Projected India interest rate in 5 years: RBI tightening momentum may continue into double digits

The RBI could maintain monetary tightening on risks of elevated inflation and a weaker rupee. Read more in overview of the India interest rate forecasts for the next 5 years.

An easing inflation rate and double-digit economic growth have not convinced the Reserve Bank of India (RBI), India’s central bank, to slow the pace of its monetary policy tightening cycle.

On 30 September, the RBI hiked its policy rate by 50 basis points (bps), bringing the repo rate, India’s key interest rate, to 5.9%. The bank’s Monetary Policy Committee said that “further calibrated monetary policy action is warranted to keep inflation expectations anchored, restrain the broadening of price pressures and pre-empt second round effects.”

As inflation remains above the bank’s target range amid risks of slowing economic growth, will the RBI ramp up its rate hike to double digits?

What is the Reserve Bank of India?

India’s central bank, the Mumbai-based RBI, was established as a private entity on 1 April 1935. It became fully government owned in 1949 after being nationalised.

The bank’s primary responsibility is to develop, implement and monitor the country's monetary policy to maintain price stability and growth.

The RBI implements monetary policy through its six Monetary Policy Committee (MPC) members, chaired by the central bank's governor. The MPC meets a minimum of four times each year to set the policy repo rate to achieve the inflation target.

The government of India, in consultation with the RBI, sets the Consumer Price Index (CPI) inflation target every five years. On 5 August 2016, the target was set at 4%, with a tolerance band of 2% to 6% for the next five years ending 31 March 2021. In April 2021, the target was extended until 31 March 2026.

The MPC uses several indirect monetary tools to manage inflation, but the main policy rate is the repo rate. The repo rate is the interest rate applied to loans that the RBI provides to all participants in the liquidity adjustment facility (LAF) in exchange for government and other approved securities as collateral.

The LAF is the RBI's primary instrument for injecting and absorbing liquidity into and out of the banking system. Overnight and term repo and reverse repos (fixed and variable rates), the Standing Deposit Facility (SDF) rate, and the Marginal Standing Facility (MSF) rate are all part of the LAF.

India interest rate: Historical data

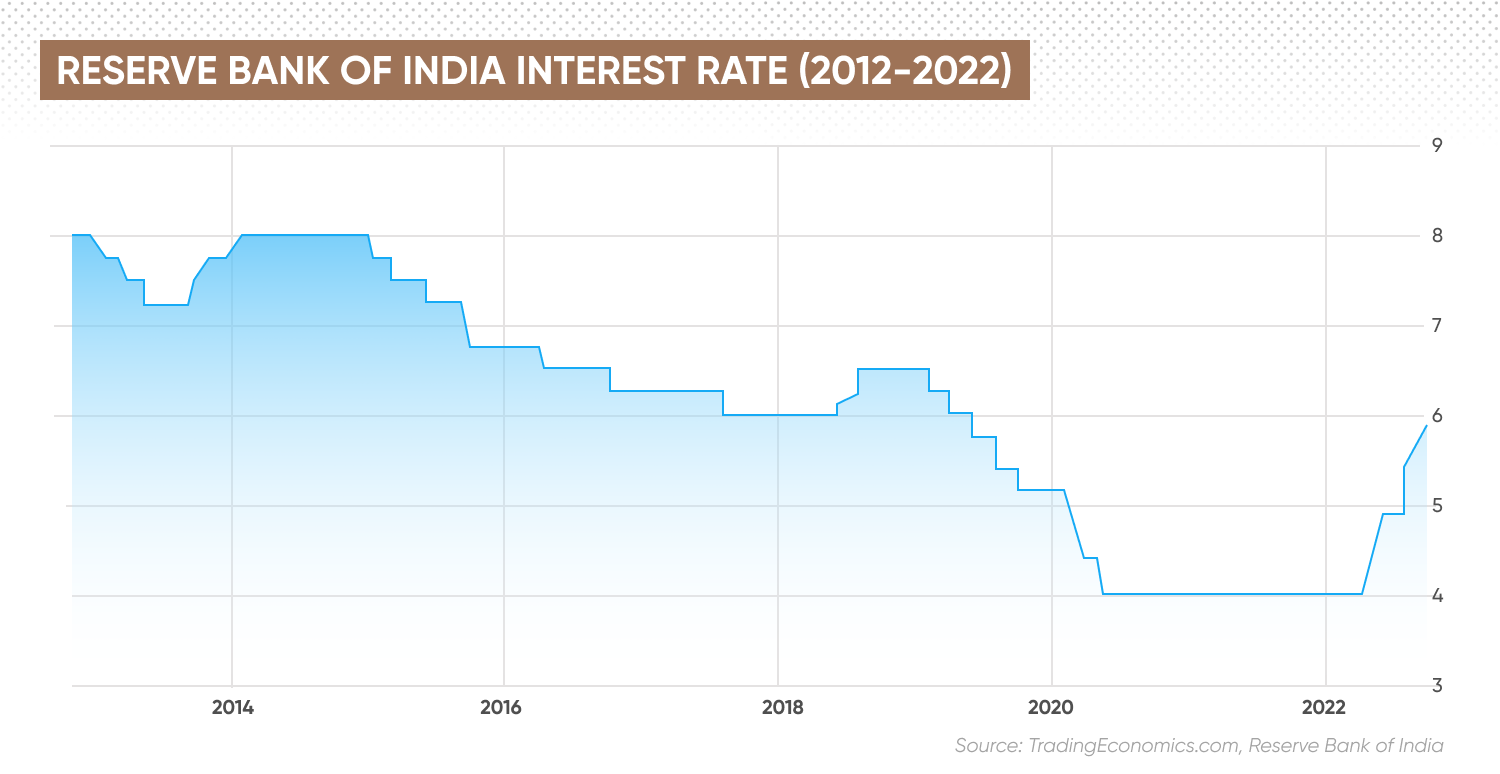

As the Covid-19 pandemic spread, the RBI, like many other central banks around the world, began loosening its monetary policy in early 2020 to shore up the economy. The bank reduced its repo rate by 75bps to 4.4% in March 2020 and by another 40bps to a record-low of 4% in May 2020.

After the United States, India had the second highest number of Covid-19 cases and deaths. Its economy shrank by 6.6% in 2021.

The MPC maintained the key rate at the record-low 4% level until April 2022, as the country recovered from the spillover effect of Covid-19 restrictions.

In May 2022, the MPC started a policy tightening cycle amid soaring inflation that reached 7.9% in April – a level not seen since 2014. Since May, the RBI has hiked the policy repo rate by a cumulative 190bps, which lifted the rate to 5.9% in September, from 4.4% in May.

India interest rate: Latest news

Let’s take a look at some of the latest news influencing the Indian interest rate.

Rising concerns on imported inflation

The RBI forecast CPI inflation to average 6.7% in fiscal year (FY) 2022/2023 before slowing to 5.2% in FY 2023/2024.

However, the bank was concerned about the upside risks of imported inflation stemming from uncertainty in the global markets.

“The outlook is fraught with considerable uncertainty, given the volatile geo-political situation, global financial market volatility and supply disruptions,” the RBI said in a statement on 30 September 2022.

“Global commodity prices have come off their highs on weaker global prospects but remain elevated and volatile. Global supply chains are gradually normalising, although they remain vulnerable to geopolitical disturbances, pandemic-related lockdowns in major production hubs, and financial market volatility,” the bank added in its Monetary Policy Report.

On the domestic front, the RBI also closely watched domestic food inflation, as food accounts for 45% of India’s CPI inflation basket.

The bank expected ample rice stock, retaining bullish outlook on harvest from the kharif, or autumn sowing, could soften inflation more than anticipated. On the other hand, it remained concerned about the fragile stability in global food prices due to geopolitical tensions, which could increase the price of energy and fertiliser.

On 28 September, New Zealand-based ANZ Research forecast India’s inflation to average 6.5% in 2022, easing to 4.8% in 2023 and 4.5% in 2024.

The outlet wrote:

Participants in the bank’s survey forecast headline CPI inflation to average 7% in the second quarter of 2022/2023, falling to 6% in the fourth quarter. The participants forecast headline inflation during the first two quarters of 2023/2024 to remain close to 5%.

Weaker rupee to amplify inflation

The RBI pointed out that Indian rupee (INR) depreciation against the US dollar was one of the risks that could elevate the country’s inflation rate. The INR has dropped more than 8% against the US dollar this year, as an aggressive monetary policy by the US Federal Reserve (Fed) has strengthened the greenback, hitting some Asian and emerging-market currencies.

A weaker rupee against the dollar could increase the prices of imported goods, contributing to rising inflation.

“Volatility in global financial markets is expected to persist due to the uncertainty around monetary policy normalisation in the US and other major advanced economies, which could put downward pressure on the INR,” the bank’s MPC said in its most recent Monetary Policy Report.

According to the RBI, inflation could edge up by around 20bps if INR depreciates by 5% from the baseline, although the country’s gross domestic product (GDP) could be 15 bps higher due to a boost to exports. And vice-versa, if INR appreciates by 5% against the baseline, inflation and GDP growth could moderate by 20 bps and 15 bps, respectively.

The USD/INR currency pair was trading at around 82.2 on 11 October, gaining close to 10% year-to-date (YTD) as the US dollar continues to strengthen on the back of the Fed’s interest rate hiking cycle.

According to ANZ Research, softer commodity prices that improved the inflation outlook were likely the reason for the RBI’s policy shift to allow a weaker rupee. The firm expected USD/INR to average at 82 by year-end, falling to 80 in 2023 and 78 in 2024.

“We see risks from further strength in the US dollar, which will weigh on the rupee. The RBI may continue to intervene, but the scale of dollar sales will have to be clipped,” the firm added.

India interest rate forecast for the next 5 years

Considering that inflation may remain elevated until 2023, and the rupee could remain weak as the Fed is expected to keep its hawkish rate hike, what are the projected India interest rates in 5 years?

Participants in RBI’s latest survey on macroeconomic indicators, published on 30 September, revised up interest rate predictions in India to a median of 5.75% by the end of the second quarter of FY 2022/2023, from 5.50% in July’s forecast. The fiscal year runs from 1 April 2022 to 30 March 2023.

The RBI was expected to raise the rate to 6% in the October to December quarter of 2022/2023 and maintain the rate at 6% until Q2 (July to September) of FY 2023/2024, according to 41 panellists who took part in the survey.

ANZ Research’s India interest rate prediction saw the RBI lifting the policy rate to 6.25% by the end of 2022 and 6.50% by the end of 2023. RBI’s policy rate was expected to stay at 6.5% until the end of 2024.

Bank of America (BofA) Global Research predicted RBI to have a 35bps hike in the December meeting and expected the repo rate to reach 6.25% by March 2023.

“We continue to see the terminal rate at 6.5%, but given the dynamic and uncertain global environment, it may get advanced vs our earlier Dec '23 forecast,” BofA wrote on 30 September.

Fitch Ratings’ India long-term interest rate forecast projected RBI’s repo rate to reach 5.90% in FY 2022/2023, 6% in FY 2023/2024 and 5.75% in FY 2024/2025.

The bottom line

In their India interest rate forecasts, analysts expected RBI to hike the policy repo until FY 2023/2024, before starting to cut the rate.

Analysts cited in this article did not provide India interest rate forecasts for 2030, as factors shaping such forecasts are highly unpredictable and complex.

You should always remember that analysts’ predictions can be wrong. Remember to always do your own research before trading or investing. Past performance is no guarantee of future results. And remember never to trade with funds that you cannot afford to lose.

FAQs

Is the interest rate going up in India?

The Reserve Bank of India has been front-loading the repo rate to combat inflation. Since early 2022, the country’s central bank has hiked its policy rate by a cumulative 190 basis points.

How high will India interest rates go?

ANZ Research has forecast India interest rates could go as high as 6.5% by the end of 2023. However, analysts can and do get their forecasts wrong. Always do your own research before trading or investing. And never invest more than you can afford to lose.

Where will India interest rates be in 5 years?

Analysts mentioned in this article did not provide India interest rates forecast for the next 5 years due to the complexity of giving such predictions. However, Fitch Ratings has projected that India’s interest rate may average 5.75% in FY 2024/2025.