LUNA 2.0 price prediction: Can the new crypto rebound?

The new LUNA token has plummeted since launch, but can it recover?

The Terraform Labs stablecoin UST and its accompanying LUNA cryptocurrency token collapsed in May, sending shockwaves throughout the crypto markets from which they have yet to recover. But in an attempt to restore the ecosystem, Terra relaunched its LUNA token with a new version at the end of May.

The so-called LUNA 2.0 token launched on 28 May 2022 and immediately plunged in value by 74%. It then fell by another 60% and a market crash saw it drop even further.

In this article we look at what happened to LUNA and the launch of the new token, and examine some of the LUNA 2.0 price predictions that were being made as of 20 December 2022.

Terra attempts to rebuild with LUNA ‘2.0’

The Terra project was founded in 2018 by former Apple (AAPL) and Microsoft (MSFT) software engineers: Do Kwon, who was previously founder and CEO of decentralised wireless mesh networking start-up Anyfi, and Daniel Shin, who co-founded South Korean e-commerce platform Ticket Monster and start-up incubator Fast Track Asia.

The project, somewhat ironically, aimed to drive the adoption of blockchain and cryptocurrency technology by focusing on price stability and user experience.

Terra focused on creating algorithmic stablecoins such as terraUSD (UST), which maintained its peg to the US dollar through a swapping mechanism with the LUNA token that enabled users to redeem 1 UST for $1 worth of LUNA tokens.

UST depegged from the US dollar over a few days from 9 May 2022, collapsing by 12 May and causing hyperinflation as sales of UST resulted in the minting of billions of LUNA tokens.

On 28 May, Terra relaunched the LUNA token without UST as a hard fork, or spin-off, of the blockchain. According to the project’s migration documentation, the “original Terra has rebranded to Terra Classic and a new chain is created with the existing Terra name… The original Cosmos chain will still run, with market swaps (mint/burn function) disabled.”

“The new chain is also a Cosmos chain, but will not have the treasury, oracle, or market modules of the original chain. The new chain’s native mining token will be LUNA. There will be no Terra stablecoins (UST, KRT, EUT, etc.) on the new chain.”

All of the LUNA coins that were previously on exchanges were renamed luna classic (LUNC) and all terra stablecoins were rebranded as terra classic stablecoins. TerraUSD (UST) became terraclassicUSD (USTC) and terraKRW (KRT) became terraclassicKRW (KRTC).

The initial maximum supply of LUNA coins on the new Terra chain is just over one billion, of which 127.4 million were in circulation at the time of writing on 20 December 2022.

“The mint module will release new coins every block as staking rewards at a default rate of around 7% [per annum],” the documentation said.

Let’s now take a quick look at the LUNA ‘2.0’ price history. While past performance should never be taken as an indicator of future results, knowing what the crypto has done in the past can help give us context if we want to either examine a LUNA price prediction or make one of our own.

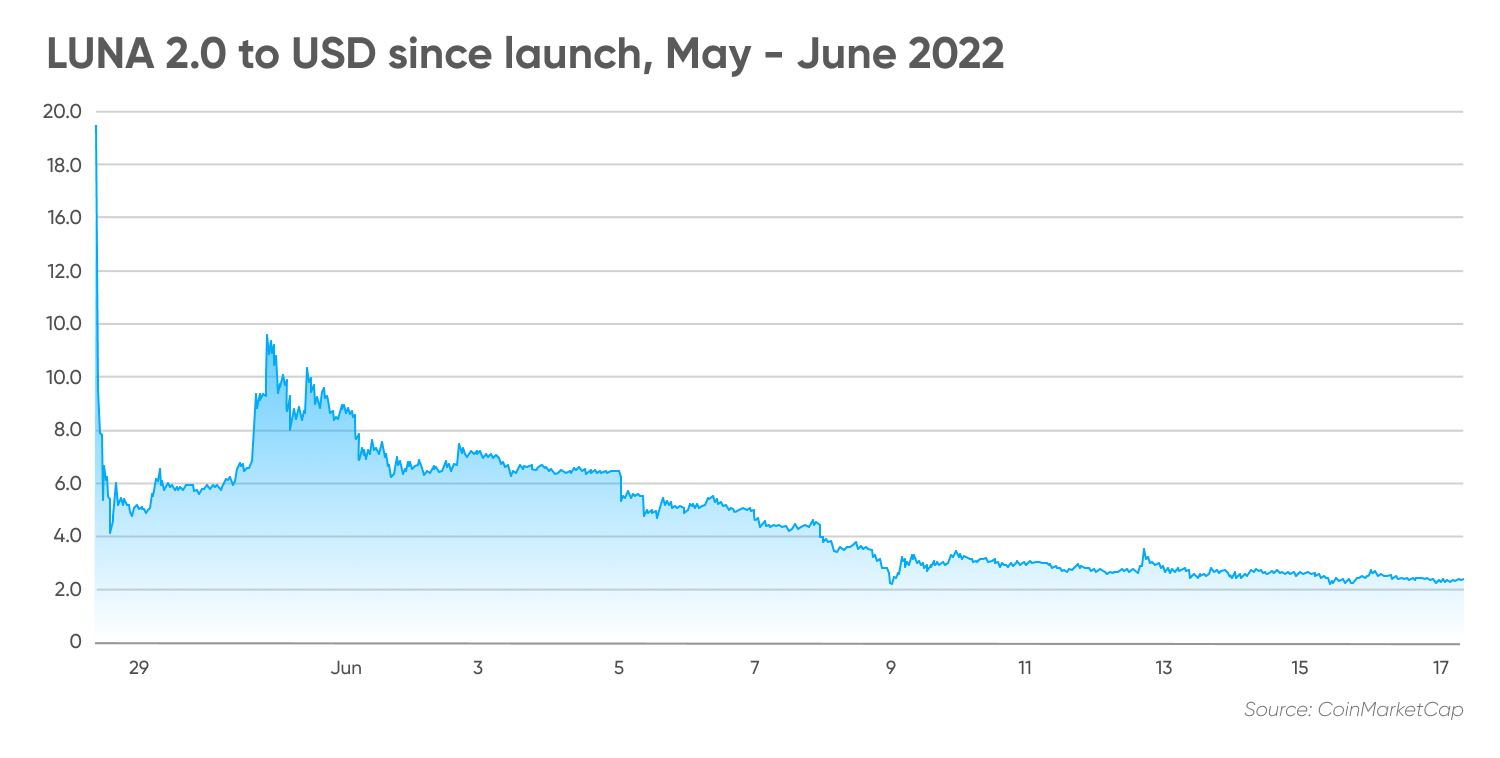

LUNA ‘2.0’ tokens were airdropped to LUNA holders starting on 27 May 2022. The new LUNA coin opened at a price of $18.98 on 28 May but immediately plummeted in value to end the day at $4.94.

Although the price moved back up to $11.97 on 30 May 2022, it fell again and by 8 June reached an intraday low of $1.96. Things got worse after the cancellation of withdrawals on the Celsius (CEL) crypto lending platform confirmed the bear market, and LUNA sank to a low of $1.66 on 18 June.

While there was some recovery after that, with LUNA trading at above $2 in early July and the start of April, there was still downward pressure and, on 29 August 2022, the coin reached an all-time low of $1.53.

After that there was some recovery and, on 10 September it reached a high of $7.06 before dropping down to $2.70 on 5 November. But things got even worse following the collapse of the FTX (FTT) exchange, when the market crashed yet again and LUNA sank to a low of $1.44 on 22 November.

Even though Kwon implied that FTX founder Sam Bankman-Fried had played a part in the downfall of UST, things got worse for LUNA and it fell to a low of $1.17 on 16 December before recovering somewhat to around $1.30 on 20 December 2022.

At that time, there were 127,475,474 LUNA in circulation out of a total supply of 1,004,262,701. This gave it a market cap of around $164m, making it the 128th-largest crypto by that metric.

How do analysts view LUNA 2.0?

Mads Eberhardt, a cryptocurrency analyst at Dutch bank Saxo, commented following the LUNA 2.0 launch that Terra “is somewhat ignoring that it has caused a meltdown worth billions”.

The UST collapse wiped out a total market capitalisation of $58bn, of which UST accounted for $18bn and LUNA $40bn.

“At some point, one should acknowledge one’s defeat and let a project die out. Terra should have been such a project,” the analyst said in a note published on 30 May.

“In our view, Terra has already caused enough harm to individuals and the crypto market as a whole. It genuinely seems the people behind Terra believe that they can always give it a new shot, in case their first effort did not turn out well, thus neglecting that their flawed design has already caused a meltdown worth billions.

“The case of Terra does not put the crypto market in a good light nor does the Terra 2.0 narrative of ‘let us just try again’. The crypto market should focus on projects that create value to become something else than a speculative asset class.”

Anders Helseth, a senior analyst at cryptocurrency research firm Arcane, pointed out that Terra’s stablecoin UST “worked as the perfect exit liquidity in what can be described as a prolonged pump and dump scheme”.

“A combination of LUNA supply control, the psychology of the dollar, and guaranteeing high yields secured with their own pre-mined tokens created sustained exit liquidity,” he said in a note.

As the Terra protocol had no built-in inflation mechanism, early token holders had two ways to profit – selling tokens to new token buyers, or holding the tokens until they appreciated in theoretical paper value.

“No block reward and a highly concentrated LUNA supply gave all power to the early holders,” Helseth wrote.

“Terra blockchain data shows that wallets connected to Terraform Labs and the large early LUNA holders have made tremendous profits… sets of John Doe wallets interacting closely in clusters have massive net outflows from the Terra ecosystem to bridges and centralised exchanges.

“The common denominator among the clusters is that one or more wallets in the cluster received significant transfers from Terraform Labs wallets or the largest John Doe wallets as of 3 October 2020.

“From October 2020 to 5 May 2022, the clusters have net outflows of $6bn to exchanges and through bridges (flow value calculated by using market prices at the time of transfer). In contrast, all the other hundreds of thousands of wallets have a net inflow of $6.5bn.

“By pumping the LUNA token, the burn/mint mechanism, and creating a sustained demand for the UST token through Anchor, the perfect exit liquidity for large LUNA bags was created. And the UST exit gates were used at scale for a set of very early LUNA holders. At best, the profits can be described as collateral winnings in a failed bootstrapping attempt.”

There were claims that Terra’s co-founder Do Kwon cashed out to the tune of $2.7bn in the months ahead of the UST crash, which he refuted in a Twitter thread.

Crypto analyst John Hargrave at Quantum Economics noted that there were “yellow flags that should have made people cautious about investing in Terra, and … red flags that we hope will keep investors from re-investing in Terra when it relaunches.”

The yellow flags included the fact that UST was an algorithmic stablecoin and that Terra is highly centralised around Do Kwon.

The red flags included the fact that Terra offered 19.5% in annual Interest through the Anchor protocol, paid from its reserves; and that Anchor held 75% of the Terra supply – unlike Ethereum, for example, which has a rich ecosystem of decentralised applications (dApps).

Do Kwon raised further red flags with instant plans to relaunch LUNA as a standalone token without the stablecoin, and by changing the proposal after voting began. That the vote still passed was another red flag, according to Hargrave.

“You'd have to be a LUNAtic to re-invest. As value investors, ask yourself: Where’s the value? Is Terra, the technology, really providing additional value to the world?” Hargrave wrote.

“Creating a new token out of thin air, getting rid of the stablecoin, and pretending as if nothing happened: How is that creating value? This is crypto, so anything could happen.”

LUNA 2.0 price prediction

With that all out of the way, let’s take a look at some of the LUNA 2.0 price predictions that were being made as of 20 December 2022.

It is important to remember that price forecasts, especially when it comes to something as volatile as cryptocurrency, often turn out to be wrong. Also, we should point out that long-term crypto price forecasts are often made using an algorithm, which means they can change at any time.

First, Gov Capital had a LUNA 2.0 price prediction for 2023 that suggested bad times were just around the corner. The site suggested that the coin could start the new year at about $9.01 but, by 28 January, it could drop to a level to be so low as not to be worth recording.

That said, Gov Capital nevertheless did not expect LUNA to become a dead coin, because it made a one-year price forecast for terra of $56.08 and thought it could reach a staggering $348.89 in five years’ time.

Next, Coin Codex had a short-term LUNA 2.0 coin price prediction that argued terra could drop to $1.18 by 25 December before making a very small fightback to $1.21 on 19 January 2023. The site’s technical analysis was, appropriately, bearish, with 20 indicators sending out negative signals against just four making bullish ones.

Meanwhile, CaptainAltCoin was also downbeat in terms of its LUNA 2.0 crypto price prediction. The site suggested it could drop to $0.6204 by March 2023 and trade at $1.21 by December 2023. The site then made a LUNA 2.0 price prediction for 2025 that saw it recover to $1.91.

That was as good as CaptainAltCoin thought things could get, though, with the site suggesting that by December 2027 LUNA could be worthless. There was also no prognosis of a recovery, with its LUNA 2.0 price predictions for 2030 and 2040 both coming in at $0, making it a de facto dead coin.

Finally, Wallet Investor was a lot more optimistic when it came to making its terra 2.0 price prediction. The site said that the coin could rise to reach a potential $34.64 in September 2023 and then hit a little below $160.23 in five years’ time.

When considering a LUNA price prediction, it’s important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin or token’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns, and never trade with money that you cannot afford to lose.

FAQs

Is LUNA 2.0 a good investment?

Cryptocurrencies are high-risk assets, especially coins like LUNA, which have a history of instability. Only you can decide whether LUNA 2.0 is an appropriate investment for your portfolio, depending on your risk tolerance, portfolio size and goals.

Remember, you should always carry out your own thorough research before making an investment. Even high market cap cryptocurrencies have proved vulnerable to the current bear markets, ao investors should be prepared to make losses and never purchase more than they can afford to lose.

Will LUNA 2.0 go up or down?

Forecasting sites differed in their view of the LUNA 2.0 token price in the future as of 20 December 2022, with some projecting the price will fall, while others predicted different levels of gains. That difference in predictions reflects the importance of doing your own research to take an informed view about potential future price moves. Note that analysts’ and algorithm-based predictions can be wrong, and that prices can go down as well as up.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether LUNA is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors.

Keep in mind that past performance is no guarantee of future returns, and never invest money that you cannot afford to lose.

Should I invest in LUNA 2.0?

This is a question that you will have to answer for yourself. Before you do so, however, you will need to conduct your own research. Never invest more money than you can afford to lose, because prices can go down as well as up.