The long-term forecast for the US dollar/British pound exchange rate

What is the long-term forecast for the exchange rate between the US dollar and the British pound? In figuring out an answer, it is important to remember that the differences between these two currencies and the economies that underpin them are as important as the similarities.

The first Atlantic telegraph cable went “live” in 1858, and two of the world’s most important currencies could now be traded in what amounted to real time. It is a tribute to the seismic consequences of the new London-New York communication channel that to this day the exchange rate between the dollar and sterling is known in the market simply as “cable”.

Unsurprisingly, given these are two denominations with much in common, the pound/dollar rate gets a lot of coverage, in particular as a gauge of the health or otherwise of the UK economy.

Both are issued by English-speaking democracies with market-based economies and long standing ties of trade, defence and mutual affection.

Less horror of inflation

But the relationship has changed markedly over the years and, before coming up with a long-term British pound/US dollar forecast, it is useful briefly to sketch what those changes have been.

When the undersea cable opened, sterling remained the top-dog currency in the world, and London was the centre of the gold standard that backed major currencies. But breakneck US industrialisation during the 19th Century gradually equalised the importance of the two denominations.

By the end of the First World War, during which Britain had been forced to suspend the gold standard, a new “gold exchange standard” was launched, in which the dollar shared equal billing with the pound as the anchor currencies of the system. Another world war saw the dollar assume sterling’s old role as number-one reserve currency, with the pound playing a subsidiary part.

More recently, the pound has been seen as a higher-yielding version of the dollar, in other words one on which traders and investors would require higher returns than on the larger currency despite the similar characteristics. Come the launch of the euro in 1999, and some feared that the pound would be like a small tugboat caught in the middle of two ocean liners, its value buffeted one way and another as the two giants wrestled on foreign exchanges.

That doesn’t seem to have happened, in part, perhaps, because both countries share a monetary policy philosophy different from that of the European Central Bank (ECB). While both the Federal Reserve and the Bank of England are independent, the ECB is almost entirely insulated from direct political accountability.

Furthermore, neither Britain nor the US has inherited Germany’s horror of inflation and accompanying tight monetary policy. The ECB has.

Post-Brexit talks loom large

There have been two big upsets to the pound/dollar rate in the last 12 years – the drop from nearly $2 to $1.75 to the pound after the financial crisis and the further decline to about $1.25 after the 2016 Brexit vote.

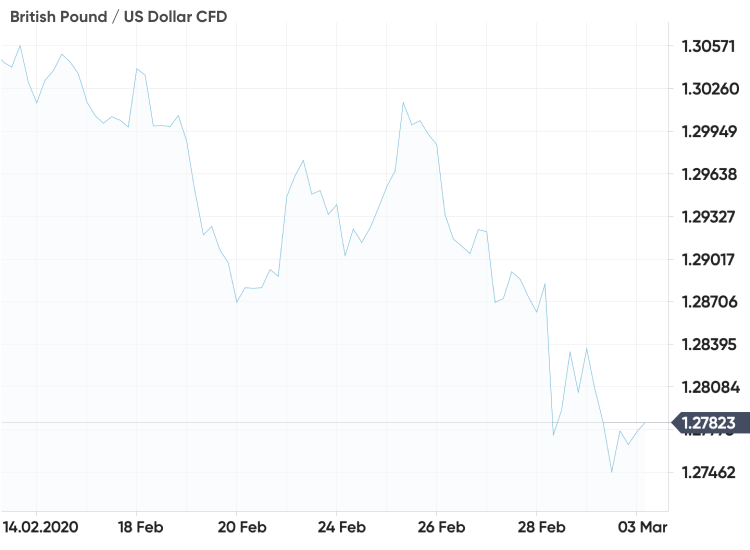

Currently, the British pound/US dollar exchange-rate trend seems to show the momentum to be with sterling, from a 12-month low in August of $1.2027 to touching $1.30 today.

So what is the outlook for the British pound/US dollar rate?

The first point to make is that much will depend on political developments on both sides of the Atlantic. In the US, a presidential election is looming in which, for the first time in many years, the outcome could profoundly affect the direction of America’s economic policy. On the one hand, Donald Trump’s big-spending and tax cutting may continue if he returns to office, assuming currency and money markets do not try to discipline Washington’s spendthrift ways, while on the other candidates such as Bernie Saunders are offering the most left-wing programme in decades.

In Britain, meanwhile, there may be no election due until 2024, but the country’s economic prospects are intimately bound up with the success or otherwise of post-Brexit negotiations over a trade deal between the UK and European Union. Sterling is a very international, outward-facing currency – in proportion to the size of the economy, probably more so than the dollar – and anything that hampers sterling-denominated trade will be bad for the pound’s value.

A second point is that the International Monetary Fund (IMF) is forecasting noticeably higher inflation in the US this year, 2.3%, than in the UK, 1.9%. Usually this would make dollar assets less attractive than sterling assets, because the value of the former is declining more rapidly than that of the latter.

But the dollar is not a usual currency, being the medium in which between a half and two-thirds of all world trade is denominated. Sterling remains widely traded round the world, but it does not have this bedrock of support enjoyed by the dollar.

This leads to a third point, which is that sterling is the smallest of the five major currencies that underpin the reserves of the IMF, along with the dollar, yen, euro and Chinese yuan. It is thus vulnerable to changes in sentiment, especially as the pound’s “big brother”, the dollar, may appear a safer bet during seriously troubled times.

A fourth point is that there is usually little incentive to hold large amounts of both dollars and pound, given the similarities between the two. In terms of diversification, any other three denominations would be more suitable.

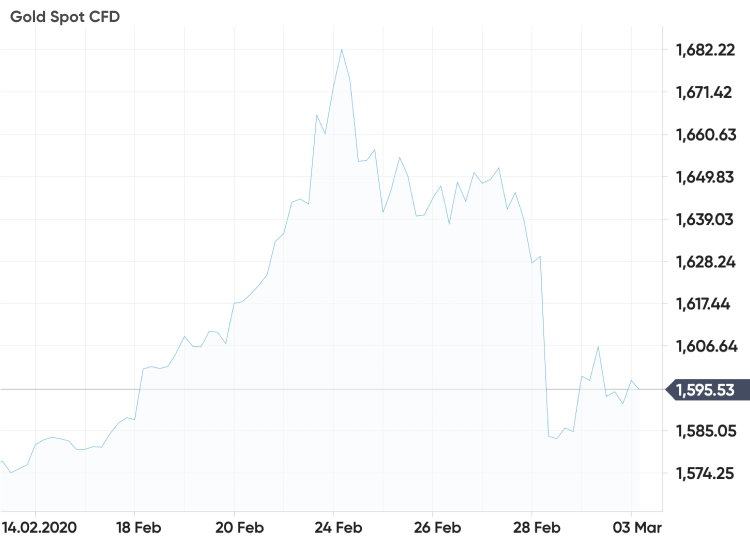

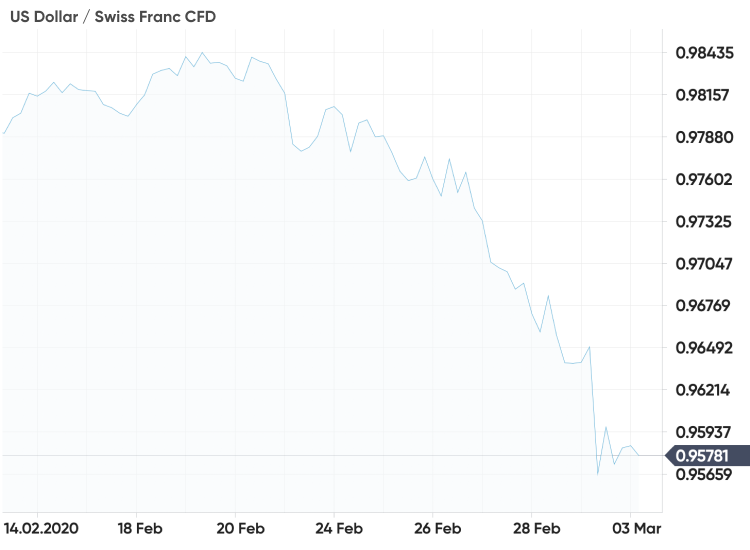

Finally, in looking at the likely path of the British pound versus the US dollar, we have to remember that they do not trade together in isolation. The relative attractions of each can be judged only by reference to other currencies – there have been times in the past when both sterling and the dollar were out of favour and traders and investors preferred to hold German marks or Swiss francs, for example.

To sum up, the current momentum seems to lie with sterling, but we are entering what may be choppy waters. Both are highly political currencies, in a way that the euro, for example, is not, and politics are set to loom large on both sides of the Atlantic.