Cryptos vs stocks: how do you trade them?

Cryptos vs stocks: an overview

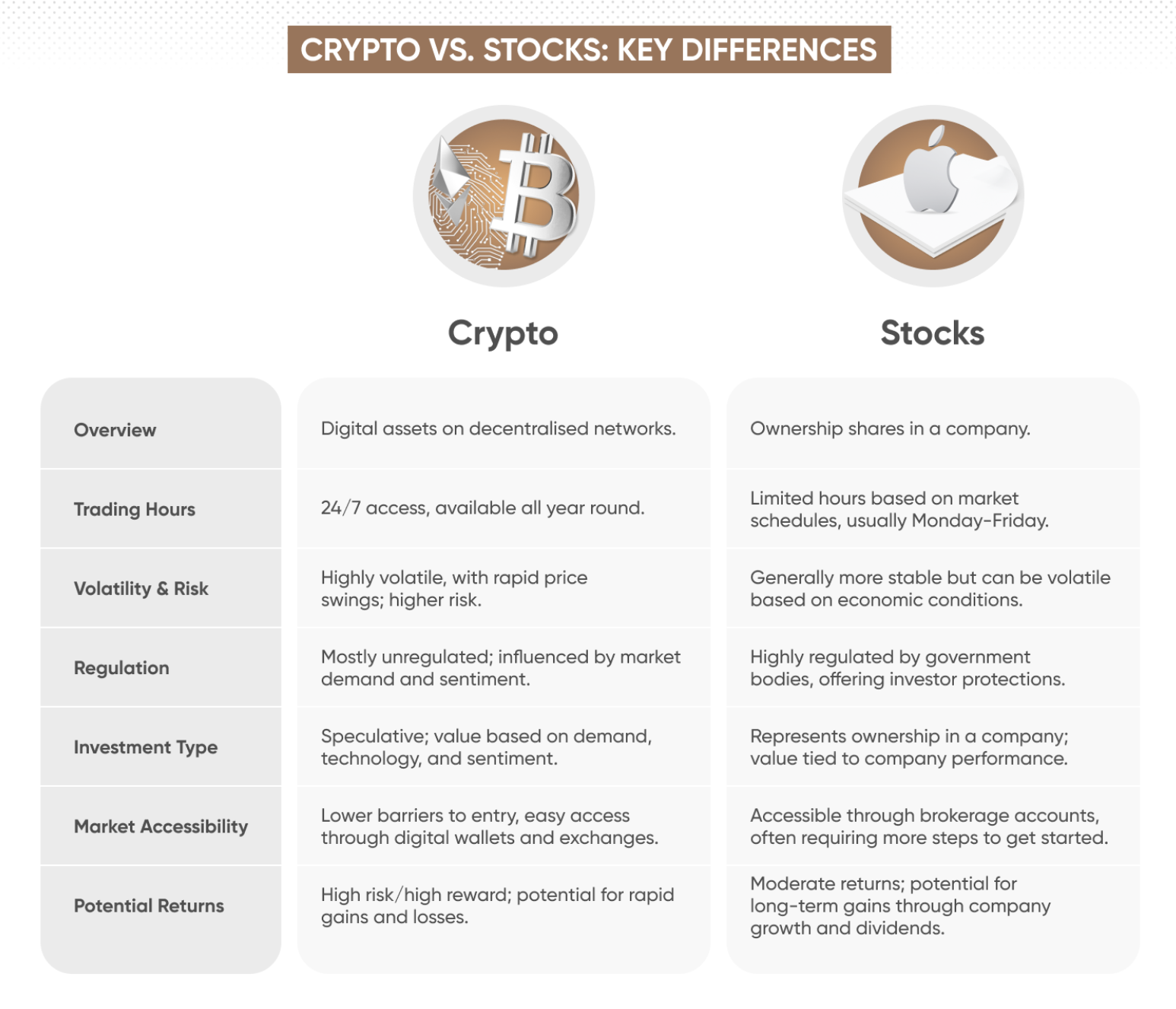

When comparing cryptos with stocks (the latter traded with us via shares), there are a range of key differences that influence trading strategies and outcomes. Cryptocurrencies offer high volatility, 24/7 trading, and fewer regulatory constraints, which may appeal to those seeking quick opportunities and flexible trading hours.

Stocks, on the other hand, are more regulated, generally less volatile, and offer relative stability through underlying company performance, meaning they may be chosen by traders interested in a more structured environment. See the graphic below for more on what to expect from these two instruments.

Why trade cryptocurrencies?

Cryptocurrencies may appeal to traders for various reasons, from high growth potential to constant market access. Here are the main reasons you may choose to trade cryptos.

24/7 trading access

Cryptocurrency markets operate around the clock, offering you the flexibility to trade at any hour without being limited by traditional market or banking hours.

Potential for high returns

Cryptocurrencies are known for their high volatility and rapid growth potential, often providing substantial returns that can outpace more traditional asset classes. However, this also means a higher risk of losses, making it essential to approach crypto trading with caution.

Innovation and portfolio diversification

Trading cryptocurrencies provides exposure to cutting-edge technologies and innovations. It also offers a unique way to diversify a portfolio, allowing investors to balance traditional assets with digital currencies.

CFD access

When trading cryptos with CFDs through a derivatives broker, you can access leverage (also known as margin trading), meaning you can control large positions with a relatively small outlay. This amplifies potential profits, but also losses, making leveraged trading risky.

Whatever reason you have for trading cryptos, it’s important to remember that they’re highly volatile, and past performance is not a reliable indicator of future results.

Learn more about cryptocurrencies.

Why trade stock CFDs?

Trading stocks as CFDs often appeals to those seeking flexibility and leverage without the need for direct ownership. Here are some common reasons for choosing stocks.

CFD access

Stock CFDs let you speculate on share price movements, profiting from both rising and falling markets without having to own the underlying stock. With leverage (also known as margin trading), you can gain greater exposure with less capital, although this amplifies losses as well as profits. CFDs also provide access to global markets, enabling diversification and quick responses to market events.

Dividend adjustments

When trading stock CFDs, many brokers offer dividend adjustments, which provide traders with cash adjustments that mirror dividend payouts from the underlying stocks, creating potential for income without share ownership.

Regulatory oversigh

Stock markets are regulated, bringing a level of transparency and protection to the underlying assets that CFDs track. While CFD trading is more speculative, the assets themselves are subject to oversight, adding a layer of trust for traders.

How crypto vs stocks trading differs

There are a range of ways cryptos and stocks differ, such as their typical liquidity, market sentiment, and external influences, and these factors can all affect trading decisions. Here’s a breakdown of these distinctions to help you decide which market may better align with your trading goals.

Regulation

Stocks are heavily regulated by bodies like the SEC, ensuring investor protection, fair markets, and mandatory company disclosures. Cryptocurrencies, however, operate in a largely unregulated space, though this is gradually changing. For CFD traders, this difference in regulation may mean additional caution is needed when trading cryptocurrencies.

Ownership status

When bought outright, stocks represent partial ownership in a company, linking their value to the company’s performance and financial health. This intrinsic value makes stocks generally less speculative. However, when traded as CFDs, you can speculate on price movements without owning the shares, focusing purely on market opportunities.

Meanwhile, cryptocurrencies are digital assets that can also be owned outright. However, they don’t represent ownership of a company or tangible asset. Their value depends on factors like technology adoption, market demand, and investor sentiment.

Volatility

Cryptocurrencies are known to be far more volatile than stocks, with large price swings driven by factors like regulatory news, technological developments, and market sentiment. This makes them attractive to speculative traders but riskier for those seeking stability.

Stocks, on the other hand, are generally steadier, with prices tied to company performance and broader economic trends. Crypto-related stocks offer a middle ground, often more volatile than traditional stocks but less so than cryptocurrencies, providing an alternative for traders seeking partial crypto exposure. But while stock trading can be less volatile overall, that doesn’t mean they always are. As always, past performance is not a reliable indicator of future results.

Liquidity

Stocks generally offer higher liquidity than most cryptocurrencies, particularly for large, well-established companies. This higher liquidity can make it easier to enter and exit trades without significantly affecting the asset’s price, meaning slippage may be minimised.

Cryptocurrencies can vary greatly in liquidity, with major coins like Bitcoin and Ethereum being relatively liquid, while lesser-known altcoins like BONK or SUI may be harder to trade without significant price impact. For derivative traders, this liquidity difference is worth considering, as it can influence the ability to trade at desired prices and manage risks effectively.

Market sentiment and external influence

Cryptocurrencies are highly sensitive to sentiment-driven events like social media trends, influencer statements, and major news, leading to sharp price swings.

Stocks, while also impacted by sentiment, are more influenced by company fundamentals, economic data, and regulatory updates. For traders comparing crypto and stocks, the latter often respond more predictably to external factors, while cryptos are more prone to sentiment-fuelled volatility.

How crypto and stocks trading are similar

Despite being different asset classes, crypto and stocks share key trading dynamics. Both allow speculation on price movements, whether rising or falling. Crypto and stock trading also rely heavily on market analysis, with traders using both technical analysis and fundamental insights to make informed decisions.

Both asset types are accessible via platforms offering tools like leverage, CFDs, stop-loss orders, and high-frequency trading. This overlap in strategies and risk management, which makes both appealing for traders seeking speculative opportunities in dynamic markets.

What are crypto and stock trading hours?

Crypto markets operate 24/7, offering unmatched flexibility for traders but also the risk of sudden price swings during off-hours.

Stocks, in contrast, follow fixed trading hours tied to their exchanges (eg., 9:30am–4:00pm ET in the US), with limited after-hours activity. This structure provides more predictable price movements, concentrated during regular business hours.

Learn more about world trading hours.

What are crypto related stocks?

Crypto-related stocks are shares of companies involved in the cryptocurrency industry or blockchain technology, offering indirect exposure to the growth and developments in the crypto market. These might include:

-

Cryptocurrency mining companies like Marathon Digital and Riot Blockchain, which generate revenue by mining popular cryptocurrencies like Bitcoin.

-

Crypto exchanges such as Coinbase, which facilitate trading and custody of cryptocurrencies for retail and institutional clients.

-

Blockchain technology firms like Block (formerly Square) and IBM, which use blockchain solutions to streamline financial services, data security, and supply chain management.

-

Payment processors embracing crypto such as PayPal and Visa, which integrate crypto payments into their platforms, allowing customers to buy, hold, and spend crypto.

Investing in crypto-related stocks can provide exposure to the cryptocurrency sector with the added stability and regulatory oversight of the traditional stock market.

Crypto vs stocks: potential trading strategies

While both stocks and cryptocurrencies can be traded using CFDs, the strategies often differ due to factors like market volatility, liquidity, and trading hours. Below are two simple strategies – one for stocks and one for crypto – to illustrate the differences.

Stock CFD strategy: moving average crossover

A common strategy for stock CFDs uses a moving average (MA) crossover, where traders look for a shorter-term MA crossing above a longer-term MA as a bullish signal and crossing below as a bearish signal. Here’s how it might be executed:

-

Watch the 30-minute chart – look for a 20/50 MA crossover to confirm trend direction.

-

Check a lower timeframe (5-minute or 15-minute chart) – wait for a pullback to support, and a candlestick confirmation before entering.

-

Enter long – once support holds, you may choose to enter the trade and set a stop-loss below the swing low on the lower timeframe.

-

Monitor the trade – stay in as long as the 30-minute trend remains intact (price above the 20 MA).

-

Exit using the 30-minute chart – you may opt to exit the trade when price drops below the 20 MA or hits a key resistance level.

-

Check the lower timeframe for fine tuning – if price fails to make new highs, exit on the lower timeframe before a reversal.

Past performance is not a reliable indicator of future results.

Crypto CFD strategy: breakout trading

Given crypto's higher volatility and 24/7 market, breakout trading is a common strategy, focusing on key support and resistance levels to make sense of price movements.

-

Look for a key resistance level that the price has tested multiple times.

-

If the price breaks above resistance with strong volume, you may choose to enter a long position.

-

If the price breaks below support, you may opt to go short.

-

Stop-loss orders are placed just outside the breakout level to manage risk.

Crypto vs stocks: which is better for derivative traders?

When it comes to deciding between crypto or stocks, it largely depends on trading goals and risk tolerance. For derivative traders seeking high volatility and quick opportunities, cryptocurrencies might offer more appeal due to their price volatility and 24/7 trading schedule. However, for those looking for stability and a well-regulated environment, stocks provide a more structured option with ties to underlying company performance.

Need more support? Try our step-by-step stock course or crypto course to guide you through the basics to the advanced concepts. Explore potential profits and losses on your CFD trades with our free profit calculators.

FAQs

Is it better to invest in crypto or stocks?

Whether it’s better to invest in crypto or stocks depends on your investment or trading objectives and comfort with risk. Stocks represent ownership in established companies, often providing dividends and long-term growth potential tied to the company’s financial health. This makes them appealing for investors focused on stability and income. Cryptocurrencies, while highly volatile and largely speculative, offer exposure to innovative technology and potential for high returns. Diversifying across both asset classes could provide a balance, allowing you to capture the growth of emerging digital assets while maintaining stability through stocks.

What are the main risks of trading crypto vs stocks?

Trading crypto and stocks each come with unique risks. Cryptocurrencies are highly volatile and largely unregulated, making them susceptible to sharp price swings and cybersecurity threats, such as hacking. Stocks, while generally more stable, are still affected by market fluctuations, economic conditions, and regulatory changes. Understanding the specific risks associated with each asset class can help traders make informed decisions based on their risk tolerance and financial goals.

Can I diversify my portfolio with both crypto and stocks?

Yes, diversifying your portfolio with both crypto and stocks can be a strategic way to balance potential returns and manage risk. Stocks provide exposure to established companies with underlying value, while cryptocurrencies offer a high-risk, high-reward profile in emerging technology markets. Combining both can give investors a blend of stability and growth potential, allowing them to capture gains from different sectors and asset classes.

Find out more about crypto and stocks trading

What is cryptocurrency trading?