BlackRock shareholders: Who owns the most BLK stock?

BlackRock is the leading asset manager in the world, yet who are its biggest shareholders?

BlackRock (BLK) has been at the forefront of the global investment industry for the last three decades. With over $11.6tn in assets under management (AUM) as of February 2025, the firm is one of the biggest asset managers in the world.

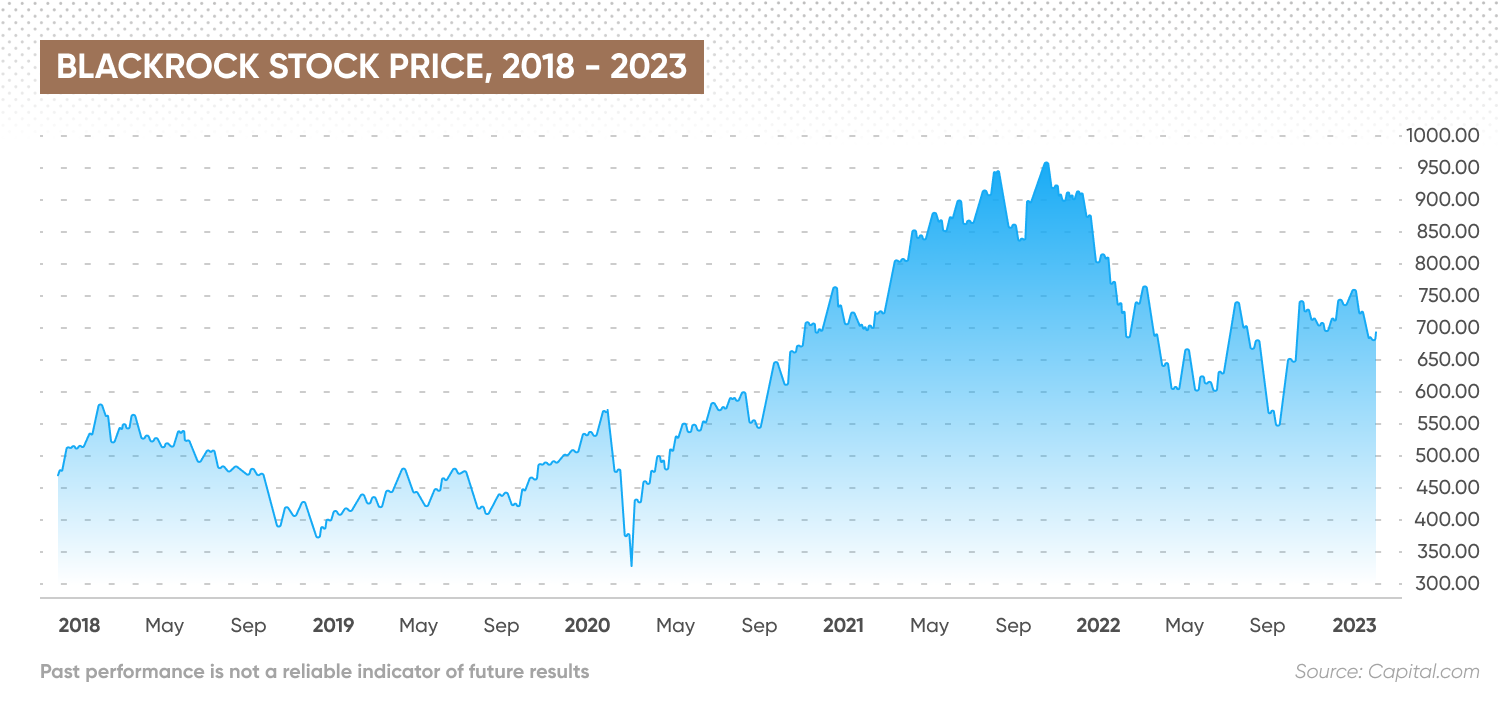

BlackRock’s stock price has certainly reflected its long-term success. On a 10-year basis, BLK posted 11.50% trailing returns annually, Morningstar data as of 19 February showed. The stock reached an all-time-high of $1,084.22 on 31 January 2025 – but who are the shareholders of BlackRock and how much power do they have over the asset manager’s direction?

BlackRock (BLK) live stock price

Past performance is not a reliable indicator of future results.

What is BlackRock (BLK)?

Blackrock was founded in New York in 1988 by eight financial professionals, including Larry Fink, Susan Wagner, Barbara Novick and Robert S. Kapito, who wanted to make the financial advisory industry more transparent and efficient.

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software known as Aladdin.

As time passed, Blackrock started to acquire the portfolios of several large firms, including Merrill Lynch Investment Management and Barclay’s Global Investors (BGI). The company eventually became the leading player in the asset management industry.

BlackRock became a publicly-traded company in 1999. It completed its initial public offering (IPO) on the New York Stock Exchange (NYSE) under the ticker symbol BLK at $14 a share. Back then, the company had $165bn in assets under management.

In over two decades of trading, BLK stock rose to as high as $1,084.22 on 31 January 2025, its record level.

Past performance is not a reliable indicator of future results.

Who are the shareholders of BlackRock?

According to the data from MarketBeat as of 18 February 2025, 80.69% of BLK shares were owned by institutional investors – including institutions such as Merill Lynch, which merged with BlackRock in 2006. This means that over half of the Blackrock Inc shareholders are investment firms and asset managers, similar to BlackRock, which hold shares on behalf of their clients.

All BLK shares have voting rights, meaning that shareholders of BlackRock have a say in the company’s affairs in line with the proportion of ownership they hold in the firm.

In most cases, individuals who buy BlackRock stock via brokers appoint them as a proxy, meaning that the broker can vote on their behalf. However, they can also opt to cast a vote on the company’s key decisions at BlackRock shareholders meetings.

Institutional BlackRock shareholders

The following is a list of BlackRock major shareholders, excluding institutional insiders, according to data compiled by WallStreetZen as of 19 February 2025.

-

The Vanguard Group – 8.64%

The Vanguard Group is a US-based asset management firm that oversees more than $8tn in assets for both individual and institutional investors. This financial services firm may own BlackRock (BLK) stock through its various investment vehicles, including exchange-traded funds (ETFs) and mutual funds.

- State Street Corp - 4.07%

State Street (STT) is one of the most successful financial services companies in the US. The asset management firm overlooks assets worth over $4tn, and is one of the biggest BlackRock shareholders.

-

Temasek Holdings Private - 3.29%

Temasek is the investment arm of the Singaporean government. The company is managed by the nation’s Minister of Finance. Temasek invests the majority of its assets in Singapore, China and the Americas, including the US. The fund is a major shareholder of Blackrock.

-

Charles Schwab Investment Management - 2.22%

Charles Schwab (SCHW) offers investment management and advisory services, mainly in the US and the UK. It was established in 1971 and named after its founder, an American investor Charles Robert Schwab.

-

Geode Capital Management - 1.94%

Although WallStreetZen’s list indicates that Geode Capital Management owns 1.94%, the company announced on 18 February 2025 that it had increased its holdings to 2.32%, signalling increased confidence in BlackRock’s earnings potential.

BlackRock major shareholders among insiders

Another data collector GuruFocus estimated that individual insiders owned 2.81% of all outstanding common shares of BlackRock as of 19 February 2025. These shares are granted to insiders by the company via stock options as part of their compensation package, or they could have been bought back when the firm was founded.

The following individuals were considered BlackRock biggest shareholders among the company’s insiders, as of 19 February 2025:

-

Laurence D. Fink – 520,124 shares

Laurence D. Fink is the CEO and co-founder of BlackRock, who started the company with seven colleagues. As of 31 January 2023, he is the biggest individual shareholder.

Before founding BlackRock, Fink was Management Director of the First Boston Corporation, an investment bank that was later acquired by Credit Suisse (CS).

-

Susan L. Wagner – 429,362 shares

Susan Wagner is a former executive and one of the co-founders of BlackRock. She occupied the position of Vice Chairman of the asset management firm until 2012. She has served as COO and Head of Corporate Strategy.

As of 17 January 2023, Wagner is the second largest shareholder.

-

Robert S. Kapito – 210,104 shares

Rob Kapito is the president of Blackrock, head of the Global Operating Committee and a member of the company’s Global Executive Committee. Kapito is also a founding member.

Kapito owned 210,104 shares of BLK as of 31 January 2023, more than half that of Wagner.

Other insider holdings

Data from WallStreetZen also indicated that an investment firm Merrill Lynch and BlackRock itself were among the biggest shareholders of BlackRock.

BlackRock acquired Merril Lynch in 2006 in an effort to expand its retail and international presence. Meanwhile, it’s likely that BlackRock holds its own stocks in its investment packages on behalf of clients.

Who is Laurence D. Fink?

Laurence D. Fink is the co-founder, Chairman, and CEO of BlackRock – and its largest individual shareholder as of 19 February 2025, with 520,124 shares – although, the firm remains primarily owned by institutional investors.

Since establishing the business in 1988, Fink has overseen BlackRock’s growth into the world’s largest asset manager, with over $11.68tn in assets under management as of February 2025. Under Fink's leadership, BlackRock has expanded through strategic acquisitions, notably merging with Merrill Lynch Investment Managers in 2006 and acquiring Barclays Global Investors in 2009.

Before BlackRock, Fink was a Managing Director at First Boston Corporation, specialising in fixed income and mortgage-backed securities. His expertise in risk management led to the creation of Aladdin, BlackRock’s proprietary investment and risk analytics platform.

Fink’s influence extends beyond BlackRock, as he is a key figure in financial policy discussions. His leadership continues to shape the firm’s global strategy and position in investment management.

The bottom line

Knowing who owns the most shares of BlackRock stock can help in understanding the company's objectives. Big investors can have significant influence over the company.

However, it shouldn’t be the key reason for your decision to buy a stock. Whether BlackRock is a good investment should depend on your investment goals, risk tolerance and the size of your portfolio. It is important to do your own research before making any investment or trading decision. And never invest or trade money that you cannot afford to lose.

FAQs

How many BlackRock shares are there?

Data from NASDAQ, as of 19 February 2025, indicated there were approximately 155,000,000 outstanding shares.

How many shareholders does BlackRock have?

According to BlackRock’s report filed with the US Securities and Exchange Commission (SEC) in 2023, there were 215 common stockholders of Blackrock as of January 2023. More recent data on the exact number of individual shareholders is not publicly available, however NASDAQ data as of 19 February 2025 suggests there are approximately 2,267 institutional BLK shareholders.

Who owns BlackRock?

BlackRock is not owned by a single individual or company. Instead, its shares are owned by a large number of individual and institutional investors. The biggest institutional shareholders such as The Vanguard Group and State Street are merely custodians of the stock for their clients.

Who are the main shareholders of BlackRock?

The main shareholders of BlackRock are institutional investors that hold shares on behalf of their clients. As of 19 February 2025, the institutions with most BLK holdings were The Vanguard Group, State Street and Temasek Holdings.

Is BlackRock a public stock?

Yes, BlackRock is a public stock that’s trading on NYSE under the ticker symbol BLK.

Should I buy BlackRock stock?

Whether you should buy BlackRock stock depends on your risk tolerance, investing goals and portfolio needs. Always conduct your own due diligence before buying a stock.