Infosys stock forecast: Will the price rebound?

Deteriorating economic outlook in the US and recession worldwide could add pressure on the Indian IT firm.

Shares of the Indian IT services company Infosys (INFY) have dropped since reaching January highs amid deteriorating economic conditions in the US and the upcoming global economic slowdown. On 26 September, the stock dropped to a fresh 52-week low of INR1,355 per share on concern about the global economy outlook.

Despite having good business and financial performance, Infosys hasn’t been spared from the slump. We take a look at Infosys’ latest financial performance and other factors that may give you insights on the latest Infosys stock forecast.

What is Infosys?

In 1981, Nagavara Ramarao Narayana Murthy and six software engineers founded Infosys Technologies in Pune, India. Dubbed as the Father of India’s IT sector by Time magazine, Murthi built Infosys into the world’s third largest IT service company by market capitalisation as of July 2022.

After moving its headquarters to Bangalore in 1992, Infosys kicked off an initial public offering (IPO) and listed on India’s stock exchange the following year. In 1994, the company became the first Indian IT firm listed on the Nasdaq under the American Depositary Shares Program (ASD). In 2012, Infosys listed on the New York Stock Exchange (NYSE).

As of July 2022, Infosys provides services through 13 subsidiaries in more than 50 countries, enabling clients to navigate digital transformation. The company’s subsidiaries include EdgeVerve Systems Limited, Infosys BPM Limited, Infosys Consulting Holding, Panaya, Noah Consulting and Infosys Public Services.

The IT giant offers digital marketing, digital commerce, digital workplace services, applied artificial intelligence (AI), blockchain, data analytics, the Internet of Things (IoT), engineering services, digital supply chain, digital process automation, cybersecurity and other services.

Customers can also use platforms offered by Infosys, such as EdgeVerve, an AI, automation and analytics service; Finacle for digital banking solutions; and Infosys Equinox, a commerce and marketing platform.

Technical view and price action

Infosys stock is trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) in India. Its American Depositary Shares (ADRs) are listed on the New York Stock Exchange (NYSE).

The IT stock is also a constituent of the NIFTY IT index, a sub-index of NSE’s flagship free float index, the Nifty 50.

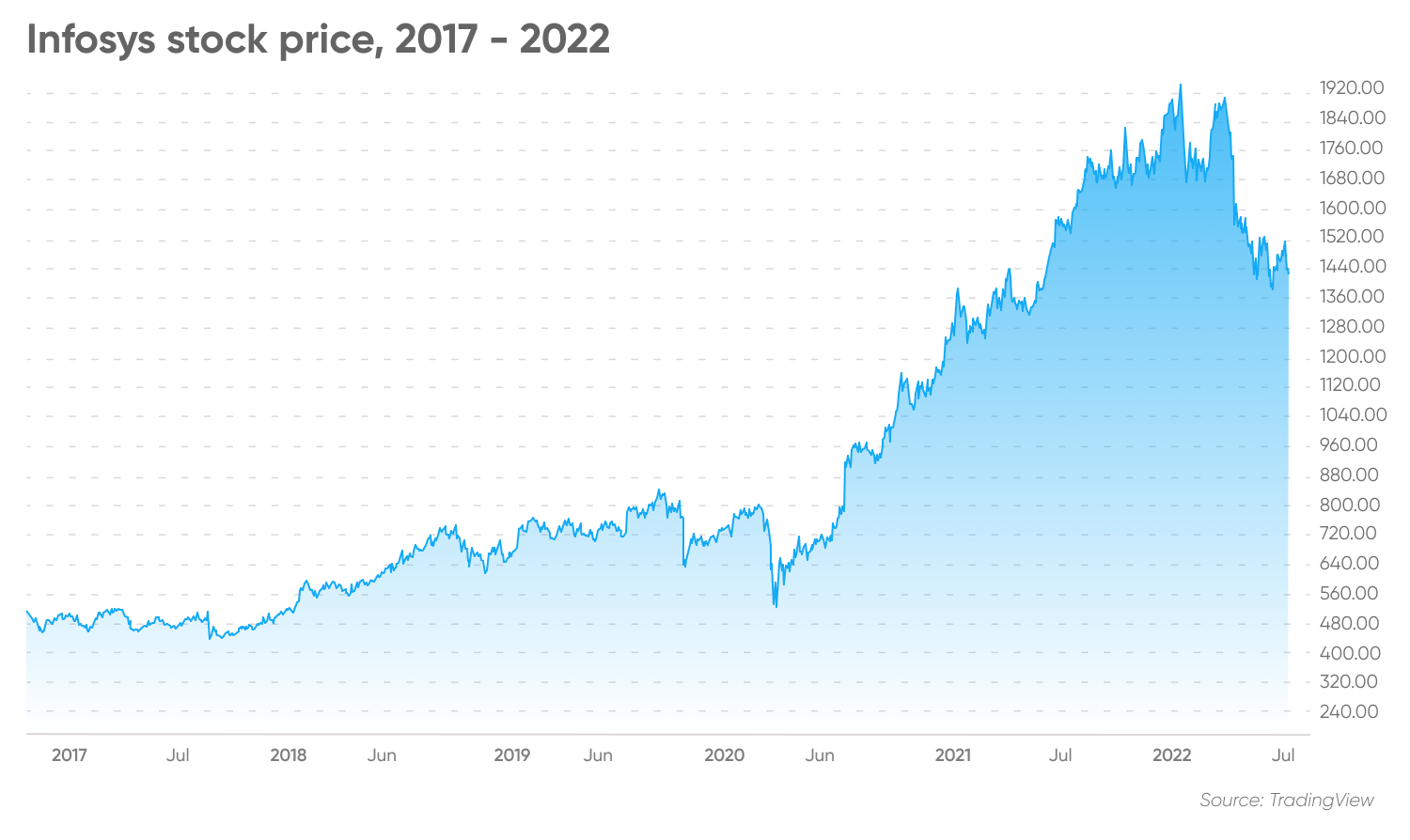

Infosys benefitted from the rapid digitalisation that happened during the Covid-19 pandemic, much like its tech stock peers, as the new working-from-home trend increased demand for software and IT services.

The pandemic-induced demand helped Infosys stock to rebound from the low of INR585 at the start of pandemic in mid-March 2020 to close the year at nearly INR1,300. The stock recorded returns of over 71% in 2020.

INFY stock price continued its robust performance in 2021, gaining 50.3% as it closed the year at INR1,887.75.

The IT stock touched its 2022 peak at INR1,953.50 on 17 January after the company reported strong quarterly earnings on 12 January.

The company recorded revenues of $12.03bn in the nine months ending 31 December 2021 – a near 21% increase year-on-year. Net profit for the period rose to $2.21bn, from $1.91bn a year earlier.

However, the stock has fallen since then. It recovered briefly to INR1,906 on 31 March, but has given up gains amid fears of recession in the US, the leading export market for Indian software products.

As of 27 September, the stock is trading at INR1,398 having dropped more than 26% in the year-to-date and 21% in one year. In comparison, the stock price of Mumbai-based Tata Consultancy Service (TCS), the world’s largest IT service firm by market cap, has dipped 19.14% this year, while the Nifty IT index has lost 30.2%.

India IT outlook and INFY news

Worries about recession in the US have put Indian IT stocks under pressure since March 2022 when the US Federal Reserve (Fed) imposed its first rate hike to tame soaring inflation.

Since then, the Fed has been aggressively raising interest rates as inflation touched a four-decade high. The most recent consumer price index (CPI) reading showed that US inflation reached 9.2% in June, which could prompt the Fed to raise rates after the 0.75% hike in June.

The economic outlook in the US and potential slowing economy has heightened concerns on earnings of Indian IT companies, as many of them have large exposure to the US market.

For example, North America accounted for 61.8% of Infosys’s revenue in the first quarter of FY 2023 ending 30 June 2022. Europe, which has been affected by war in Ukraine and the energy crisis, contributed 25% of its revenue in the same period, slightly down from 25.2% in the fourth quarter of 2022.

The macroeconomic headwinds came amid otherwise rosy projections, with software exports by the IT companies reaching $16.29bn in the first quarter of 2022, according to India Brand Equity Foundation (IBEF) reports, citing data from Software Technology Park of India (STPI). IBEF is a trust founded by India’s Department of Commerce at the Ministry of Commerce and Industry.

According to the National Association of Software and Service Companies (Nasscom), the Indian IT industry’s revenue is expected to touch $227bn this year, up from $196bn in 2021.

Jeffries lowered its revenue and earnings per share (EPS) estimates for Indian IT firms by up to 9% after reviews 1Q earnings, Jefferies analysts Akshat Agarwal and Ankur Pant wrote on 12 August.

On the corporate news side, Infosys has continued to push ahead partnerships and acquisitions, including the five-year extension of a technology partnership with Roland-Garros through 2026, the company announced in March.

In the latest news, on 13 July the company announced the acquisition of Danish life sciences technology and consulting firm BASE life science.

Strong 1Q 2023 revenue growth

For the first quarter of 2023 fiscal year ending 30 June 2022, Infosys booked revenue of $4.44bn, a 17.5% growth year-on-year, the company announced on 25 July 2022. The digital segment remained the main driver of the revenue, accounting for 61%.

Net profit dropped to $689m in the period compared to $705m a year-ago. Basic EPS fell 1.1% ro $0.16 a share, from $0.17 in the same period a year ago.

Infosys inked $2.3bn of total contract value (TCV) in the fourth quarter of fiscal year 2022.

Meanwhile, the board proposed the total dividend per share at approximately $0.41 for fiscal year 2022, a 14.8% increase over 2021.

Infosys CEO Salil Parekh said the company revised revenue growth guidance for FY 2023 at 14% to 16%, compared to 12%-15% set in June on strong demand opportunity and pipeline.

However, the company maintained its margin guidance at 21%-23%.

Infosys stock forecast:Analyst views

Jefferies has kept Infosys as its top pick, given its growth leadership and strong execution.

In the previous note published on 6 June, Agarwal and Pant wrote that Infosys is on the path to deliver 11%-15% compound annual growth rate (CAGR) in revenue/EPS 2023-2025.

In a note published on 25 July, Mumbai-based financial service company Motilal Oswal said they expected Infosys to deliver margin on the lower side of its guidance band, with strong growth and reduced dependence on sub-contractors as attrition falls.

“We expect the company to be a key beneficiary of an acceleration in IT spends,” the company said, highlighting opportunity in the digital segment.

Price targets for the stock

Analysts have mixed views on the Infosys share price forecast.

In August, Jefferies lowered the price target for INFY stock price to INR1,619.70 down from INR1,700 it forecast in July. It maintained a ‘buy’ rating for the stock.

Motilal Oswal lowered their Infosys stock forecast to INR1,760 from INR2,000 in June, but maintained a ‘buy’ rating on 25 July.

ICICI Securities retained its rating to ‘hold’ for the stock on 25 July with target price of INR1,506.

Equity analysts typically provide forecasts covering one year. However, algorithm-based forecasting services can give long-term outlooks and price targets.

Wallet Investor was bullish on its INFY stock forecast, suggesting that the stock is a “very good long-term investment”. In its Infosys stock forecast for 2022, the service predicted the stock to trade at INR1,549.349 by December 2022.

According to the site’s Infosys stock forecast for 2025, the stock could reach INR 2,801.334 by December 2025. The Infosys stock price could rise to INR 3,451.513 in September 2027, according to Wallet Investor.

When considering the Infosys stock predictions, remember that analysts and algorithm-based price targets can be wrong.

Their INFY stock forecasts should not be used as substitutes for your own research. Always conduct your own due diligence by reviewing the most recent market analysis and Infosys stock news. Keep in mind that your decision to trade or invest should be based on your risk tolerance, market expertise, portfolio size and goals.

Remember that past performance does not guarantee future results. And never invest or trade money that you cannot afford to lose.

FAQs

Is Infosys a good stock to buy?

Analysts at Jefferies and Motilal Oswal recommended the INFY stock as a ‘buy’. However, remember that analysts can be wrong. Forecasts should not be used to replace your own research. Always conduct your own due diligence by reviewing the most recent market analysis and Infosys stock news. Remember that past performance does not guarantee future results. And never invest or trade money that you cannot afford to lose.

Will Infosys stock go up or down?

Analysts have different views on Infosys stock price, with price targets ranging from INR1,506 to INR1,760. Remember that markets are volatile and analysts get their predictions wrong, so there are no guarantees.

Should I invest in Infosys stock?

Whether you should invest in Infosys stock depends on your risk tolerance, investing goals and portfolio composition. Always conduct your own research. Remember that past performance does not guarantee future results. And never invest or trade money that you cannot afford to lose.