Solana coin price prediction: Third-party outlook

Solana (SOL) traded at $186.34 as of 14:07 UTC on 21 October 2025, staying within its daily range of $183.73–$193.85. The price remains close to this week’s low after retreating from Monday’s peak, following a wider crypto sell-off.

The downturn came after $19bn in leveraged positions were liquidated between 10–11 October, as markets reacted to U.S. President Trump’s announcement of 100% tariffs on Chinese imports – triggering sharp volatility across Bitcoin and altcoins (Reuters, 14 October 2025).

Solana price prediction 2025-2030: Analyst price target view

DigitalCoinPrice (independent research)

DigitalCoinPrice forecasts an average Solana price of $369.73 for 2025, rising to $451.08 in 2026. The outlook reflects continued network development and expanding on-chain activity, particularly within DeFi and NFT markets (DigitalCoinPrice, 21 October 2025).

CryptoPredictions (formerly TradingBeasts)

CryptoPredictions expects Solana to trade between $147.33 and $216.66 by December 2025, with an average of $173.33. The forecast notes that on-chain growth may offset regulatory pressures and market sentiment changes (CryptoPredictions, 21 October 2025).

Gov Capital (quantitative models)

Gov Capital’s algorithm-based outlook projects Solana coin at $493.97 within one year, citing increased NFT activity and ongoing DeFi protocol scaling. However, the platform notes potential volatility linked to shifts in market sentiment (Gov Capital, 21 October 2025).

CoinCodex (technical indicators)

CoinCodex’s model estimates an average Solana price of $202.47 in 2025 and $208.78 in 2026, supported by a neutral RSI reading and stable moving averages (CoinCodex, 21 October 2025).

Predictions and third-party forecasts are inherently uncertain, as they cannot account for unforeseen market events. Past performance is not a reliable indicator of future results.

SOL price: Technical overview

On the daily chart (21 October 2025), SOL/USD remains below its main moving average cluster – the 20-, 50-, 100- and 200-day moving averages (DMAs) at approximately 206, 215, 200 and 175 – keeping the near-term bias muted. Momentum is largely neutral, with the 14-day RSI at 41.5, indicating indecisive trading conditions.

The first level to monitor on the upside is the 217.7 pivot; a daily close above this could bring the 280.5 area into focus. On the downside, initial support lies around 181.8, and a break below the 200-DMA near 175 could open the way to lower levels (TradingView, 21 October 2025).

This is technical analysis provided for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Solana price history

Solana’s SOL token ended at $185.96 on 21 October 2025, compared with $165.02 on the same date in 2024. Over the past year, SOL rose to a high of around $294.43 on 19 January 2025 before retreating to trade within the $180–240 range.

Between October 2023 and October 2024, SOL advanced from about $102 to $165, following a mid-2024 decline below $95. The token subsequently moved above $200 in October 2024, which preceded its strong performance in early 2025.

Past performance is not a reliable indicator of future results.

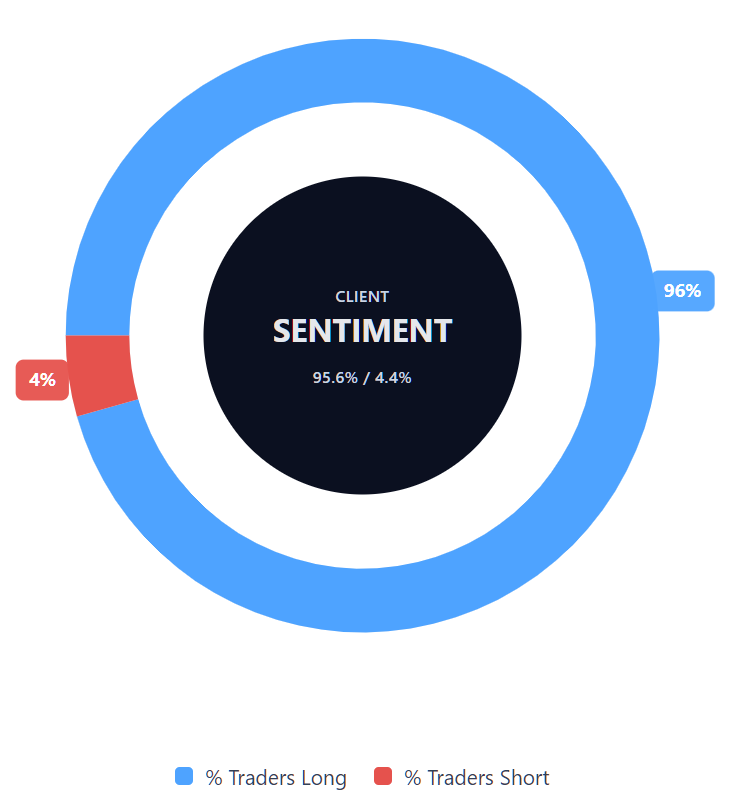

Capital.com’s client sentiment for Solana CFDs

As of 21 October 2025, buyers account for 95.6% of open Solana CFD positions, compared with 4.4% held by sellers, indicating a notable tilt towards long positions and placing buyers ahead by 91.2 percentage points. This snapshot represents current open positions on Capital.com and is subject to change.

FAQ

What is the Solana price prediction?

Third-party forecasts for Solana differ significantly. As of October 2025, projections from independent platforms range between $147.33 and $493.97 for the following year, depending on assumptions about network growth, market sentiment and broader cryptocurrency trends. These projections are not guaranteed and may change as conditions develop.

Who owns the most Solana?

The largest holders of Solana (SOL) include the Solana Foundation, early project contributors, and a mix of institutional and individual investors. Holdings are distributed across multiple wallets, with data available via public blockchain explorers.

How many Solana coins are there?

According to Solana’s network data, the maximum supply is not fixed, while the current circulating supply is estimated at over 450 million SOL. New tokens are created through inflationary rewards for validators and stakers, which may be adjusted over time by the network.

Could Solana’s price go up or down?

Solana’s price is influenced by factors such as market demand, adoption levels, regulation and overall risk sentiment. Like other cryptocurrencies, it can fluctuate sharply depending on wider market conditions and investor activity.

Should I invest in Solana?

Capital.com does not provide investment advice. Whether to trade or invest in Solana depends on individual research, risk appetite and financial goals. It is important to note that cryptocurrency and CFD trading involve risk, and prices can move rapidly in either direction. Contracts for difference (CFDs) are traded on margin – leverage amplifies both profits and losses.