Shopify stock forecast: To buy, or not to buy SHOP post-split?

After dropping for the majority of the first half of 2022, where to next for the SHOP share price? Read on to learn more.

Shopify’s stock split on a 10-for-1 basis on 28 June, one of several technology stocks that have split in 2022. The share price has continued to decline, so is it a good investment at a lower price, or should you consider shorting the stock?

In this article, we take a look at the company, how the Shopify stock split news has affected the share price, and the latest Shopify stock predictions to help you better navigate the market.

Who founded Shopify?

Shopify was launched in 2006 in Ottawa, Canada, by co-founders Tobias Lütke, Daniel Weinand and Scott Lake, after they encountered difficulties with existing e-commerce platforms while building an online store to sell snowboarding equipment.

Lütke, a computer programmer, built a new platform to launch the store. The team then launched the product as Shopify for other online businesses to use. The system is designed to make it fast and straightforward for businesses to start and maintain an online store without requiring a background in e-commerce.

According to the Shopify website:

Shopify’s service enables businesses to create online stores using its website builder and shopping cart suite. They then have access to a suite of store management and marketing tools, as well as a mobile app and support team. Shopify also offers integrations with other e-commerce sites and platforms to help businesses manage their stores and marketing with external tools. Shopify sells monthly subscription plans based on the features a business needs to use.

Shopify brings together multiple sales channels into a single e-commerce platform, so that merchants can use their single Shopify store account to sell their products and services through online stores, marketplaces and social media, mobile websites and apps, physical store locations and pop-up shops.

The company launched its shopping cart system in 2007 and retailers using the platform reached $100m in sales in March 2010. Shopify raised $7m in Series A venture capital financing in December 2010, attracting Bessemer Venture Partners, FirstMark Capital and Felicis Ventures. It followed that with a $15m Series B round in October 2011, with Georgian Partners joining the previous investors.

SHOP share price: historical performance overview

Shopify launched its initial public offering (IPO) in May 2015 on the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE) with the ticker symbol SHOP. The IPO was priced at $17 per share.

The share price gradually trended higher over the following years but began to accelerate in 2019 as the company’s investments in services, fulfilment and international expansion drove up its revenue and it surpassed one million merchants on the platform. The stock was trading at an all-time high before the start of Covid-19 pandemic lockdowns in March 2020. While the share price dipped to late-2019 levels, it quickly rebounded and accelerated as the pandemic prompted a massive increase in online retail.

The Shopify stock price reached an all-time intraday high of $1,762.90 per share and a closing high of $1,690.60 on 19 November 2021, the company having reported a 46% year-on-year jump in third-quarter revenue to $1.1bn in late October. That attracted the attention of investors on social media, which increased interest from retail traders. The stock was also carried along with a broader technology sector rally.

But tech stocks have suffered so far in 2022 from unfavourable comparisons in their earnings results with the explosive growth at the height of the pandemic, as well as macroeconomic concerns. With inflation at 40-year highs, central banks around the world have begun aggressively raising interest rates and easing back on asset purchases. This has raised expectations of a global economic slowdown that could tip into a recession and hit sales at high-growth technology companies like Shopify.

Companies with high share-price valuations after periods of rapid growth like Alphabet (GOOGL) and Amazon (AMZN), as well as Shopify, have opted to split their stock. While a stock split does not affect a company’s overall valuation, it increases the share count and reduces the price for each share. This makes the shares more accessible to retail investors with small portfolios who do not have access to partial shares in their trading accounts and can increase interest in a stock.

Shares extend losses post Shopify stock split

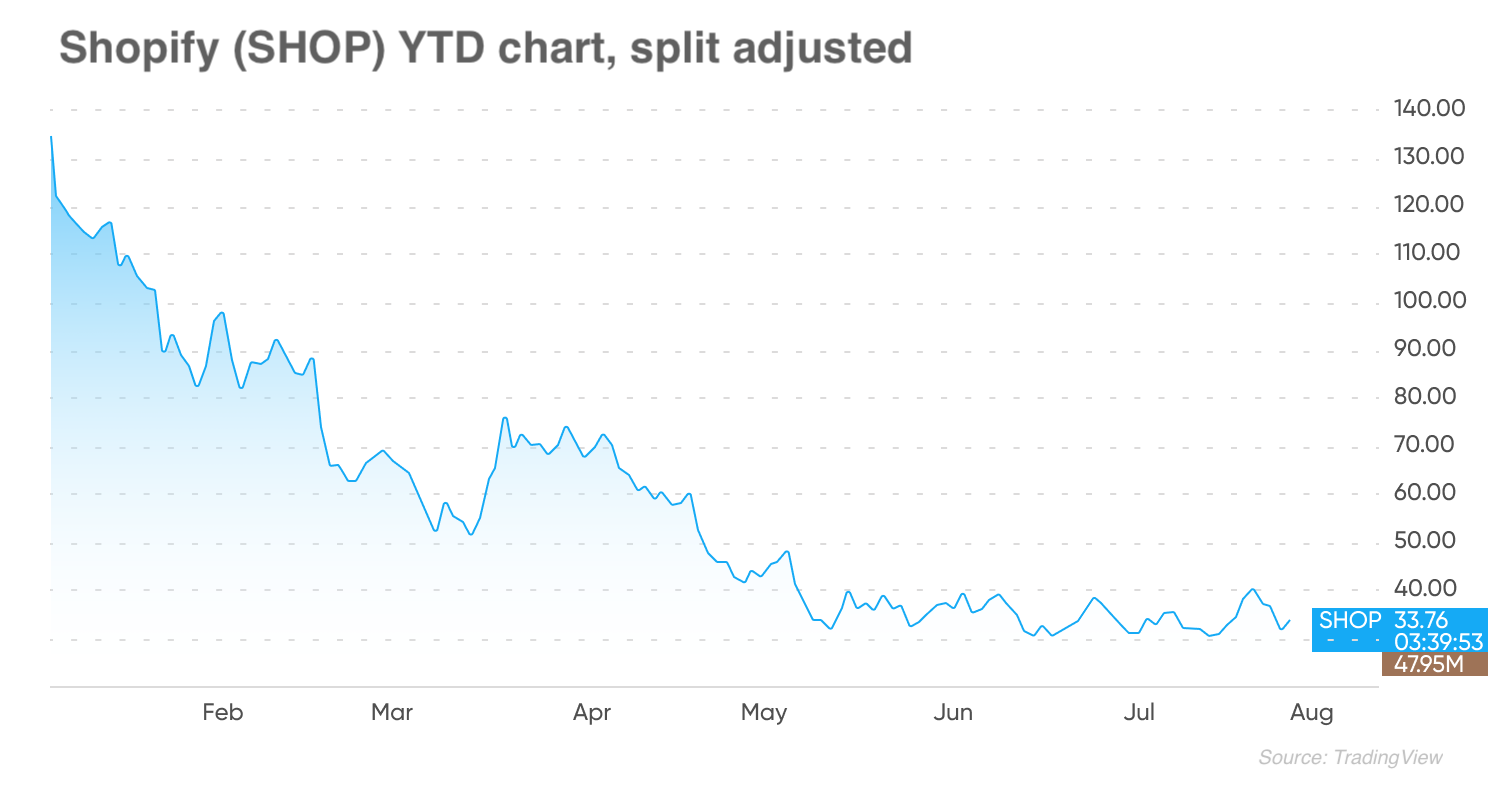

Shopify held its 10-to-1 stock split on 28 June, in which shareholders as of 22 June received 10 shares for every share they owned, and the stock began to trade on an adjusted basis from the Shopify stock split date of 29 June. With the stock down by around 75% since the start of the year, this brought the share price down from $350 a share to an adjusted $35.03.

The share price has since continued to slip lower, closing at $34.09 on 27 July. On a split adjusted basis, the stock has fallen from its all-time high of $176.29 in November and $136.31 at the start of 2022. It is trading under its adjusted price of around $40 at the end of 2019, reversing its rapid growth during the pandemic.

Shopify reported first-quarter revenue of $1.2bn, a year-on-year (YoY) increase of just 22% compared with the 110% increase to $988.6m reported in the first quarter of 2021. The company said it expected “year-over-year revenue growth to be lower in the first half and highest in the fourth quarter of 2022, as the Covid-triggered acceleration of e-commerce in the first half of 2021 from lockdowns and government stimulus is absent from the first half of 2022”.

What does that mean for the Shopify stock price for the rest of 2022 and in the coming years? Let’s take a look at some of the latest Shopify stock predictions from analysts.

Shopify stock forecast: To buy, or not to buy SHOP shares?

The average 12-month price target from 38 Wall Street analysts that have issued a Shopify stock forecast is $88.39, according to data compiled by Market Beat. The estimates range from $32 per share at the low end to a high of $200 per share. Among the 38 analysts, 19 issued buy ratings, 18 rated the stock as a hold and one recommends selling.

Ahead of the stock split, analysts at Morgan Stanley resumed coverage of the stock with a Shopify stock forecast of $450 per share, or $45 on a split-adjusted basis, and an equal weight rating.

“We see Shopify continuing to expand and capitalising on the attractive e-commerce tailwinds, and highlight at $50B+ ‘serviceable’ opportunity for the company driven by international expansion, continued payments penetration, and growth within Shopify Fulfilment Network,” the analysts wrote.

On 22 June, Morgan Stanley analysts reduced their pre-split price target from $800 to $700, for an adjusted $70 per share SHOP stock forecast, but maintained their outperform rating.

They added: “Commerce innovation and commerce everywhere strengthen Shopify’s value proposition, in our view. With scale, Shopify has an opportunity to monetise value-added services. While macro concerns are continuing to weigh on the stock, we believe Shopify is well positioned in the long term.”

On 26 July, Citigroup adjusted its Shopify share price target to $37 from $43.20 while maintaining a neutral rating. One day later, analysts at Oppenheimer also adjusted its price target to $45 from $50, but maintained an outperform rating.

Algorithm-based forecast site Wallet Investor was highly bearish on the long-term outlook for Shopify’s stock at the time of writing. The website’s Shopify stock forecast for 2022 had the share price plunging to $3.075 per share by the end of the year and continuing to fall next year. Wallet Investor’s Shopify stock forecast for 2025 showed the price at effectively zero at $0.000001.

When looking at any SHOP stock forecast it’s important to keep in mind that analysts and algorithm-based forecasters can and do get their predictions wrong. We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis before making any investing or trading decision. Remember that past performance is no guarantee of future returns. And never invest money that you cannot afford to lose.

FAQs

Is Shopify a good stock to buy?

Whether SHOP is a suitable stock for your portfolio depends on your investing strategy, portfolio composition and risk tolerance, among other factors. You should do your own research. And never invest money that you cannot afford to lose.

Will Shopify stock go up or down after the split?

At the time of writing, some analysts forecast that the Shopify share price could rise in the future. However, it’s important to keep in mind that analysts can get their predictions wrong. Share prices are particularly volatile at the moment because of economic pressures such as the war in Ukraine and its affect on inflation. You should do your own research to take an informed view of the share price.

Should I invest in Shopify stock?

Whether you should invest in Shopify is a personal decision only you can make based on your personal circumstances and investment portfolio. Keep in mind that past performance is no guarantee of future returns. And never invest what you cannot afford to lose.