Helium price prediction: What is helium (HNT)?

Can Helium make investors feel like they are lighter than air?

It aims to build communities and help them to work with a variety of internet-linked devices, but what is helium (HNT)?

Here we take a look at the token and examine some of the helium price predictions that were being made as of 3 April 2023.

Helium explained

The Helium blockchain is a de facto moribund chain, following a community vote which saw proposals to have the network it hosted migrate to the Solana (SOL) blockchain, with the official transfer to take place on 18 April 2023.

The original system was designed to work with the internet of things (IoT), which at its heart is a computing phenomenon. Traditionally, people have used their laptops and desktops to go online. Even smartphones, which have boomed in the last 10 years, are, in effect, portable computers.

There are, however, a growing number of devices that connect to the internet that are not computers in any traditional sense. For instance, smart fridges that can message users if their doors open, or digital voice-controlled assistants such as Amazon’s Alexa or Google Home.

Helium’s origins date back to 2013, when the project was founded by game designer Amir Haleem, Napster founder Shawn Fanning and developer Sean Carey. The idea was to create a platform that would make building internet-connected devices much easier.

The Helium blockchain, however, didn’t launch until six years later on 29 July 2019, when it began to power the largest, public, decentralised long-range wide area network (LoRaWAN) globally.

‘People-powered network’

The company aims to create a “people-powered network” by strengthening communities through shared internet hotspots, instead of using big cellular towers to create wireless internet connections.

Helium uses an algorithm-based mechanism called proof-of-coverage (PoC) to check the locations and legitimacy of hotspots. Once a user buys a Helium hotspot, they become part of the People’s Network and thus have the opportunity to mine the blockchain’s native cryptocurrency, helium, also known by its ticker handle HNT.

Helium hotspot owners earn HNT for providing internet connectivity to neighbouring devices. The coins can be exchanged for data credits, US dollar-pegged utility tokens, which are what aid the hotspot device to surf the Helium network, or US dollars.

People with hotspots receive an amount of helium coins based on how much they contribute to the network. Generally, HNT can be earned in three ways:

-

By transferring data from devices on the Helium network. PoC is used to validate wireless coverage, which amounts to approximately 0.9% of earnings.

-

By participating in PoC challenges and validating others’ wireless coverage. Each hotspot involved in the challenge earns a portion of the HNT allocated for the task.

-

By monitoring the PoC activity of other hotspots.

In addition to HNT, the platform also has fixed-value data credits. These are used as transaction fees by devices so they can send data to the network and are created by burning HNT. Burned HNT are recycled into rewards for hotspots as the issuance of new coins decreases over time.

It is worth noting that the switch to Solana will see HNT move from being a coin to a token. Therefore, barring the immediate short-term, it is not entirely accurate to refer to such things as helium coin price predictions.

Helium price history

Let’s now cast our eyes over the HNT price history. While past performance should never be taken as an indicator of future results, knowing the coin’s price in the past can provide context when it comes to either interpreting a helium price prediction or making one of our own.

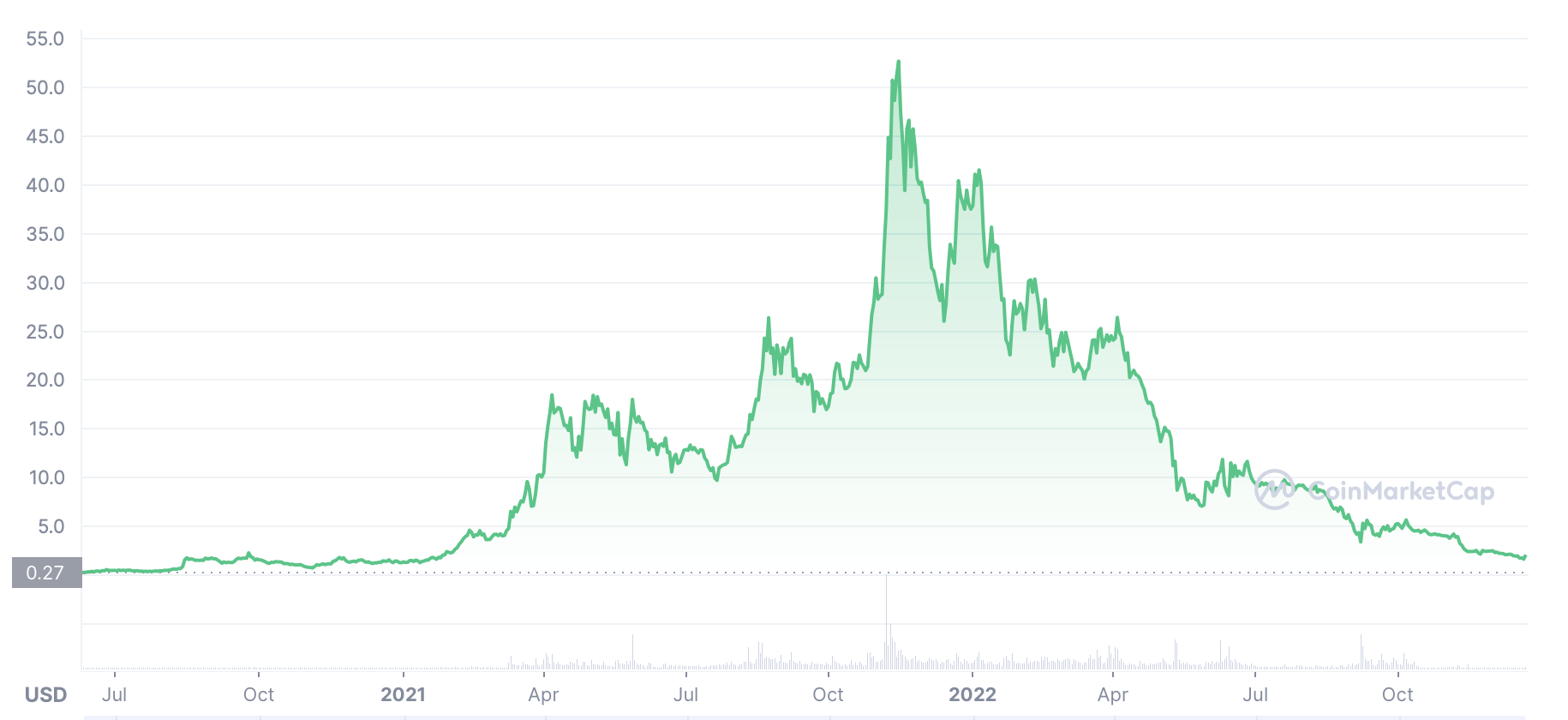

When HNT first came onto the open market in July 2019 it was worth about $0.27. The token reached an all-time low of $0.2534 on 10 June 2020. The sentiment, however, shifted in August and the token broke through the $1 barrier for the first time.

In early 2021, helium took advantage of the general bull market and reached highs of over $15 in April and May, before the market took a downturn and the HNT price slumped.

In November, a combination of upbeat news – Helium’s partnership with 5G carrier DISH, and a buoyant market – boosted HNT to an all-time high of $55.22. After that, though, market contractions triggered by concerns about the Omicron variant of Covid-19 pushed the coin to close the year at $37.86.

2022 was a poor year for crypto generally, and HNT is no exception. While the coin reached a high of $45.06 on 5 January 2022, it reversed to $28.31 on 17 February, despite the upbeat news of $200m raised in a funding round in February.

Later in 2022, the depegging of the UST stablecoin and the collapse of the associated LUNA cryptocurrency created market turmoil which saw the HNT price drop to $6.59 on 12 May. Any recovery was pretty unimpressive, although it did trade at above $10 at various points over the next few months.

The announcement of a proposal to move all of its tokens to the Solana blockchain in late August may well have deterred investors, and HNT closed August at $5.26 as it went on its way to a low of $3.28 on 6 September. After that, there were ups and downs but, following the Solana announcement, the crypto rallied somewhat and it was worth about $5.05 on 29 September 2022.

Following that, the news that Binance (BNB) had delisted HNT caused the price to drop somewhat and, on 14 October, the crypto was worth about $4.47. The following month, the collapse of the FTX crypto exchange hit the market and HNT hard, and not even the news that Pershing Square CEO Bill Ackman had seemingly given his seal of approval to helium could stop it sliding to a low of $1.59 on 20 December, before it spiked to $2.38 on 21 December.

After that, it slid down to close the year at $1.53, representing an annual loss of more than 95%. The decline continued into 2023, with it reaching a nadir of $1.49 on New Year's Day, before a recovery saw it hit a high of $3.34 on 21 February, its highest price since November. After that, though, the collapse of the Silvergate bank, coupled with the news of HNT being delisted by Binance again meant that it fell to a low of $1.16 on 23 March before making something of a recovery to around $1.31 on 3 April.

At that time, there were about 142.75 million HNT in circulation out of a total supply of 223 million. This gave the coin a market cap of about $187m, making it the 165th-largest crypto by the metric.

Helium price prediction

Let’s now take a look at some of the helium price predictions as of 3 April 2023. Remember that price forecasts, especially for something as volatile as cryptocurrency, are often wrong. Meanwhile, long-term crypto price predictions are often made using an algorithm, which means that they can change at a moment's notice.

First, CoinCodex had a rather downbeat short term helium price prediction for 2023 which suggested that the crypto could drop to just under $1.13 on 8 April before it continued to fall to trade at $0.9763 by 4 May 2023. Fittingly, site’s technical analysis was neutral, with 23 indicators sending bearish signals against just six making bullish ones.

Meanwhile, PricePrediction made a helium price prediction that saw the crypto rise to $3.09 this year, before potentially hitting $4.53 in 2024 and $6.34 in 2025. In 2026, the site suggested HNT could trade at $9.38, before climbing to $14.04 in 2027 and $20.80 in 2028.

The site suggested that helium could close the decade at $31.11, while the site’s helium price prediction for 2030 projected HNT to trade at around $46.54, before arguing that it could reach $64.40 in 2031.

Next, CaptainAltCoin was cautious in terms of its helium crypto price prediction, suggesting that the crypto could trade at $1.29 in June 2023 before rising to $2.12 in April next year. The site then made a helium price prediction for 2025 of $17.16, before suggesting the token could climb to $42.91 in 2030 and $85.81 in 2040.

Finally, Wallet Investor struck a more downbeat note in its HNT crypto price prediction. The site suggested that helium could potentially lose a lot of its value over the coming 12 months, dropping to trade at a mere $0.0545 in early April 2024.

When considering an HNT price prediction, it’s important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin or token’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns, and never trade with money that you cannot afford to lose.

FAQs

Is helium a good investment?

It is hard to say. A lot will depend on how smoothly the transition to Solana goes, as well as the overall performance of the crypto market.

Remember, you should always carry out your own thorough research before making an investment. Even high-market-cap cryptocurrencies have proved vulnerable to the current bear market, so investors should be prepared to make losses and never purchase more than they can afford to lose.

Will helium go up or down?

It is difficult to tell. While the likes of CaptainAltCoin were upbeat as of 3 April 2023, others such as Wallet Investor struck a more bearish tone. Note that price predictions very often end up being wrong, and that prices can go down just as easily as they can go up.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether HNY is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors.

Keep in mind that past performance is no guarantee of future returns, and never invest any money that you cannot afford to lose.

Should I invest in helium?

This is a question that you will have to answer for yourself. Before you do so, however, you will need to conduct your own research.

Never invest more money than you can afford to lose, because prices can go down as well as up.