USD/GYD forecast: Guyanese dollar gathering momentum as Guyana’s oil wealth swells

We look at the latest analyst USD/GYD forecasts as Guyana’s oil revenues grow rapidly.

The Guyanese dollar (GYD) is largely stable against the US dollar (USD) as foreign exchange (forex) flows consistently cover its imports, and the currency is not traded in high volumes on the international forex markets.

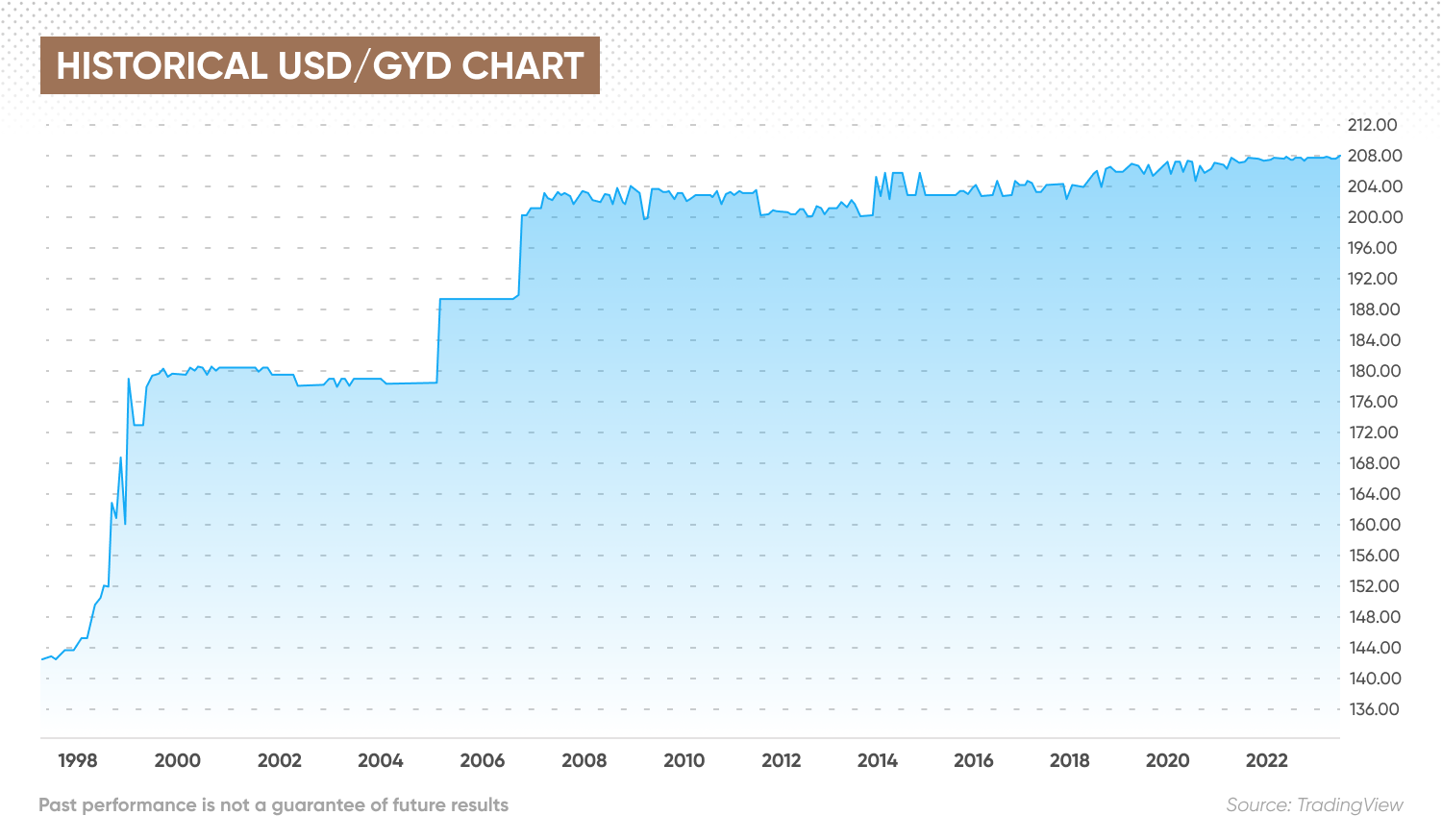

The last major change in the USD/GYD exchange rate was a 2007 devaluation. The rate dipped earlier this month but quickly returned to its previous levels. However, could the Guyanese dollar appreciate in value as the country’s oil wealth grows?

Let’s look at what determines the value of the Guyanese dollar and the potential USD/GYD forecast.

What drives the value of the GYD?

Issued by the Bank of Guyana, the country’s central bank, the Guyanese dollar was introduced in 1839 as the country transitioned from using the Dutch guilders to the British pound (GBP). The pound was used until Guyana gained its independence from the UK in 1966, when the Guyanese dollar was reintroduced in its current form.

The GYD was fixed to the pound at the rate of 4.80 until October 1975, after which it was linked to the US dollar at a rate of 2.55. The GYD was then pegged to a basket of currencies in 1981. The GYD was devalued several times in 1987-1991, bringing the official exchange rate in line with the prevailing market. In 1990, the cambio system for foreign currency transactions was introduced, with licensed dealers setting exchange rates.

From October 1991, the average weighted daily exchange rate from the three largest commercial banks was used to determine the exchange rate for the Bank of Guyana’s daily transactions.

Today, there are few fluctuations in the value of the GYD against its four major trading currencies, the US dollar, euro (EUR), British pound and Canadian dollar (CAD).

Commodities are the main contributors to Guyana’s gross domestic product (GDP), including sugar, gold, bauxite, rice and diamonds.

In 2015, US oil producer Exxon Mobil (XOM) discovered substantial offshore oil reserves, which it expected to be worth 12 times Guyana’s national economy. It has since increased its estimate from 700 million barrels to 3.2 billion barrels. Exxon Mobil started production in 2019.

In April, the World Bank predicted that Guyana’s real GDP could grow by 47.9% in 2022 and 34.3% in 2023, from 5.4% in 2019.

The International Monetary Fund (IMF) stated in September that Guyana’s “Oil GDP is expected to grow over 100 percent in 2022, and by about 30 percent on average per year during 2023-26. Oil production has the potential to transform profoundly Guyana’s economy (overall real GDP growth rate is projected to be 57.8 percent in 2022). Guyana’s commercially recoverable petroleum reserves is expected to reach over 11 billion barrels, one of the highest levels per capita in the world. This could help Guyana build up substantial fiscal and external buffers to absorb shocks while addressing infrastructure gaps and human development needs.”

The IMF projects that Guyana’s gross official reserves could soar from $810.8m in 2021 to 2.88bn by 2027.

“Directors agreed with the authorities that exchange rate stability serves Guyana’s current needs best and emphasised the importance of taking measures to further develop and deepen financial and foreign exchange markets, as the oil production increases,” the statement added.

GYD stability in question

The US dollar to Guyanese dollar exchange rate has changed little over the past 15 years, especially when compared with other Latin American countries.

The USD/GYD exchange rate moved up from 201 to 203 during 2007, from 189 in 2006, and traded up to 206 in 2009 before moving back down to around 202 in 2012. By 2014 the pair was valued around 206, and since 2018 it has been stable around 208-209. The pair briefly dipped to 204.72 on 7 November, but quickly returned to the 208-209 range. However, there has been some movement around that range.

According to the central bank, in the first half of the year, “the Guyana dollar mid-rate, relevant for official transactions, remained at G$208.50 at the end of June 2022. The weighted average mid-rate was G$207.64 compared with G$212.67 for the corresponding period in 2021, thereby indicating an appreciation by 2.4 percent.”

The stable exchange rate has helped to limit the impact of international inflation on the Guyanese economy. Bank of Guyana governor Gobind Ganga told local media earlier this year that the currency will have to appreciate over the long term as the economy grows rapidly from oil revenues, but noted that it would reduce the value of exports while also reducing the cost of imports. The country would need to increase its production of commodities to offset a higher currency value.

What does that mean for the USD/GYD prediction in the meantime?

USD/GYD forecast: Will the GYD remain stable over the long term?

The Bank of Guyana’s US dollar to Guyanese dollar forecast indicates that “the exchange rate of the Guyana dollar to the US dollar is expected to remain relatively stable due to a net supply of foreign exchange to the market.

At the time of writing, the USD/GYD forecast from data provider Trading Economics projected that the pair could average 208.33 by the end of the quarter, and 209.39 in 12 months’ time.

The USD/GYD forecast for 2023 from algorithm-based forecaster Wallet Investor indicated that the pair could remain around the 209 level throughout the year, ending December at 209.313. The USD/GYD forecast for 2025 estimated the pair could be valued at 209.548. By 2027, the pair could move up towards the 2010 level.

Given the long-term uncertainty of the foreign exchange outlook, analysts have yet to issue a USD/GYD forecast for 2030.

If you are looking for a USD/GYD forecast or any other foreign exchange rate outlook, it’s important to remember that currency markets are highly unpredictable and influenced by many variables. We recommend that you always do your own research.

Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Why has USD/GYD not been dropping or rising?

The USD/GYD exchange rate has been stable as Guyana has ample foreign currency reserves to cover its imports, and the currency is not actively traded on the international forex markets.

Will USD/GYD go up or down?

Some analysts’ forecasts, at the time of writing, expected the USD/GYD rate to remain stable in the short term, which could be revalued over the long term to accommodate rapid growth in the country’s oil revenues.

When is the best time to trade USD/GYD?

You can trade currency pairs, including USD/GYD, around-the-clock. However, there are certain times when forex trading is most liquid. This usually occurs around the release of major economic announcements, such as trade data, inflation and interest rates, which often tends to drive volatility on forex markets higher. Keep in mind that high volatility increases risks of losses.

Is USD/GYD a buy, sell or hold?

How you trade USD/GYD is a personal decision that depends on your trading strategy, risk tolerance and investing goals. You should do your own research to take an informed view of the market. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence.