Tencent (0700) share price forecast: China’s most valuable company surged nearly 40% in November

The Tencent stock price has seen a surge in the past couple of months, can the uptrend continue?

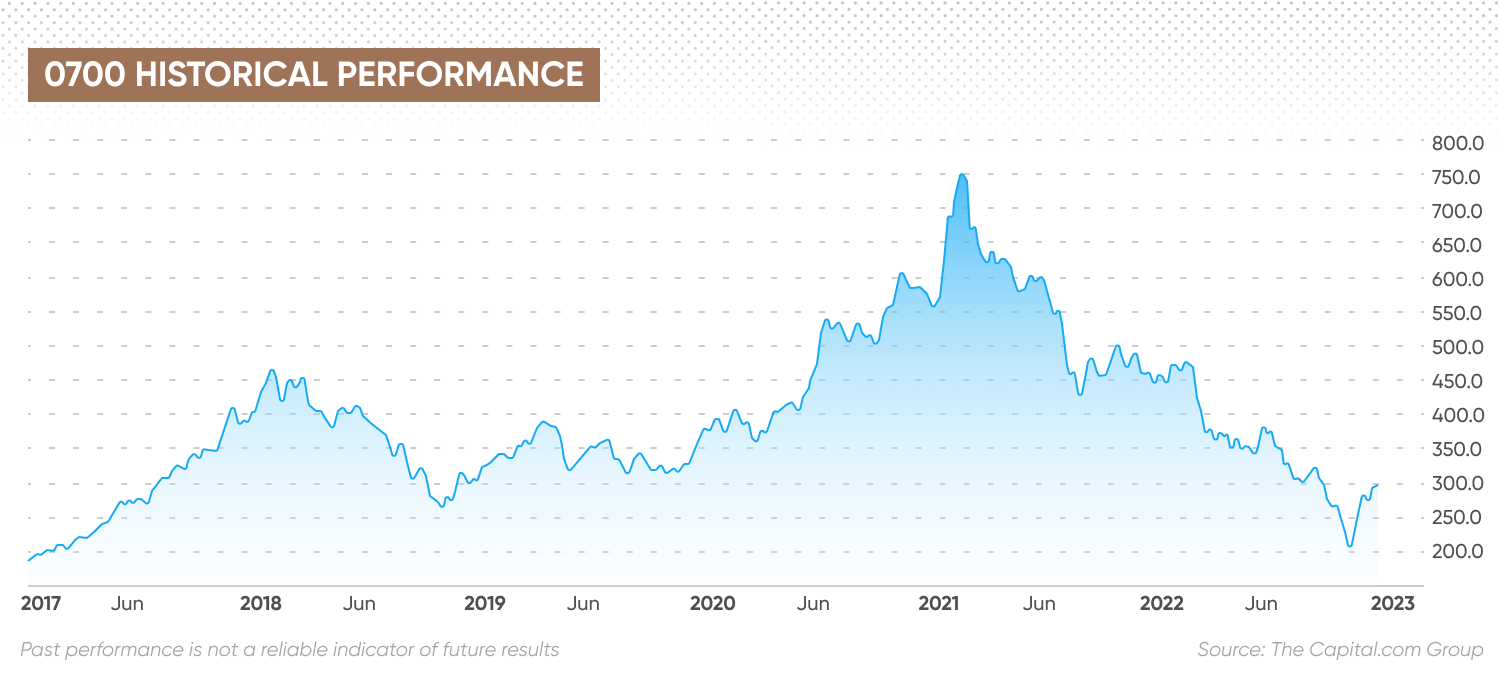

Tencent Holdings (0700), China’s biggest company by market capitalisation, staged a rebound in November as the stock rose from its lowest price in over five years.

However, the tech giant remained over 60% below its all-time high, despite surging about 40% in November.

Tencent Holdings (0700) live price chart

Has the 0700 stock price fallen to attractive levels that warrants a deeper assessment? Read our company analysis and Tencent stock forecast for 2023 and beyond.

Tencent Holdings: China’s most valuable company

Tencent Holdings is a Chinese technology conglomerate primarily focused in internet value-added services, gaming and telecommunication services.

The company classifies its revenue streams into key business lines which include:

-

Communication and social: Tencent operates China’s largest instant messaging app by monthly active users called WeChat or Weixin. The mobile app has developed into a super app over the years.

-

Digital content: It also operates one of China’s largest video streaming platform under Tencent Video

-

Gaming: Popular mobile games in Tencent’s portfolio include PUBG Mobile, Clash of Clans, Honor of Kings, among others.

-

Online advertising

-

FinTech

-

Cloud and other business services

Tencent is listed on the Hong Kong Stock Exchange (HKEX) under the ticker 0700. The company is headquartered in Shenzhen, China.

As of 7 December, Tencent had a market capitalisation of HKD3.03trn ($3.9bn), making it the most valuable company listed in Hong Kong.

According to Morningstar, Tencent is “arguably the most influential internet firm in China as one can hardly go by a day without using its products”.

The investment research firm added that Tencent owns Honor of Kings, the world’s top grossing mobile game, and is the world’s largest video game vendor.

Tencent stock price analysis

Sino-US tensions a key risk for Tencent

Tencent Holdings’ stock has experienced wild swings in recent years, marked by record highs and multi-year lows. Domestic regulatory developments and Sino-US relationship concerns have emerged as key risks for Tencent shareholders.

In January 2018, Tencent rose to a then-record high of HKD476.6 following a run of 13 consecutive months of gains.

In the months that followed, Tencent only saw one month of gains in nine as Sino-US tensions worsened following former US President Donald Trump’s commencement of a tit-for-tat trade war with Asia’s largest economy.

Tencent stock slumped nearly 50% from its January high to HKD251.4 by October 2018.

At the start of 2020, Tencent stock rebounded to HKD375. The Chinese tech giant extended its recovery as its portfolio of gaming, video streaming and social media businesses helped the company’s earnings weather the economic downturn brought on by Covid-19-induced lockdowns.

While global peers underperformed in the difficult economic conditions of the Covid-19 era, Tencent stock surged to an all-time high of HKD775.6.

Beijing regulatory blitz hurts Tencent in 2021

Tencent stock went on to experience its worst periods of losses in succeeding months as China embarked on a regulatory drive in 2021.

Chinese tech stocks were hit the hardest as authorities in Beijing scrutinised a wide range of concerns including data security, gaming addiction, education expenses and antitrust issues.

Gaming stocks saw intense selloffs as state-affiliated news agencies in China described video games as “spiritual opium” and “electronic drugs”. By August 2021, Beijing authorities had placed restrictions that limited minors from playing video games to only one hour a day on weekends and holidays.

Regulators also took notice of Tencent’s dominance of the music streaming industry. The company’s music streaming unit Tencent Music was forced to give up its exclusive music rights in July 2021 as the State Administration for Market Regulation (SAMR) took matters into hands to restore market competition.

Furthermore, the advertising industry in China saw a slowdown after tutoring firms were forced to go non-profit and were barred from listing on the stock market.

Tencent closed 2021 at about HKD456, giving a year-to-date (YTD) loss of over 18%.

Tencent slumps to over five-year low in 2022

2022 proved to be a similar story for the Tencent stock. The gaming-to-social media firm extended its losses into the year due to weakness at its core gaming and advertising businesses.

Frequent lockdowns in China due to the ongoing zero-Covid policy continued to hurt Chinese businesses through the year. In November, Tencent reported a back-to-back drop in quarterly revenue.

Rumours of technology investment firm Prosus and Naspers plan to offload their stake in Tencent also caused a negative overhang on the stock.

By 25 October, Tencent slumped to HKD198.6, its lowest since January 2017.

However, on 1 November, Dutch investment group Prosus clarified the speculation and said that it had only sold “small numbers of ordinary shares in Tencent” to fund its share repurchase programme.

Prosus also reiterated its “continued confidence in Tencent's long-term prospects”.

Tencent stock surged nearly 40% in November, following the clarification from its major shareholder. An announcement of Tencent distributing shares of food delivery company Meituan to its shareholders also propped the price.

As of 7 December’s close, Tencent stock traded at about HKD300, following YTD losses of over 33%.

The 0700 stock price was down over 61% from its all-time high of HKD775.6 hit in February 2021.

Fundamentals analysis: Weakness in earnings

Tencent’s quarterly reports in 2022 revealed the weakness in earnings growth experienced through the year. The company reported flat revenue growth in the first quarter, hurt by lower user activity and spending in the mobile game industry.

The second quarter saw revenue fall 3% year-over-year (YOY) due to a slump in online advertising earnings.

Tencent carried out cost-cutting measures by exiting non-core businesses and lowering marketing spends as quarterly profit fell for 55% YOY in the June 2022 quarter.

On 16 November, Tencent said it would divest its over 90% of its stake in Meituan by distributing over 958 million Meituan shares to Tencent shareholders.

Tencent had similarly divested 86% of its state in Chinese e-commerce company JD.com (JD) in the form of a special dividend to its shareholders in late 2021.

Q3 2022 saw the company report consecutive YOY drops in quarterly revenue. Revenue for the quarter slipped 2% YOY to RMB140.09bn ($20.07bn) due to continued weakness in domestic online advertising and gaming markets. Profits came in at RMB38.84bn, down 3% from the previous year.

Tencent stock forecast for 2023 and beyond

Analysts at investment firm Jefferies expected Tencent’s international game revenue to grow at a faster rate than its domestic market on the back of strategic partnerships with French video game development studio Ubisoft and new releases such as Tower of Fantasy and GODDESS OF VICTORY: NIKKE.

As for online advertising revenue, which was about 15% of its most recently reported quarterly revenue, Jefferies said it expected positive YOY growth in online advertising revenue in the fourth quarter.

In its Tencent stock predictions, Jefferies rated the stock ‘buy’ and set a price target of HKD421, representing an upside of over 40% from 7 December close of HKD300.2.

Elsewhere, research firm Morningstar maintained its fair value estimate of HKD741 for Tencent Holdings, with senior equity analyst Ivan Su saying:

In its Tencent share price forecast, Japanese investment firm Nomura cut the target price from HKD420 to HKD398 following its Q3 earnings results.

Meanwhile, Iris Pang, Greater China chief economist at ING Think, said increased regulation of China’s consumer tech industry has seriously dented company revenues with widespread implications.

“This note has found that intensive regulation of the internet sector in China has more serious consequences than just the fines and penalties imposed so far,” said Pang.

“The potential loss in value could be close to CNY21trn between 2021-2030, which is a lot bigger than the fines and penalties of CNY303.5bn in 2020-2022. This loss of revenue could be reflected in less innovation and creative business ideas.”

Finally, an artificial intelligence-based 0700 stock forecast from Wallet Investor expected Tencent stock to close the first quarter of 2023 at an average price of HKD313.5.

The forecaster’s Tencent stock forecast for 2025 saw the stock closing the year at HKD288.

When looking for Tencent stock projections, it’s important to bear in mind that analysts’ forecasts can be wrong. Analysts’ predictions are based on making a fundamental and technical study of the stock’s performance. However, past performance is no guarantee of future results.

It’s important to do your own research and always remember your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never invest more than you can afford to lose.

FAQs

Is Tencent a good stock to buy?

In its Tencent stock predictions, Jefferies rated the stock ‘buy’ and set a price target of HKD421, which represented an upside of over 40% on the 7 December close of HKD300.2.

However, analysts’ predictions can be wrong and have been inaccurate in the past. It is important to do your own research. Only you can decide whether Tencent is suitable for your portfolio. Always conduct your own due diligence, looking at the latest stock news, a wide range of analyst commentary, technical and fundamental analysis.

Remember, past performance does not guarantee future returns. And never trade with money you cannot afford to lose.

Will Tencent stock go up?

No-one can know for sure. At the time of writing, research firm Morningstar maintained its fair value estimate of HKD741 for Tencent Holdings. And Jefferies rated the stock ‘buy’ and set a price target of HKD421. While, Japanese investment firm Nomura in its Tencent share price forecast cut its target price from HKD420 to HKD398 following its third quarter earnings.

However, analysts’ predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before trading. And never invest or trade money you cannot afford to lose.

Should I invest in Tencent stock?

Your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. Always conduct your own research before investing. And never invest more than you can afford to lose.