PCE Index Preview: Gradual decline in Fed’s preferred inflation indicator expected

The markets expect to see signs of continued disinflation in the United States. The latest PCE Index data, the US Federal Reserve’s preferred inflation gauge, is released on June 28, 2024.

The markets expect to see signs of continued disinflation in the United States. The latest PCE Index data, the US Federal Reserve’s preferred inflation gauge, is released on June 28, 2024.

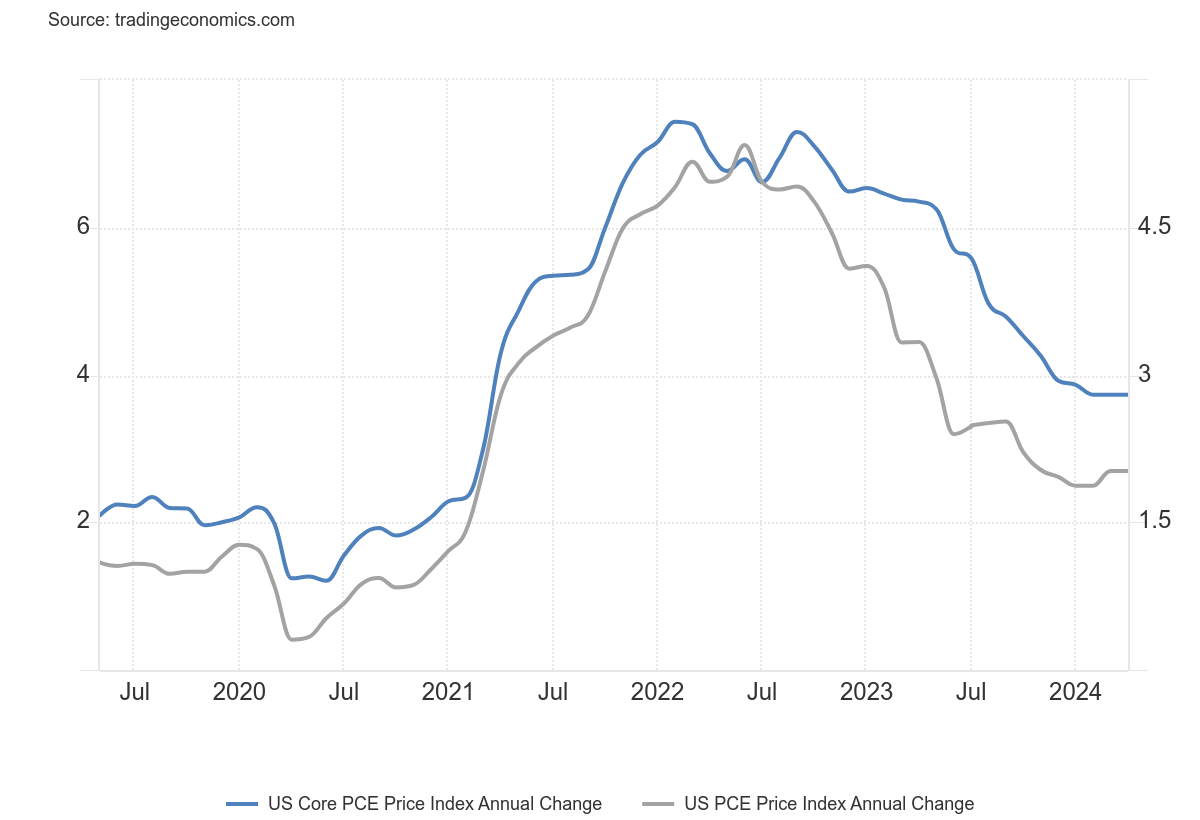

Headline and core PCE deflator expected to fall

Economists forecast another drop in the headline and core PCE deflator last month. The headline number is tipped to fall from 2.7% to 2.6%, while the core number is expected to drop from 2.8% to 2.6%.

Source: Trading Economics

If the number comes in line with expectations, it will be the lowest PCE read since March 2021. It will also support other data points, including the recent CPI data and PMI surveys, which point to softening price pressures in the US economy.

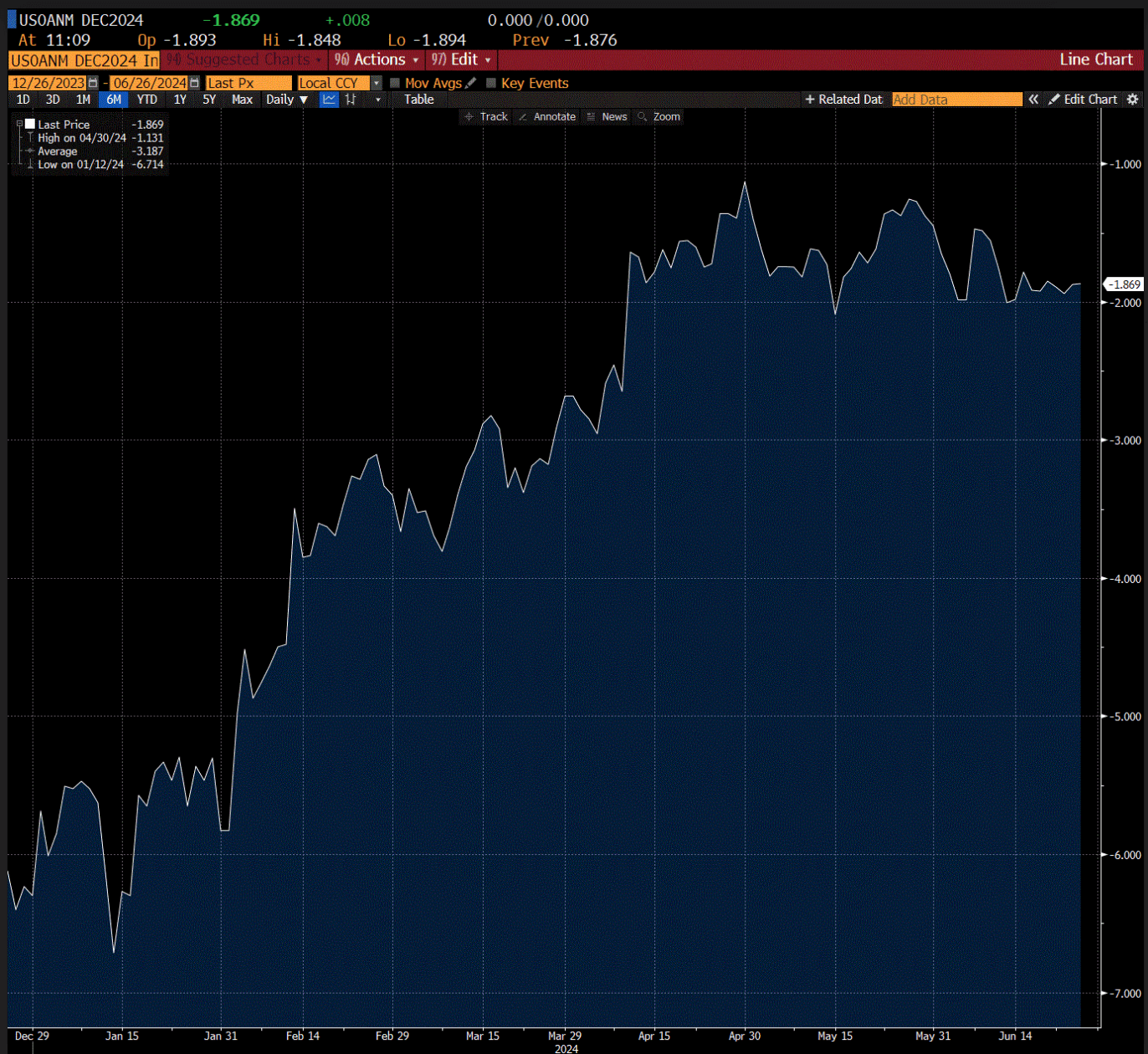

Rates markets imply potential for two Fed cuts in 2024

Confidence about looming interest rate cuts in the US has grown, with the markets moving towards two cuts from the US Federal Reserve before the end of the calendar year. Softer growth data, along with signs of easing price pressures, has fuelled the dynamic, with both the number and timing of rate cuts the critical questions. Currently, the markets are fully pricing in a cut for the November meeting, with a better than 50/50 chance of one coming at the September meeting.

Source: Bloomberg

Interest rate markets are flirting with the idea of two cuts before the end of the year. Approximately 85 basis points are baked into the curve for the December meeting. A second cut is fully baked in by the first meeting of 2025 at the end of January.

Source: Bloomberg

Market analysis: US Dollar Index and Wall Street

A lower-than-expected PCE deflator may raise the probability of a Fed rate cut in September while boosting the odds of two cuts before the end of the year, a result which would typically support stocks and weaken the US Dollar. A number that’s in line with expectations will confirm the disinflationary trend and may add to the case for two cuts this year, which, based on the reaction to recent inflation data, could also support equities and weigh on the US Dollar. Meanwhile, an upside surprise from the PCE deflator could push back the expected timing for the first Fed cut and lower the odds of two cuts this year, which could put downward pressure on stocks and boost the US Dollar.

When looking at the NASDAQ, a critical psychological resistance level appears around 20,000, with a positive result from the PCE deflator a potential catalyst to test that level. Conversely, a negative surprise from the data could bring a confluence of support levels around 18,900 into view.

Source: Trading View

Past performance is not a reliable indicator of future results

The US Dollar Index is rangebound in the medium term, trading within the 106.50 and 104 levels. In the short term, the index has respected an upward-sloping trendline. A downside surprise could see that trend-line break and signal a deeper pullback. An upside surprise could spark a push towards the top of the index’s range. The US Dollar is likely to be exposed to event risk outside of US data in the short term, which could limit the impact of the PCE deflate release amid potential political uncertainty in Europe subsequent to the first round of French parliamentary elections.

Source: Trading View

Past performance is not a reliable indicator of future results