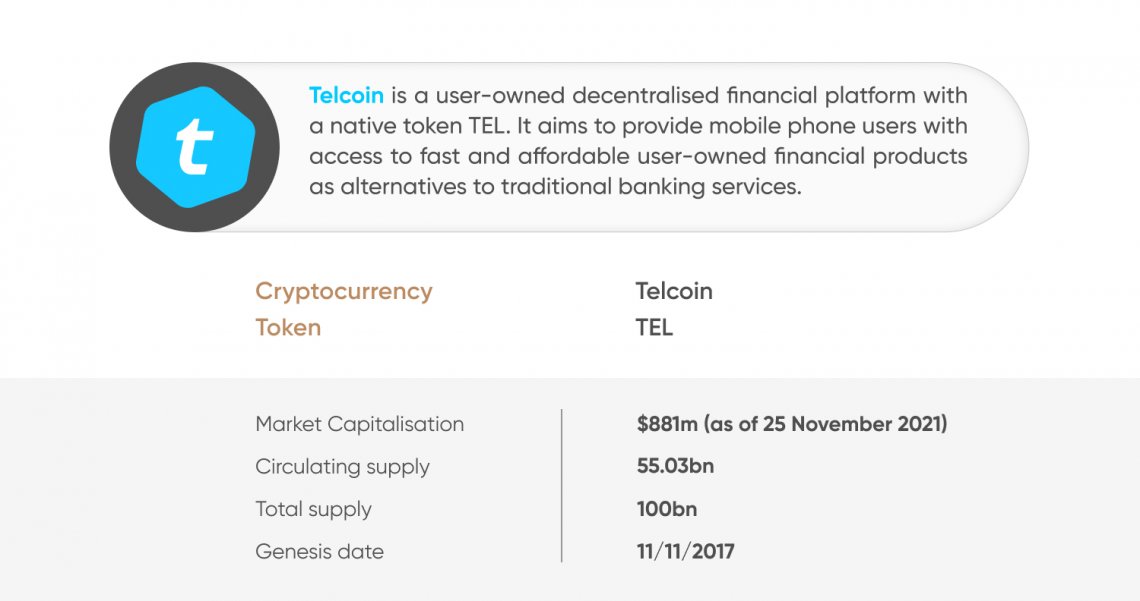

Telcoin is a decentralised financial platform powered by active Telcoin users. It aims to build user-owned, decentralised applications and distribute these products and services through telecom providers to mobile phone users globally. TEL is an ERC-20 token, powered by the Ethereum blockchain.

While the Telcoin token competes against other cryptocurrencies specialising in facilitating financial operations, such as ripple (XRP) and eCash, it has an advantage through its use-case model in the telecoms industry.

Providing remittance services to mobile service providers, Telcoin is positioned to make its mark as an industry pioneer.

According to the Statista report, the number of smartphone users globally exceeded 6 billion in 2021. Based on its forecast, the market would hit 7.5 billion in five years. The telecoms segment therefore provides the largest group of users who can access financial products via smartphones on a daily basis.

Meanwhile, the decentralised finance segment is gaining traction, with more than $75.16bn locked on DeFi platforms, as of 29 April 2022. Telcoin is trying to seize this opportunity and enable telecom providers to distribute decentralised financial products to their subscribers.

Telcoin crypto news: new products

Telcoin was established in Singapore in summer 2017 by Paul Neuner, an entrepreneur with more than 12 years of experience in cybersecurity and telecommunications, and blockchain expert Claude Eguienta. The company’s launch product, Telcoin Remittances, specialises in low-cost, high-speed money transfers to e-wallets.

In June 2021, Telcoin launched Version 3 (V3) of its mobile platform and introduced two products: TELxchange and Send Money Smarter (SMS) Network.

-

TELxchange is a decentralised user-owned digital asset exchange. It uses TEL coins as a medium of exchange and a reserve asset.

-

Send Money Smarter (SMS) Network is a decentralised, user-owned international money transfer platform that aims to “disrupt the $700bn remittance industry”, according to Telcoin.

V3 is designed to simplify contactless payments. It also delivers a hub for storing TEL tokens and allows you to swap crypto tokens for fiat money.

In its November community update, Telcoin mentioned that it is preparing for global expansion. “From January 2022 forward (eg, V3.2+), we expect to have a version of the product that will be primed and ready for greatly increased marketing and deeper global scalability,” the company said.

The company will focus on revenue generation and engagement with new partners: “We have put our pre-series A fundraise to work in preparation for this rapid expansion.”

Regarding the technological update, the company mentioned upgrading its wallets and migrating users to the Polygon Network: “This allows users to consume extremely low fees and experience much faster transaction times.”

On 16 December Telcoin announced it will be joining Alchemy Platform's Certified Infrastructure Alliance. It said the partnership "helps ensure Telcoin infrastructure is secure, fast and available to all users".

Telcoin price drivers

TEL crypto price predictions take into account technological advancements that allow users to take control of their assets without high-priced banking fees or trade commissions.

The buy-in, expressed by the spikes in TEL trading volumes on the chart below, hit $373m in May-June 2021 – almost 5,500% higher than the trade volume of $6.7m, as of 20 December, according to CoinMarketCap.

This performance indicator shows that the project managed to attract investors’ attention last year, but that interest then faded.

Telcoin has created a blockchain solution for sending peer-to-peer payments worldwide, and has established itself with the clear focus of merging telecoms with the blockchain.

According to Telcoin, it targets speedy transactions that occur in seconds at a cost of 2% per transaction, which is cheaper than an average 7% taken by other payment services. Will it be enough to boost the Telecoin (TEL/USD) forecast and help its global adoption?

As of December 2021, Telcoin announced it had expanded its services to 24 mobile money platforms in 16 countries. In addition to its first remittance partner from the Philippines, GCash, Telcoin users can now conduct money transfers in the following countries:

"Opening these initial corridors is an exciting and important foundational moment in Telcoin's journey," said Telcoin CEO Paul Neuner. "We see this as not only about affordable remittances, but as a first step toward expanding the financial opportunities of people in these new markets."

According to a report from the Asian Development Bank in December global remittances are likely to have grown by $34bn in 2021 and expected to grow a further $31bn in 2022 as economies recover from the impact of the coronavirus pandemic.

Telcoin price prediction: Analyst sentiment

Commenting on Telcoin future price projections, Capital.com’s analyst Mikhail Karkhalev said: “Mobile money transfers are very promising, especially for the blockchain industry, where there are very few telecom-focused projects. The advantage of Telcoin is that it has the potential to reach a huge audience of 5 billion potential users very quickly.

“However, despite its real prospects, the project also has a number of drawbacks,” added the analyst. “First, when partnering with major telecom operators, the TEL token and the project itself might become centralised, which carries the risk of changing pricing or customer service policies. Second, telecommunications are closely tied to the defence industry and, of course, the government and various security agencies. So, despite the blockchain bases, the project might be tightly regulated.

Telcoin (TEL) price prediction: 2022, 2023, 2025, 2030

According to Allied Market Research: “The rise in need for transparency in the payment system and increase in flow of remittances from foreign countries drive the growth of the global cryptocurrency market.” The research expects the global cryptocurrency market to hit $4.94bn by 2030.

This might serve as a positive driver for the Telcoin future price expectations as the project is at the forefront of the blockchain-based remittances services segment.

Algorithm-based forecasting services, including Wallet Investor and Digital Coin, also express bullish long-term telcoin price predictions (as of 29 April):

-

Wallet Investor saw the token trading around $0.0032 in twelve months' time and estimated that it could rise to $0.00012 in five years.

-

Digital Coin was more conservative in its long-term TEL coin price prediction, expecting the token to average $0.0061 over 2022, $0.007 in 2023 and $0.01 in 2025. It expected the TEL cryptocurrency to hit $0.021 in 2030.

When looking for Telcoin crypto price predictions, it’s important to bear in mind that analysts’ forecasts can be wrong. Analysts’ projections are based on making a fundamental and technical study of a crypto’s performance. Past performance is no guarantee of future results.

It’s important to do your own research, and always remember that your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never invest money that you cannot afford to lose.

FAQs

1. Is Telcoin a good investment?

The project has a fundamental value and could well gain further adoption due to the size of global telecommunication market it targets. However, the project has yet to gain wider adoption by global telecoms service providers, and it’s too early to say if it will manage to become another crypto gem. You should perform your own due diligence before making any trading decisions.

2. Will the Telcoin price reach $1?

The price target of $1 seems overly ambitious for the Telcoin coin price prediction. Even though algorithm-based forecasting services Wallet Investor and Digital Coin expect TEL to climb higher within the next five years, the highest TEL prediction target set by Wallet Investor (as of 29 April) is at $0.0012 by 2027.

However, as we have said, you shouldn’t base your investment decisions on these predictions as they could be wrong – there are other factors that may positively or negatively affect Telcoin’s price performance, such as decisions by regulatory bodies. Always conduct your own due diligence before making any trade.

3. What is the outlook for Telcoin?

Telcoin’s future as a platform depends on the number of telecom companies, investors and users that adopt it. Meanwhile, the growing number of smartphone users globally and the increased flow of remittances bodes well.

However, the Telcoin platform has yet to gain support from big global telecom providers. You should also always remember that cryptocurrencies are extremely volatile assets and therefore subject to sharp and often apparently random price fluctuations. You should perform your own research before making any investment decision. And never invest money that you cannot afford to lose.