Ethereum Price Prediction: Third-party outlook

Ethereum is the second largest cryptocurrency by market capitalisation, second only to Bitcoin, with its price shaped by a mix of market sentiment, network developments and broader financial conditions.

Ethereum (ETH) is trading around $3,110.21 against the US dollar, near the lower end of its intraday range between $3,109.95 and $3,295.50 as of 9:19am UTC on 8 January 2026. Past performance is not a reliable indicator of future results.

Price action comes amid a firmer US dollar, with the DXY index near 98.8 on 8 January 2026 (Trading Economics). Broader crypto sentiment is being shaped by Bitcoin holding above $91,000, alongside earlier gains that lifted total digital asset market capitalisation above $3 trillion in early January (Yahoo Finance, 7 January 2026). Ethereum-specific attention also remains on network developments, including planned increases in data capacity per block ahead of the Fusaka upgrade, which market observers have highlighted as a potential factor for on-chain activity and fee dynamics (CoinDesk, 8 January 2026).

Ethereum price prediction 2026-2030: Analyst price target view

As of 8 January 2026, third-party ETH price predictions span a wide range, with targets reflecting differing assumptions around institutional adoption, regulatory developments and broader crypto market conditions. These projections are speculative, may not materialise, and do not represent Capital.com’s view.

Citi (12-month forecast)

Citigroup has set a 12-month ether price target of about $4,300 in September 2025, describing the outlook as being driven by investor demand and broader use of the Ethereum network (Reuters, 16 September 2025). In a separate October 2025 note referenced by deVere Group, Citi is reported to have forecast Ethereum at about $5,440 within 12 months as of 19 October 2025. The rationale links this view to rising investor demand and sustained inflows into ether-linked investment products, set against expectations of broader adoption (deVere Group, 20 October 2025).

Grayscale Investments (2026 digital asset outlook)

Grayscale notes in its '2026 Digital Asset Outlook' that Bitcoin and Ether are described as scarce digital commodities and alternative monetary assets, positioned as potential beneficiaries of demand for alternatives to fiat‑denominated instruments. The manager cites macro demand for alternative stores of value and expectations of improving regulatory clarity as key assumptions underpinning an upbeat view on larger tokens that show clear use cases, sustainable revenues, and access to regulated venues (Grayscale Investments, 15 December 2025).

FXStreet (2026 thematic outlook)

An FXStreet article discusses scenarios in which ETH would need to break above $5,000 during 2026 to support a constructive outlook. The piece links these possibilities to a potentially more supportive US regulatory environment under the Trump administration, alongside expectations for expanding use of Ethereum in tokenised assets and stablecoins (FXStreet, 24 December 2025).

Changelly Research Desk (2026 range projections)

Changelly’s Ethereum crypto price prediction suggests a 2026 trading range with an indicative minimum near $4,565, an average around $4,690, and a maximum close to $5,201. The methodology combines historical price patterns and technical indicators, assuming ongoing ecosystem development and generally supportive digital asset conditions (Changelly, 6 January 2026).

Fitch Ratings (risk‑focused view on Ethereum volatility)

Fitch Ratings does not publish an explicit Ethereum price target, but in its commentary it flags that price swings in Bitcoin and Ethereum have significantly outpaced broader markets, contributing to risk for US banks with sizeable crypto exposure. The rating agency underlines volatility, stablecoin adoption, and regulatory uncertainty as ongoing sources of caution for institutions, even as some areas of the crypto market continue to mature (Investing.com, 8 December 2025).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

ETH price: Technical overview

Ethereum (ETH) is trading around $3,110.21 as of 9:19am UTC on 8 January 2026, sitting just below its short-term 10-day simple moving average near 3,113 and slightly under the 10-day EMA around 3,121.7. The broader SMA cluster places the 20-, 50-, 100- and 200-day moving averages at roughly 3,034, 3,018, 3,422 and 3,619 respectively, leaving price closer to the shorter-term basing area than the higher long-term averages.

On momentum, the 14-day RSI around 52.9 sits in a broadly neutral zone, while the ADX near 23.9 points to a modestly developed trend rather than a strong directional phase. On the upside, the first area to watch is the Classic R1 pivot near 3,372, with R2 around 3,778 only coming into view after a sustained daily close above the initial level. On pullbacks, initial support aligns with the Classic Pivot at about 3,044, followed by the S1 area around 2,639 if selling pressure extends, while the 100-day SMA near 3,422 remains a notable reference point on rebounds (TradingView, 8 January 2026).

This technical analysis is provided for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Ethereum price history

Ethereum spent much of 2024 trading between roughly $2,200 and $4,100, climbing from about $2,587 on 10 January 2024 to finish the year near $3,332 on 31 December as crypto markets broadly recovered. After a volatile stretch in late 2024 and early 2025 that saw ETH dip toward the mid-$1,500s in April before rebounding above $2,800 by June, the coin extended its advance through the second half of 2025, peaking above $4,900 in late August before easing back toward $3,000 into year-end.

Across 2025 as a whole, Ethereum opened around $3,354 on 1 January, fell to close near $2,488 by 30 June, and then re-accelerated to end the year at about $2,968 on 31 December, before moving above $3,100 in early January 2026. As of 8 January 2026, ETH closed at $3,110.67, leaving it below the late-August 2025 highs but above the April 2025 lows in the mid-$1,500s over this two-year period.

Past performance is not a reliable indicator of future results.

Capital.com analyst: Ethereum outlook

Ethereum’s price (ETH/USD) over the past two years has reflected broader shifts in digital asset sentiment, moving from the mid-$2,000s in early 2024 through rallies above $4,000 in mid-2024 and late summer 2025, before consolidating back toward the low-$3,000s into January 2026. These moves have tended to track changes in wider risk appetite, evolving expectations for US interest rates and the dollar, and flows into and out of major cryptocurrencies. Ethereum has at times benefitted from network upgrades and institutional interest, while also facing periods of pressure when regulation, liquidity or macroeconomic data have weighed on the asset class.

From a trading perspective, Ethereum’s intraday range on 8 January 2026 between about $3,088 and $3,182 highlights that volatility remains a core feature of the market. This can create potential opportunities for short-term traders, while also increasing the risk of rapid adverse price moves. Factors often cited as potential supports for ETH, such as higher on-chain activity, expanding use cases and easier financial conditions, may also turn into headwinds if adoption slows, fees rise or central banks maintain tighter policy for longer, underlining that crypto prices can move sharply in either direction over short timeframes.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

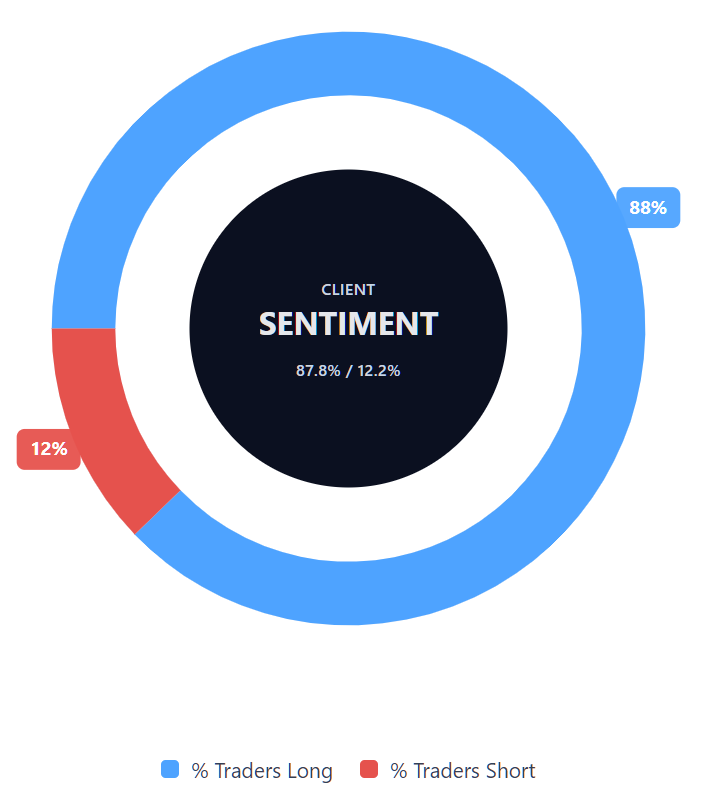

Capital.com’s client sentiment for Ethereum CFDs

As of 8 January 2026, Capital.com client positioning in Ethereum CFDs shows 87.8% buyers versus 12.2% sellers, leaving a heavy skew towards long positions and a buyer lead of 75.6 percentage points. This snapshot reflects open ETH CFD positions on Capital.com at the time of reporting and can change as clients open, close or adjust trades.

Summary – Ethereum price 2026

- Ethereum traded within a wide range during 2025, falling toward the mid-$1,500s in April before rebounding to late-August highs above $4,900 and then easing back toward $3,000 into year-end.

- By 31 December 2025, ETH closed near $2,968, below its summer peak but above the April trough, illustrating the degree of volatility seen across the year.

- Technical readings into early January 2026 show ETH trading just under short-term moving averages, with the 14-day RSI around neutral levels and trend strength remaining modest.

- Third-party analyst and research forecasts for 2026 cluster roughly between the mid-$3,000s and low-$5,000s, typically linking their views to institutional participation, regulation and network usage rather than any single driver.

Past performance is not a reliable indicator of future results.

FAQ

What is the ETH price prediction?

Ethereum price predictions vary widely and depend on assumptions about factors such as market sentiment, regulation, network usage and broader financial conditions. Third-party forecasts for 2026 cited in this article generally span from the mid-$3,000s to the low-$5,000s range. These projections are speculative, may not materialise and do not reflect Capital.com’s view. Cryptocurrency prices are volatile and can be influenced by unexpected events.

Who owns the most Ethereum?

Ethereum ownership is distributed across a large number of wallets, including individual holders, decentralised protocols, exchanges and institutional custodians. No single entity is publicly confirmed as owning a majority of ether. Some early adopters, investment funds and large on-chain contracts hold substantial balances, but wallet data does not necessarily reflect ultimate ownership, as a single address may represent multiple underlying users or pooled assets.

How many Ethereum coins are there?

Unlike Bitcoin (BTC), Ethereum (ETH) does not have a fixed maximum supply. The total amount of ether in circulation changes over time, influenced by new issuance and mechanisms such as transaction fee burning introduced through network upgrades. As a result, Ethereum’s supply growth can vary depending on network activity. This flexible supply model is a key structural feature and can affect how market participants assess longer-term dynamics.

Could Ethereum’s price go up or down?

Ethereum’s price can move in either direction and has historically done so sharply over short periods. It is influenced by factors including overall crypto market sentiment, macroeconomic conditions, regulatory developments and changes to the Ethereum network itself. While periods of rising prices may occur, declines can also be sudden and significant. This two-sided risk highlights the importance of accounting for volatility and potential losses as well as gains.

Should I trade Ethereum CFDs on Capital.com?

Trading Ethereum CFDs on Capital.com lets you speculate on price movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.