Jupiter price prediction: Coinbase listing gives JUP forecast a bump

JUP coin surged after Coinbase listing, but can it keep the momentum?

Layer 1 blockchain network Jupiter’s native token JUP, has outperformed most cryptocurrencies in 2022 by returning over 100% year-to-date as of 12 July. JUP’s listing on crypto exchange Coinbase (COIN) in June has helped the token gain exposure to return-seeking investors amid a crypto bear market.

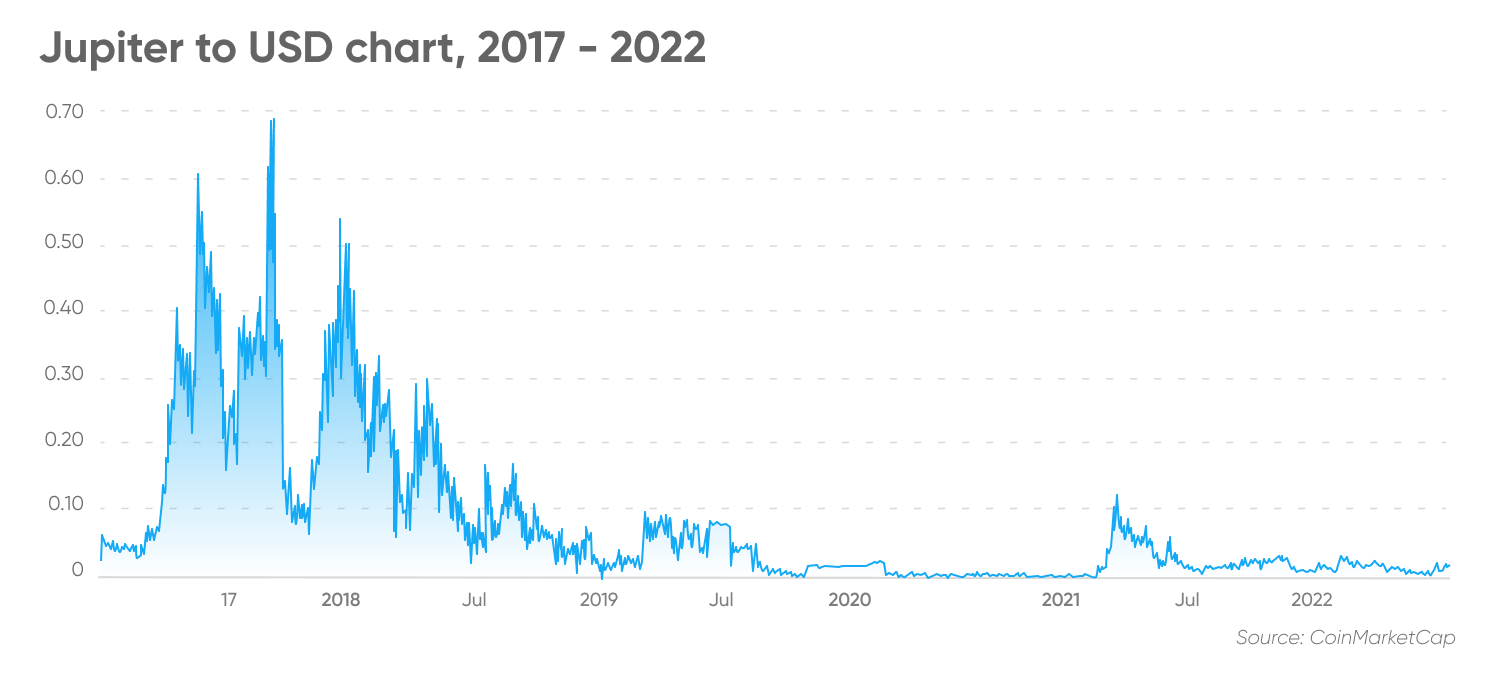

However, historical data from CoinMarketCap showed that JUP has been through multiple phases of peaks and troughs. The token last hit an all-time high of $0.9044 in September 2017. It lost 99.9% of its value between January 2018 and December 2020.

After more than doubling in value since the start of 2022, JUP still remains about 98% below its record levels at current prices of near $0.015. Here we take a look at what’s next for the token and what factors could shape Jupiter price prediction.

What is Jupiter?

Jupiter is a layer 1 blockchain that allows developers to build applications on top of its network. The project was developed by Missouri-based Sigwo Technologies co-founded by Steve Grove and David May.

According to the company’s website, Grove is an IT professional with over 20 years of experience and has worked in the blockchain technology sector for five years. May had previously founded a decentralised sports-betting blockchain in 2016. He is also a medical practitioner and is exploring the role of blockchain technology in the medical field.

According to its website, Jupiter uses “military-grade encryption” to store data on applications. The blockchain is powered by the Gravity framework that developers can use to create customisable and secure decentralised applications (dApps) on its network. Developers can also use the Jupiter SDK to complete common tasks like data fetching and data encrypting/decrypting.

Metis, an encrypted and decentralised messaging application, is the project’s flagship offering. According to Jupiter, users do not need to submit their personal information to use Metis. The app also offers ad-free experience and two-factor authentication security.

Leda is a non-fungible token (NFT) marketplace built on the Jupiter blockchain that uses the network’s native JUP token to create or buy NFTs. Fndr is an encryption password manager on Jupiter.

JUP is the native token of the Jupiter blockchain used to create and buy NFTs on Jupiter’s NFT marketplace Leda and to earn yield on decentralised and centralised crypto exchanges.

Token holders can also join the Jupiter Earn program by buying a crypto called FORGE in exchange for JUP.

According to CoinMarketCap, as of 12 July, JUP is the 643rd largest cryptocurrency with a market capitalisation of about $15m. The token has a maximum supply of one billion tokens and JUP’s circulating supply was at 999.17 million tokens at the time of writing.

Coinbase listing and other JUP news

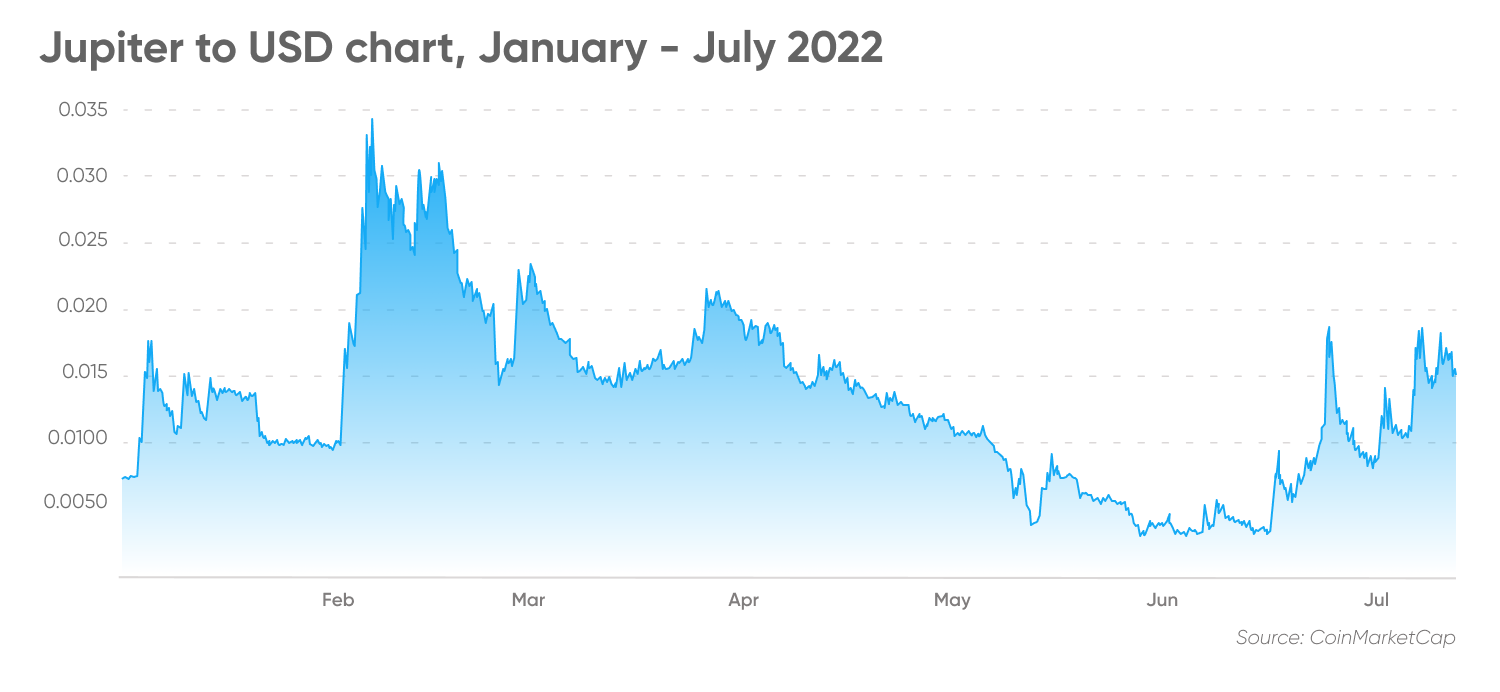

In the most recent Jupiter news, on 22 June Coinbase (COIN) announced that it will list the JUP coin on its exchange, boosting the coin’s value to reach $0.02191 on 24 June, a 70% surge from the $0.0728 a day earlier.

According to Anndy Lian, chief digital advisor at Mongolian Productivity Organization and the author of Blockchain Revolution 2030, the price spike was accompanied by a series of factors.

Earlier in June, Metis Messenger was launched on Apple’s App Store. In February this year, Jupiter released Metis Messenger v1.4 that allowed sending and receiving JUP tokens. Future versions will focus on buying and selling assets and managing NFTs within the app.

In late December 2021, crypto exchange KuCoin integrated Jupiter Mainnet to allow deposit and withdrawal services. KuCoin previously listed the token in June 2021.

Earlier in 2021, Jupiter Bridge was hacked on multiple occasions. Fortunately for the users, their funds were not lost and only the Jupiter team was affected, according to the project’s blog post. JUP slumped over 50% in the fourth week of November 2021.

JUP price performance: Volatile ride

Data from CoinMarketCap showed that JUP was trading at around $0.02 on 12 January 2017. The token would see its best year in 2017 amid an initial coin offering (ICO) boom in the cryptocurrency sector.

JUP soared to an all-time high of $0.9044 on 17 September 2017. Even though the token saw its prices drop after hitting record highs, JUP closed the year over 1600% higher at $0.33.

However, its value nearly wiped out in the three years that followed. Between 1 January 2018 and 31 December 2020, the token fell from $0.33 to $0.00029, a slump of 99.9%.

JUP price got a boost after KuCoin listed the token in June 2021, rising to a high of $0.07 in the first week of that month. However, JUP prices failed to keep the momentum and fell 90% to $0.007 by 31 December 2021.

The token has rebounded in 2022 helped by Jupiter’s mainnet integration on KuCoin, release of its latest version of decentralised messaging app and token listing on Coinbase (COIN). As of 12 July 2022, JUP has gained 109% year-to-date from about $0.007 to its current price of about $0.015.

Jupiter price prediction

As of 12 July, CoinCodex’s Jupiter coin price prediction based on technical indicators showed that the token’s value could surge over 100% to reach $ 0.030899 by 17 July 2022.

CoinCodex’s one-month JUP price prediction saw the token rising further to $0.047442.

For the longer term, algorithm-based website Wallet Investor’s Jupiter price prediction for 2022 suggested the token could trade at an average price of $0.00159 by the end of the year.

Wallet Investor’s Jupiter price prediction for 2025 saw the token to rise to an average price of $0.000542 by the end of 2025.

DigitalCoinPrice was bullish on JUP’s price performance for the long term. According to its Jupiter price prediction for 2030, the site expected the token to trade at an average price of $0.0695 in 2030.

GovCapital’s Jupiter price prediction as of 12 July 2022 saw the token trading at $0.214 in five years’ time.

Note that algorithm-based Jupiter price predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence and remember that your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and investment goals. And never invest money that you cannot afford to lose.

FAQs

Is Jupiter a good investment?

Jupiter is a layer 1 blockchain that allows developers to build applications on top of its network. Whether JUP coin is a suitable investment for you would depend on your risk attitude, portfolio goals and composition, and other personal factors. Always conduct your own research before investing. And never invest or trade money you cannot afford to lose.

Will Jupiter go up?

According to the Jupiter crypto price prediction by algorithm-based forecasting service Wallet Investor, the token could trade at an average of $0.00159 by the end of 2022. Meanwhile, DigitalCoinPrice expected the token to trade at an average of $0.0695 in 2030. Note that algorithm-based predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research.

Should I invest in Jupiter?

Whether you should invest in JUP token should be based on your risk attitude, portfolio goals and composition, and other personal factors. Always conduct your own research before investing. And never invest or trade money you cannot afford to lose.