Nvidia’s 5-year stock forecast: Will the chipmaker remain at record highs?

Nvidia has been the winner of the AI race, being the first chip-maker to hit a $1tn market cap. Will the growth continue?

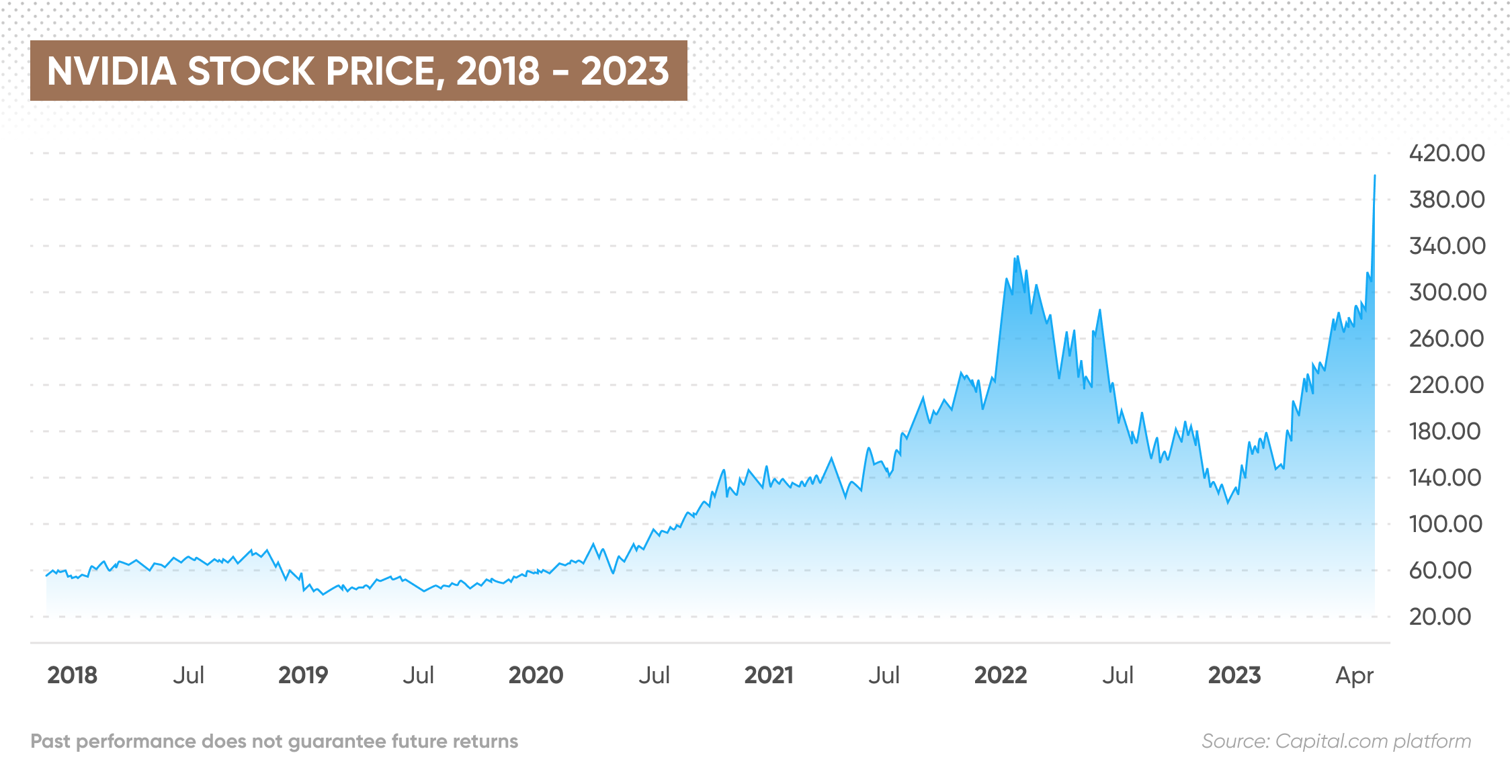

Riding high on the AI wave, chip giant Nvidia (NVDA), emerged as a winner with its stock surging to record highs, making it the first chip maker to hit $1tn market capitalisation. Nvidia is the powerhouse behind semiconductors that power AI programmes like ChatGPT, and saw an uptick in demand and revenues in the latest quarter.

Will the chip behemoth maintain the momentum and what’s NVIDIA’s 5-year stock forecast amid the AI-driven exuberance? Here we take a look at the latest news and future predictions from analysts.

Nvidia stock live price

History of Nvidia

Nvidia Corporation, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, is a multinational technology company recognized globally for its pioneering work in graphics processing units (GPUs) and artificial intelligence (AI).

From the very beginning, Nvidia has been a trailblazer in visual computing, producing the first Graphics Processing Unit (GPU), the GeForce, in 1999. This key development in computational technology revolutionised the way we interact with graphics and images, from gaming and entertainment to professional design and visualisation.

Over the years, Nvidia product line has grown to include not just GPUs for gaming and professional use, but also system-on-a-chip units (SoCs) for mobile computing and automotive markets. The company's latest venture, data centre GPUs, are designed to accelerate AI, data science, and high-performance computing (HPC).

Today, Nvidia stands as a leading force in the technology sector, not just for its hardware but also for its software and services. Their full range of products now extends into AI computing platforms, deep learning software, autonomous driving technology, and much more. In essence, Nvidia innovations continue to redefine the boundaries of what's possible in visual and computational technology.

Why is Nvidia’s stock rising?

The robust growth of Nvidia share value, which has soared by 188% year-to-date (as of 30 May), is largely attributed to the burgeoning interest in generative AI, sparked by the remarkable success of OpenAI's ChatGPT. The stock reached the record high of $419 on 30 May, making it the first semiconductor company to hit the $1tn market cap mark.

Nvidia recently announced the development of a new AI supercomputer platform DGX GH200, strengthening its position at the forefront of the AI revolution. This announcement came shortly after NVIDIA revealed a promising second-quarter revenue outlook of $11bn.

Meanwhile, Nvidia first-quarter results revealed revenue of $7.19bn, 19% up from the previous quarter. The Record Data Center revenue amounted to $4.28bn in the quarter. The firm’s CEO Jensen Huang commented:

The tech giant returned $99m to shareholders in cash dividends, and will pay the next quarterly dividend of $0.04 per share on 30 June to all shareholders of record on 8 June.

The primary driver of this growth is the rising demand for Nvidia’s chips, specifically designed for AI applications. This escalating demand signifies the potential for Nvidia’s revenue to continue its upward trajectory, and hence the developments in the AI sector will be key in determining the stock projections.

Nvidia stock forecast boosted by AI boom

The stock was rated as a “Moderate Buy” according to MarketBeat, based on 37 analyst ratings the website compiled as of 30 May. The average Nvidia stock forecast for the next 12 months as of 30 May was $379.73, ranging from the high of $500 to the low of $133.

Following the first-quarter results, 22 analysts boosted their Nvidia stock price targets, or upgraded their ratings, for the stock. This included Nvidia stock predictions from Citigroup, Morgan Stanley, Goldman Sachs, and Barclays.

None of the analysts have provided a Nvidia stock 5-year forecast due to the high number of uncertainties. Yet it’s likely that the revolution in the AI sector and its projected growth will be the key factor shaping the chip giant’s future. As noted by Russ Mould, investment director at AJ Bell, the AI demand is so high that Nvidia is having to strain to keep up. He added:

Yet according to Sophie Lundt-Yates, the exuberance experienced by the market players about the AI boom is not without risks, as it may distort Nvidia’s long-term forecasts. She explained:

Final thoughts

Remember that analyst views and predictions can be wrong, and it’s impossible to accurately estimate the value of Nvidia stock in 5 years as there are many uncertainties at play. Always conduct your own due diligence before trading, looking at the latest technical and fundamental analysis, and never trade more money than you can afford to lose.

FAQs

Where will Nvidia stock be in 5 years?

None of the analysts have provided a Nvidia stock 5-year forecast due to the high number of uncertainties. Yet it’s likely that the revolution in the AI sector and its projected growth will be the key factor shaping the chip giant’s future. Always conduct your own due diligence before trading, looking at the latest technical and fundamental analysis, and never trade more money than you can afford to lose.

Will Nvidia stock go up or down?

The stock was rated as a “Moderate Buy” according to MarketBeat, based on 37 analyst ratings the website compiled as of 30 May. The average Nvidia stock forecast for the next 12 months as of 30 May was $379.73, ranging from the high of $500 to the low of $133. Note that analyst predictions can be wrong.

Is Nvidia a good long-term investment?

Whether Nvidia is a good long-term investment would depend largely on your risk tolerance, investing objectives and portfolio composure. Always conduct thorough research before investing.