US dollar forecast: Third-party price targets

The US dollar’s performance often sits at the centre of broader market conversations, reflecting how investors are interpreting interest rates, economic data and policy direction at a given moment.

Movements in the US dollar index (DXY) provide a snapshot of how the currency is behaving relative to its major peers.

Price action comes against a backdrop of slightly lower US Treasury yields, with the 10-year benchmark easing towards the 4.1–4.2% area as investors await further economic data and policy signals (CNBC, 7 January 2026). The backdrop also includes commentary from Federal Reserve officials indicating that policy remains restrictive, with any further interest-rate cuts in 2026 dependent on incoming data, while markets continue to price in additional easing following three recent cuts (Reuters, 7 January 2026).

US dollar forecast 2026–2030: Analyst price target view

As of 7 January 2026, third-party USD forecasts generally point to a gradual softening against several major currencies, while stopping short of a uniformly bearish outlook. Rather than focusing on explicit DXY point targets, most institutions frame expectations through bilateral currency forecasts, reflecting assumptions around Federal Reserve policy, relative interest-rate paths and medium-term growth dynamics.

ING Think (FX snapshot)

ING’s FX projections imply a steady appreciation of several G10 currencies against the US dollar through 2026. The bank’s EUR/USD forecast indicates a rise from 1.18 at end-2025 to 1.22 by end-2026, alongside a gradual decline in USD/JPY from 152 to 148 over the same period. Similar patterns are projected for sterling and the Australian dollar, with GBP/USD seen at 1.36 and AUD/USD at 0.69 by the end of 2026. Taken together, these forecasts outline a scenario in which narrowing yield differentials and easing US monetary conditions weigh on the dollar, with moves remaining incremental rather than abrupt (ING Think, 8 December 2025).

Scotiabank (forex predictions)

Scotiabank projects continued US dollar depreciation through 2027, with EUR/USD rising from 1.16 in 2025 to 1.24 by 2027, and GBP/USD increasing from 1.30 to 1.39 over the same horizon. In North America, USD/CAD is forecast to fall from 1.40 in 2025 to 1.30 by 2027, while its USD/JPY forecast projects a decline from 150 to 130, reflecting expectations of shifting relative policy stances and longer-term valuation adjustment (Scotiabank, 11 December 2025).

J.P. Morgan (FX market outlook)

J.P. Morgan Global Research maintains a net bearish view in its USD forecast for 2026, although it characterises the expected weakness as less pronounced and less broad-based than in 2025. According to the bank, concerns around labour-market softness and a global environment supportive of higher-yielding currencies could weigh on the dollar, while solid US growth and persistent inflation may limit the extent of any decline

J.P. Morgan’s projections indicate EUR/USD around 1.20, while its GBP/USD forecast suggests 1.36 by December 2026. The bank’s USD/JPY forecast expects the pair to remain elevated, highlighting that any dollar weakness may be uneven across currency pairs rather than uniform.

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

US dollar: Technical overview

The US Dollar Index (DXY) is trading near 98.19 as of 3:43pm UTC on 7 January 2026, holding below the Classic pivot at 98.53 after moving within an intraday range of 97.84–98.29. The short-term moving-average cluster on the daily chart places the 10/20/50/100-day SMAs around 98.2 / 98.4 / 99.1 / 98.6, while the 200-day SMA sits higher near 98.9, indicating that price remains slightly below the broader long-term band.

Momentum indicators show a 14-day RSI near 49, consistent with neutral conditions, while ADX around 21 suggests a modest trend backdrop rather than a strongly established direction. On the upside, the Classic R1 pivot near 99.32 is the first area to monitor, with a daily close above that level bringing the R2 region around 100.35 back into focus. On pullbacks, initial support lies near the Classic pivot around 98.53, with the 200-day SMA acting as a key moving-average reference; a sustained move below this area could open the way towards the S1 zone near 97.50 (TradingView, 7 January 2026).

This technical analysis is provided for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

US dollar index history

DXY spent much of 2024 trading within a relatively narrow 100–105 range, with periodic swings reflecting changes in interest-rate expectations and global risk sentiment. While prices fluctuated within this band, there were no sustained breakouts, leaving the dollar broadly firm against major peers.

That pattern shifted in early 2025, when DXY rose to peaks above 109 in January and February, before gradually declining through the spring and summer. From levels around 107–109 at the start of the year, the index fell back below 100 by late June and continued lower into autumn, briefly reaching the mid-96s in September, marking its weakest levels of the two-year period. Into late 2025 and early 2026, DXY has stabilised just below 100, closing at 97.96 on 31 December 2025 and 98.27 on 7 January 2026, leaving it well below earlier highs but above the third-quarter lows.

Past performance is not a reliable indicator of future results.

Capital.com analyst view: US dollar

The US dollar index has shifted from the elevated levels seen in early 2025 to a softer profile into January 2026, with the index now trading in the high-90s rather than the 100–109 range that dominated last year. This evolution aligns with a broader phase of consolidation following a strong cycle, as markets reassess US interest-rate expectations and global risk appetite. At the same time, the recent stabilisation below 100 suggests that demand for the dollar as a reserve and funding currency remains present, and sudden moves can still occur in response to macroeconomic data or policy developments.

You may wish to consider both the potential for rapid price movements in either direction and the impact of trading costs when assessing whether this type of exposure aligns with their objectives and risk tolerance.

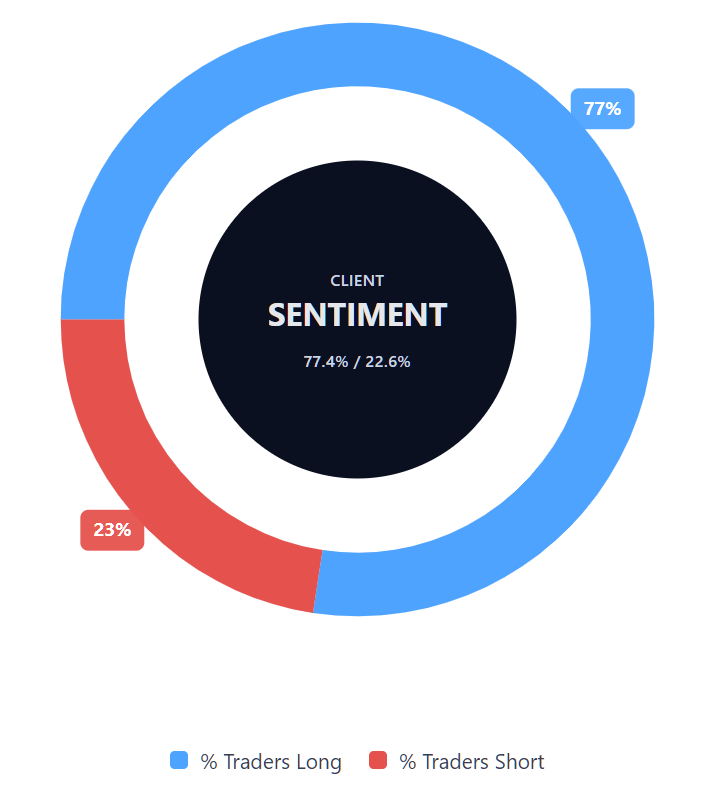

Capital.com’s client sentiment for US dollar CFDs

As of 7 January 2026, Capital.com client positioning in US dollar index CFDs is skewed towards long positions, with buyers accounting for 77.4% of open positions versus 22.6% sellers, a difference of 54.8 percentage points. This places DXY in heavy-buy territory, indicating that most open positions on the platform are positioned for further dollar strength rather than weakness. This snapshot reflects current open positions on Capital.com and can change over time.

Summary – US dollar index 2026

- The US dollar index (DXY) began 2025 near 109, spending the first quarter above 106 before trending lower through the year.

- From late spring into September 2025, DXY moved from the low-100s towards the mid-96s, marking the weakest levels of the two-year period.

- Into Q4 2025, the index recovered towards the high-90s but remained well below its early-year peaks, closing the year at 97.96.

- Technical readings at the turn of the year showed price hovering just below key longer-dated moving averages, with mixed signals across daily SMAs and EMAs.

- Momentum indicators such as the 14-day RSI remained near neutral levels, while ADX readings pointed to a modest trend backdrop rather than a strong directional move.

Past performance is not a reliable indicator of future results.

FAQ

What is the US dollar forecast?

Current third-party forecasts for the US dollar generally point to a mildly softer outlook over the medium term, reflecting expectations of further Federal Reserve easing and narrowing yield differentials. However, views are not uniform across institutions. Some analysts note that shifts in growth expectations, relative interest rates or capital flows could alter this trajectory. As a result, forecasts tend to focus on scenarios and risk factors, rather than fixed price targets.

What influences US dollar index movements?

The US dollar index is influenced by a range of macroeconomic and financial factors, including Federal Reserve policy, US Treasury yields, inflation data, and relative growth dynamics. Global risk sentiment, geopolitical developments and capital flows also play a role, given the dollar’s role as a widely used reserve and funding currency. Technical factors, such as market positioning and momentum, can further affect short-term price behaviour.

Could the US dollar index go up or down?

The US dollar index can move in either direction, depending on evolving economic data, policy signals and market expectations. Shifts in interest-rate outlooks, changes in global risk appetite or unexpected macroeconomic developments can all influence direction. While some scenarios may support further weakness, others could favour stabilisation or a rebound. Past price behaviour does not guarantee future outcomes, and volatility can increase around key economic or policy events.

How can traders access US dollar exposure using CFDs on Capital.com?

You can access exposure to US dollar index CFDs on Capital.com, which lets you take long or short positions without owning the underlying currencies. Alternatively, you may wish to trade CFDs on forex pairs that include the US dollar – such as EUR/USD, GBP/USD, AUD/USD, or USD/JPY*.

*Contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses.