How many bitcoins are there: Biggest owners

How many bitcoins are there? Read in our analysis of the top cryptocurrency project.

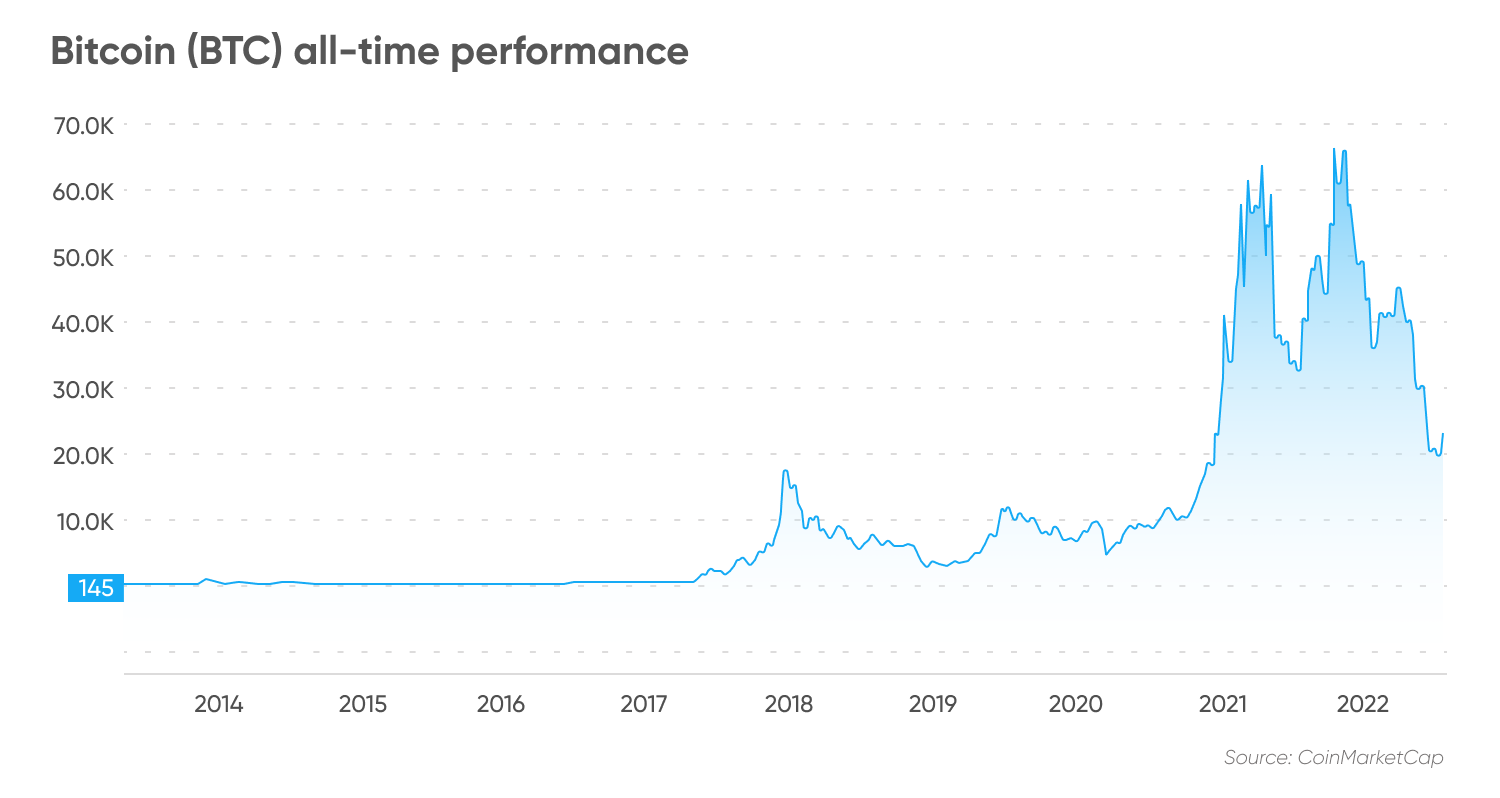

Bitcoin (BTC), the world’s oldest, largest and most well-known cryptocurrency, was valued at over $1.2trn at its peak in November 2021.

The peer-to-peer currency’s permission-less and censorship-resistant property make bitcoin an attractive draw for many. Others rave about the bellwether cryptocurrency’s sound monetary policy.

Cryptocurrency supporters see bitcoin as a revolutionary currency with the potential to correct monetary policy errors that have plagued fiat currencies due to its fixed hard cap and ever-decreasing inflation rate.

How many bitcoins are there? In this article we answer this question and find out who owns the most bitcoins.

Hard cap: How many bitcoins are there?

Bitcoin has a hard cap which means that only a certain number of bitcoins can ever be mined. Bitcoin’s hard cap is one of the key differentials that sets its monetary policies apart from that of fiat currencies.

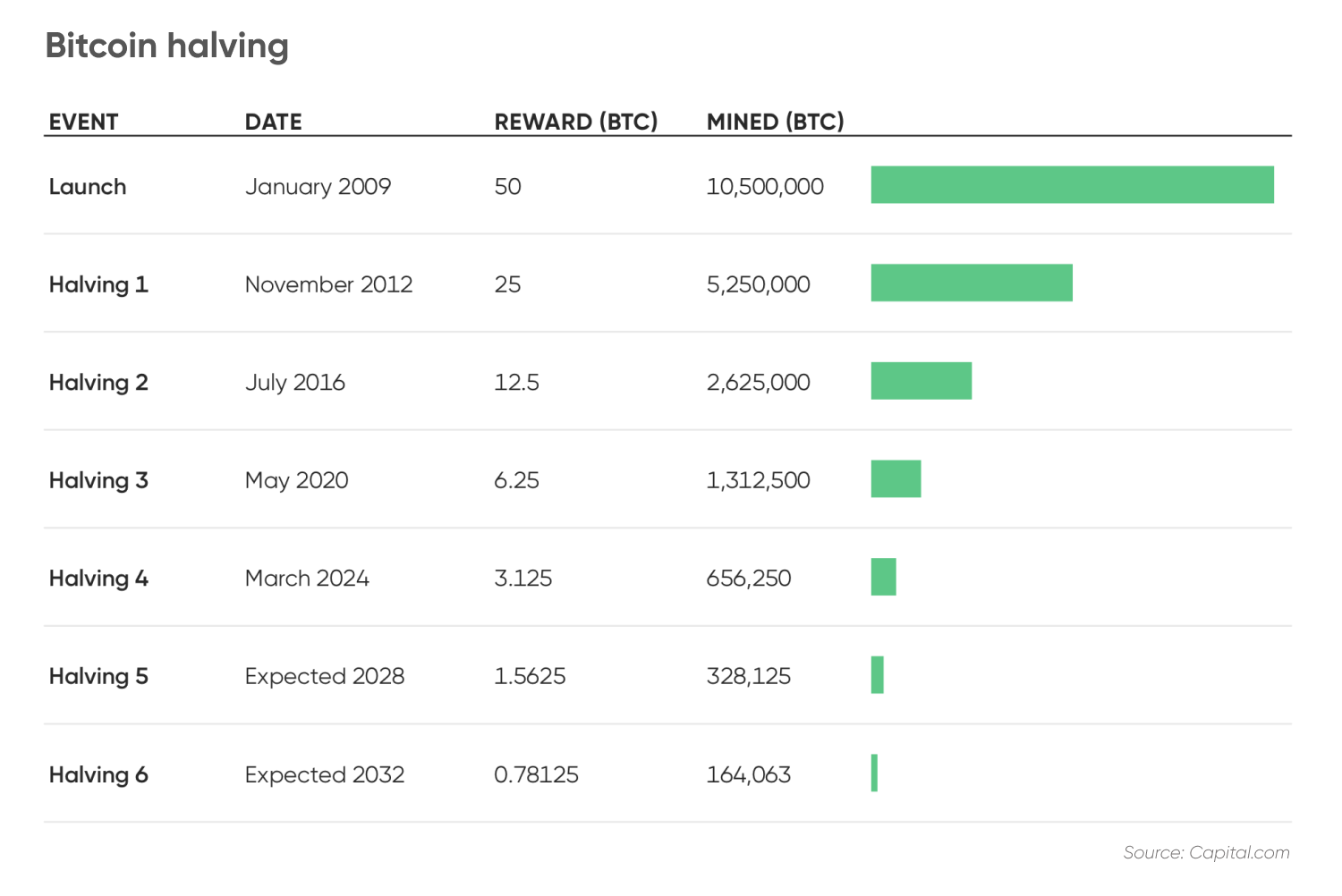

The maximum supply of bitcoin is capped at 21 million. Furthermore, the emission rate of bitcoin is designed to reduce with time in a process known as halving.

The halving event occurs every 210,000 blocks, which is roughly four years, upon which the mining rewards are cut into half. As of 22 July 2022, the most recent halving event occurred in May 2021 when mining rewards dropped from 12.5 BTC a block to 6.25 BTC a block.

The next halving event is expected to occur in 2024 after which BTC emissions will drop further to 3.125 BTC a block.

How many bitcoins are there in the world? As of 22 July 2022, about 19.09 million bitcoins have been mined representing 91% of the maximum supply, according to data from CoinMarketCap.

How many bitcoins are available to be mined? Less than 2 million bitcoins are left to be mined. The last bitcoin is expected to be mined in the year 2140.

As of 22 July 2022, the market capitalisation of BTC was over $444.8bn at current prices of $23,298. Bitcoin’s fully diluted market capitalisation stood at over $489.4 bn.

Who owns the most bitcoins?

According to bitcoin-focused asset manager River Financial, Satoshi Nakamoto, the anonymous inventor of Bitcoin, is estimated to be the largest BTC holder in possession of over 1 million BTC stored in roughly 22,00 addresses.

None of Nakamoto’s estimated BTC holdings have been moved besides a few test transactions, according to River Financial.

If we look at public on-chain data compiled by Bitinfocharts, the top two richest bitcoin addresses were identified as those belonging to crypto exchanges Binance and Bitfinex.

How many bitcoins are there in total in the richest bitcoin address?

The Binance wallet held about 252,597 BTC worth over $5.8bn, representing 1.3% of the circulating supply, as of 22 July 2022.

The third richest bitcoin address remained anonymous. It held 132,878 BTC worth over $3bn, as of 22 July 2022.

Several corporations have accumulated BTC over the years.

US-based software company MicroStrategy (MSTR) is the world’s biggest publicly traded corporate owner of bitcoin with holdings of about 129,218 BTC, according to its Q1 2022 earnings report. MicroStrategy’s BTC holdings are worth over $3bn, as of 22 July 2022.

Tesla is also known to be a holder of bitcoin. However, the company announced on 20 July 2022 that it had sold 75% of its bitcoin holdings by the end of the second quarter of 2022.

The electric car maker did not disclose the amount of bitcoin it held. The company reported “digital assets” worth $218m, as of 30 June 2022 in its balance sheet, down from $1.26bn held on 31 March 2022.

Meanwhile, the total number of bitcoins held by early BTC adopter El Salvador was about 2,301, as of 15 June 2022, according to news agency Fortune.

Bitcoin lost: Millions of BTC irretrievable

According to a 2020 report by Cane Island Digital Research, there will never be more than 14 million total bitcoins available as many will be irretrievably lost due to various factors including:

-

User accidentally throwing away keys. UK newspaper The Telegraph reported in 2017 that an early bitcoin miner from Wales named James Howell lost keys to 7,500 BTC saved on a hard drive after he mistakenly threw it away. Howell’s BTC holdings would be worth $175.75m, as of 22 July 2022.

-

Loss of keys.

-

Death without having made arrangements to transfer keys.

-

Sending BTC to the wrong addresses or defunct addresses.

Bitcoin future: What’s next for the top crypto?

Michael Saylor, Founder and CEO of MicroStrategy, highlighted that the cryptocurrency became more “clean and efficient”, having improved the sustainable power mix. According to the Bitcoin Mining Council, the bitcoin mining electricity mix increased to 59.5% sustainable in the second quarter of 2022.

“Stick with bitcoin,” said Saylor in a recent tweet, confirming his positive view on bitcoin’s future.

What’s your view of bitcoin? Do you prefer to buy, ‘hodl’, or stick away from the volatile cryptocurrency?

If you are considering investing in bitcoin, we recommend that you do your own research to develop an informed view of what is a realistic market outlook. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never trade money you cannot afford to lose.

FAQs

How many bitcoins are left?

As of 22 July 2022, about 19.09 million bitcoins have been mined representing 91% of the maximum supply. As BTC has a max limit of 21 million, less than 2 million bitcoins are left to be mined.

How many bitcoins are lost?

According to a 2020 report by Cane Island Digital Research, there will never be more than 14 million total bitcoins available as many bitcoins will be “irretrievable lost” due to various factors.

How many bitcoins are mined per day?

As of 22 July 2022, 6.25 BTC are mined per block. A bitcoin block is created approximately every 10 minutes.

What happens when all bitcoins are mined?

After the 21 millionth bitcoin is mined, bitcoin miners will depend on network fees for revenue.