Palantir stock forecast: Third-party PLTR price target

Palantir Technologies (PLTR) is trading at $199.53 at 12:20pm UTC on 31 October 2025, near its intraday high of $199.88 and slightly above the session low of $194.53.

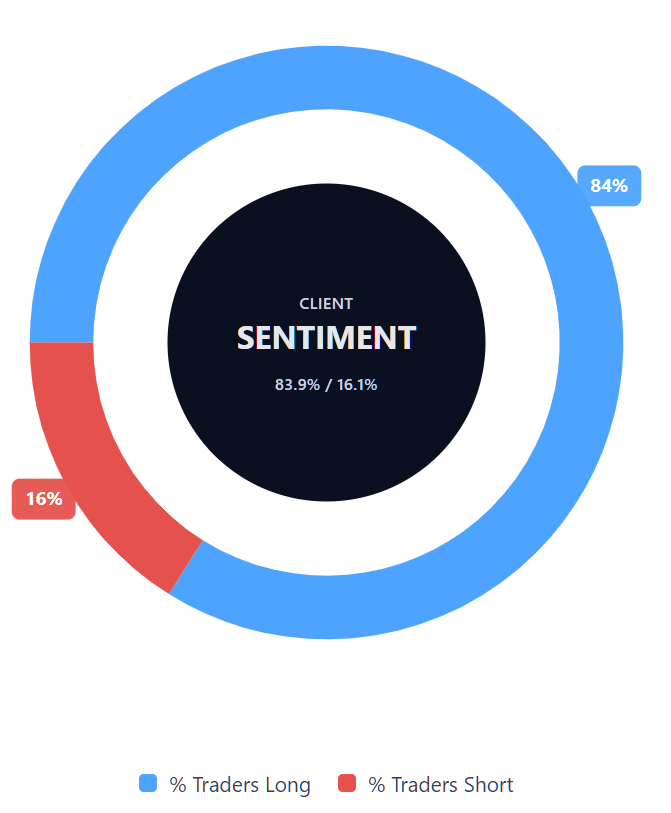

The stock sits at the upper end of today’s range on Capital.com’s quote feed, with client sentiment showing 83.93% buyers and 16.07% sellers for this CFD product. Past performance is not a reliable indicator of future results.

Key Palantir drivers – as of 31 October 2025 – include anticipation of Palantir’s upcoming quarterly results (Barchart.com, 31 October 2025). Meanwhile, broader equity markets remain cautious ahead of macroeconomic data releases (MarketBeat, 31 October 2025), and growth in Palantir’s commercial and government revenue continues to support market interest (Yahoo Finance, 4 August 2025).

Palantir stock forecast: Analyst price target view

TipRanks (analyst consensus)

TipRanks reported that the average 12-month Palantir price target among covering analysts in September and October 2025 stands at $158.41. The platform categorises the rating as 'Hold,' reflecting divided analyst outlooks amid ongoing questions about valuation levels and execution risks (TipRanks, 31 October 2025).

MarketBeat (poll/aggregated data)

MarketBeat maintained a consensus analyst target around $142 for Palantir in late October 2025, with underlying rationale focused on both rapid AI adoption and lingering questions about profit sustainability into 2026 (MarketBeat, 31 October 2025).

Bank of America Securities (AI/defense focus)

Bank of America Securities raised its target to $215, keeping a ‘buy’ rating following updates on major government deals and accelerating adoption of Palantir’s AI Platform (TipRanks, 23 September 2025).

TheStreet (quant/tech special)

TheStreet moved its price target to $220 after several positive developments, including new defence partnerships and increased customer additions, noting that further adjustments may follow upcoming results (TheStreet, 27 October 2025).

Analyst forecasts and predictions are often inaccurate. Past performance is not a reliable indicator of future results.

PLTR stock price: Technical overview

PLTR last traded at $199.53 at 12:20pm UTC on 31 October 2025, trading above its key moving average cluster – 20/50/100/200-DMAs at ~182 / 174 / 163 / 132 respectively. The 200-day EMA at 136 acts as the nearest long-term support. A 20-over-50 alignment remains intact, keeping the trend structure firm.

Momentum is neutral-to-positive, with the 14-day RSI at 63.26 and the ADX indicating a weak trend at 13.67. On the upside, resistance sits at the Classic R1 pivot at 196.10, with a close above that level bringing R2 at 209.78 into view. Support lies around the Classic Pivot at 172.07, with the 100-day SMA near 163 offering deeper structure. A move below this zone could target S1 at 158.39 (TradingView, 31 October 2025).

This technical overview is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Palantir share price history

Palantir’s share price began November 2023 below $15, remaining range-bound for much of late 2023. It gained steadily through mid-2024, crossing $30 by September, supported by company updates and a broader tech rally.

Momentum accelerated in early 2025 – PLTR closed at $75.17 on 1 January, climbing above $150 in September and reaching $199.65 on 31 October 2025. This marks a 166% rise year-to-date. The price is now nearly fivefold higher than two years ago, reflecting strong contract growth and sector interest in AI-driven firms. Volatility has also increased compared with 2023’s gradual trend.

PLTR closed at $199.65 on 31 October 2025 – up 166% since January and more than 1,200% from November 2023.

Past performance is not a reliable indicator of future results.

Capital.com’s client sentiment for Palantir CFDs

As of 31 October 2025, Capital.com client data shows 83.9% buyers versus 16.1% sellers in Palantir CFDs, indicating a strong long bias among traders. This figure reflects open positions on Capital.com and may change over time.

FAQ

Is Palantir a good stock to buy?

Palantir’s share price has risen over the past two years, supported by growth in artificial intelligence and government contracts. Analyst targets as of 31 October 2025 reflect mixed views on valuation and growth potential. However, past performance is not a reliable indicator of future results. This information is for general purposes only and does not constitute investment advice.

Could Palantir stock go up or down?

As with any listed company, Palantir’s share price may move in either direction, influenced by market sentiment, contract news, earnings updates and wider technology trends. Recent volatility suggests both upward and downward movements remain possible. Past performance is not a reliable indicator of future results.

Should I invest in Palantir stock?

Whether to invest depends on your objectives, experience and understanding of risk. Contracts for difference (CFDs) are complex instruments and carry a high risk of losing money quickly due to leverage. Always research independently or seek professional guidance if unsure. CFDs are traded on margin – leverage amplifies both profits and losses.