Avalanche Price Prediction: Third-party outlook

Avalanche (AVAX) was trading at $31.25 on 22 September 2025 at 11.43pm UTC, moving within an intraday range of $30.37-$33.36.

The price is holding near recent highs after gaining about 33% from $28 support levels earlier in September. It has since eased from last week’s eight-month high of around $33.3, reflecting typical profit-taking after a sharp rally.

Support has come from several institutional developments. These include Bitwise’s September 2025 filing with the SEC for an AVAX ETF, alongside earlier applications from VanEck and Grayscale. Avalanche’s network adoption also grew after South Korea’s first KRW-backed stablecoin, KRW1, launched on the platform with backing from Woori Bank. As a result, daily active addresses reached a two-week high of 70,000. The platform has also attracted $1bn in institutional treasury flows as financial institutions expand on Avalanche’s subnet architecture (Crypto Economy, 21 September 2025).

Avalanche price prediction 2025-2030: Analyst price target view

Standard Chartered (house view)

Standard Chartered’s Geoff Kendrick expects AVAX to reach $55 by end-2025, followed by $100 in 2026, $150 in 2027, $200 in 2028, and $250 in 2029. This view is based on Avalanche’s subnet scaling approach and the Etna upgrade, which reduced subnet launch costs from $450,000 to close to zero, encouraging migration from other Layer-2 solutions (Crypto News Australia, 3 April 2025).

Changelly (algorithmic forecast)

Changelly’s models suggest AVAX could reach a peak of $34.04 in October 2025, with November estimates between $24.51 and $31.92. Their December 2025 forecast points to a maximum value of $26.90, indicating a more conservative near-term outlook compared with other sources (Changelly, 22 September 2025).

Blockchain.News (momentum analysis)

Technical forecasts suggest a $45 level by October 2025, despite current RSI readings of 74.09 showing overbought conditions in September 2025. The analysis indicates AVAX may sustain bullish momentum through consolidation, with short-term targets in the $38-$40 range, representing an 11-17% move from recent prices (Blockchain.News, 19 September 2025).

CoinCodex (third-party consensus)

CoinCodex projects an average AVAX price of $34.60 for 2025, with a low of $31.64 and a high of $38.96, based on algorithmic forecasts. These reflect anticipated price swings linked to network upgrades and shifting DeFi activity (CoinCodex, 22 September 2025).

Forecasts are often inaccurate, as they cannot factor in unforeseen market changes. Past performance should not be relied upon as a guide to future outcomes.

AVAX price: Technical overview

On the daily chart, Avalanche (AVAX) is trading above its key moving-average cluster – approximately the 20-, 50-, 100- and 200-day moving averages at $29, $26, $23 and $22 – with the 20-day average still above the 50-day, supporting the near-term trend. Momentum is moderately positive: the 14-day RSI is around 60, while an ADX reading of 38 points to an established trend, consistent with a buy-the-dip tendency provided price remains above the moving-average band.

The first level to monitor on the upside is the $26.56 pivot. A sustained daily close above this point would bring $29.74 back into focus and, if broken, could open the way to the $35.91 resistance area.

On pullbacks, initial support lies at the $23.57 pivot, followed by the $23-$22 moving-average shelf around the 100-day average. A break below this would weaken the short-term trend and increase the risk of a move towards the $20.39 support area (TradingView, 22 September 2025).

This analysis is for informational purposes only and does not constitute financial advice or a recommendation to trade.

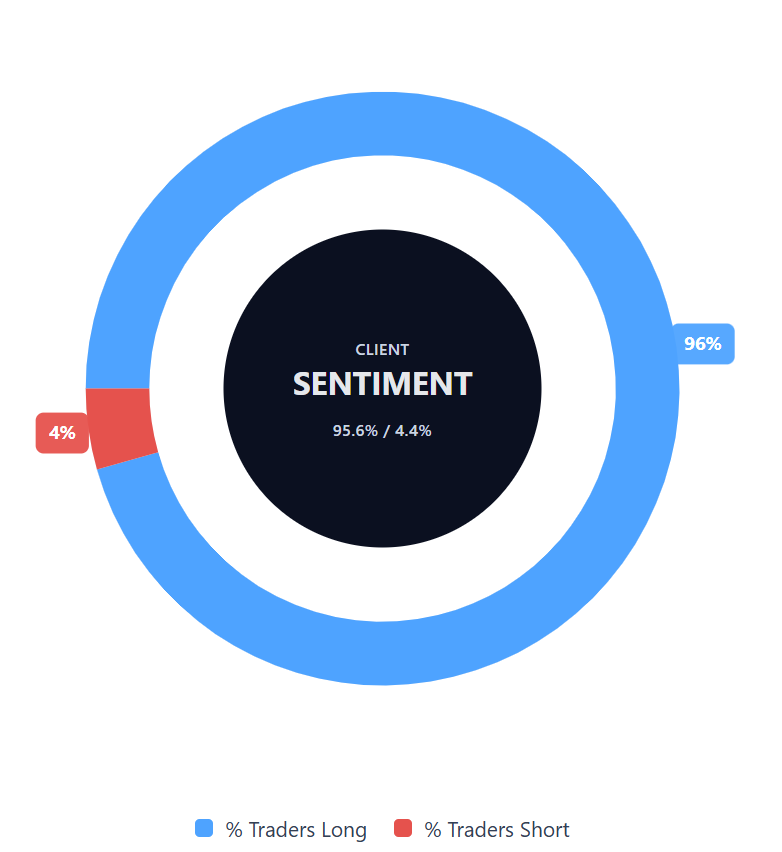

Capital.com’s client sentiment for Avalanche

Capital.com client positioning in Avalanche (AVAX) CFDs shows a strong long bias, with 95.6% of positions long and 4.4% short (22 September 2025). This leaves buyers ahead by 91.2 percentage points, placing sentiment firmly on the long side. This snapshot reflects open positions on Capital.com and may change over time.

FAQ

What is the 5 year forecast for Avalanche?

Analyst consensus for AVAX over the next five years spans from shorter-term averages of around $30-$40 in 2025 to higher projections of $150-$250 by 2029. These figures reflect a mix of conservative algorithmic models, such as Changelly and CoinCodex, alongside more optimistic outlooks like Standard Chartered’s house view. Forecasts are based on assumptions around subnet adoption, potential institutional ETF approvals, and continued DeFi growth. They typically represent annual averages rather than year-end targets and are dependent on technology upgrades, regulatory progress, and wider market sentiment. Analyst forecasts can be inaccurate and can’t account for unforeseen market events. Past performance is not a reliable indicator of future results.

Could Avalanche’s price go up or down?

AVAX price movements remain influenced by broader crypto market trends, institutional adoption factors (such as ETF approvals), network upgrades affecting throughput and fees, and regulatory shifts. Any of these may contribute to upward rallies or downward corrections.

Should I invest in Avalanche?

This content is for informational purposes only and does not constitute financial advice. Readers should conduct their own research and assess their risk tolerance before trading cryptocurrency instruments. CFDs are traded on margin. Leverage amplifies gains and losses.