NIO stock forecast: Is it time to buy the dip?

The Chinese EV-manufacturer has suffered a volatile rise, with its stock losing over half of its value in 2022.

NIO (NIO), the electric vehicle maker, has seen its share price drop almost 50% in 2022 after tough Covid-19 lockdowns were introduced in China. Shares in the company were trading at $33.47 in early January, but had slumped to $13.85 as of 9 May.

Do these recent falls make the stock attractive to investors, or are there deeper concerns that need to be considered? Here we take a look at NIO’s recent performance and what factors are shaping NIO stock price prediction for 2022 and beyond.

NIO stock analysis: Downtrend continues

NIO is the fourth largest electric vehicle manufacturer, with a market capitalisation of $26.68bn.

Founded in November 2014, it aims to “shape a joyful lifestyle” by building a community starting with electric vehicles.

NIO designs, develops, jointly manufactures and sells premium smart electric vehicles. It also drives innovations in next-generation technologies, such as autonomous driving and electric powertrains.

NIO’s stock has risen over 150% since the company floated on the New York Stock Exchange (NYSE) in September 2018. The stock has also achieved trailing returns of 45.14% over the past three years to 9 May, ahead of the 42.88% industry average, according to Morningstar. However, it has endured ups and downs.

From a flotation price of $6.26, the stock reached a record high of $66.99 on 11 January 2021. NIO stock value has since lost over 75% of its value.

The new wave of Covid-19 in China combined with the Chinese government’s regulatory crackdown on tech firms and wider geopolitical tensions have fuelled the bear trend for NIO. It’s trading at $13.85 (9 May), having lost over half its value in 2022.

The stock crashed 15% on 5 May after the US Securities and Exchange Commission (SEC) added it to the list of companies that risk delisting. The stock is subject to the Holding Foreign Companies Accountable Act (HFCAA) status, which requires companies listed in the US to declare that they are not owned or controlled by the Chinese government, which proves itself as a regulatory hurdle for the stock, damping NIO stock projections.

Meanwhile, the Chinese EV-maker is exploring its options on other stock exchanges. In the most recent NIO stock news, the company announced plans for a secondary listing on the Singapore Exchange at $0.00025 a share. This would be the third venue for the stock, with NYSE being the primary listing and Hong Kong the secondary.

In terms of NIO technical analysis, as of 9 May, the stock was trading below its 10 and 20-day moving averages, which typically signifies a bear trend. The relative strength index (RSI) reading of 39.19 was still neutral, yet close to underbought territory. An RSI reading of 30 or below typically signals that the stock is undervalued and there may be a trend reversal.

Strong deliveries yet a widening loss

NIO delivered 25,034 vehicles in the fourth quarter of 2021 – 44.3% higher than the same quarter in 2020, according to the company’s most recently announced results. Meanwhile, the number of vehicles delivered in 2021 hit 91,429. This was 109.1% up on the 43,727 during 2020.

Vehicle sales were RMB9.2bn (US$1.5bn) in the fourth quarter of 2021, representing an increase of 49.3% from Q4 2020 and 6.7% from Q3 2021. Total fourth-quarter revenues came in at RMB9.9bn, 49.1% higher than a year ago and 1% up on the last quarter.

However, the quarterly net loss was RMB2.2bn (US$336.4m), representing an increase of 54.4% over the same period in 2020. NIO expected earnings per share (EPS) stood at -$0.63 for 2022, an estimation provided by Zacks Investment Research. This compares to an EPS of -$1.05 in 2021, and could indicate that the losses are projected to shrink going forward.

The company itself forecasts deliveries to reach between 25,000 and 26,000 in the first quarter of 2022, with the total revenues expected at between RMB9,631m (US$1,511m) and RMB9,987m (US$1,567m). This would represent an increase of 20.6% to 25.1% year on year.

Supply chain issues amid a new wave of Covid-19

Another factor to consider in NIO stock outlook is the rising Covid-19 cases in China and how it can affect the EV-maker’s deliveries. In an update issued on 1 May, NIO admitted that vehicle production and delivery had been adversely impacted in recent weeks.

It highlighted “supply chain volatilities and other constraints” caused by a new wave of the Covid-19 outbreaks in certain regions in China. The update also revealed NIO had delivered 5,074 vehicles in April 2022.

In addition, the first batch of tooling trial builds of the ET5 rolled off the production line at the new manufacturing plant at NeoPark in Hefei during late April. Nio expects to start delivery of the ET5 in September 2022.

In late May 2022, the manufacturer plans to unveil the 2022 NIO ES8, ES6 and EC6 with the latest digital cockpit hardware, and to launch the digital cockpit upgrade plan for existing users. In the meantime, NIO ES7, Nio’s new mid-to-large five-seater SUV equipped with NIO Technology 2.0 (NT2), will also make its debut.

Backdrop: What is the market like for electric vehicles

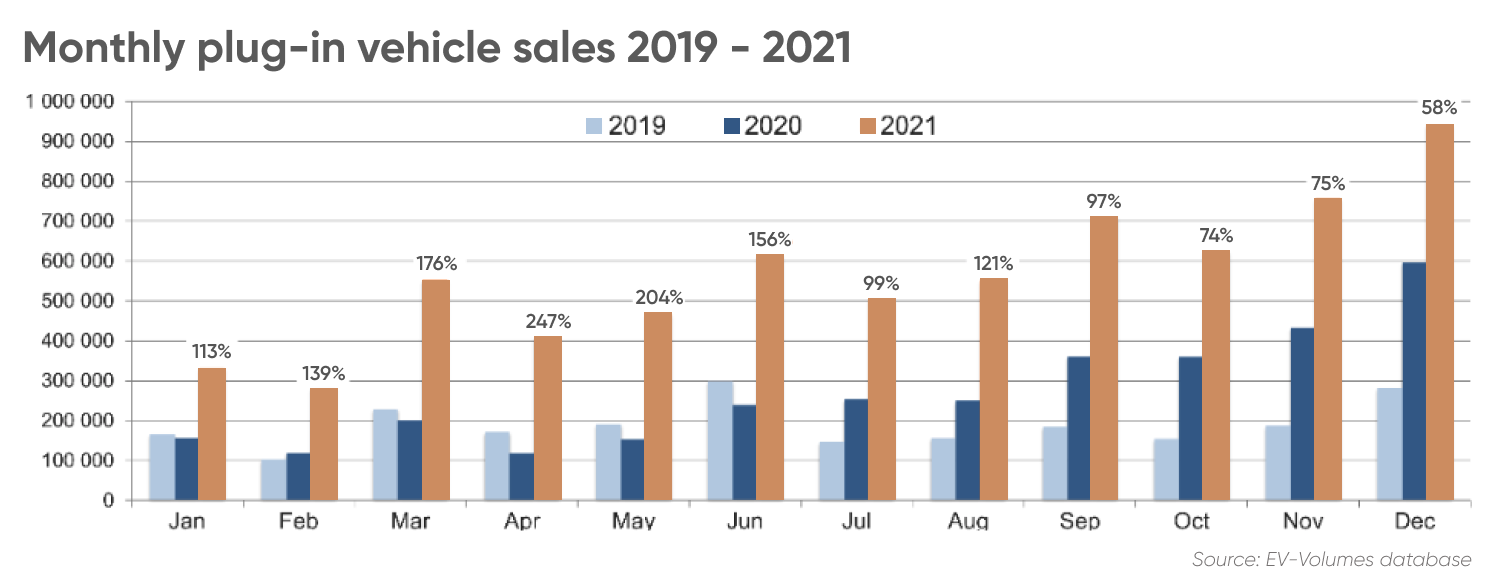

Global electric vehicle sales reached 6.75bn units in 2021, 108% more than the previous year, according to data from EV-Volumes database. However, this remarkable growth rate needs to be seen in context to the low base volume of 2020 caused by regulations and Covid-19.

The figures also showed a particularly strong performance in China. Sales jumped by more than two million units, more than the combined volume increase of all other regions combined, which could prove a positive for NIO stock future price.

“For this year we expect EV sales to return to more normal growth and reach around 9.5bn units, higher if remaining issues in supply and logistics are resolved,” the EV volumes report stated.

NIO stock forecast for 2022 and beyond

As the stock is suffering through a major decline and buying the dip may appear tempting, the question on investors’ lips remains: is NIO stock a buy, sell or a hold?

Wall Street analysts gave the stock a consensus ‘buy’ rating at the time of writing, according to the data compiled by MarketBeat, with 14 rating the stock as a ‘buy’ and one analyst giving it a ‘hold’ recommendation.

Meanwhile, the NIO stock price target for the year ahead stood at $50.25, which would represent a significant upside from the $13.85 share price as of 9 May. Their NIO share price forecast ranged from the high of $87 to the low of $32.

While analysts rarely give forecasts beyond one year, algorithm-based prediction sites do provide long-term forecasts using past performance analysis to inform estimations of the future price.

NIO stock is a “good long-term investment”, according to the algorithm-based forecasts of Wallet Investor at the time of writing (9 May). The site predicted that the stock could reach $23.521 by the end of 2023. The share price was then forecast to move sideways to lower to $23.482 by the end of 2024.

In terms of NIO stock forecast for 2025 and beyond, Wallet Investor suggested that the price could fall slightly to $22.709, and $21.597 in 2026. While the site didn’t provide an estimate for 2030, it predicted that the stock could hit $12.326 in April 2027.

Note that analyst or algorithm-based price predictions can be wrong. Forecasts shouldn’t be used to substitute your own research. Always conduct due diligence before trading. And never trade money you cannot afford to lose.

Analyst sentiment on NIO stock expectations

According to Danni Hewson, financial analyst at AJ Bell, Covid-19 lockdowns have had a huge impact on consumer spending and consumer confidence in China.

“NIO’s far from the only company that’s had to deal with shutdowns but investors have been rattled, wondering how production stops will impact on delivery targets,” she told Capital.com.

Then there’s the issue of cost. “The price tag on NIO’s models have shot up, but then sticker prices are rising across the board so that shouldn’t overly trouble investors,” she said.

However, an issue that’s likely to be of concern is the cost of living crisis. In fact, Hewson believes this could be enough to “dull demand” for the next couple of years.

“Investors considering the long game might be more interested in NIO’s falling share price and might consider that an opportunity. Ultimately drivers are going to have to make the switch and even in this inflationary environment wait lists are lengthy.”

“Looking ahead even five years and NIO seems well positioned on the grid and price pressures at the pump are making motorists really think about their next four wheel investment,” she added.

FAQs

Is NIO stock a good investment?

Whether NIO stock is a good investment will depend on your objectives. It’s also vital that you conduct your own research and not rely on analysts’ recommendations. Never invest money that you cannot afford to lose.

Will the NIO share price go up or down?

No-one knows for sure. The consensus view of Wall Street analysts is that the stock could rise $50.25 over the coming year, according to MarketBeat data at the time of writing (9 May). Analysts can be wrong. You should conduct due diligence before making any financial decisions.

Why has the NIO stock price been going down?

There are various factors that are moving NIO share price. The risk of being delisted due to regulatory hurdles combined with concerns about the recent Covid-19 lockdowns in China and geopolitical tensions all affect investor sentiment for NIO.

What will the NIO stock be worth in five years?

While analysts don’t typically give price forecasts beyond one year, algorithm-based forecasting site Wallet Investor gave a negative long-term NIO forecast. As of the time of writing (9 May), the site suggested the stock could fall as low as $12.326 by April 2027. Note that price predictions can be wrong and shouldn’t be used as a substitute for your own research. And never invest money that you cannot afford to lose.