Moroccan dirham (MAD) forecast: Will the dirham continue to dip amid falling foreign exchange reserves?

Will the MAD gain momentum against the USD and EUR after a sharp decline?

The Moroccan dirham (MAD) has made gains against a softening US dollar (USD) after an extended decline over the past year on a surge in the dollar and falling foreign currency reserves.

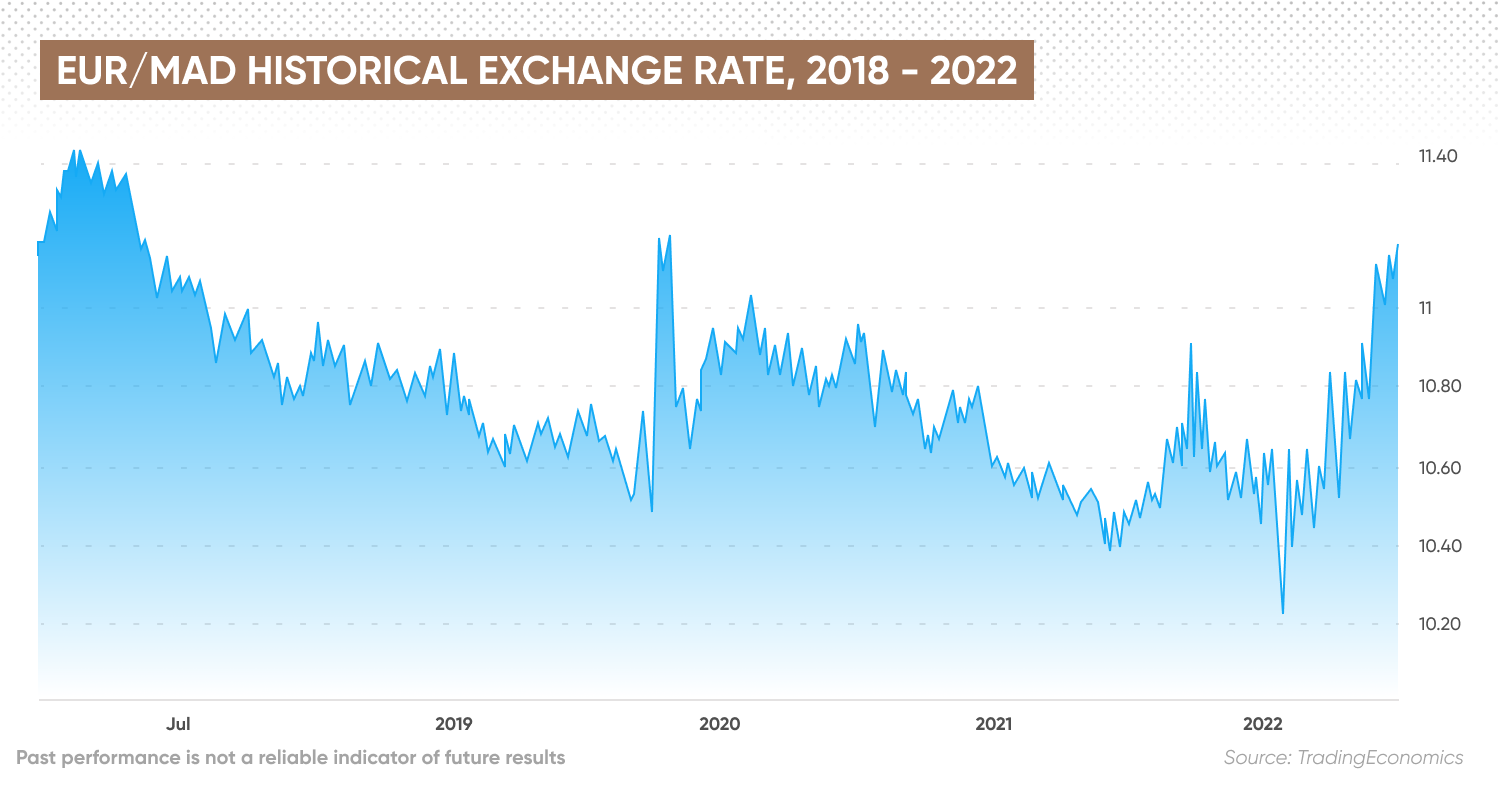

The dirham has also stabilised against the euro (EUR) following a sharp fall over the past year.

Can the dirham continue to strengthen and provide relief to the Moroccan current account, or will it come under renewed pressure as its trading partners face the prospect of recession?

In this article we look at the major drivers for the value of the Moroccan dirham and the latest MAD forecast analysis heading into 2023.

What drives the value of the MAD?

The Moroccan dirham has been the official currency of Morocco since 1960, replacing the French franc after the country gained independence from France.

The dirham is a closed currency, so it can only be bought in Morocco. The dirham is managed against a basket of the currencies of its major trading partners, which has changed over time. The basket currently contains the euro and the US dollar at a weighting of 60% to the euro and 40% to the dollar.

In 2018, Morocco began a gradual transition from a fixed exchange rate to a more flexible regime by widening the band in which the currency is allowed to fluctuate from ±0.3% to ±2.5%. In March 2020, the band was widened to 5%.

The use of a currency basket and fixed band means that when the euro or dollar rises sharply, Morocco must sell its foreign currency reserves to keep the dirham within the band. That means the value of the currency is strongly influenced by the economic performance and monetary policy of its trading partners, as well as its own economy.

Dirham halts extended downward trend

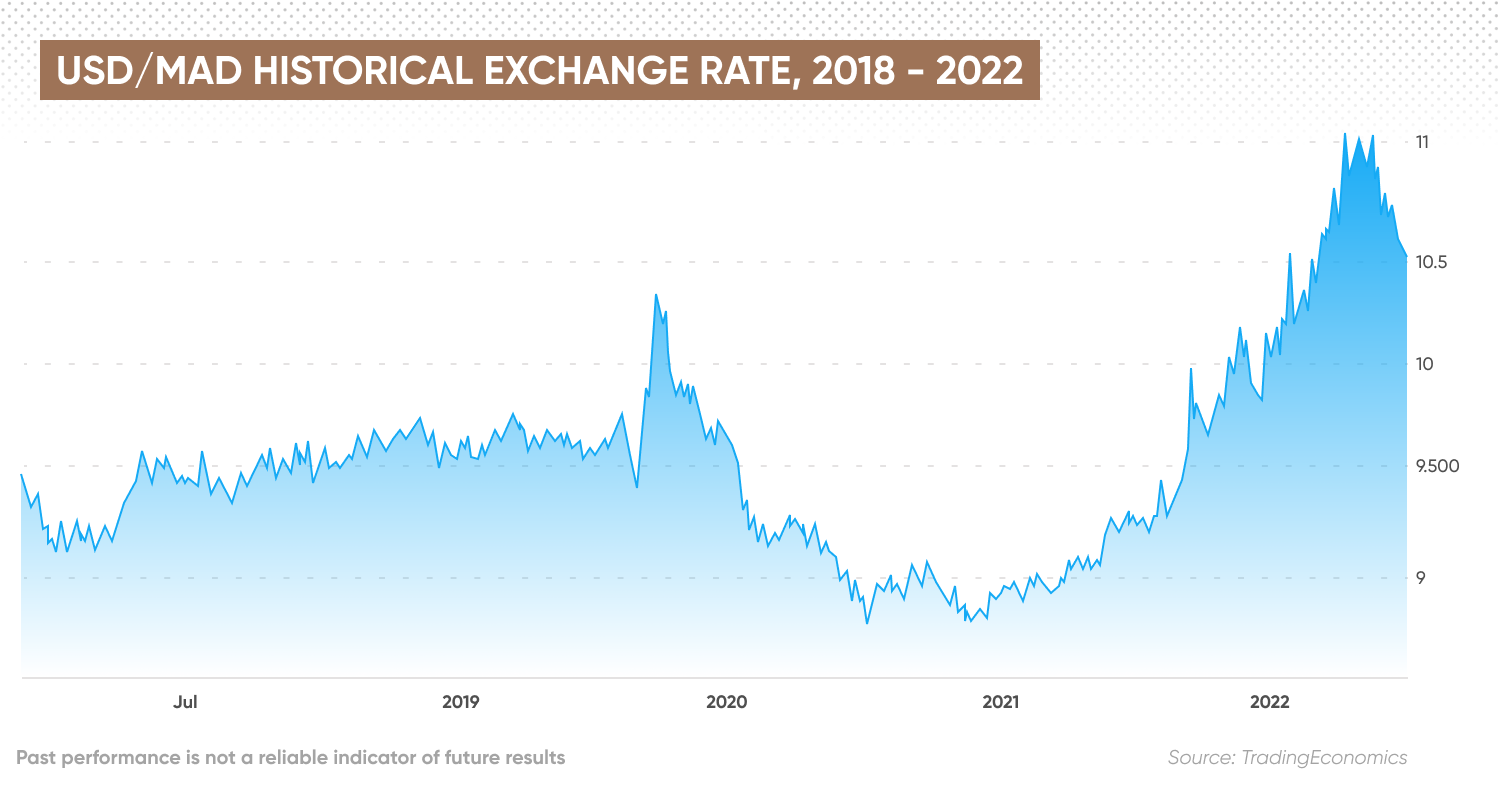

The Moroccan dirham has been in decline against the US dollar since May 2021, when it was trading around 8 dirhams to the dollar.

The USD/MAD exchange rate ended 2021 around 9.25. It climbed to 9.74 in late February as the dollar strengthened in response to Russia's invasion of Ukraine. The dollar’s gains accelerated to reach the 10 mark in May 2022 as the US Federal Reserve (Fed) increased the pace of its interest rate hikes.

The USD/MAD pair briefly dipped to 9.83 in early June, but was back above 10 by mid-month, approaching 10.50 in July. The pair reached the 11 mark in late September, tradeing around that level until 3 November.

With the US dollar retreating from its highs in the past month at the prospect of a slowdown in the pace of interest rate hikes, the USD/MAD has retreated towards the 10.50 level for the first time since August.

Against the euro, the dirham has fluctuated widely in the past year, from around 10.40 in late November 2021 to 10.90 in March 2022, down to 10.22 in July and then up to 11.13 on 23 November, its highest level since April 2020. The EUR/MAD pair reached 11.14 on 1 December and has remained above the 11 mark since.

As of October note, analysts at Fitch Solutions expected that Morocco will need to seek financing from the International Monetary Fund (IMF), as its foreign exchange reserves have dropped below five months of import cover for the first time in nine years. The agency said:

The IMF added that it expected FX reserves to come under more pressure throughout the first half of 2023 as the US dollar and commodity prices remain elevated. “This will lead to a decrease in Morocco’s import cover from 7.3 months in 2021 to 4.9 months in 2022 and 4.8 months in 2023, the lowest such level since 2012,” the analysts stated.

Moroccan dirham forecast: Has the dirham bottomed out?

What do the foreign exchange headwinds mean for a realistic Moroccan dirham forecast?

In a September note Fitch Solutions said that a weaker Moroccan dirham could continue to raise the cost of imports, keeping the country’s inflation rate elevated at 3.7% next year, which would be the second highest inflation rate since 2008 – second only to 2022 – and well above the 10-year pre-Covid-19 average of 1.1%.

USD/MAD forecast

Fitch Solutions analysts were bearish in their USD/MAD forecast as they expected the US dollar strength to further weigh on the Moroccan dirham, which prompted them to revise down their end-of-year forecast from MAD10.50/USD to MAD11.15/USD.

“Our revision entails the dirham will average MAD10.21/USD in 2022, weaker than our previous forecast of MAD10.00/USD. Our new forecast reflects a 13.4% depreciation relative to 2021, the steepest depreciation since at least the 1990s,” they said.

“A weaker-for-longer dirham will keep inflation elevated in 2023. We forecast the dirham will average MAD10.48/USD in 2023, marking a depreciation of 2.5% y-o-y due to a strong greenback.”

The Moroccan dirham forecast for 2023 from data provider Trading Economics, as of 13 December, projected that the currency could retreat to its lows against the US dollar, trading at 11.09 in 12 months’ time, up from 10.68 at the end of this quarter, based on its global macro models and analysts’ expectations.

The MAD could then stabilise around the low, according to the Moroccan dirham forecast for 2025 from the algorithm-based service Wallet Investor, which at the time of writing showed the MAD/USD rate at 11.122 by the end of the year, up from 10.448 at the end of 2023 and 10.797 at the end of 2024.

EUR/MAD forecast

The euro to Moroccan dirham forecast from Trading Economics, as of 13 December, indicated that the MAD could remain relatively stable against the euro over the next year, trading at 11.0651 by the end of this quarter and at 10.9325 in one year.

Wallet Investor’s EUR/MAD forecast suggested that the dirham could gain some value against the euro next year, with the pair trading down to 10.711 at the end of 2023. But the MAD prediction showed that the pair could then move back up to 10.855 by the end of 2025 and 11.494 in December 2027.

Given the volatility of currency markets, analysts have yet to issue a Moroccan dirham forecast for 2030.

If you are looking for a Moroccan dirham forecast to help inform your trading strategy, it’s important to remember that currency market volatility makes it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions. Their predictions can be wrong.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and a wide range of commentary, before making any trading decisions. Keep in mind that past performance is no guarantee of future returns. And never trade money you cannot afford to lose.

Stay up to date with the major forex pairs using our currency strength meter.

FAQs

Has the Moroccan dirham been going up or down?

The Moroccan dirham has halted a sharp decline against other currencies such as the US dollar and euro in the past month.

Will the Moroccan dirham get stronger in 2023?

The direction of the MAD will depend on the economic performance and monetary policy of its trading partners such as the US and Europe, as well as its trade deficit and FX reserves.

Is it a good time to buy the Moroccan dirham?

Whether now is a good time for you to buy the MAD will depend on your personal circumstances and trading goals. As with any asset, you should do your own research to take an informed view of the market.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and a wide range of commentary, before making any trading decisions. Keep in mind that past performance is no guarantee of future returns. And never trade money you cannot afford to lose.