What is the securities market?

What is a securities market?

A financial securities market is a marketplace where various securities such as stocks, bonds, and derivatives are bought and sold by individuals and organisations.

Below, we have the securities market explained in detail.

Key takeaways

-

The definition of a securities market is that it is a financial market in which individuals and organisations buy and sell securities, such as stocks, bonds, and derivatives.

-

Securities markets are divided into two categories – primary and secondary markets.

-

They can be organised as exchanges, over-the-counter (OTC) markets, or electronic platforms.

-

Some of the examples of securities markets are the New York Stock Exchange (NYSE), London Stock Exchange (LSE), and Frankfurt Stock Exchange (FSE).

What are financial securities?

Financial security is a type of financial asset that holds value and can be traded in financial markets. They are usually issued by governments or companies, and are used to raise capital to finance operations and growth.

Securities often trade on a secondary market, with buyers and sellers trading securities between themselves. These transactions involve a variety of laws and regulations designed to protect investors and ensure fair and transparent trading practices.

Financial securities are subject to market risk, meaning their value can fluctuate quickly and dramatically in response to changes in the economy, politics, and other factors. As such, investors who buy securities are exposed to both the potential for gain or loss, depending on the performance of the asset.

Types of securities

![Types of financial securities] Types of financial securities]](https://img.capital.com/glossary/Securities-markets_MCT-8986_EN---1.jpg)

There are two main types of securities: equity and debt.

-

Equity securities: These represent ownership in a company. When an investor buys equity securities, they become a shareholder of the company. Shareholders are typically not entitled to regular payments – although equity securities often pay out dividends. In the meantime, they are able to profit from capital gains when they sell the securities, assuming they have increased in value.

-

Debt securities: These represent a debt obligation, usually issued for a fixed period of time. When an investor purchases a debt securities, they are lending money to the issuer – corporations, governments and other entities – in exchange for regular interest payments and a return of the principal amount at maturity.

In addition to these, there can also be found hybrid securities. These represent a combination of characteristics of both debt and equity securities. They typically offer fixed interest payments, like bonds, while also having features of equities, such as the potential to appreciate in value and the ability to convert into the issuer’s stock.

Examples of hybrid securities are convertible bonds and equity warrants.

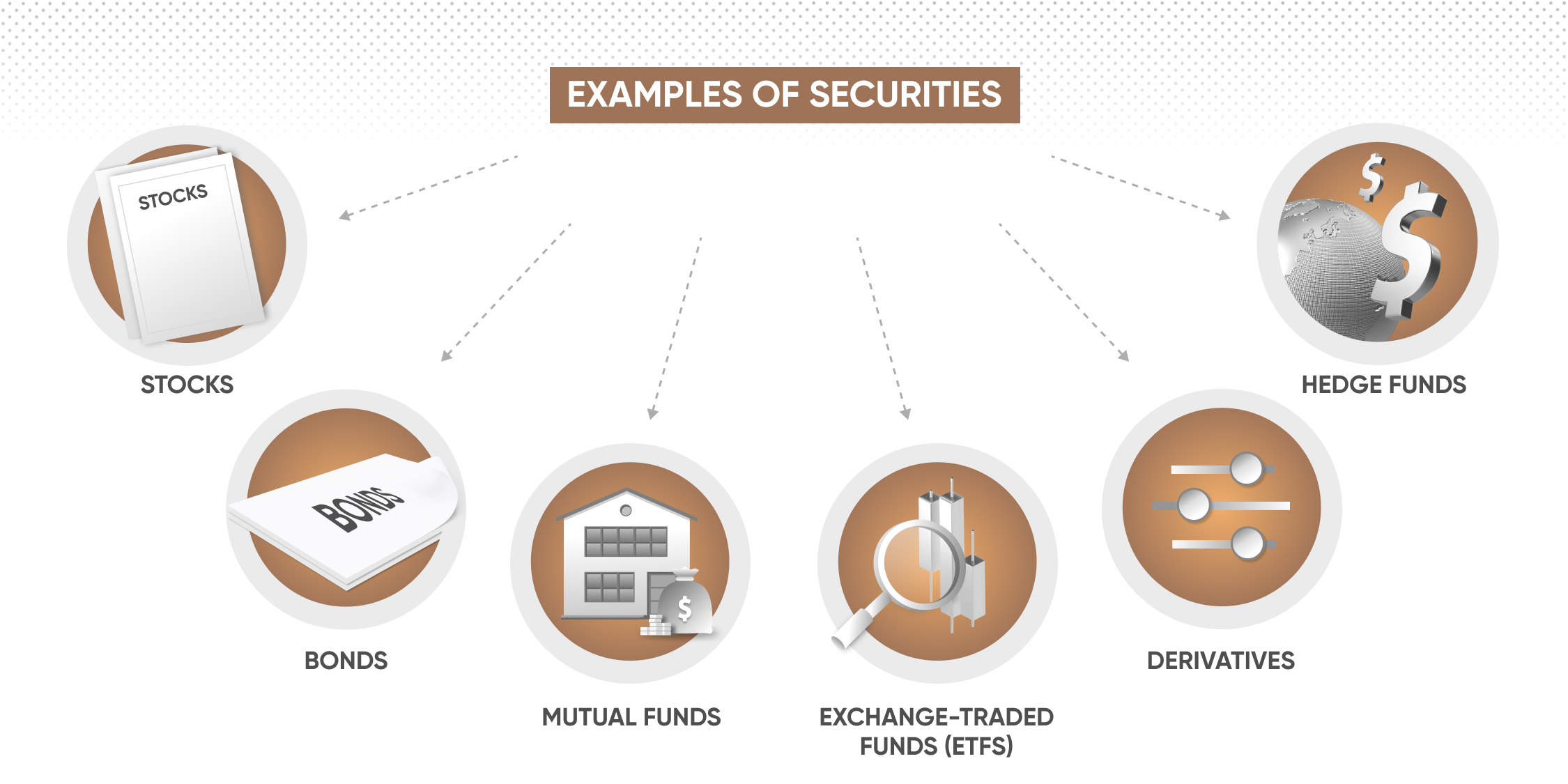

Securities examples

How securities are traded

There are a few different ways that securities can be traded depending on their type.

Participants in the securities market

Participants in the securities market are individuals or institutions that play a role in the buying and selling of securities. These participants can be organised into two categories: primary market participants, who are responsible for issuing securities, and secondary market participants, who are responsible for trading securities already issued.

Primary market participants include investment banks, governments, and corporations.

-

Investment banks act as intermediaries between issuers and investors. They assess the underwriting risk of an issuer, and if they decide to take on the risk, they will bring the issuer to the market and work to secure the necessary funding.

-

Governments and corporations can also issue securities directly to the public without an intermediary.

Secondary market participants include retail investors, institutional investors, and broker-dealers.

-

Retail investors can purchase securities through their retail brokers or directly from the issuer.

-

Institutional investors are large investors such as mutual funds, hedge funds, or pension funds. They usually purchase large amounts of securities directly from issuers or in the secondary market.

-

Broker-dealers are firms that act as both brokers and dealers. They buy and sell securities on behalf of their clients, while also trading for their own accounts.

Conclusion

Securities markets are financial markets where securities, such as stocks, bonds and derivatives, are bought and sold. These markets provide a platform for companies to raise capital, enabling them to fund their operations and growth, while also providing liquidity to investors, allowing them to trade securities.

Securities markets are divided into two main categories: primary and secondary markets. In the primary market, securities are issued by companies and governments for the first time. The proceeds from the sale of these securities are used to finance the issuer's operations. In the secondary market, securities are traded by investors. This market is used to facilitate the trading of existing securities, as well as to provide liquidity to the primary market.

Securities markets are the foundation of the global financial system and are essential for the efficient allocation of capital around the world.

FAQs

What is the securities market in simple terms?

The securities market is a place where people buy and sell various financial instruments, such as stocks and bonds.

What is the difference between stocks and securities?

Stocks are a type of security that represent ownership in a company. A security is a broad term that refers to any tradable financial instrument in the financial markets, such as stocks, bonds, mutual funds, options, and futures contracts.

What are marketable securities?

Marketable securities refer to financial instruments that can be easily bought or sold in the financial markets. They are highly liquid and can be quickly converted into cash.

Examples of marketable securities include stocks, bonds, and short-term debt securities such as treasury bills, commercial paper, and certificates of deposit (CDs).

Such securities are generally issued by government entities, corporations, or financial institutions and are traded on securities exchanges or over-the-counter (OTC) markets.

What are examples of the securities market?

There are many securities markets around the world. Some of the most well-known are New York Stock Exchange (NYSE), London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and Bombay Stock Exchange (BSE).

How are securities traded?

Securities are traded through a variety of channels, including securities exchanges, over-the-counter (OTC) markets, and electronic trading platforms.