Woolworths Group shareholders: Who owns the most WOW stock?

We look at Woolworths shareholders and discuss why it’s important to know who owns most of the stock within listed companies.

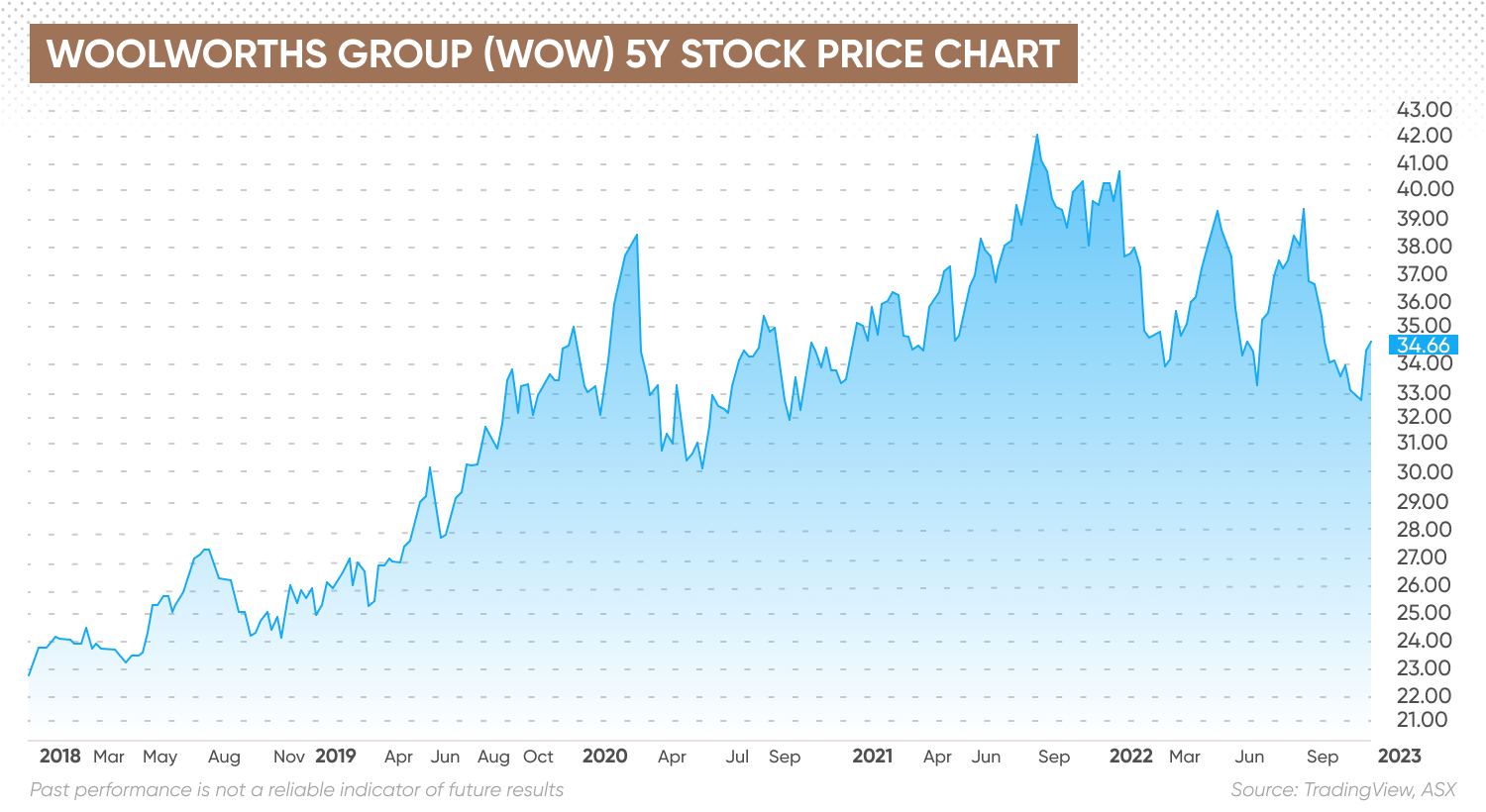

Woolworths Group (WOW), the Australian retailer, has seen its stock price start recovering after revealing an increase in first-quarter group sales.

The company reported revenue of AU$16.3bn for the 14 weeks to 2 October 2022 – 1.8% higher than during the same period last year.

It helped push the WOW stock price up 4% over the past month to AU$34.66 at market close on 18 November 2022

Woolworths Group (WOW) Live Stock Price Chart

But what is the outlook for the business? Here we take a look at its prospects and explore who are the shareholders of Woolworths.

What is Woolworths Group?

Woolworths Group is primarily a food retailing giant with 1,400 stores across Australia and New Zealand. It employs 205,000 people.

The company opened for business on 5 December 1924, when the Woolworths Stupendous Bargain Basement began trading in Sydney’s Imperial Arcade. Its second store opened three years later, followed by the first New Zealand outlet in 1929. By 1930, there were 16 stores across New South Wales, Queensland and Western Australia.

On 19 May 1993, Woolworths chairman Paul Simons announced that the company was going public in Australia’s largest-ever market flotation. Shares were priced at A$2.45. It listed on the Australian Securities Exchange (ASX) on 12 July 1993, trading under the ticker ‘WOW’.

As of 18 November 2022, Woolworths has a market capitalisation of $28.16bn, which makes it the world’s 606th most valuable business, according to economic data aggregator CompaniesMarketCap.

It is the world’s 28th largest retailer and 8th biggest supermarket chain.

As of 18 November 2022, the WOW stock price stood at AU$34.66, reflecting a fall close to 10% of its value year-to-date.

Woolworths Group: Latest news

In its first quarter 2023 results, Woolworths emphasised its focus was on delivering a “much-needed inspirational and affordable” festive season for all its customers.

According to chief executive Brad Banducci, customer shopping behaviours and the trading environment continued to normalise during the quarter. He said:

Woolworths shareholders: Who owns WOW shares?

Who are the Woolworths shareholders?

As with most companies, Woolworths is owned by a variety of investors. As well as insiders and retail investors, there are also 256 institutional owners and shareholders.

It’s important to pay attention to who the shareholders of Woolworths are as this can influence how the business is run over the longer term.

Investors with very significant shareholdings, for example, will be able to use their power to demand a seat on the board and take an active role in deciding the company’s direction.

That’s why it’s important to know who the Woolworths shareholders are and monitor the impact of any stock transactions they make.

For example, an existing investor or insider raising their stake in the business can often be seen as a positive statement for its future.

However, shareholders reducing their interests may be seen as a potential red flag and, as with any change, should encourage you to take a closer look at the company’s financial situation.

According to Woolworths, there were 374,275 WOW shareholders, as of 1 August, 2022. The vast majority, 254,387, had between one and 1,000 shares, accounting for seven per cent of issued share capital.

Let’s take a look at Woolworths’ biggest shareholders.

Five biggest WOW shareholders

Here we look at who owns the most shares of Woolworths, according to data from Marketscreener.

BlackRock

BlackRock is a leading asset management firm that provides services to institutional, intermediary, and retail clients.

The global investment house offers a range of solutions, such as rigorous fundamental and quantitative active management approaches aimed at maximising outperformance.

It also provides highly efficient indexing strategies designed to gain broad exposure to the world’s capital markets.

Different parts of BlackRock are listed as being shareholders in Woolworths, according to Marketscreener data.

BlackRock Fund Advisors has a 3.76% stake, courtesy of its 45,589,373 shares, which makes it the largest shareholder in the business.

BlackRock Investment Management (Australia) has 13,170,856 shares, BlackRock Advisors (UK) Ltd 7,963,570, and BlackRock Investment Management UK 7,070,897.

Vanguard

The index tracking specialist has a unique ownership structure. Rather than being owned by external shareholders, the company belongs to the people investing in its funds.

Vanguard’s founder, the late Jack Bogle, who died in 2019 at the age of 89, first introduced index tracker funds to provide people with a cheaper way to invest.

The Vanguard Group is listed as the second largest shareholder in Woolworths. Its 30,277,698 shares amount to a 2.49% stake.

However, Vanguard Investments Australia is also on the list. According to Marketscreener, it has a 1.34% stake courtesy of its 16,293,362 allocation.

Norges Bank Investment Management

This oil fund – whose formal name is the Government Pension Fund Global – is responsible for the long-term management of revenue from Norway’s oil and gas resources.

The fund has a small stake in more than 9,000 companies across the world, including household names such as Apple, Microsoft, and Samsung.

According to Marketscreener, it’s the third largest shareholder in Woolworths, with 17,811,453 shares. This gives it a 1.47% share of the business.

The fund was established after Norway discovered oil in the North Sea to shield the economy from ups and downs in oil revenue.

Currently, its investments are spread across most markets, countries, and currencies to achieve a broad exposure to global growth and value creation.

Australian Foundation Investment Co. Ltd.

This is a listed investment company that specialises in managing a portfolio of Australian equities, whose origins date back to 1928.

AFIC invests in between 60 and 80 companies across a range of industries. Holdings are selected for their ability to perform – regardless of economic cycles – and generate long-term returns.

It currently has a 0.59% stake in Woolworths, with equity holdings of 7,174,718, according to Marketscreener data.

AFIC claims to have low management costs and no performance fees to let its clients “enjoy the benefit” of their investment. It also aims to provide shareholders with long-term returns and dividends that grow faster than the rate of inflation.

Geode Capital Management LLC

Geode is a US investment manager that was founded in 2001 and currently has US$799b in assets under management.

The firm describes itself as a “systematic asset manager” that provides core beat exposures across a range of equity and niche asset classes.

“Geode provides clients with a transparent investment process with a focus on risk-adjusted performance,” it has stated.

Geode embraces a team-based approach, with its systematic techniques being drawn from a wide variety of information sources, with a focus on liquidity and transparency.

According to Marketscreener, Geode has 6,860,944 shares in Woolworths, which gives it a stake of 0.57%.

Final thoughts: Outlook for WOW stock

The stock is a ‘hold’, based on the views of 10 Wall Street analysts compiled by TipRanks, although opinions are divided.

Four analysts had ‘buy’ recommendations in place, three had it down as a ‘hold’, and the remaining three believed the stock was a ‘sell’.

The consensus view was that WOW stock could slip 0.45% to A$34.58 over the coming year from its current AU$34.66 level, as the stock market closed on 18 November 2022.

The algorithmic forecasts of WalletInvestor suggested the stock was a “bad long-term (one year) investment” that could fall 6% to A$32.59 over the coming year.

Johannes Faul, a director at Morningstar, had a fair value estimate of AU$26.50 on WOW stock and pointed out first quarter group sales increased by 2%.

“However, sales performance differed significantly across Woolworths’ three businesses segments: Australian food; New Zealand food; and discount department store Big W,” he said.

While supermarket sales benefited from Covid-19 restrictions on both sides of the Tasman Sea in the previous corresponding period, Big W’s sales were negatively affected. Faul added:

The bottom line

Remember that information on a company’s stock ownership structure may be important in terms of forming an idea of the firm’s performance, but it shouldn’t be used in place of your own research.

You should always conduct your own due diligence before trading, looking at the latest news, a wide range of commentary, as well as technical and fundamental analysis.

Past performance does not guarantee future returns. And never trade money you cannot afford to lose.

FAQs

How many Woolworths shares are there?

There are currently 1.21bn Woolworths shares outstanding, according to Macroaxis. About 27% of them are owned by institutional investors.

How many shareholders does Woolworths have?

The company has 374,275 investors as of mid-November 2022, with the vast majority being Australian retail investors

Who owns the Woolworths company?

Woolworths has 256 institutional owners and shareholders, according to data from Fintel. These institutions hold a total of 79,741,731 shares.