S&P 500 vs US Tech 100: Recession outlook

S&P 500 and US Tech 100 are among the most popular indices in the world.

US indices S&P 500 (US500) and US Tech 100 (US100) are among the most popular indices in the world. They provide investors with exposure to world-renowned US-based companies like Apple (AAPL), Nike (NKE), Coca-Cola (KO) and Tesla (TSLA). Investors around the world invest in US Tech 100 or S&P 500 by buying exchange-traded funds (ETF) that track their performance.

Yet since a number of large-cap companies overlap in the components of US Tech 100 (US100) and S&P 500 (US500), investors may want to choose one index to put their money in for the sake of diversification.

Here we take a look at the difference between the US Tech 100 and the S&P 500 in terms of composition and past performance, and examine how the US equity market might fare in 2022 in the face of the first rate hike cycle in four years.

US Tech 100 vs S&P 500 vs Dow

Beginner investors can get confused and wonder what’s the difference between the Dow, Nasdaq and S&P 500. The US Tech 100 Index tracks the performance of the 100 largest domestic and international non-financial stocks listed on the Nasdaq Stock Exchange.

The S&P 500 tracks the performance of the 500 biggest companies listed in the US. The Dow Jones Industrial Average Index, commonly known as the Dow, is an index comprising of 30 blue-chip stocks listed in the US.

Difference between US Tech 100 and S&P 500

According to index provider S&P Dow Jones Indices, the S&P 500 covers about 80% of available market cap. Companies must have an unadjusted market cap of over $13.1bn to be eligible for inclusion.

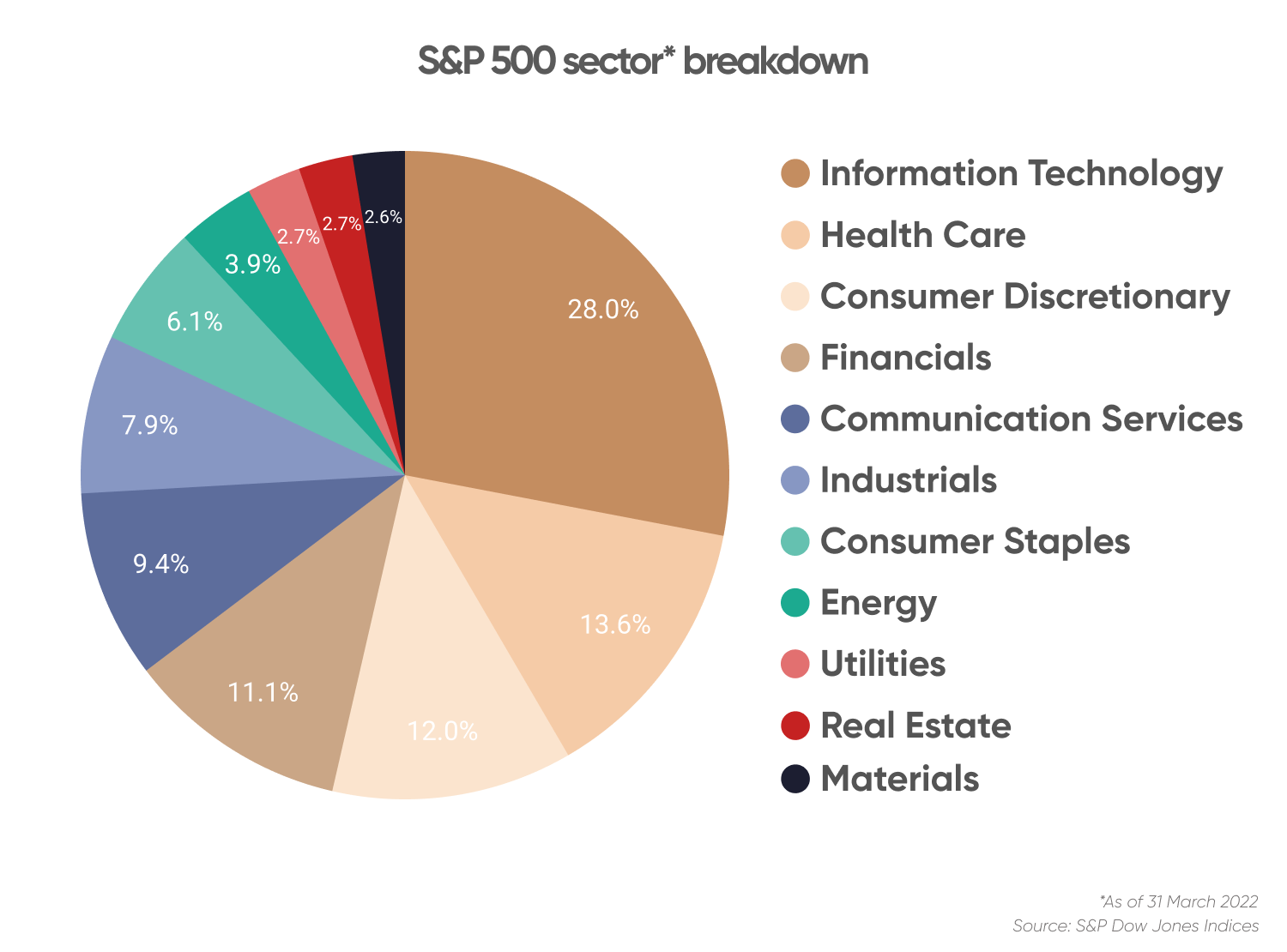

As of 31 March 2022, information technology had the highest weighting on the S&P 500 Index, coming in at 28%. Healthcare and consumer discretionary sectors made up the rest of the top three, with 13.6% and 12% weightings, respectively.

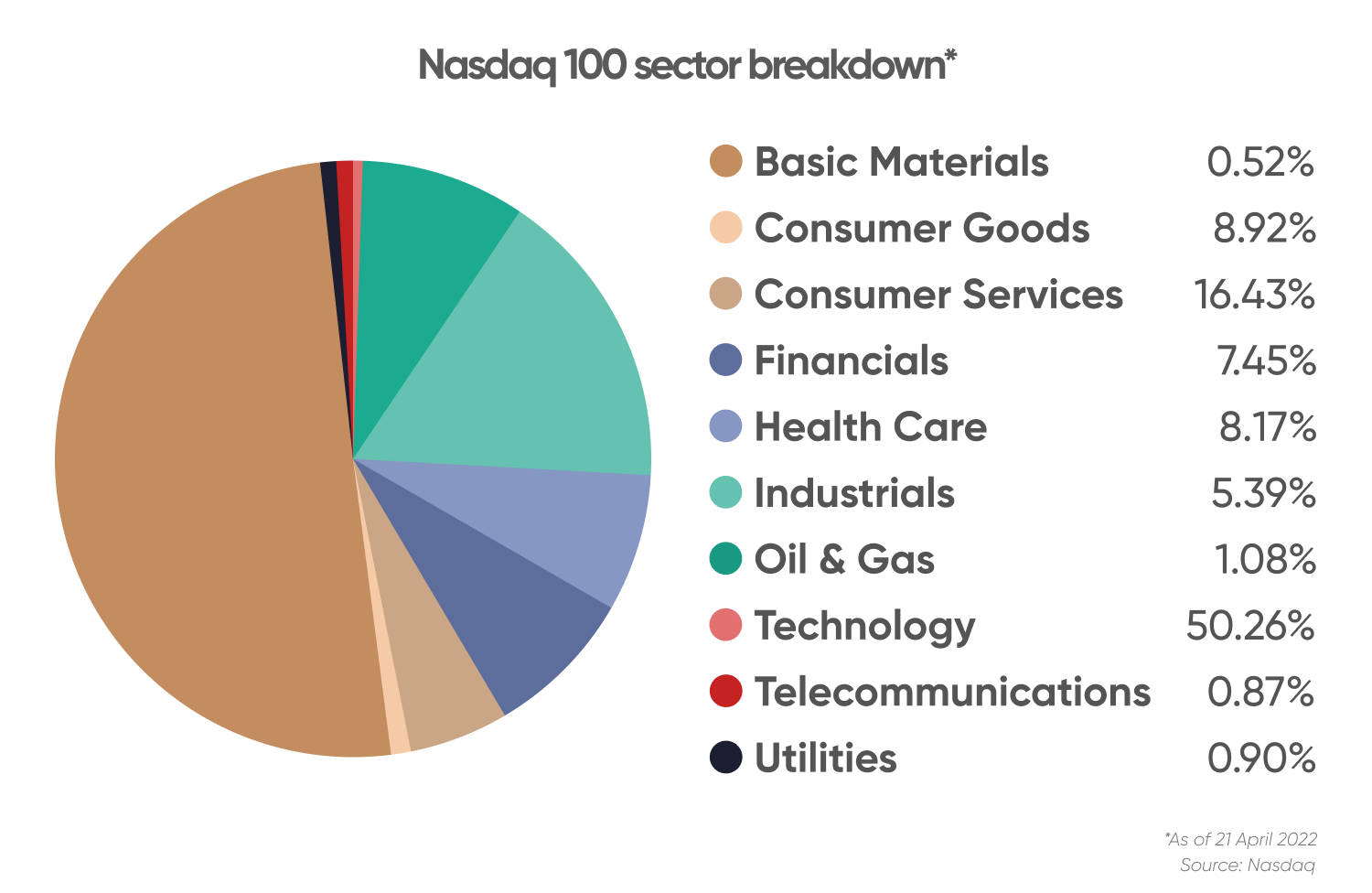

The US Tech 100 Index tracks the performance of the 100 largest domestic and international non-financial stocks listed on the Nasdaq Stock Exchange. Any company classified as a financial company or a real estate investment trust is not eligible for inclusion in the index.

Tech stocks dominate the US Tech 100 Index with a weightage of 50.26%, as of 21 April 2022. Consumer Discretionary and healthcare sectors follow with weightages of 16.43% and 8.17%, respectively.

Eight of the top ten companies by weightage were the same of both the S&P 500 Index and the US Tech 100 Index, as of 31 March 2022, with iPhone maker Apple (AAPL), software company Microsoft (MSFT), e-commerce firm Amazon (AMZN) and electric vehicle manufacturer Tesla (TSLA) among the top four constituents for both the indices.

It is clear that the S&P 500 Index is more diverse in terms of sector weightage versus the US Tech 100 Index, which has over 50% tech exposure. Therefore, any strength or weakness in tech stock performance will reflect at a higher magnitude on the US Tech 100 Index than on the broader S&P 500 Index.

Past and present: US Tech 100 vs S&P performance

Tech stocks are considered growth stocks and tend to trade at higher valuations compared with other sectors as investors price these companies based on their future earning potential.

In optimistic market conditions, tech stocks tend to outperform peers as investors have a rosy view of the future. This is evident when we compare the five-year performance of the US Tech 100 Index and the S&P 500 Index.

According to the US Tech 100 vs S&P 500 chart, over the past five years, optimism over technology sector growth and favourable ultra-low interest rate conditions propelled the US Tech 100 Index to post returns of over 161%, as of 19 April’s close. The tech-heavy index outperformed the diverse S&P 500 Index by a large margin as the latter returned about 90% in the same period.

US Federal Reserve (Fed) came under pressure to tame 40-year high US inflation, which pushed the Fed to embark on its first rate hike cycle in four years on 16 March 2022.

Investors already jittery over the rising cost of capital became increasingly nervous after the outbreak of war between Russia and Ukraine, which exacerbated runaway inflation by disrupting the global supply of oil, gas, metals and wheat.

“The economic effects of the war are spreading far and wide – like seismic waves that emanate from the epicentre of an earthquake – mainly through commodity markets, trade and financial linkages,” said Pierre-Olivier Gourinchas, economic counsellor and director of research at International Monetary Fund.

“Because Russia is a major supplier of oil, gas, and metals, and, together with Ukraine, of wheat and corn, the current and anticipated decline in the supply of these commodities has already driven their prices up sharply,” he added.

Souring investor sentiment led the S&P 500 Index to post negative returns in 2022, down about 7%, as of 19 April’s close. The US Tech 100 Index on the other hand slumped even further, down about 14% in the same period, as investors sold high-flying tech stocks to seek the shelter of old economy and value stocks.

“There’s no doubt that inflation concerns in the US are causing technology stocks to de-rate, as anticipated rate rises impact company valuations,” said Blair Modica, director at Sydney-based ETF fund manager BetaShares.

Recent crashes seen in Meta Platforms (FB) and Netflix (NFLX) stock shows the underlying fear among investors and proves that even the blue-chip stocks are not immune to derating.

Investors were quick to dump Meta Platforms on 3 February as the company plunged over 26% on announcing weak growth forecasts. Risk aversion took centre stage on 20 April as Netflix stock crashed over 35% after the streaming giant reported losing subscribers for the first time in a decade.

Recession outlook: S&P 500 vs US Tech 100

A 25 basis point interest rate increase by the US Federal Reserve in March kickstarted a discussion about an upcoming recession in the market. According to analysts at brokerage firm Jefferies, over the last 70 years, all ten recognised recessions were “immediately” preceded by a Fed rate hike cycle.

Having studied recessions of the past, Jefferies noted that “sectors with leverage to inflation” or cyclical sectors such as energy, financials, industrials and materials have shown consistent stock outperformance as a recession nears.

Jefferies added that historical fundamental data suggested that the healthcare sector demonstrated the most durability in terms of both revenue and net income growth during past recessions.

“The current trading environment would seem to imply that market participants are already breaking out the ‘recession is <12M away’ playbook,” said Jefferies in a report entitled ‘Admiring the Sunset or Afraid of the Dark? Equities for a Dimming Outlook’.

In terms of industry breakdown for the S&P 500 Index and the US Tech 100 Index, the healthcare sector had a weighting of 13.6% in the former and a weighting of 5.9% in the latter, as of 31 March 2022.

“Jefferies’ view is that certain realities of the economy indicate that while a recession is unlikely in 2023, conditions may have deteriorated enough by 2024 to see a downturn,” said the brokerage firm.

Elsewhere, US investment bank Morgan Stanley called for investors to proceed with caution after the S&P 500 Index corrected from a more than nine-month low to rally over 12% by the end of March. Both the S&P 500 Index and the US Tech 100 Index posted their first monthly gains of the year in March.

“Recent strength in the equities market may be nothing more than a bear-market rally, fueled by wishful thinking and excess liquidity,” said Lisa Shalett, chief investment officer at the wealth management unit of Morgan Stanley.

“Many investors today appear to believe the recent rise in interest rates will be short-lived and that real rates will remain negative, which could support higher stock valuations. This may be wishful thinking. We believe the Fed is apt to tighten policy more than many investors expect, impacting real rates and valuations as a result,” Shalett added.

World economic forecasts from the International Monetary Fund (IMF) spoke along the same lines, as the institution on 19 April cut its global growth projections for 2022 and 2023 citing war in Europe, lockdowns in China, rising inflation and tightening monetary policy.

“Overall risks to economic prospects have risen sharply and policy trade-offs have become ever more challenging,” said the IMF in its April report.

Note that analysts can be wrong. Economic forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing, and never invest or trade money you cannot afford to lose.

FAQs

Does the US Tech 100 outperform the S&P 500?

Over the last five-year period, optimism over growth in the US technology sector and favourable ultra-low interest rate conditions propelled the US Tech 100 Index to post returns over 161%, as of 19 April’s close. The tech-heavy Index outperformed the diverse S&P 500 Index by a large margin as the latter returned about 90% in the same time. Please note that past performance does not guarantee future returns.

What factors affect US Tech 100 and S&P 500?

The S&P 500 Index is more diverse in terms of sector weightage versus the US Tech 100 Index, which has over 50% tech exposure. Therefore, any strength or weakness in tech stock performance will reflect at a higher magnitude on the US Tech 100 Index than on the broader S&P 500 Index.

Are US Tech 100 stocks in the S&P 500?

A number of large-cap companies overlap and form constituents of both US Tech 100 and S&P 500 indices.