Rolls-Royce share price forecast: third- party price target

Our Rolls-Royce share price forecast looks at the outlook for the FTSE 100-listed engineering company after a tough few years.

As of January 2025, Aerospace giant Rolls-Royce (RR) has secured a significant £9 billion ($11 billion) contract with the UK Ministry of Defence to design, manufacture, and provide support services for nuclear reactors powering the Royal Navy's submarine fleet. This eight-year "Unity" contract aims to enhance the UK's continuous at-sea deterrent and supports the AUKUS defence pact between the UK, the United States, and Australia. The investment is expected to create 1,000 new jobs and safeguard 4,000 existing positions, bolstering both national security and the economy.

Past performance is not a reliable indicator of future results

In this Rolls-Royce share price forecast we look at the recent history, where it’s focusing attention, and what analysts predict.

What is Rolls-Royce Holdings?

Rolls-Royce Holdings, which trades on the London Stock Exchange (LSE) under the RR ticker, operates in three core business segments: civil aerospace, power systems, and defence.

The civil aerospace division builds aircraft engines, power systems provides power solutions to multiple end markets, and defence is involved in the military.

It’s important not to get the company confused with Rolls-Royce motor cars, which is now a totally separate entity owned by BMW. While both businesses can trace their roots back to 1884, when Henry Royce established an electrical and mechanical business, they have been on different paths since the early 1970s.

What is now known as Rolls-Royce Holdings had been nationalised following bankruptcy but was privatised by the British government in 1987.

Rolls-Royce share price prediction

As of January 2025, Rolls-Royce Holdings plc (LSE: RR.) is trading at approximately £6.20 per share. Analyst forecasts for the company's share price over the next 12 months vary:

- Investors Chronicle reports a median target of 635p, with estimates ranging from a low of 450p to a high of 850p, based on assessments from 16 analysts.

- Yahoo Finance UK notes a consensus price target of 609p, which is about 5% above the current level.

- Investing.com indicates a slightly lower average short-term price target of 603p, with a high of 850p and a low of 240p.

These forecasts reflect varying levels of optimism among analysts regarding Rolls-Royce's future performance. It's important to consider that such predictions are uncertain and should be evaluated alongside broader market conditions and company-specific developments.

This RR share price forecast doesn’t constitute investment advice. It’s important to remember that analysts’ and algorithm-based Rolls-Royce share price predictions can be wrong.

You must always carry out your own due diligence before trading, looking at the latest news, a wide range of commentary, and technical and fundamental analysis. Remember that past performance is no guarantee of future returns so you should never invest money you can’t afford to lose.

Rolls-Royce share price drivers

1. Defense Sector Strength

Rolls-Royce has secured a record £9 billion ($11 billion) contract with the UK Ministry of Defence for nuclear reactors for the Royal Navy's submarine fleet. This deal supports the UK's continuous at-sea deterrent and the AUKUS pact, solidifying Rolls-Royce's position in defence. The contract is expected to create over 1,000 new jobs and safeguard 4,000 existing ones. This will likely boost investor confidence and strengthen long-term revenue prospects in a stable sector.

2. Recovery in Civil Aerospace

The company's civil aerospace division continues to recover post-COVID, with an increase in flying hours for wide-body aircraft engines. The continuation of the global travel rebound in 2025 supports the demand for aircraft engines and services. This will likely improve cash flow and revenue growth from maintenance and new orders.

3. Commitment to Sustainability

Rolls-Royce is pioneering sustainable aviation technologies, including its involvement in the first net-zero transatlantic flight with Virgin Atlantic. This aligns with the growing demand for decarbonized travel and government-backed sustainability initiatives, which positions Rolls-Royce as a leader in green aviation, attracting ESG-focused investors.

4. Cost Restructuring and Efficiency Programs

The company has undergone significant cost-cutting measures, disposing of assets worth over £2 billion and restructuring operations to improve margins. The appointment of CEO Tufan Erginbilgic has emphasised disciplined financial management and operational efficiency, which could enhance profitability and operational resilience.

5. Global Economic and Geopolitical Trends

Inflation and supply chain constraints persist but have been partly mitigated by operational improvements. Rolls-Royce benefits from defence spending increases due to heightened geopolitical tensions, especially in Europe and the Indo-Pacific, which offsets broader economic uncertainties.

However, there are some risks to consider. Ongoing supply chain pressures and geopolitical instability could hinder performance. Weakness in emerging markets or a slow recovery in air travel would weigh on the civil aerospace segment, and rising financing costs due to higher interest rates might impact profitability.

Overall, Rolls-Royce’s share price will likely depend on its ability to sustain growth in defence and aerospace, coupled with a clear commitment to innovation and efficiency.

How has RR price performed?

Past performance is not a reliable indicator of future results

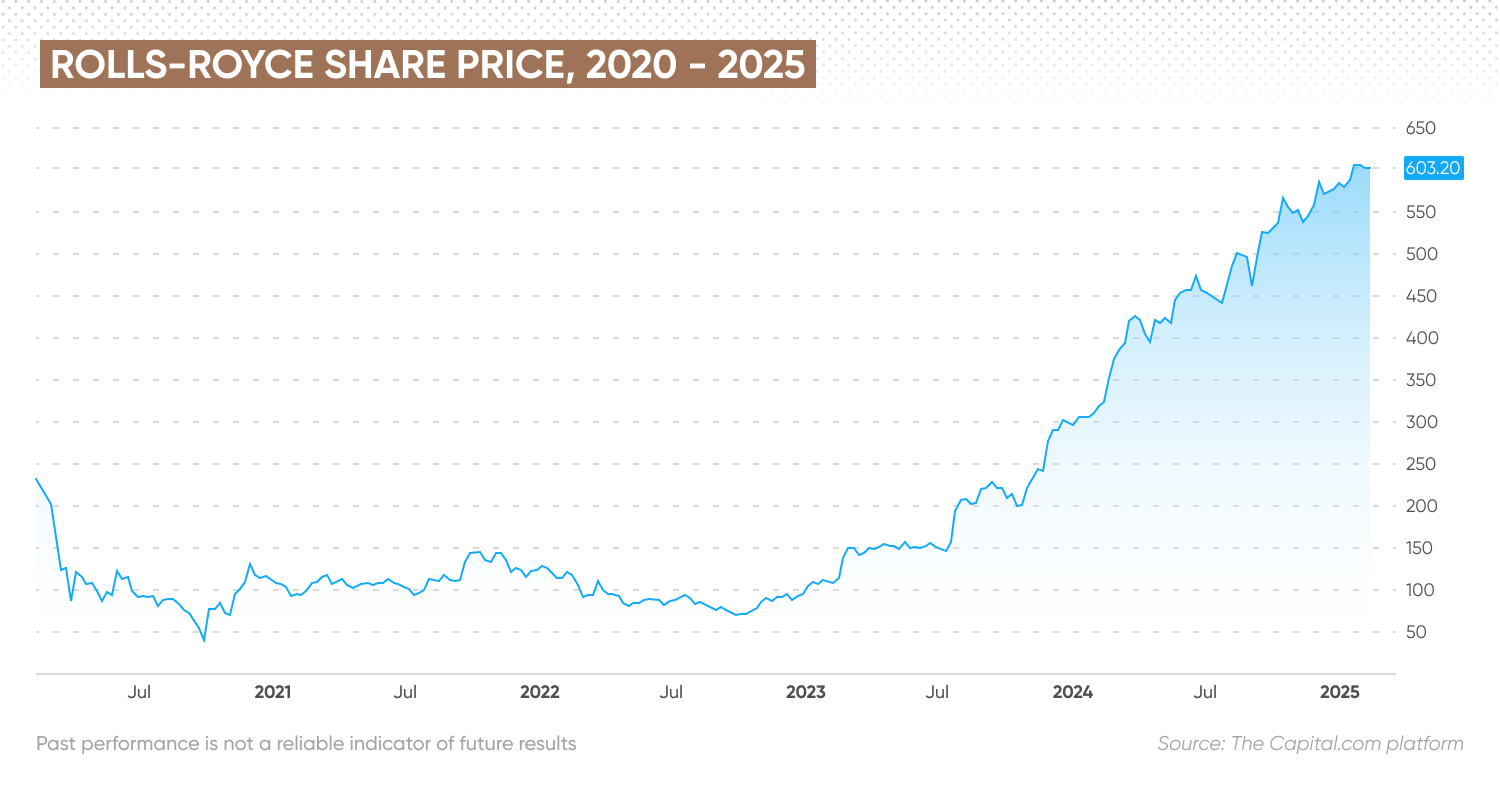

Over the past five years, Rolls-Royce Holdings plc has experienced significant fluctuations in its share price, influenced by various internal and external factors.

2019-2020: Pre-Pandemic Stability and Initial Impact

In 2019, Rolls-Royce's share price remained relatively stable, trading between £2.45 and £3.70. However, the onset of the COVID-19 pandemic in early 2020 severely impacted the aviation industry, leading to a sharp decline in the company's share price. By October 2020, the stock had plummeted to around £0.37, necessitating a rescue rights issue to bolster the company's finances.

2021-2022: Gradual Recovery Amid Challenges

Throughout 2021 and 2022, the share price showed a gradual recovery, fluctuating between £1 and £1.60. This period was marked by ongoing challenges, including supply chain disruptions and varying levels of air travel demand due to pandemic-related restrictions.

2023-2024: Significant Turnaround and Growth

Under the leadership of CEO Tufan Erginbilgiç, appointed in January 2023, Rolls-Royce implemented strategic initiatives focusing on cost reduction and operational efficiency. These efforts, coupled with a resurgence in air travel, led to a substantial increase in the share price. By mid-2024, the stock had risen to approximately £4.80, reflecting renewed investor confidence.

2025: Continued Momentum

As of January 2025, Rolls-Royce's share price has continued its upward trajectory, reaching £6.25. This growth is attributed to ongoing improvements in financial performance, successful restructuring efforts, and significant contracts in the defence sector. Overall, the past five years have been a period of volatility for Rolls-Royce, characterized by a sharp decline during the pandemic, followed by a strategic turnaround leading to substantial recovery and growth in the share price.

Rolls Royce reports increasing profits

Rolls-Royce Holdings plc's most recent earnings report was released on August 1, 2024, covering the first half of 2024. The company reported an underlying operating profit of £1.2 billion, a significant increase from £673 million in the same period the previous year. This improvement was attributed to increased demand in the civil aerospace and power systems divisions and ongoing cost-reduction initiatives.

In November 2024, Rolls-Royce reaffirmed its financial guidance for the year, citing strong demand in the aerospace and defence sectors. The company also highlighted progress in its transformation plan to achieve substantial cost savings and improve profitability.

The next earnings report, detailing the full-year results for 2024, is scheduled for February 27, 2025. Analysts anticipate an underlying operating profit between £2.1 billion and £2.3 billion for the full year, reflecting continued growth despite challenges in the aerospace supply chain.

Rolls-Royce trading strategies to consider

Trading shares could be a rewarding way to grow your portfolio, but success requires more than speculation—it demands a well-defined strategy. By understanding and applying effective trading strategies, you can make informed decisions about when to enter and exit trades, as well as how to manage open positions. Keep in mind that a strategy tailored for other asset classes, such as commodities or currency pairs, may not perform effectively when applied to shares.

Below, we explore key trading strategies and provide actionable insights to enhance your trading skills.

1. Position Trading: Long-Term Gains

Position trading involves holding a position over a longer time horizon to benefit from sustained price movements. For shares, this might mean identifying companies with strong fundamentals and growth potential. Traders often rely on fundamental analysis to evaluate factors like earnings growth, market trends, and competitive positioning.

Insight:

Position trading in shares requires patience and a deep understanding of a company’s intrinsic value. Using tools like discounted cash flow (DCF) analysis can provide a clearer picture of long-term potential.

2. News Trading: Reacting to Market Events

News trading is a short-term strategy that capitalises on volatility triggered by market-moving events, such as earnings reports, economic data releases, or central bank announcements.

Insight:

For shares, monitoring company-specific news like mergers, product launches, or leadership changes can provide opportunities to act swiftly. Subscribing to real-time market alerts and news feeds can help you stay ahead.

3. Trend Trading: Riding the Momentum

Trend trading involves identifying and following established price trends. Traders use technical analysis to spot patterns, such as moving averages or support and resistance levels, to anticipate price movements.

Insight:

In share trading, combining technical indicators like the Relative Strength Index (RSI) or MACD with fundamental cues can provide a more robust view of potential trends. For example, a strong earnings report could signal the start of an upward trend.

4. Day Trading: Intraday Opportunities

Day traders focus on short-term price movements within a single trading session, leveraging intraday volatility. Shares of large-cap companies with high liquidity and narrow bid-ask spreads are popular choices for this strategy.

Insight:

Day trading requires discipline and fast decision-making. Utilize real-time charting and market data to refine your intraday strategies.

Additional insights to trading

- Diversify Your Strategies: Instead of relying on a single approach, consider a mix of strategies based on market conditions. For instance, position trading might work well in a bullish market, while trend trading can be effective in volatile conditions.

- Risk Management is Key: Set clear stop-loss levels and position sizing rules to protect your capital. Even the most effective strategies can lead to losses without proper risk controls.

- Stay Educated: Regularly update your knowledge of market trends, economic indicators, and sector performance. Enrolling in share trading courses or following expert analysts can deepen your expertise.

- Leverage Technology: Our platform at capital.com offers MT5 integration to gain a competitive edge. Such tools can analyse vast amounts of data to identify potential trading opportunities.

- Understand Tax Implications: Be aware of tax regulations in your jurisdiction, as capital gains and losses from share trading can impact your net returns.

FAQs

Is Rolls Royce a good stock to buy?

Whether Rolls-Royce Holdings is a good stock for you to buy depends on your view of the company and your personal investment objectives. Remember, it’s very important to reach your own conclusion of the company’s prospects and likelihood of achieving analysts’ targets.

Will Rolls Royce stock go up or down?

The stock's trajectory depends on Rolls-Royce's ability to execute its growth strategies, navigate economic challenges, and capitalize on new opportunities in defence and sustainability. While the outlook is positive, any investment carries risks, and due diligence is crucial.

Should I invest in Rolls-Royce stock?

This is a decision for you to make based on your analysis. It’s important to draw your own conclusions and not rely solely on Rolls-Royce share price prediction of analysts. Your long-term investment goals and attitude to risk must play a part in the decision-making process.