JasmyCoin price predictions 2025-2030: Third-party price target

How might JASMY behave in the future?

JasmyCoin (JASMY) is an ERC-20 token on the Ethereum blockchain, serving as the native cryptocurrency of the Jasmy platform. This platform aims to empower users with greater control over their personal data by decentralising data ownership, challenging the dominance of large technology companies.

Within the Jasmy ecosystem, JASMY facilitates transactions and rewards, acting as a medium of exchange and an incentive for secure data sharing and management.

JasmyCoin price predictions: 2025 and beyond

JasmyCoin price predictions as of 3 March 2025 included Changelly, which predicted JASMY to average $0.0235 in 2025, with a $0.0226 minimum and $0.0273 maximum. The platform projected steady growth, forecasting an average price of $0.0345 in 2026, rising to $0.0478 in 2027, $0.0681 in 2028, and $0.0999 in 2029.

AMB Crypto was more optimistic, predicting a $0.029 average price for 2025, with a $0.044 high and $0.037 low. The site sees JASMY averaging $0.034 in 2026, $0.038 in 2027, $0.043 in 2028, and $0.057 in 2029.

Coin Codex took a bearish stance, forecasting a $0.0155 average JASMY price in 2025, ranging between $0.0183 and $0.0197. The site expects a further decline, predicting $0.0183 in 2026 and $0.0064 by 2029.

Coinpedia offered a more bullish outlook, estimating a $0.067 average price for 2025, with a $0.115 maximum and $0.022 minimum. The site predicts JASMY will rise to $0.094 in 2026, $0.119 in 2027, $0.136 in 2028, and $0.159 in 2029.

Digital Coin Price predicted an average price of $0.0369 in 2025, with fluctuations between $0.0168 and $0.0416. The platform forecasts an average of $0.0437 in 2026, $0.0644 in 2027, and $0.0854 in 2028-2029.

Note that analyst Jasmycoin predictions can be inaccurate. Forecasts are based on historical data and shouldn’t be used as a substitute for your own research. Past performance is not a reliable indicator of future results.

JasmyCoin: Long-term price forecast

|

2030 |

|||

|

Low |

Avg |

High |

|

|

Changelly |

$0.1397 |

$0.1437 |

$0.1653 |

|

AMB Crypto |

$0.066 |

$0.052 |

$0.079 |

|

CoinCodex |

$0.006482 |

$0.00013 |

$0.000659 |

|

Coinpedia |

$0.049 |

$0.186 |

$0.323 |

|

Digital Coin Price |

$0.0901 |

$0.0995 |

$0.10 |

Analysts’ long-term projections for JASMY vary, with some expecting steady gains and others forecasting more modest growth over the coming decades.

Changelly remained modestly bullish, predicting JASMY to average $0.1437 in 2030, climbing to $0.6402 by 2034. Looking further ahead, the platform anticipates a breakout to $12.06 by 2040, with a potential rise to $16.96 by 2050.

AMB Crypto took a more conservative outlook, projecting a $0.052 average JASMY price in 2030, ascending to $0.082 in 2031, $0.072 in 2032, $0.1 in 2033; all the way up to to $0.13 by 2036.

Digital Coin Price was more bullish in its long-term prediction, estimating JASMY will average $0.0995 in 2030, increasing steadily to $0.37 by 2034

Could JasmyCoin reach $1?

Given JASMY’s total supply of 50 billion tokens, a price of $1 would imply a market capitalisation of $50 billion – a level significantly higher than its historical valuations. This would place JasmyCoin among the largest cryptocurrencies by market cap, surpassing established assets such as Litecoin (LTC) and Polygon (MATIC) based on current valuations.

No widely followed analysts currently predict JasmyCoin reaching $1 in the foreseeable future, and price forecasts vary among sources. For instance, Changelly’s long-term forecast sees JASMY averaging $0.1437 by 2030, while CoinCodex anticipates a continued decline, projecting an average of $0.00013 in the same period. Even the more optimistic Coinpedia outlook, which expects a $0.186 average price in 2030, falls significantly short of the $1 mark.

For JASMY to reach $1, it would require exponential adoption, significant technological breakthroughs, or a major shift in market dynamics. While cryptocurrency prices can be unpredictable, current projections and market conditions suggest such a target remains highly unrealistic.

JasmyCoin price drivers

The price of JasmyCoin could be determined by a variety of factors, including market sentiment, adoption, and regulatory developments.

Technological developments and partnerships

In March 2024, Jasmy partnered with Panasonic to integrate its Personal Data Locker (PDL) with Panasonic’s IoT technology, boosting user privacy and data management. The announcement drove JASMY’s price higher, reflecting market confidence. However, delays or implementation issues could dampen sentiment and weigh on the token.

Adoption and utility

Increased use of Jasmy’s Secure Knowledge Communicator (SKC) and PDL in IoT, finance, and healthcare could strengthen demand, especially with Japan’s push for Web3. Institutional partnerships may further support growth. However, competition from data-focused blockchains like Ocean Protocol (OCEAN) and Filecoin (FIL) could limit market share. Slow adoption or stronger rivals may hinder price momentum.

Regulatory environment

Japan’s crypto-friendly stance and government-backed Web3 initiatives have supported Jasmy’s growth. However, stricter anti-money laundering (AML) rules or limits on data tokenisation could pose challenges. Global regulations, including Europe’s MiCA framework and potential US policy shifts, could also impact liquidity and accessibility.

Cryptocurrency market trends

JASMY, like most altcoins, is influenced by Bitcoin’s price cycles. Bullish BTC phases often drive capital into smaller assets, while bearish markets can lead to risk aversion and outflows. Future bitcoin halving events could create periods of heightened volatility, which could spill over into JASMY’s price movements. Institutional crypto adoption could provide support, while market downturns – like those in late 2022 – could pressure prices.

Macroeconomic factors

Economic factors such as inflation, central bank policies, and global stability affect demand for speculative assets. Rate cuts by the US Federal Reserve, which began in September 2024, may have supported risk assets like JASMY. However, economic downturns could shift traders toward safe-haven assets, limiting upside potential.

JasmyCoin explained

JasmyCoin (JASMY) is the native token of Jasmy, a blockchain-based platform focused on decentralised data management and the Internet of Things (IoT). The project was founded in 2016 by former Sony executives, including Kunitake Ando and Kazumasa Sato, with the aim of giving individuals control over their personal data while enabling businesses to securely manage and exchange information.

The platform’s Secure Knowledge Communicator (SKC) and Personal Data Locker (PDL) allow individuals and businesses to manage data ownership and permissions without relying on centralised entities.

JASMY is an ERC-20 token on the Ethereum blockchain and serves multiple functions, including as a medium of exchange for transactions within the Jasmy ecosystem – and as a reward mechanism for users monetising their data. At launch, 50 billion JASMY were minted, with allocations for ecosystem growth, institutional investors, and business financing. While widely used in Japan’s blockchain sector, JasmyCoin faces competition from data-focused projects like IOTA (MIOTA) and Storj (STORJ).

Despite its name, JasmyCoin is technically a token, not a coin, as it does not run on its own blockchain. However, ‘JasmyCoin’ remains the commonly used term in market discussions.

JasmyCoin price history

Past performance isn’t a reliable indicator of future results.

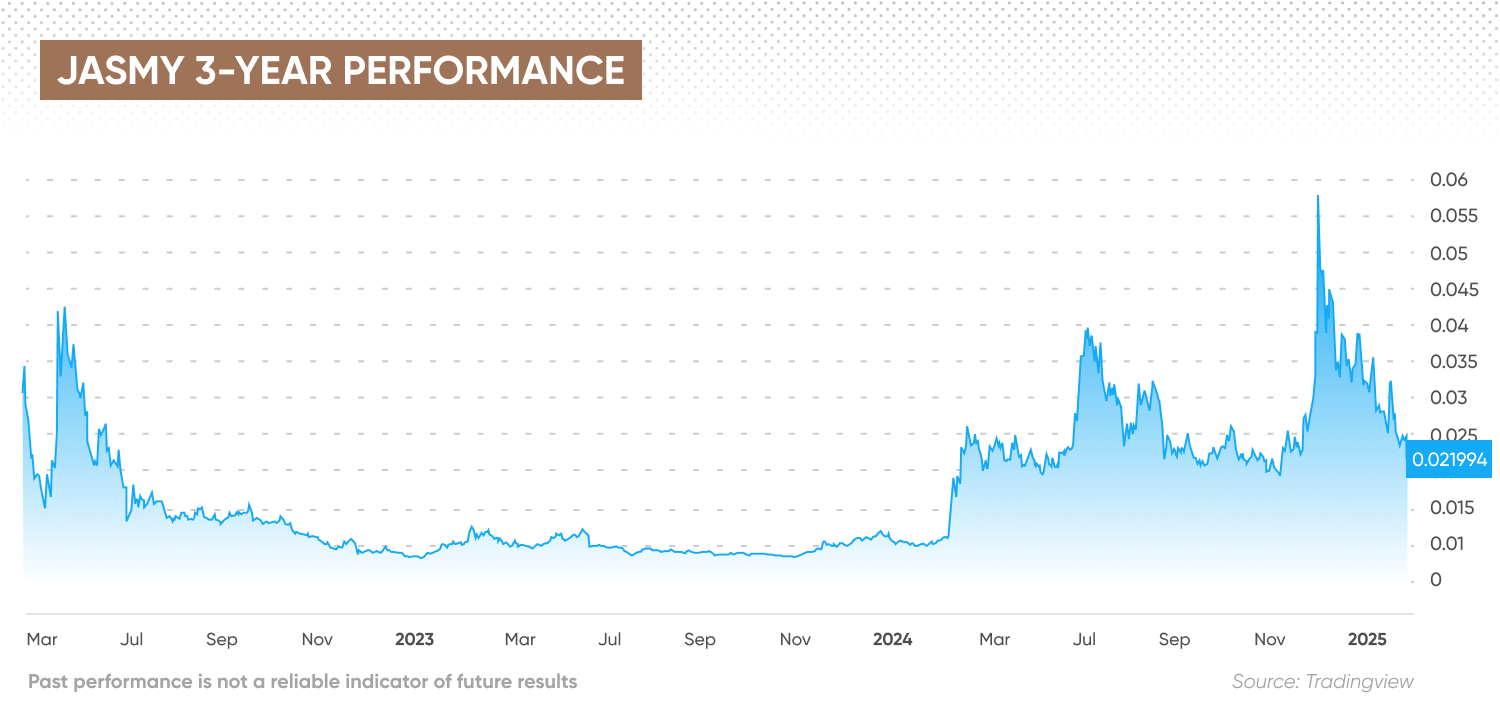

JASMY has experienced significant volatility since its launch. In 2021, it surged from $1.29 to an all-time high of $4.99 before falling over 64% within a week. By July, it had dropped to $0.011 as the market struggled. A brief recovery in Q4 2021 saw JASMY spike to $0.27 after a Coinbase listing, but it ended the year at $0.08544.

Throughout 2022, JASMY remained below $0.09. It fell to $0.008124 in June, recovered to $0.01219 in August, but dropped to an all-time low of $0.002747 in December, closing the year down 96.5%.

2023 saw some recovery. JASMY peaked at $0.008285 in February before falling to $0.00431 in March. By April, it traded at $0.006385 with a market cap of $303.7m, ranking 125th among cryptocurrencies.

In 2024, JASMY traded between $0.00453 and $0.05853, closing the year at $0.03169 – a marked improvement from the previous year. The start of 2025 showed volatility, with JASMY falling below $0.02 in February.

JasmyCoin trading strategies to consider

Whether trading on JASMY or any other asset prices – a good strategy helps to maintain discipline for traders, providing a structured approach to financial markets.

-

Day trading – A short-term strategy where ‘day traders’ aim to capture gains from intraday volatility, typically starting and ending within one day.

-

Position trading – A long-term strategy where ‘position traders’ seek gains from broader price movements, holding positions for months or years.

-

Scalping – Another short-term strategy where ‘scalpers’ aim for gains from minute price fluctuations, often in less than a day.

-

Trend trading – A variable-term strategy where ‘trend traders’ seek gains by following a price trend for as long as they can, before the price changes direction.

Discover more trading strategies on our comprehensive trading strategies page.

Risks and rewards to crypto trading

Trading cryptocurrencies like JASMY presents potential opportunities and risks.

Potential rewards of trading JASMY

-

Market adoption: As Web3 adoption grows, JASMY may benefit from increased demand for decentralised data solutions.

-

Trading opportunities from volatility: JASMY has experienced significant price fluctuations, which could create potential opportunities for short-term traders.

-

Expanding ecosystem: The Jasmy project’s integration with IoT devices and data security applications could enhance the token’s utility and demand.

-

24/7 market access: Unlike traditional markets, cryptocurrency trading is available around the clock, allowing traders to react to price movements at any time.

Risks of trading JASMY

-

Regulatory uncertainty: Evolving regulations in key markets could impact JASMY’s availability and liquidity.

-

High volatility: JASMY has experienced substantial price fluctuations, such as its 96.5% decline in 2022, highlighting the risks of trading smaller-cap altcoins.

-

Security risks: Cryptocurrency exchanges and DeFi platforms have been targeted by hacks. Trading with a reputable broker or exchange can help mitigate risks.

-

Liquidity concerns: Lower trading volumes can result in wider spreads and slippage.

Before speculating on JASMY or any cryptocurrency, traders should assess their risk tolerance, stay informed on market developments, and use risk management as part of a trading strategy.

Learn more crypto trading in our comprehensive cryptocurrency trading guide.

Create an accountOpen a demo account

FAQ

Is JasmyCoin a good investment?

JasmyCoin (JASMY) is a highly volatile cryptocurrency, with significant price fluctuations over time. Some analysts see potential in its decentralised data management use case and partnerships, such as the collaboration with Panasonic to develop a Web3-based IoT platform. However, others highlight concerns over adoption and regulatory risks. As with any crypto asset, investors should conduct their own research, assess market conditions, and be aware that past performance does not guarantee future returns. Only trade or invest with funds you can afford to lose.

Will JasmyCoin go up or down?

Price forecasts for JASMY vary significantly. For instance, CoinCodex predicts a potential decrease to $0.0194 by April 2025, while Changelly anticipates an average price of $0.0247 in 2025. Cryptocurrency prices are influenced by broader market sentiment, technological developments, and macroeconomic factors. Given JASMY’s volatility, its price can move in either direction. It is essential to stay informed and understand that predictions are speculative and often inaccurate. Past performance is no guarantee of future returns.

Should I trade JasmyCoin?

Whether JASMY is a suitable trade depends on individual risk tolerance and market outlook. While some traders see opportunities in its volatility, others may view it as a high-risk asset. Conducting independent research, staying updated on regulatory developments, and implementing risk management strategies are crucial before making any investment decision. Always remember that cryptocurrency investments carry significant risks, and prices can go down as well as up.